Some workers will win, others will lose as the use of artificial intelligence grows

Technological developments—such as factory robots, smart home devices, and self-driving cars—transform the way we live and work. Such developments are exciting in many ways, because they promise higher productivity and standards of living. But they can also be frightening: when the machines take over, how will many people make a living?

This is an old question, of course. Fears about technology destroying jobs, displacing workers, and damaging lifestyles arose during the Industrial Revolution—best exemplified, perhaps, by the Luddites in England, who fought life-altering changes in the textile industry. These fears persist today. As then-US Senator John F. Kennedy said in 1960, at the dawn of the computer revolution, “Today we stand on the threshold of a new industrial revolution—the revolution of automation. This is a revolution bright with the hope of a new prosperity for labor and a new abundance for America, but it is also a revolution which carries the dark menace of industrial dislocation, increasing unemployment, and deepening poverty.”

In retrospect, Kennedy’s concern about lost jobs seems misplaced. In the years after his speech, the US economy created millions of net new jobs, and mass technological unemployment did not emerge—as demonstrated by today’s unemployment rate of about 3.5 percent and the multi-decade-high ratio of employment to population.

These labor market developments would seem to assuage the concerns of a modern-day Luddite: with the benefits of technology and the power of the market, people will find new jobs, and rising productivity will raise living standards—which ultimately happened during the Industrial Revolution of the 18th and 19th centuries. Indeed, the standard of living has increased enormously since 1900. Technologies such as electricity, internal combustion engines, telephones, and modern medicine have improved the quality of life and increased life expectancy.

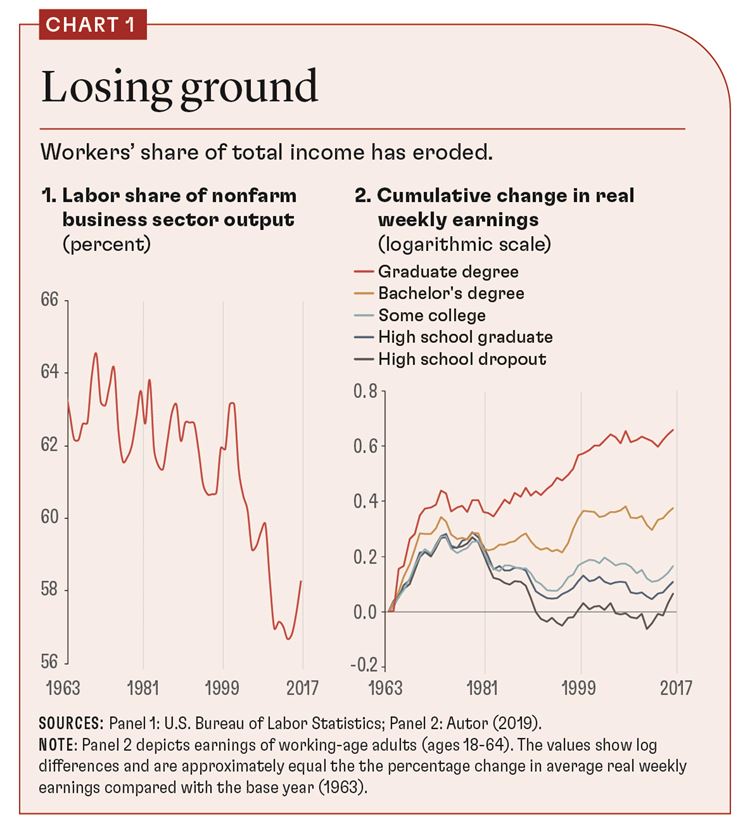

That is not to say, however, that Kennedy’s concerns were unfounded. Only a few years after his speech, wage inequality began to worsen sharply (see Chart 1), and the share of income going to workers fell (Karabarbounis and Neiman 2014).

Economists have developed frameworks for thinking about the implications of artificial intelligence (AI)—which simulates human intelligence in machines—and, more generally, the impact of technological change, automation, and robots on inequality. In this respect we will highlight four key channels that affect inequality:

- Technological change that improves the productivity of skilled more than unskilled workers

- Reductions in the cost of capital that complement chiefly skilled labor

- Increased ability of machines to replace workers entirely for particular tasks

- Increased concentration of market power in a few firms as a result of technology

Regarding the first channel, Katz and Murphy (1992) explained the evolution of relative wages in the United States as the outcome of a race between increases in the demand and supply of skilled workers. They focused on aggregate productivity and factor-augmenting technological change. Increases in the supply of skilled workers reduced the skill premium, whereas persistent increases in demand for such workers had the opposite effect. These forces explain both the dip in the skill premium in the early 1970s—when the supply of educated workers rose sharply because more people went to college—and the rise in skill premiums after the 1980s.

