In a more shock-prone world, strengthening the financial safety net is more important than ever

In times of economic crisis, countries can tap various financial resources, both internal and external. The global financial safety net is a set of institutions and mechanisms that provide insurance for economies against crises to lessen their impact.

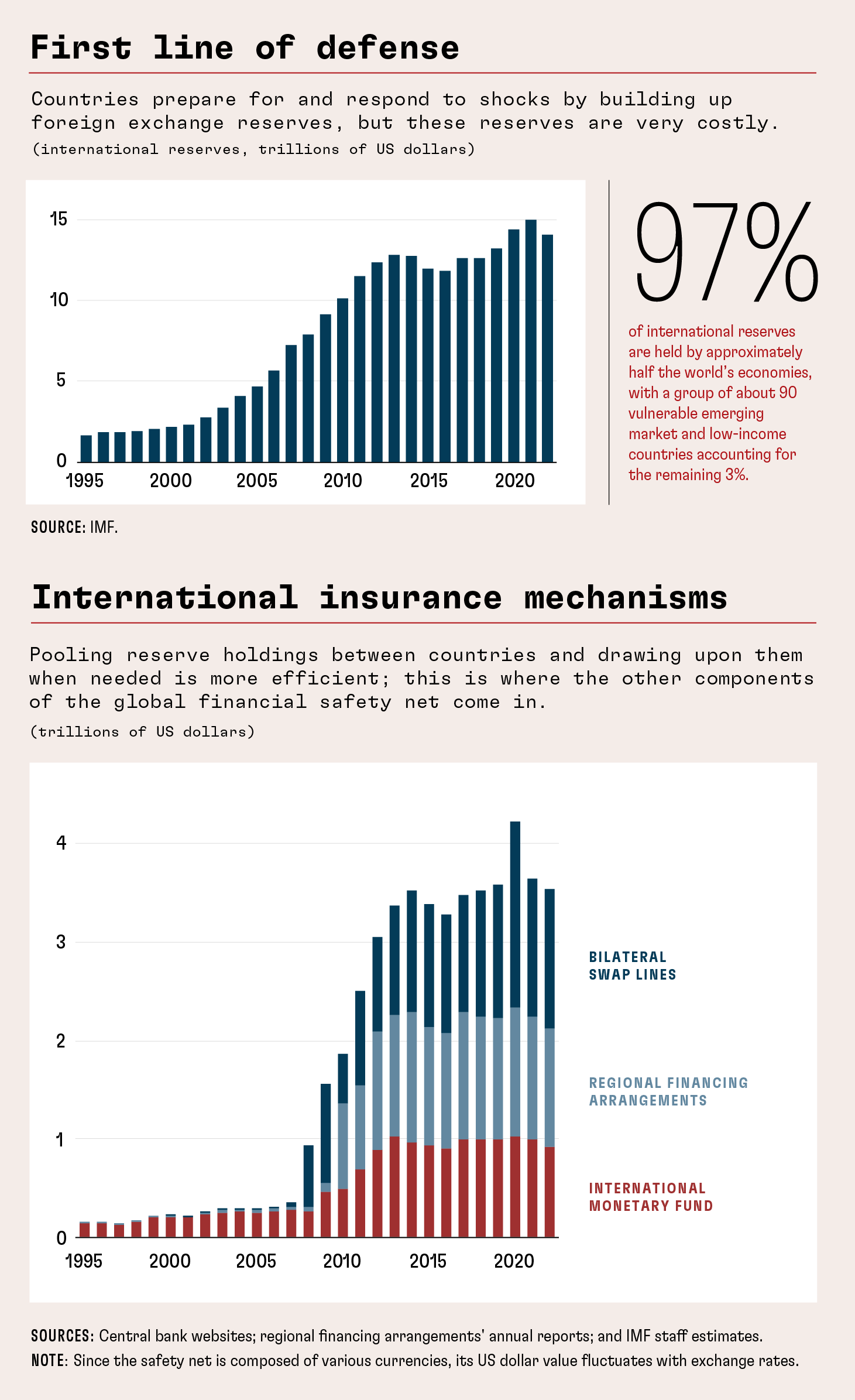

This safety net consists of four main layers: countries’ own international reserves, bilateral swap lines whereby central banks exchange currencies to provide liquidity to financial markets, regional financing arrangements by which countries pool resources to leverage financing in a crisis, and the IMF.

