Frequently Asked Questions on the Fund’s Charges and the Surcharge Policy

Last Updated: October 11, 2024- Q1. What was the outcome of the Review?

- Q2. How does the IMF charge for loans?

- Q3. Why did the IMF launch a review of its charges and the surcharge policy?

- Q4. What charges, surcharges, and fees will GRA borrowers pay?

- Q5. How much less will GRA borrowers pay once the reforms take effect?

- Q6. Did any other changes result from this review?

- Q7. How many countries pay surcharges?

- Q8. What is the difference between the nominal and effective rates paid by borrowers?

Q1. What was the outcome of the Review?

The IMF Executive Board considered that the framework for charges, surcharges, and fees remains an essential part of the IMF’s cooperative lending and risk management framework. However, Executive Directors saw scope for adapting the framework in light of developments since the last review, notably the sharp increase in global interest rates that have pushed up borrowing costs for members, successive adverse shocks that have led to record IMF credit outstanding, and the achievement of the IMF’s medium-term precautionary balance target.

After careful deliberations, the membership has come together to agree on a comprehensive package of reforms that:

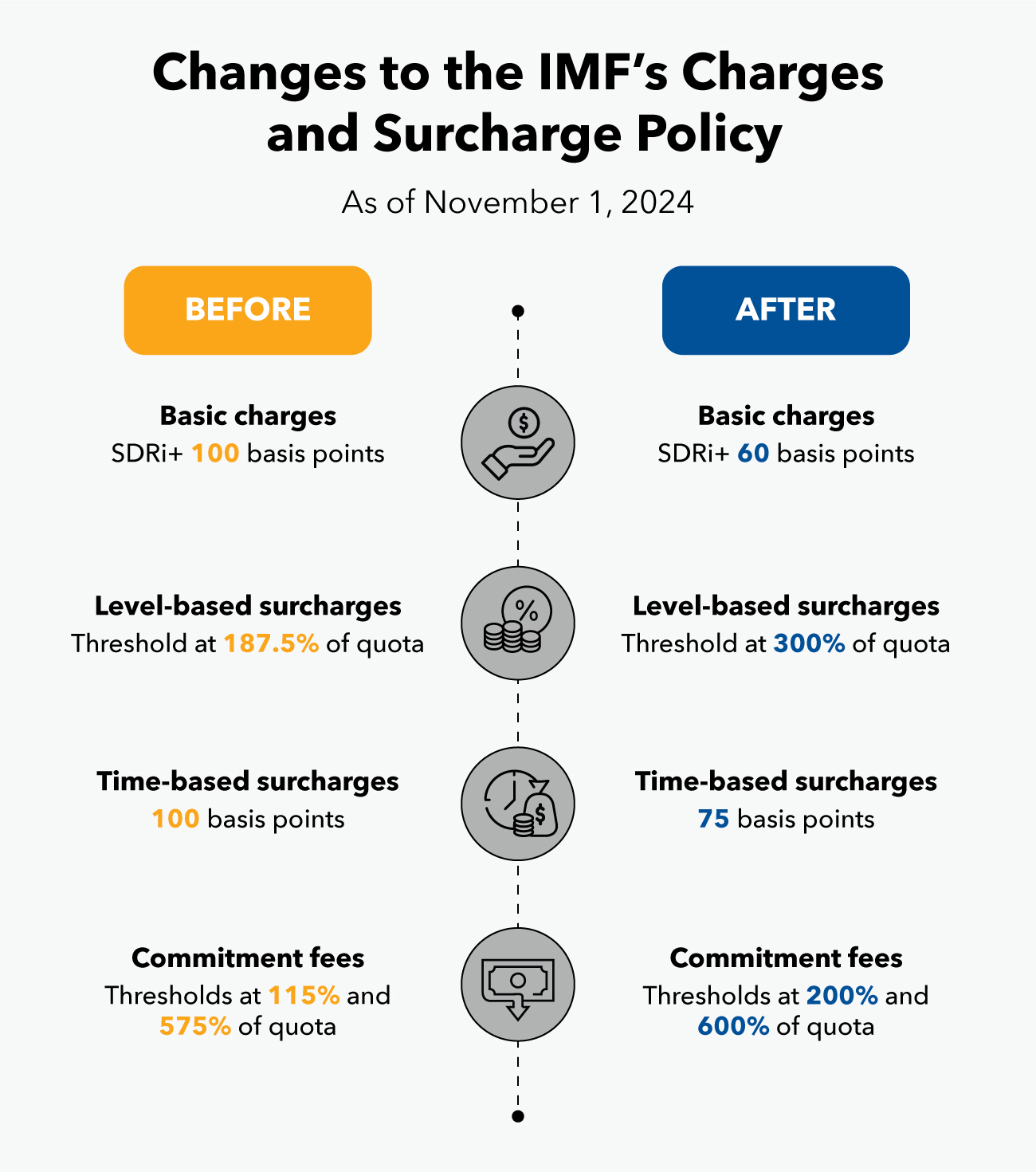

- Reduce the margin over the SDR interest rate to 60 basis points from 100 basis points currently.

- Raise the threshold at which level-based surcharges apply to 300 percent of quota from 187.5 percent.

- Lower the rate for time-based surcharges to 75 basis points from 100 basis points.

- Increase the threshold for commitment fees to 200 percent of quota annually and 600 percent cumulative, from current levels of 115 and 575 percent of quota.

The approved package will substantially lower the cost of IMF borrowing on account of the margin of charge and surcharges by 36 percent, or about US$1.2 billion annually. The expected number of countries subject to surcharges in fiscal year 2026 will fall from 20 to 13. The approved package will take effect on November 1, 2024.

While substantially lowered, charges and surcharges remain an essential part of the IMF’s cooperative lending and risk management framework. Together, charges and surcharges cover lending intermediation expenses, help accumulate reserves to protect against financial risks, and provide incentives for prudent borrowing.

Q2. How does the IMF charge for loans?