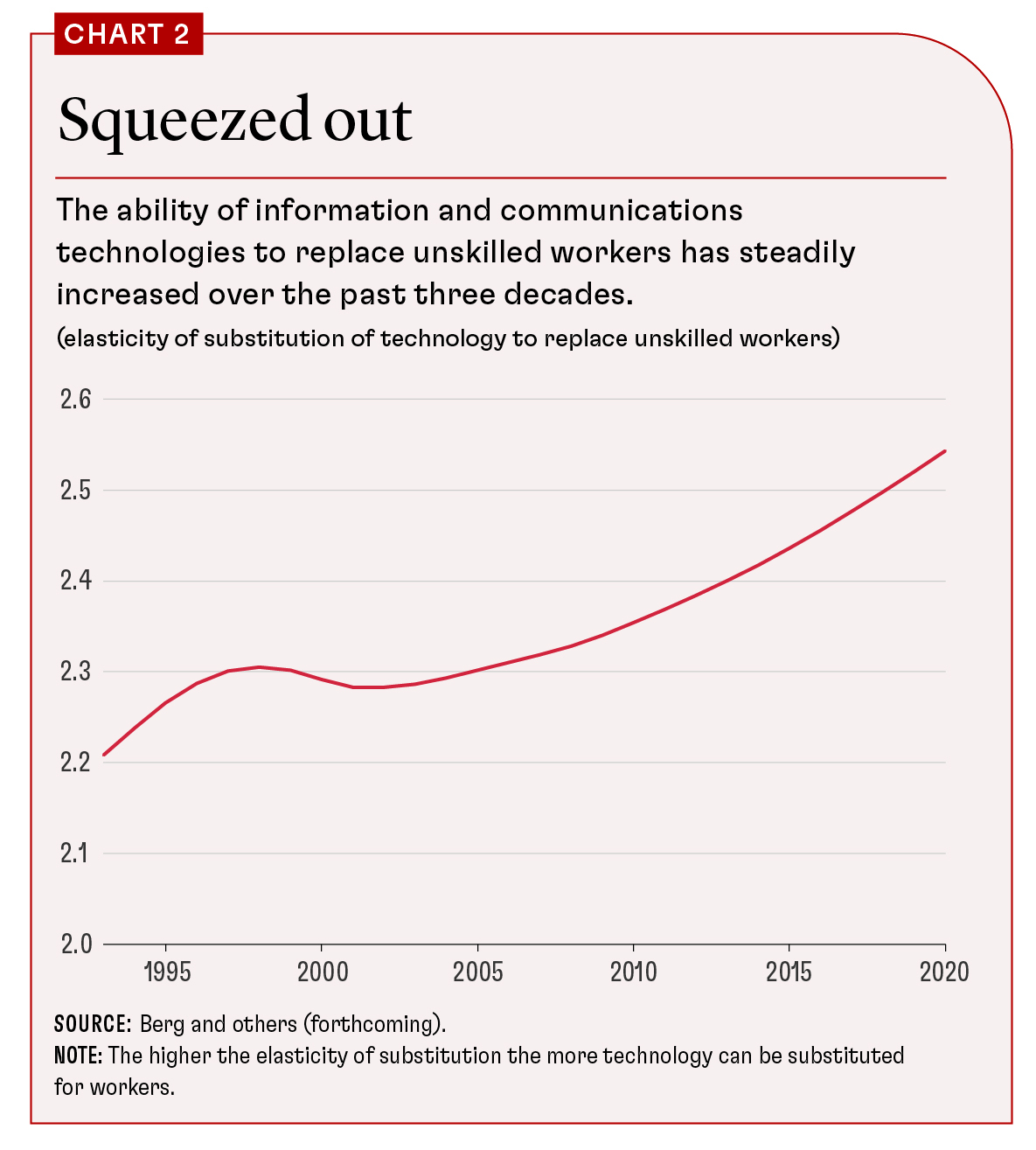

In the second channel, capital, especially machinery and equipment, tends to complement skilled workers and substitute for unskilled workers—for example, machine tools require more programmers but replace other workers in factories. Berg, Buffie, and Zanna (2018) extend this approach to look at AI and robots as a new type of capital—additional to traditional machinery and structures—that substitutes for some groups of workers and complements others. Over the past 30 years the substitutability between information and communications technologies (ICT)—a proxy for new technologies, including computers and early AI—and unskilled workers seems to have increased (see Chart 2). In other words, ICT capital apparently is now better able to perform the tasks of unskilled workers.

