AI, social media, and mobile banking may bring more bank runs; safeguards of yesterday may not be sufficient tomorrow

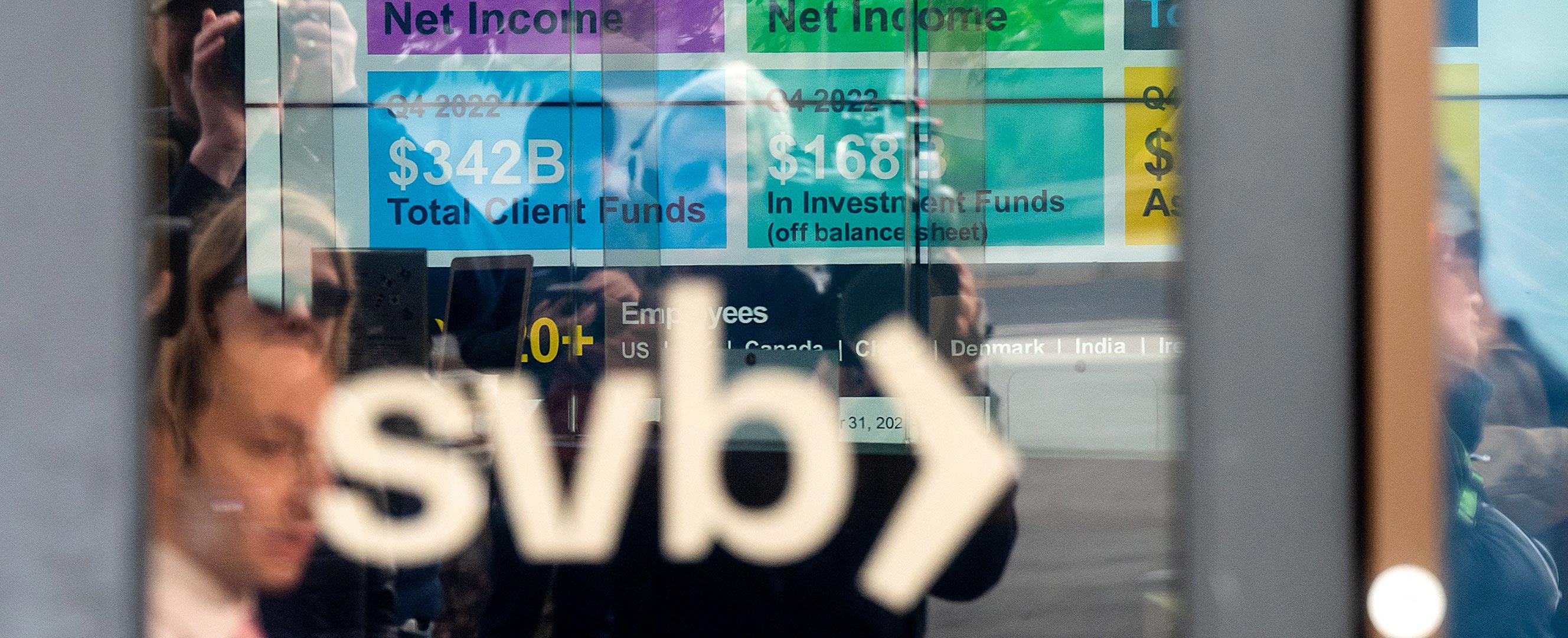

The sudden withdrawal of bank deposits—accelerated by digital technology—contributed to the failures of Silicon Valley Bank, Signature Bank, and First Republic Bank in the United States and Credit Suisse in Switzerland in the spring of 2023. While a complex set of factors led customers to lose confidence in these banks’ financial health, the spread of rumors on social media and access to deposit withdrawals with the click of a button in mobile apps contributed to the speed with which customers moved their money out of the banks. The speed was unprecedented: in earlier episodes of bank runs, such as during the global financial crisis, social media and mobile banking apps were unheard of or barely existed.

Banks differ, and the reasons customers may suddenly question a bank’s viability vary. As events in 2023 illustrate, however, the risk of sudden bank runs may generally be affected by advancing digital frontiers in banking.

A bank run occurs when many customers simultaneously withdraw their deposits because they are worried about the bank's financial health. Although some deposits are often insured through national deposit guarantee programs, uninsured deposits may be withdrawn when there are concerns about a bank’s health. Even if the bank is fundamentally healthy, suspicion of problems can potentially be self-fulfilling if the bank does not have enough liquid funds to meet customer withdrawals.

In the worst-case scenario, a bank that would otherwise survive may collapse if concerns trigger a bank run. The effects of bank runs can go beyond the cost to banks’ owners and remaining creditors and can become a financial stability concern. Bank runs can be contagious, and adversely affect real economic growth. For this reason, financial authorities and regulators have set up a governance framework for containing this risk.

Speedy bank withdrawals

A typical bank funds itself mainly with deposits from its business and household customers. The bank holds on to a fraction of these deposits to meet potential withdrawals. The rest is used to generate income for the bank. For instance, the bank will offer loans to individuals or businesses in need of funding.

This business model relies on depositors not withdrawing their money all at once. In this case, the bank cannot pay it all back because the deposits are now tied up in longer-term lending to other bank customers.

In normal times, deposit funding of bank lending activities is rather stable. Depositors usually keep a certain balance in their accounts to pay for such expenses as housing and groceries. Individual depositor account fluctuations generally cancel out over time across the many account holders of a bank.

