Listen to the brightest minds in the field of economics and development discuss their latest research and deconstruct global economic trends. IMF Podcasts are free to use for broadcasters, educators and institutions.

Jim Tebrake January 23, 2024

Jookyung Ree July 20, 2023

NICHOLAS BLOOM September 3, 2024

MARK AGUIAR August 8, 2024

March 28, 2024

Financial Stability / Financial sector stability

Jason Wu, Nassira Abbas October 22, 2024

As inflation and interest rates continue to decline and the likelihood of a recession slowly fades, the latest Global Financial Stability Report (GFSR) warns of several factors that could upend the recovery, including the disconnect between market buoyancy and heightened uncertainty. Jason Wu and Nassira Abbas lead the IMF’s work on financial stability. In this podcast, they say while the near-term risks appear contained, medium-term prospects remain a concern.

November 2, 2023

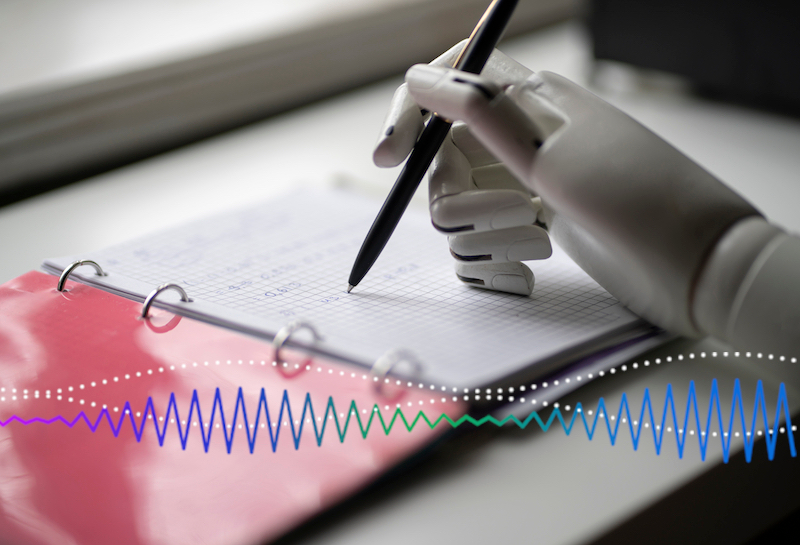

WENJIE CHEN April 25, 2024

Sub-Saharan Africa is slowly emerging from four turbulent years with higher growth expected for nearly two thirds of countries. But while inflation has almost halved and debt has broadly stabilized, economies still face financing shortages and impending debt repayments. Wenjie Chen is deputy head of the team that publishes the Regional Economic Outlook for sub-Saharan Africa. In this podcast, she says the surging global demand for minerals could help the region overcome the ongoing funding squeeze.

Christine Richmond, Raphael Lam November 28, 2023

International Monetary Fund

Bruce Edwards produces the IMF podcast program. He's an award-winning audio producer and journalist who's covered armed conflicts, social unrest, and natural disasters from all corners of the world. He believes economists have an important role in solving the world's problems and aspires to showcase their research in every IMF podcast.

Sign up for our weekly podcast newsletter by entering your email address below:

IMF Podcasts are the views of the International Monetary Fund (IMF) staff and external officials on pressing economic and policy issues of the day. The IMF, based in Washington D.C., is an organization of 191 countries, working to foster global monetary cooperation and financial stability around the world. The views expressed are those of the author(s) and do not necessarily represent the views of the IMF and its Executive Board.

@ COPYRIGHT INTERNATIONAL MONETARY FUND