The higher substitutability of workers with machines and AI increases wage inequality and the share of total income that goes to the owners of capital—raising the question of how the benefits of AI technologies should be distributed or, put differently, who owns AI. In the long run, society may well be better off with the higher overall productivity that ensues, but there would be many losers, concentrated among those already less well off. And during a possibly decades-long transition, many could see real wage declines.

Acemoglu and Restrepo (2020) point out that technology has increasingly replaced workers in routine tasks, even as it has enhanced the creativity of other workers’ roles. The race between these new creative tasks and automation of routine tasks affects the demand for different types of workers and ultimately determines wages and overall productivity. Acemoglu and Restrepo (2020) show that exposure of different labor groups to automation explains most changes in relative wages—without much of a role for skill-based technological change or for foreign trade and outsourcing-related replacement of workers.

A fourth dimension of technological change extends beyond the labor market to firms’ market power. Corporations such as Alphabet and Microsoft clearly dominate leading AI technologies. Developing these technologies is costly and depends heavily on big data, to which only a few firms have access. Yet it also means that as owners of the AI capital those few firms will take a larger slice of the pie. As they rent their technologies to firms in other industries, labor share will continue to fall, while the income from AI technologies will increase.

But the implications of corporate market power are not limited to owning AI. So far, we have discussed technological change as a process that happens naturally. In reality, however, companies innovate, and their innovations shape both the speed of growth and the kinds of new technologies that emerge. Once firms are big enough, they can purchase and bury possible competitors—potentially stifling competition, limiting innovation, and worsening inequality.

Moreover, large corporations with access to leading AI technologies may be able to influence the regulatory framework to align with their interests and to direct innovation toward corporate goals rather than social welfare. For example, Acemoglu and Restrepo (2022) note that the automation observed in recent decades may have been the sort that displaces workers without producing much in the way of overall productivity growth. They show that machines can displace workers without being all that much better at the relevant tasks. Moreover, higher inequality and lower labor share in income may be permanent features, and any transition could be very difficult. The short run could be a lifetime for some workers (Berg, Buffie, and Zanna 2018).

The First Industrial Revolution reflected both the optimistic long-term and worrisome short-term perspectives. Few would want to give up the benefits from earlier industrial revolutions—from indoor toilets to cell phones—but the transition was both economically and politically wrenching. Carl Benedikt Frey argues in The Technology Trap that for certain “vulnerable” groups three entire generations were worse off as a result. Joseph Stiglitz argues in the December 6, 2011, issue of Vanity Fair that the technology-driven transition from agriculture to manufacturing in the 1920s set the stage for the Great Depression. More recently, the distributional implications of technological change are arguably an important factor in the rise of populism and anti-globalization sentiment.

AI is rapidly evolving in unpredicted directions—perhaps making it impossible to draw any historical lessons. The early 2023 emergence of ChatGPT-4—an AI model that seeks to generate human-like language—marks a significant acceleration in the pace of change, highlighting AI’s ability to extend far beyond routine tasks. Experts in AI surveyed by McKinsey in 2019 expected computers to be able to write at the level of the top 25 percent of humans by 2050 and perform human-level creative tasks by 2055. However, they have revised their estimates to 2024 and 2028, respectively.

It is easy to see why the projections have changed so sharply. Generative pretrained transformers (GPT) seem to have the potential for widespread labor market impact—one estimate suggests that once GPT is introduced into the work environment, about 20 percent of workers could see at least half of their tasks affected. GPT seems to increase productivity in more creative tasks, such as writing, legal analysis, and programming. These studies compare the productivity of groups using GPT with a control group in the given task and find big jumps in productivity with GPT. Just as remarkable, though, is the observation that the least-skilled participants benefit most and that at least in some cases the GPT-augmented input is more creative; moreover, there are signs that GPT-4 alone may exceed human-level output. These findings contrast with earlier emphasis on the automation of routine tasks and the substitution of AI and robots for unskilled labor. Such shifts in the impact of new technologies on skilled and low-skilled workers seems to be a key difference between GPT and previous waves of technology, such as digitalization.