All IMF members have access to financing through the General Resources Account (GRA). These loans are subject to charges (the SDR interest rate plus a small margin), surcharges (for loans above a certain threshold and duration), and commitment fees (for precautionary/non-disbursing arrangements). See Q4 for details.

The charges, surcharges, and commitment fees levied on GRA loans are an essential part of the IMF’s cooperative lending and risk management framework. All members contribute and all can benefit from financial support when needed.

The charges, surcharges and commitment fees cover lending intermediation expenses, help accumulate reserves to protect against financial risks, and provide price-based incentives for prudent and temporary borrowing. This provides fundamental strength to the IMF balance sheet, enabling the provision of vital balance of payments support to member countries when they need it most.

Low-income member countries have access to loans on concessional terms provided through the Poverty Reduction and Growth Trust (PRGT), and these are not subject to charges or surcharges.

Q3. Why did the IMF launch a review of its charges and the surcharge policy?

The 2024 Review of Charges and the Surcharge Policy is part of a continuous effort to ensure that the IMF’s lending policies remain fit for purpose in a changing global economy, and at a time of high borrowing costs.

Since the last review of the surcharge policy in 2016, global interest rates have risen sharply, pushing up borrowing costs for members; successive adverse shocks have led to record levels of IMF lending; and the IMF’s reserves (“precautionary balances”) have reached the medium-term target of SDR 25 billion needed to adequately protect against current financial risks.

Against this backdrop, the Fund has reviewed its charges and surcharges together to consider options for lowering the cost of borrowing from the GRA while preserving appropriate incentives and the IMF’s financial strength that underpins its ability to serve its membership at the center of the global financing safety net.

Q4. What charges, surcharges, and fees will GRA borrowers pay?

The changes approved by the Executive Board will take effect on November 1, 2024. The charges, surcharges and commitment fees paid by GRA borrowers will be adjusted as follows:

Basic Charges

Basic charges apply to all borrowing of non-concessional GRA resources and consist of the market-determined Special Drawing Rights (SDR) interest rate plus a margin, which is set by the IMF Executive Board every two years and has been at 100 basis points since May 1, 2012.

Once the reform takes effect, the margin on the basic rate of charge will decline to 60 basis points—the first ever change in this charge.

