Counting wealth in offshore tax havens boosts estimates of inequality

The amount of wealth stashed in offshore tax havens has big implications for inequality. Why? Unless you can account for hidden riches, it’s difficult to know how wide the disparities in wealth really are. So economists led by Berkeley’s Gabriel Zucman decided to find out who owns the wealth in tax havens.

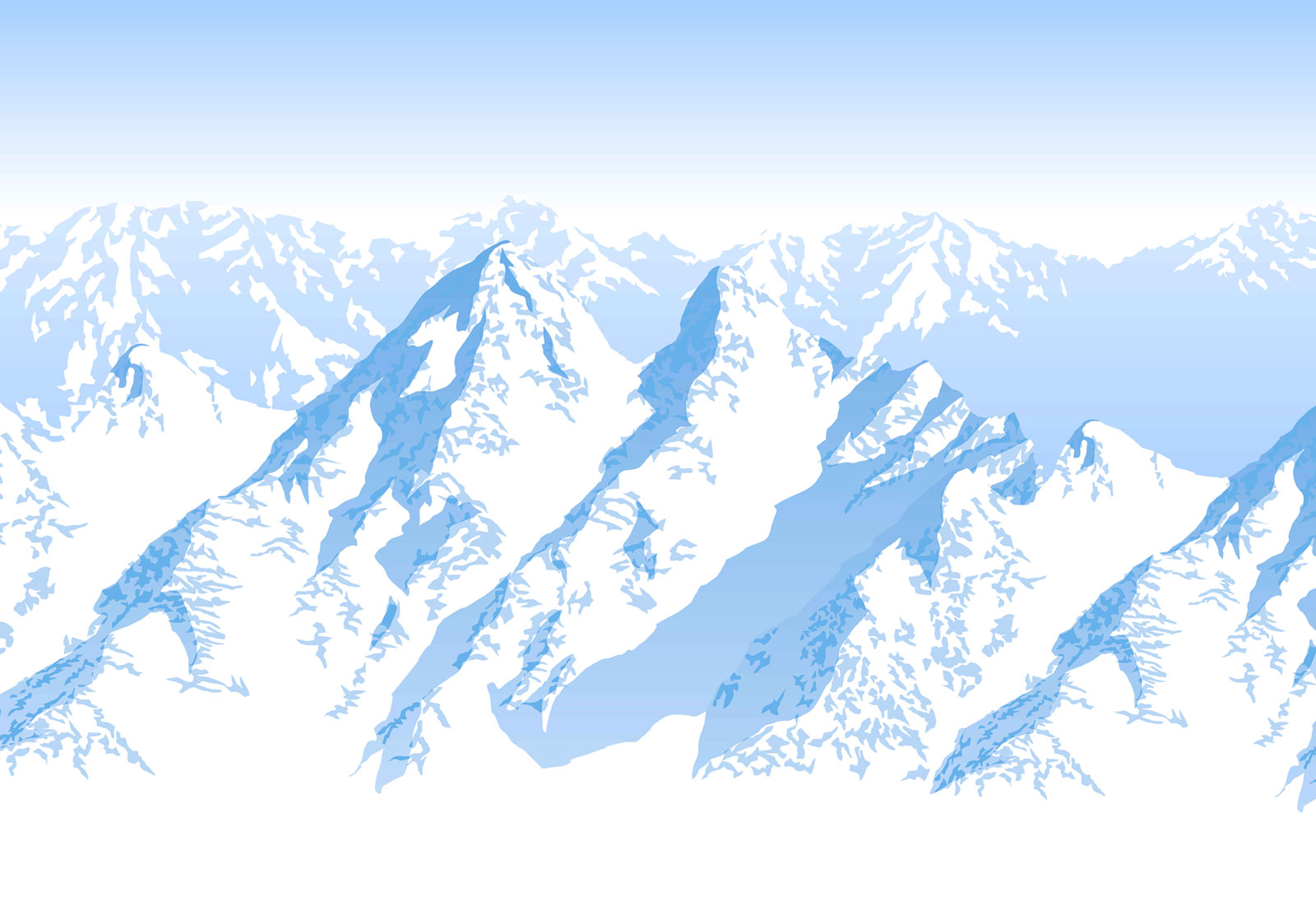

They estimated total offshore wealth at about 10 percent of world GDP in 2007, or $5.6 trillion. About half was kept in Switzerland, the world’s premier offshore banking center since the 1920s. Conveniently, the central bank of Switzerland publishes country-by-country breakdowns of offshore wealth in the nation’s banks.

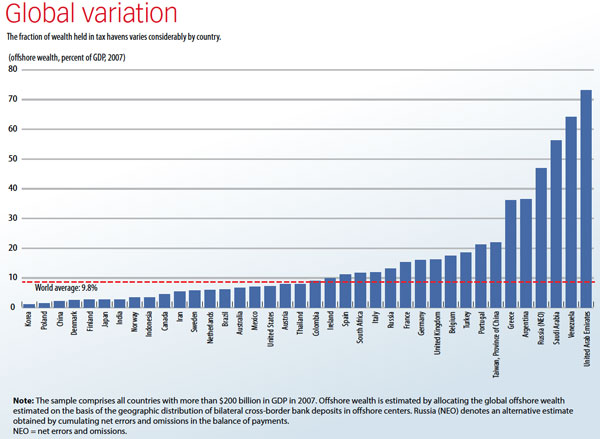

But what about other tax havens? In 2016, the Bank for International Settlements started to release data on the origin of bank deposits held in offshore banking centers like Jersey and Luxembourg. That made it possible to see how much money residents of Germany, for example, held in accounts in Hong Kong SAR. Zucman and his collaborators used the two data sources to estimate the ratio of offshore wealth to GDP by country.

The figures vary dramatically, from just a small percentage of GDP in Scandinavia to as much as 60 percent in Russia, the Gulf states, and Latin America. Interestingly, they found connections between offshore wealth and the presence of natural resources, a history of political instability, and proximity to Switzerland.

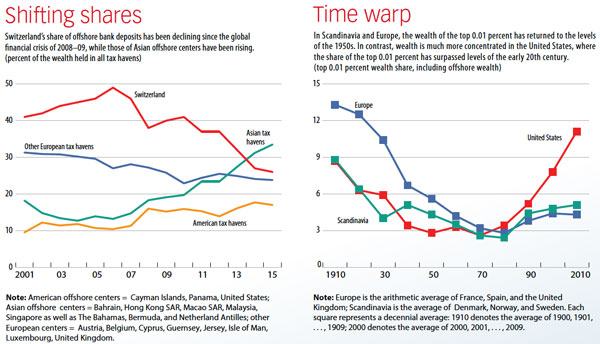

Other data—including a leak of confidential records from the Swiss subsidiary of HSBC in 2007—suggest that the distribution of offshore wealth is heavily skewed toward the rich: about 80 percent belongs to the top 0.1 percent of households. The conclusion: accounting for offshore assets substantially boosts the wealth share of the very richest people. In other words, inequality may be far greater than other studies have found.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.