What does a Fiscal Stress Test do?

- Assesses the impact of a macro-fiscal and contingent liability shock on general government fiscal and balance sheet aggregates, over a medium-term horizon.

- Assesses the impact on three summary outputs for government solvency, liquidity and financing burden under the baseline and stress scenarios.

- Can consider the implications for long-term fiscal sustainability by producing projections for long-term fiscal aggregates under the baseline and stress scenario, taking into consideration trend growth drivers, ageing-related expenditure, and the lingering impact of the shock in the stress scenario.

- Can assess the implications or shock scenarios for the governments comprehensive public sector balance sheet, considering all of the assets and liabilities of the public sector as well as the net present value of future revenues and payments under current policies.

Why analyze these risks?

Large macroeconomic shocks can produce substantial and long-lasting effects on the financial position of the public sector, with sizeable increases in net liabilities and a lower probability of compliance with long-term solvency constraints. These shocks are often considered tail events only because the fluctuations they induce are very pronounced in comparison with the historical volatility of macroeconomic aggregates. Nonetheless, in a globalized world characterized by continuous shocks and multiple transmission channels, tail macroeconomic events are by no means impossible, as the global financial crisis and the COVID-19 pandemic have showed, and their legacy can seriously constrain fiscal policy.

The FST, developed by FAD in 2016, aims to assess the possible impact of this kind of macroeconomic shocks on the finances of the main public sector players -including general government and state-owned enterprises-, as well as their interactions and consolidated effects for the public sector as a whole.

How can Fiscal Stress Tests inform policymaking?

- Help governments better understand the main financial transmission channels of macroeconomic shocks within the public sector and between the public and the private sector.

- Help governments understand how resilient public finances are to extreme, correlated shocks which can be used to inform the size of required fiscal buffers and prudent debt limits.

- Help policymakers better understand the exposures and vulnerabilities in the balance sheets of the public sector agents and the consolidated public sector balance sheet and enhance asset-liability management accordingly.

- To help governments to reinforce fiscal risks monitoring in those areas highly exposed to macroeconomic shocks, such as ailing SOEs or systemically critical financial institutions.

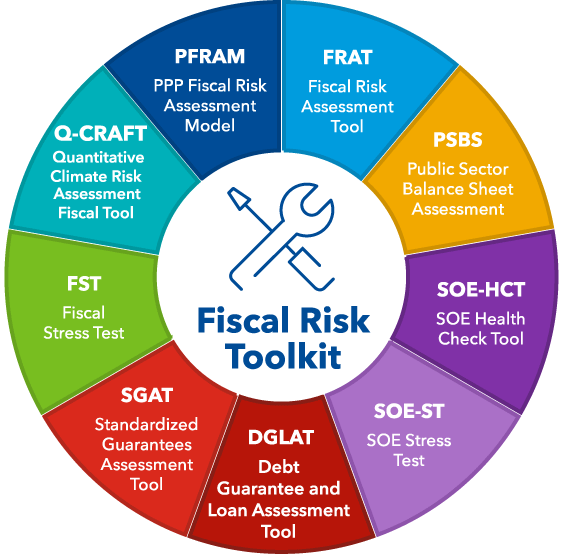

Linkages to other IMF fiscal risk and macro-fiscal analytical tools

The FST can bring together the analysis and outputs from other discrete IMF Fiscal Risk Tools which can help identify the size of potential contingent liability realizations including:

- The FRAT can help identify the main risks that may be catalyzed by a large macroeconomic shock.

- The SOEs Stress Test Tool which can help to calculate the evolution of their assets and liabilities, and liquidity needs, under different scenarios.

- The IMF's loan and guarantee tools, which provide a sense of the probability of crystallization of guarantees under adverse scenarios.

- Information on long-term government's obligations stemming from PPP contracts can be obtained from the PPP Fiscal Risk Assessment Model and used in the calculation of comprehensive net worth of the public sector.

The FST's output can be used to enrich debt sustainability analysis results from a longer-term and more granular perspective.