FISCAL RISK TOOLKIT

analyzes loans or explicit debt guarantees to support debt raised by a public or private sector company on a corporate finance basis, that is, where lenders have recourse to the cash flows and assets generated by the company as a whole. The tool focuses on the creditworthiness of the obligor, rather than the viability of the project for which the financing will be used, and aims to inform the decision to issue a guarantee or provide a loan as well as support the management of the loan and guarantee portfolios.

Public loans and guarantees create a substantial fiscal risk. According to the IMF's Public Sector Balance Sheet Database, the general government loan portfolio averages 6.5 percent of GDP across a group of 49 countries, and is as large as 20 percent of GDP in some of them. Governments often provide discrete loans and guarantees to address market failures or provide entities with access to cheaper credit to support project financing. During crises, these instruments can also support macroeconomic stability, by ensuring. the flow of credit during periods of sever market disruption or economic stress.

While loans and guarantees generally do not impact on fiscal balances immediately, they can expose governments to future costs. For example, loans expose government balance sheets to losses and can increase the government's financing burden if they are unable to be serviced, while government guarantees create contingent liabilities that result in future fiscal costs in the event they are called. These risks should be understood, assessed, monitored, and transparently reported.

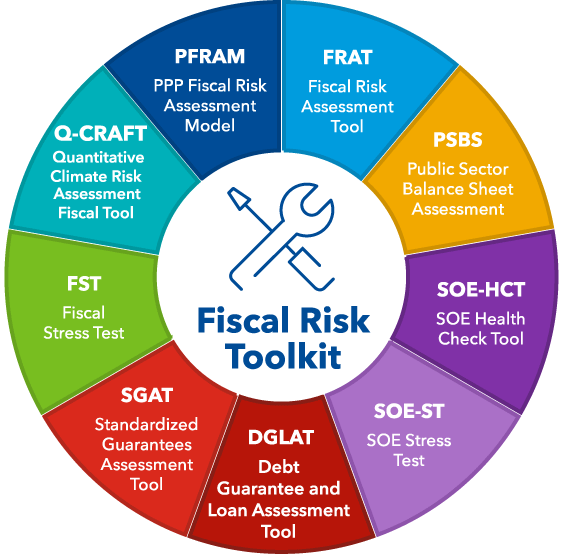

The DGLAT is complementary to the Standardized Guarantee and Loan Assessment Tool (SGAT): both estimate the fiscal costs and risks from guarantees and loans with the SGAT focused on guarantee and loan schemes and the DGLAT focused on discrete guarantees and loans.

The DGLAT builds on, and is consistent with, the methodological approach used for the SOE Health Check Tool and can be completed by the SOE Stress Test Tool. The outputs of the tool can also help inform inputs for other IMF tools including: the Fiscal Risk Assessment Tool; Fiscal Stress Test; Public Sector Balance Sheet Assessments; and the IMF's Debt Sustainability Analysis by informing the size of potential contingent liability realizations from guarantee calls and the balance sheet implications from loan exposures.