But if rumors emerge that a bank may be at risk of collapse, widespread deposit withdrawals may occur. If withdrawals happen slowly, the bank has time to find funding elsewhere or sell assets to raise funds. Fast withdrawals, on the contrary, can bring down a bank before it can secure funding alternatives.

The potential speed of withdrawals is hence crucial. As the digital frontiers of banking further advance, the speed with which bank customers can withdraw deposits may further increase. Without appropriate adjustments to banks’ management of such funding risks, this could pose a potential threat to financial stability.

Quick transfers between banks

One way that bank withdrawals can become faster is through easier and faster transfers to other banks. Historically, transfers of deposits between banks have been somewhat limited. Among the reasons is that many bank customers typically have accounts with only one bank, notably because it is time-consuming to collect information about terms and conditions and open an account with a new bank. It may also be expensive to change banks.

New technology may eliminate some hurdles. For instance, online and mobile banking services have made it easier for customers to transfer money between banks 24/7. Increasing access to cheap instant payment systems is reducing the time it takes for a customer to transfer money from one bank to another. It is also likely that personal banking relationships, and the associated loyalty to a bank, play less of a role when banking relationships are increasingly digital.

Artificial intelligence may also accelerate bank withdrawals and transfers. Today, AI-powered tools can analyze an almost unlimited amount of data at high speed, including banks' terms and conditions and news flows from both social media and more traditional media, such as newspapers. Based on such analysis, future AI-powered tools may help bank customers automatically and instantly reallocate deposits across different banks, based on criteria set by the customer. Such criteria could include the interest paid on deposits, perceived bank safety, or the customer’s wish for diversification across banks.

Regulatory requirements, such as the requirement to verify the identity of their customers (know-your-customer requirements), may not prevent AI-powered tools from opening accounts on behalf of a customer. Once a customer uploads the necessary documents and mandates to an AI-powered tool, it may be able to engage in dialogue with several banks and confirm the customer’s identity.

While the future impact of AI and tech innovations in banking is uncertain, it is possible to imagine that the frequency of bank runs may increase significantly.

Fighting tech with tech

Although new technology can increase the risk of bank runs, banks may also use technology to reduce the risk. For example, AI tools may be developed to improve liquidity management and monitor withdrawal patterns, which could help lower bank-run risk.

Other tools to reduce run risk include adequate funding—such as more equity financing or more liquid assets on banks’ balance sheets—that can be used quickly to raise funds to repay depositors. Banks may themselves find it optimal to use more equity financing or hold more liquid assets—or they may be required to do so if authorities are concerned about systemic financial risk. Authorities may also extend deposit insurance and access to central bank funding facilities in case of a crisis. In addition, appropriate recovery and resolution regimes can help restore confidence in the financial system after a bank failure to avoid the spread of bank runs.

The set of tools is not a panacea, however. Each tool can have undesirable side effects that should be balanced against their benefit of reducing risks. Take a potential requirement that banks place more of their deposits in assets that can be sold immediately at no cost, such as high-quality government bonds. In case of a run, the bank can quickly sell the bonds and pay back its depositors. In the extreme, all deposit funding could be placed in highly liquid safe assets, which would effectively eliminate bank runs. However, it would also mean that bank lending to households and businesses would have to be financed by other means, notably equity or long-term borrowing on the part of the bank. There is a risk that it would reduce lending to the real economy, temporarily or permanently. It could also affect the balance sheets of central banks and governments, as well as asset prices, because of higher demand for safe liquid assets.

Expanding deposit insurance programs would also reduce risks. However, depending on how the insurance is financed, high coverage could impose unacceptably high costs on the public purse in case of bank failures: a sufficiently large prepaid insurance fund in many cases would be difficult to put in place up front. Such coverage could also interfere with banks’ incentives to behave prudently (creating moral hazard). Similar effects are present if banks’ access to central bank emergency lending is extended. This move could place the central bank at risk of a financial loss, and it may lead to risky behavior of banks or disruption of the interbank loan market.

In employing such tools, the potential adverse side effects should always be balanced against the benefit to society of risk reduction, and some risk will always remain. Our point is that with new technological advances, this balance may have to shift.

Central bank digital money

The increased use of electronic payments in place of cash has led a growing number of central banks to consider introducing a central bank digital currency (CBDC). A CBDC would allow households and firms to convert their deposits at commercial banks into deposits at a CBDC account—that is, at the central bank.

A deposit with the central bank would in most cases be considered very safe. Depending on how they are designed, CBDCs might shift the dynamics of bank runs, transforming them from runs between commercial banks to runs from commercial banks to the central bank's balance sheet. If there are no constraints on the account at the central bank, customers of a commercial bank perceived as risky might opt to shift all their money to the central bank. The concern is that this option may in itself increase the risk of, or exacerbate, bank runs. Notably for this reason, some central banks considering the introduction of CBDCs are contemplating constraints on how much money a household or firm can deposit in a CBDC account.

However, if future technology in banking substantially increases the speed of possible deposit withdrawals, the speed of bank runs may be unaffected by the presence of even unlimited CBDCs.

We do have tools available to address bank-run risks, but it is crucial to acknowledge that there is no silver bullet.

Each tool comes with its own set of advantages and drawbacks. However, given the unpredictable nature of technological breakthroughs and their uptake in financial markets, it is important to follow developments closely and consider how best to adjust the toolkit. What ensured the safety of the financial system yesterday may not prove sufficient tomorrow.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.