Unlike development banks, the IMF does not lend for specific projects. Instead, the IMF provides financial support to countries hit by crises to create breathing room as they implement policies that restore economic stability and growth. It also provides precautionary financing to help prevent crises. IMF lending is continuously refined to meet countries’ changing needs.

The causes of crises are varied and complex. They can be domestic, external, or both.

Domestic factors include inappropriate fiscal and monetary policies, which can lead to large current account and fiscal deficits and high public debt levels; an exchange rate fixed at an inappropriate level, which can erode competitiveness and result in the loss of official reserves, and a weak financial system, which can create economic booms and busts. Political instability and weak institutions also can trigger crises.

External factors include shocks ranging from natural disasters to large swings in commodity prices. Both are common causes of crises, especially for low-income countries. With globalization, sudden changes in market sentiment can result in capital flow volatility. Even countries with sound fundamentals can be severely affected by economic crises and policies elsewhere.

The COVID-19 pandemic was an example of external shock affecting countries across the globe. The IMF responded with unprecedented financial assistance to help countries protect the most vulnerable and set the stage for economic recovery.

Crises can take many different forms. For instance:

Balance of payment problems occur when a nation is unable to pay for essential imports or service its external debt.

Often, countries that come to the IMF face more than one type of crisis as challenges in one sector spread throughout the economy. Crises can slow growth, increase unemployment, lower incomes, and create uncertainty, leading to a deep recession. In an acute crisis, defaults or restructuring of sovereign debt may be unavoidable.

The IMF offers various types of loans that are tailored to countries' different needs and specific circumstances. Loans to low-income countries carry a zero interest rate.

IMF lending gives countries breathing room to adjust policies in an orderly manner, paving the way for a stable economy and sustainable growth. Policy adjustments will vary depending on the country’s circumstances. For example, a country facing a sudden drop in the price of key exports may need financial assistance while moving to strengthen its economy and diversify its exports. A country facing severe capital outflows may need to restore investor confidence by addressing the problems that led to capital flight —perhaps interest rates are too low, the budget deficit and debt are growing too fast, or the banking system is inefficient or poorly regulated.

Without timely IMF financing, a country’s adjustment process may be more abrupt and difficult. For example, if investors are unwilling to provide new financing, the country may suffer a painful compression of government spending, imports, and economic activity. IMF financing facilitates a more gradual adjustment. Because IMF lending usually is accompanied by a set of corrective policy actions, it signals that appropriate policies are being put in place, encouraging the return of private investors. IMF lending also aims to protect the most vulnerable population via policy conditionality. In low-income countries, IMF lending is also typically meant to catalyze financial support from other donors and development partners.

The IMF lending process is flexible. Countries that maintain a commitment to sound policies may be able to access resources with no or limited conditionality. The same is true for certain urgent and immediate needs covered by emergency financing instruments.