All this suggests major implications for both growth and inequality, but it also suggests that the past may not be prologue. Will some wage inequality be reversed as lower-skilled workers benefit more? Or will major corporations—with the best access to data, computers, and top talent—gain more economic and political power? The so-far-hypothetical prospect of artificial general intelligence (AGI) adds another dose of uncertainty. AGI would presumably be capable of any human intellectual effort. How all this would play out will clearly depend on both the evolution of the technology and the policy and broader societal response. There are optimistic and pessimistic AI scenarios, but under any of them, economic, social, and political upheaval seems a safe prediction, and policymakers must do their best to understand the distributional implications of the rapid changes that are underway.

DATA

25%

Computers may

be able to

write at the

level of the

top

25 percent

of humans by

2024,

according

to AI experts

surveyed by

McKinsey.

As we navigate the transition to widespread use of AI, it is crucial to acknowledge the global implications of AI technologies—which so far have not been largely studied. Previous research suggested that the substitution of AI for unskilled labor could widen global income disparities, putting lower-income countries at a disadvantage (Alonso and others 2022). But the advent of generative AI suggests that the impact of these technologies on different countries is uncertain. Developing economies may benefit from AI as a tireless universal tutor and expert programming assistant that strengthens their workforces. Conversely, limited access to data and expertise and technological gaps could widen divergence.

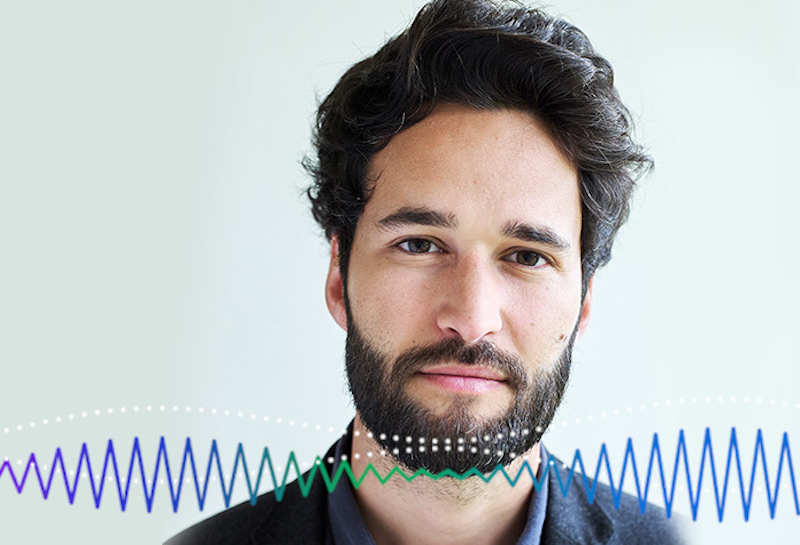

Podcast

There’s no question that Artificial Intelligence will increase productivity- but at what cost? What happens when systems out-perform not only factory workers but society’s most esteemed professions? Daniel Susskind is a research professor at King's College London and a senior research associate at the Institute for Ethics in AI at Oxford University. In this podcast, he speaks with journalist Rhoda Metcalfe about how encouraging technologies that complement rather than substitute human work would place fewer livelihoods at risk.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.

References:

Acemoglu, D., and P. Restrepo. 2020. “Robots and Jobs: Evidence from US Labor Markets.” Journal of Political Economy 128 (6): 2188–244.

Acemoglu, D., and P. Restrepo. 2022. “Demographics and Automation.” Review of Economic Studies 89 (1): 1–44.

Alonso, C., A. Berg, S. Kothari, C. Papageorgiou, and S. Rehman. 2022. “Will the AI Revolution Cause a Great Divergence?” Journal of Monetary Economics 127: 18–37.

Autor, D. H. 2019. “Work of the Past, Work of the Future.” In AEA Papers and Proceedings, vol. 109, 1–32. Nashville, TN: American Economic Association.

Berg, A., E. F. Buffie, and L. F. Zanna. 2018. “Should We Fear the Robot Revolution? (The Correct Answer Is Yes).” Journal of Monetary Economics 97: 117–48.

Karabarbounis, L., and B. Neiman. 2014. “The Global Decline of the Labor Share.” Quarterly Journal of Economics 129 (1): 61–103.

Katz, L. F., and K. M. Murphy. 1992. “Changes in Relative Wages, 1963–1987: Supply and Demand Factors.” Quarterly Journal of Economics 107 (1) 35–78.