Surcharges

High and prolonged borrowing of non-concessional GRA resources is subject to surcharges. There are two types:

- Level-based surcharges of 200 basis points are applied on the outstanding portion of GRA credit over a fixed threshold. This threshold will be raised to 300 percent of a member’s quota, from 187.5 percent of quota currently. This new, higher threshold will reduce the number of countries expected to pay surcharges in fiscal year 2026 from 20 to 13.

- Time-based surcharges are applied on the portion of credit exceeding the level-based threshold for more than 36 months (51 months in case of borrowing under the Extended Fund Facility). This rate will be reduced by 25 basis points to 75 basis points, from 100 basis points currently.

Commitment fees

Commitment fees help contain liquidity risks and compensate the IMF for the cost of establishing and monitoring arrangements while also setting aside resources for potential disbursements. They are applied to the undisbursed portion of a loan and refunded in proportion to the amounts borrowed. If a country borrows the entire amount, the fee is fully refunded.

For simplicity, the threshold at which these commitment fees apply will now be increased to align with the annual and cumulative access limits for borrowing under the GRA (of 200 and 600 percent of quota, respectively). Previously, these thresholds were 115 and 575 percent of quota.

The fee structure is upward sloping, with (i) 15 basis points for committed amounts up to 200 percent of quota; (ii) 30 basis points for committed amounts above 200 percent and up to 600 percent of quota; and (iii) 60 basis points for committed amounts exceeding 600 percent of quota.

Q5. How much less will GRA borrowers pay once the reforms take effect?

Based on projections for fiscal year 2026, these reforms are expected to lower borrowing costs by about SDR 880 million (US$1.2 billion) annually for all GRA borrowers. That will be a 36 percent reduction in payments, in average effective terms, on account of the margin for the basic rate of charge and surcharges.

Q6. Did any other changes result from this review?

The Executive Board approved three additional measures:

- Reviews of the surcharge policy will be conducted on a regular five-year cycle, or earlier if circumstances warrant, to allow for timely assessments of the surcharge policy framework and help enhance predictability for members and markets;

- Disclosures and operational procedures will be strengthened to give authorities more information about the cost of Fund borrowing during negotiations of GRA financing; and

- Net income after distributions will be exclusively allocated to the IMF’s Special Reserve until it reaches the precautionary balances floor of SDR 20 billion, to further strengthen the backstop provided by precautionary balances for the absorption of possible losses.

Q7. How many countries pay surcharges?

Loans provided to low-income countries under the IMF’s Poverty Reduction and Growth Trust (PRGT) do not pay surcharges (or charges). The same applies for loans provided under the IMF’s Resilience and Sustainability Trust (RST) that help low-income and vulnerable middle-income countries build resilience to external shocks and ensure sustainable growth.

Out of 52 member countries currently borrowing from the GRA, 19 are subject to surcharges. Once the reform becomes effective on November 1, 2024, the number of countries paying surcharges will fall from 19 to 11. Eight countries will not be subject to surcharges because their credit outstanding will be below the new threshold (300 percent of quota): Benin, Côte d’Ivoire, Gabon, Georgia, Moldova, Senegal, Sri Lanka, and Suriname.

For fiscal year 2026, staff projects that 20 countries would have been subject to surcharges prior to this Review. With the approved reforms, the number of countries paying surcharges is expected to fall to 13.

Historical data and projections on the amount of surcharge payments by country to the IMF is available at IMF Financial Data Query Tool.

Q8. What is the difference between the nominal and effective rates paid by borrowers?

No borrower pays the maximum nominal surcharge rate of 3 percent on credit outstanding to the IMF because surcharges only apply to the portion of credit that exceeds the fixed threshold of 300 percent of quota.

As a result, the average effective surcharge rate that will be paid by the 13 member countries projected to incur surcharges during fiscal year 2026 will be 1.3 percent, with rates for individual member countries ranging from 0.1 to a maximum of 1.9 percent and 10 countries paying less than 1 percent.

Even with surcharges, the average cost of borrowing from the Fund, in effective terms, is significantly lower than market rates. Following the approved reforms, during fiscal year 2026, the effective cost of borrowing from the GRA is projected to fall, and will range between 3.4 percent and 5.2 percent, with more than half of the countries paying less than 4 percent.