Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Market Liquidity Not in Decline, but Prone to Evaporate

September 29, 2015

- Low interest rates have supported market liquidity

- Changes in market structure make liquidity prone to evaporate in case of shocks

- Policymakers need to monitor risks, prepare for normalization of monetary policy

The level of liquidity in financial markets—the ability to buy or sell a large quantity of a financial asset at a low cost in a short time—has not shown a marked decline in most asset classes; however, low interest rates may be masking an erosion of its underlying resilience, according to new research from the International Monetary Fund.

Pedestrians walk past a graph of the London stock market: a sharp drop in liquidity can threaten financial stability (photo: Toby Melville/Reuters)

GLOBAL FINANCIAL STABILITY REPORT

The new Global Financial Stability Report sheds light on the factors that determine the level and resilience of market liquidity, with a focus on the corporate bond market. In recent years, investors prepared to take more risks for a higher return on their investment, and accommodative monetary policies such as low interest rates and bond buying known as quantitative easing, have sustained market liquidity. However, structural changes such as a less diverse investor base, the proliferation of small bond issues, and banks’ retrenchment from trading suggest that once interest rates rise, liquidity will probably decline. A smooth return to more normal monetary policy in advanced economies is crucial to avoid sudden and disruptive changes in market liquidity, according to the IMF.

When markets are illiquid, asset prices become more volatile and less aligned with developments in the economy, and less informative about assets’ fundamental values. When market liquidity is low, the transfer of funds between savers and borrowers becomes less efficient. Investors may postpone investment decisions and economic growth will suffer. In extreme conditions, a sharp drop in liquidity can threaten financial stability since several asset markets, for example, bond and repo markets can freeze altogether—as seen in the global financial crisis.

Explaining market liquidity

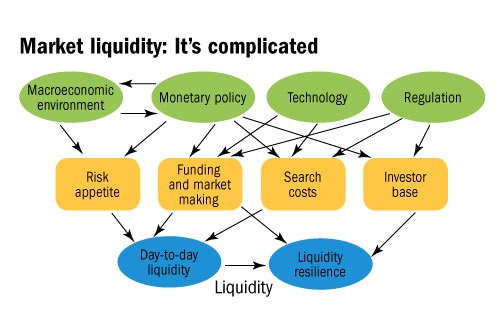

Market liquidity depends, among other things, on the overall risk appetite of investors and on the funding constraints faced by financial intermediaries (Figure 1). The risk appetite of market makers—a bank or financial intermediary that stands ready to buy or sell financial assets—affects their inclination to trade. Changes in bank business models may also affect their willingness and ability to make markets.

Regardless of the activities of market makers, other factors such as search costs in the marketplace and investor characteristics also affect market liquidity. For instance, a positive development has been the emergence of electronic trading platforms, which has probably made it easier and cheaper for buyers, and sellers of financial instruments to find each other. Likewise, more trade transparency in bond markets has improved liquidity. Large scale asset purchases by central banks, despite a generally positive effect on market liquidity, have reduced the availability of certain securities.

Behind market liquidity and its resilience

“In recent years, factors such as investors’ higher risk appetite and low interest rates have been masking growing underlying fragilities in market liquidity,” said Gaston Gelos, Chief of the Global Financial Stability Analysis Division at the IMF.

Such factors explain nearly 80 percent of the behavior of liquidity for U.S. investment grade corporate bonds since 2010. Structural changes have also affected the level of market liquidity. For instance, the decline in banks’ willingness to bear risks has played a role. However, not enough time has passed for a proper evaluation of the role of new bank regulation behind these developments, since countries are only now implementing some of these new rules, according to the IMF.

If financial conditions worsen or investors become weary of a particular asset class or financial market, market liquidity can quickly evaporate. Furthermore, swings in market liquidity in one asset class seem to spill over to other asset classes more frequently, and high-yield and emerging market bonds show some signs of deterioration in market liquidity. As spillovers between asset classes increase, it becomes more likely for a liquidity shock in one market to spread to other markets, possibly leading to a shock to the global financial system, as was the case in 2008.

“It is crucial that we continue with market infrastructure reforms that improve the resilience of liquidity, such as guaranteeing equal access to electronic trading platforms or fostering instrument standardization,” said Gelos. “At the same time, central banks and financial supervisors need to be prepared for episodes of liquidity breakdowns.”

Financial supervisors and central banks should develop preemptive strategies to cope with financial instability caused by market illiquidity. In order to do this, they must recognize the importance of monitoring liquidity for a wide range of assets, on a regular basis, and using a broad range of measures that cover liquidity’s quantity, cost, and time dimensions.

The IMF will release more details from its Global Financial Stability Report on October 7.