assesses the financial vulnerability and risks emerging from SOEs. It allows governments to identify and monitor high-risk SOEs and helps inform early and targeted interventions where necessary. The tool provides a starting point for SOE vulnerability assessment and can be complemented by more in-depth analysis of the underlying drivers of financial performance.

SOEs comprise a significant share of economic and public sector activity in many countries, managing public assets equivalent to half of global GDP. Well-governed, SOEs can promote economic development and have the potential to support the provision of important goods and services to the public, while generating financial returns for taxpayers. But, poorly performing SOEs can be costly for public finances and generate significant fiscal risks.

Fiscal risks can arise from multiple sources, including lower than expected dividends, royalties or taxes received from SOEs, higher subsidies, the non-repayment of loans, need to service guarantees on their borrowing, or equity injections to cover previous losses. Poorly performing SOEs can also reduce the government's net worth. Historically, equity injections or other support provided to individual SOEs have cost on average, about 3 percent of GDP, and in some cases have been as large as 15 percent of GDP. Policymakers should regularly monitor the financial position and performance of SOEs and assess the potential for them to impact on public finances.

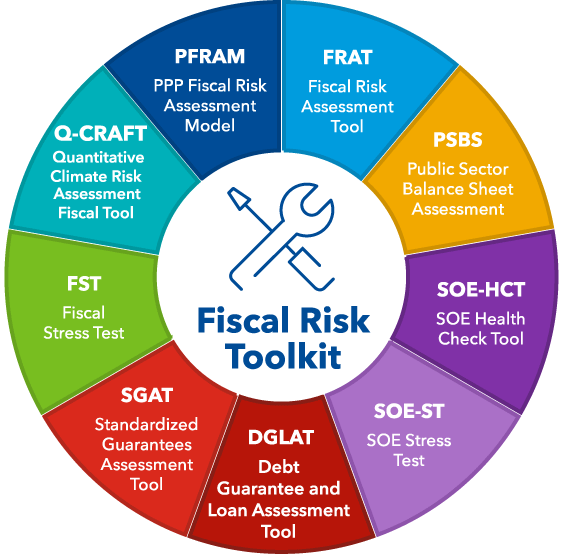

The SOE HCT can be used in conjunction with the forward looking SOE Stress Test Tool to provide complementary information about SOEs financial vulnerabilities. The HCT is also based on the same methodology of the Discrete Loan and Guarantee Tool, which can help assess potential fiscal costs arising from state-support provided to SOEs. The outputs of the SOE HCT can also be used to inform further fiscal risk analysis using the IMF's Fiscal Stress Test approach, Public Sector Balance Sheet Assessments, or Debt Sustainability Analyses, by providing information on the overall assets and liabilities of SOEs, their exposures, and potential risks they pose.