|

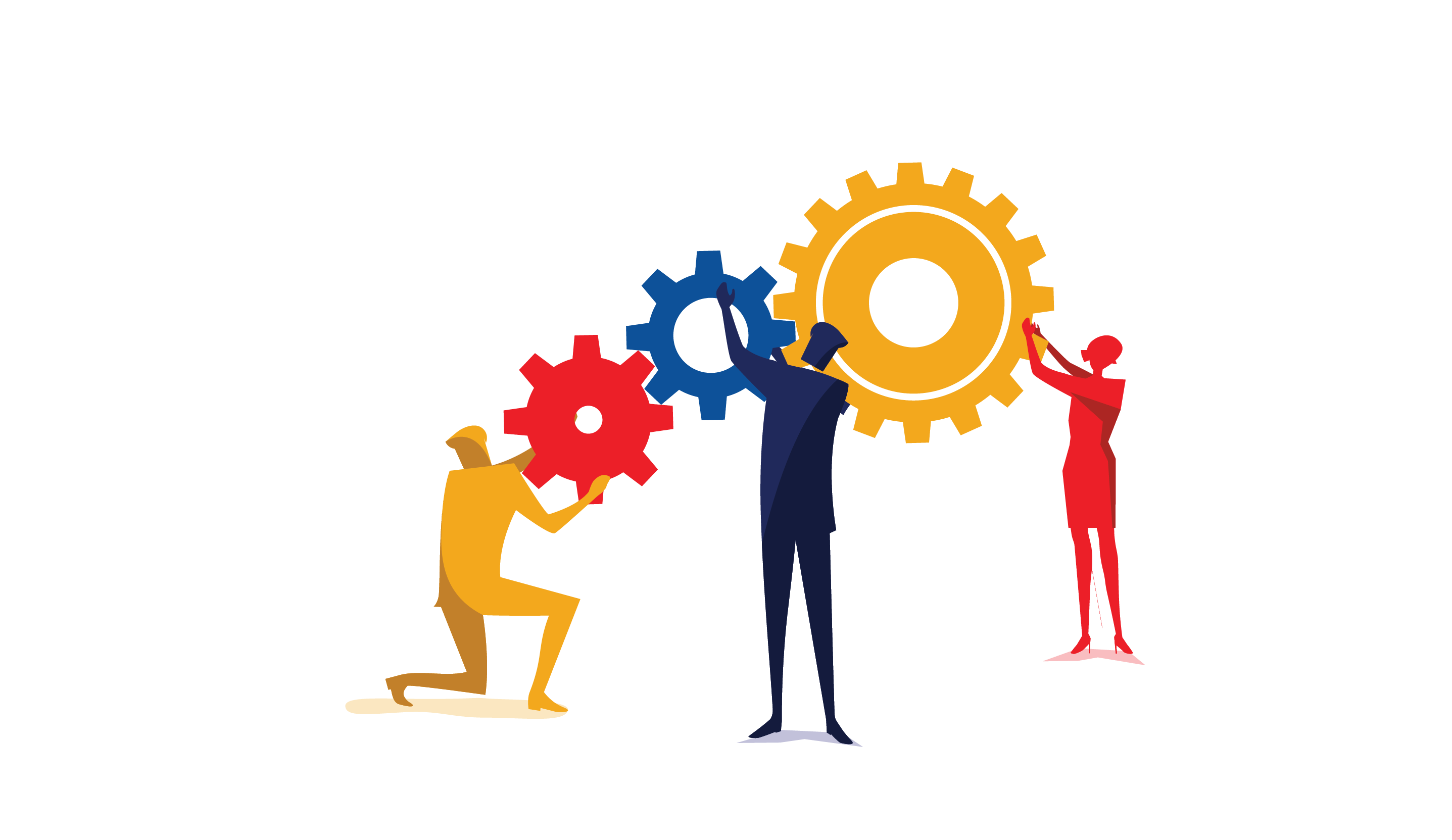

1. |

First, a member country in need of financial support makes a request to the IMF. |

|

2. |

Then, the country’s government and IMF staff discuss the economic and financial situation and financing needs. |

|

3. |

Typically, a country’s government and the IMF agree on a program of economic policies before the IMF lends to the country. In most cases, a country’s commitments to undertake certain policy actions, known as policy conditionality, are an integral part of IMF lending. |

|

4. |

Once the terms are agreed upon, the policy program underlying an arrangement is presented to the IMF’s Executive Board in a “Letter of Intent” and detailed in a “Memorandum of Understanding.” The IMF staff makes a recommendation to the Executive Board to endorse the country’s policy intentions and offer financing. This process can be expedited under the IMF’s Emergency Financing Mechanism. |

|

5. |

After its Executive Board approves a loan, the IMF monitors how members implement the policy actions underpinning it. A country’s return to economic and financial health ensures that IMF funds are repaid so that they can be made available to other member countries. |

The IMF has several lending instruments to meet the different needs and specific circumstances of its members.

IMF members have access to the General Resources Account on non-concessional terms (market-based interest rates), but the IMF also provides concessional financial support (currently at zero interest rates) through the Poverty Reduction and Growth Trust, which is better tailored to the diversity and needs of low-income countries. The recently established Resilience and Sustainability Trust offers longer-term financing to low-income and vulnerable middle-income countries seeking to build resilience to external shocks at affordable interest rates.

Reflecting different country circumstances and challenges, GRA-supported programs are expected to resolve the country’s balance of payments problems during the program period, while PRGT programs envisage a longer duration for addressing them. The RST provides financing to address longer-term challenges, including climate change and pandemic preparedness.

FOR MORE INFORMATION:

The IMF’s lending arrangements with countries

Weekly summaries of financial assistance to member countries

1 This instrument does not require the IMF Executive Board’s approval.

All IMF members have access to financial support through the General Resources Account (GRA), which is subject to various charges. These charges are designed to cover the operational costs of the IMF and support its activities, including those related to providing policy advice and capacity development to member countries.

Basic charges: based on the market-determined Special Drawing Rights (SDR) interest rate – which has a minimum floor of 5 basis points – plus a margin established by the IMF Executive Board every two years (currently 60 basis points).

Surcharges: high and prolonged borrowing of non-concessional resources is subject to surcharges. There are two types:

Commitment fee: applied to the undisbursed portion of a loan. This fee is typically a small percentage of the loan amount. For most IMF lending instruments the fee is levied at the beginning of each 12-month period on amounts that could be drawn in the period: 15 basis points for committed amounts up to 200 percent of quota; 30 basis points on committed amounts above 200 percent and up to 600 percent of quota; and 60 basis points on amounts exceeding 600 percent of quota.

Service charge: a fixed charge on each amount drawn from the GRA (currently at 50 basis points, except for the Short-term Liquidity Line (SLL) which has a reduced rate of 21 basis points).

For detail on each type of non-concessional loan, see Stand-by Arrangement (SBA), Extended Fund Facility (EFF), Flexible Credit Line (FCL), Precautionary and Liquidity Line (PLL), Short-term Liquidity Line (SLL), and Rapid Financing Instrument (RFI).

This page was last updated in July 2023