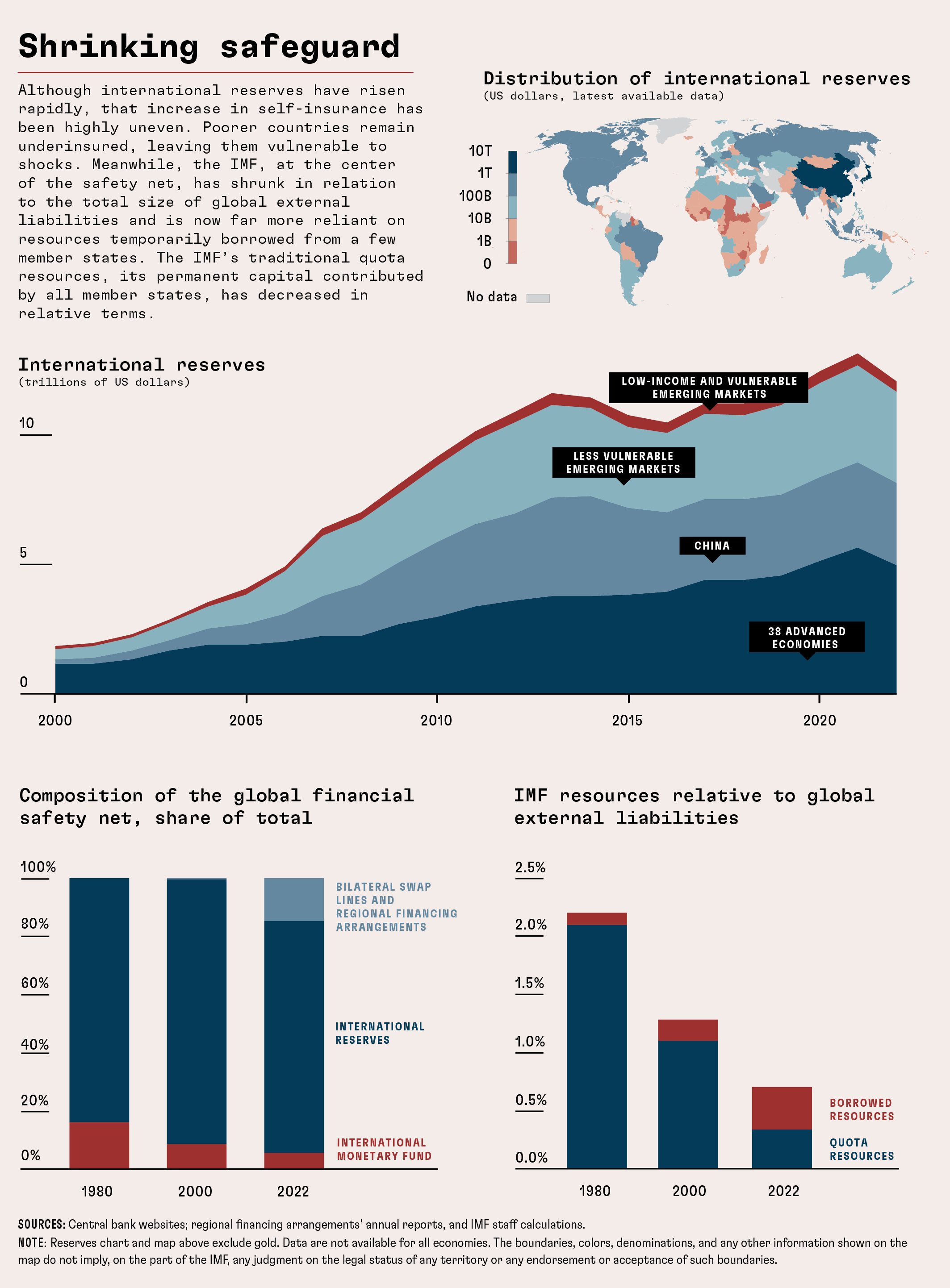

International reserves are the first line of defense in a crisis; however, because of their high cost, they are unevenly distributed, with most held by advanced economies and larger emerging market economies.

A more efficient way of insuring against crises is through pooled resources, such as the IMF, swap lines, and regional financing arrangements. Although the latter two have grown considerably over the past two decades, they are still available only to a limited group of countries.

This is why the IMF is so important to this system. It is the ultimate global crisis lender and insurer of the uninsured. Yet the IMF’s lending capacity as a share of global external liabilities has gradually diminished over time. And the share of borrowed resources has increased.

To continue to play this critical role at the center of the global financial safety net, permanent quota resources of the IMF need to be boosted. This will bolster the capacity to protect against future crises and, in particular, support members with smaller financial buffers, who need them most.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.