Disruption in trade threatens losses to global living standards as severe as those from COVID-19

Last year, on the 24th of February, Russia invaded Ukraine. Beyond the direct suffering and humanitarian crisis, the entire global economy has felt the adverse effects of the war. As the invasion disrupted production in Ukraine, and Western countries imposed sanctions on Russia, the global supply of key commodities was curtailed. Within days, energy, food, and certain mineral prices shot to record levels.

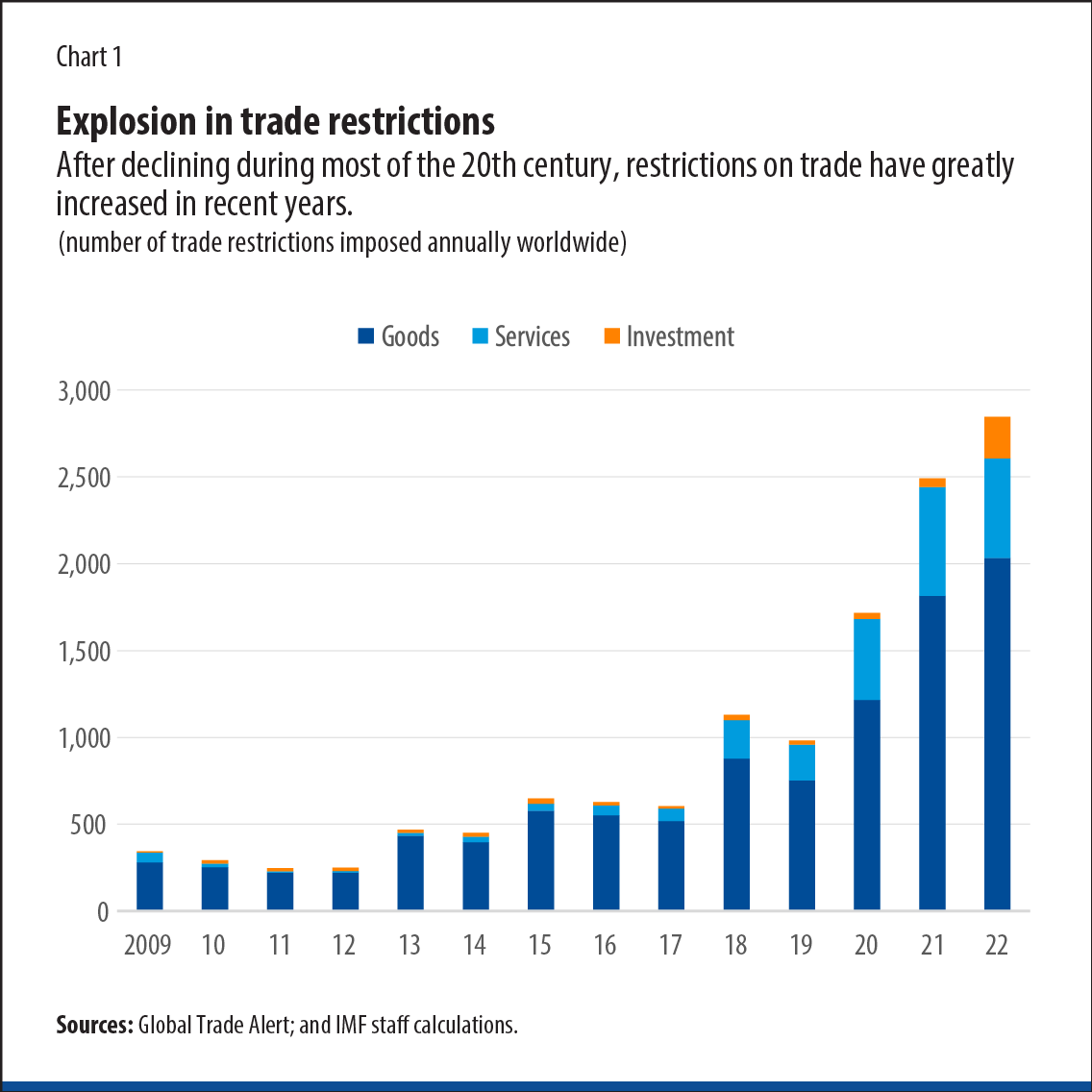

The disruption in global trade following the Russian invasion of Ukraine is not an isolated event. In recent years, trade restrictions in sectors like commodities and semiconductors, which are seen as crucial for national security and strategic competition, have increasingly taken precedence over global economic integration and its shared benefits. The United Kingdom’s decision to leave the European Union in 2016 is an example of this broader trend. The world‘s two largest economies, the United States and China, have imposed a series of bilateral trade barriers in recent years. And, during the COVID-19 pandemic, many countries chose to restrict exports of medical goods and foodstuffs. While trade barriers were generally on a decreasing path throughout the 20th century, this trend has reversed over the past decade (Chart 1). These events may be early signs of broader geoeconomic fragmentation—defined as a policy-driven reversal of economic integration, of which international trade is a central component.

The rise in trade barriers in recent years has accompanied a plateauing of global trade integration. In the three decades preceding the global financial crisis, global incomes and international trade increased in tandem. For many low-income countries and emerging market economies, this integration into the global economy was a crucial contributor to their development, providing access to affordable imports, extensive export markets, and foreign technology.

How do trade barriers affect living standards? Let’s zoom out for a second to explain.

Consider a country that imposes an import tariff on semiconductors. First, for consumers who buy computers, a tariff immediately increases the price they pay. Of course, domestic firms can try to introduce competing models or expand production. But this is costly—in particular because consumers had already revealed over time their preference for the foreign chips by their purchasing choices, either because of lower prices or product characteristics. Consumers are therefore worse off.

Second, consider the perspective of workers in the country that used to produce semiconductors for export. With shrinking access to their export markets, their incomes tend to fall.

Third, consider the impact on the prices of other goods and services that use computers as inputs. In the professional services sector, for example, accounting firms will now need to charge customers more to cover the higher prices of their computers. These indirect effects through complex supply chains can be large and have knock-on effects on consumers in other countries as well.

In sum, higher trade barriers tend to be a double whammy for households. Not only do they lead to higher prices, but they also tend to reduce the incomes households receive.

So what are the potential costs of geoeconomic fragmentation through trade? In a recent paper, we study this question in more detail.

We explore different illustrative scenarios using a quantitative multicountry model of international trade that allows us to simulate the impact of changes in trade barriers on prices, trade flows, and incomes. Given the importance of commodities in global trade and recent restrictions, and given that they are produced in a relatively small set of countries, we construct a dataset that allows for significantly more detailed coverage of their trade and production as an input to the model.

This dataset covers 24 aggregated sectors and 136 disaggregated commodities across 145 countries— representing 99 percent of global GDP. Other datasets leave commodities aggregated, treating products as dissimilar as gold and natural gas as perfect substitutes. Our approach allows us to capture the imperfect substitutability of different commodities, along with the fact that production of specific commodities is often concentrated in a few countries. Both of these elements increase the cost of trade barriers.

It is worth noting that our work focuses on the output losses of geoeconomic fragmentation through trade. The total losses of fragmentation will likely be even larger.

First, we look at a scenario in which trade fragmentation is limited to the elimination of all trade between Russia on one hand and the United States and the European Union on the other, as well as the elimination of trade in high-tech sectors between China and the United States and European Union. This scenario is akin to a broadening of current Russian sanctions to the entire spectrum of trade in goods and services, and expanding beyond the current focus on semiconductor chips to all high-tech goods.

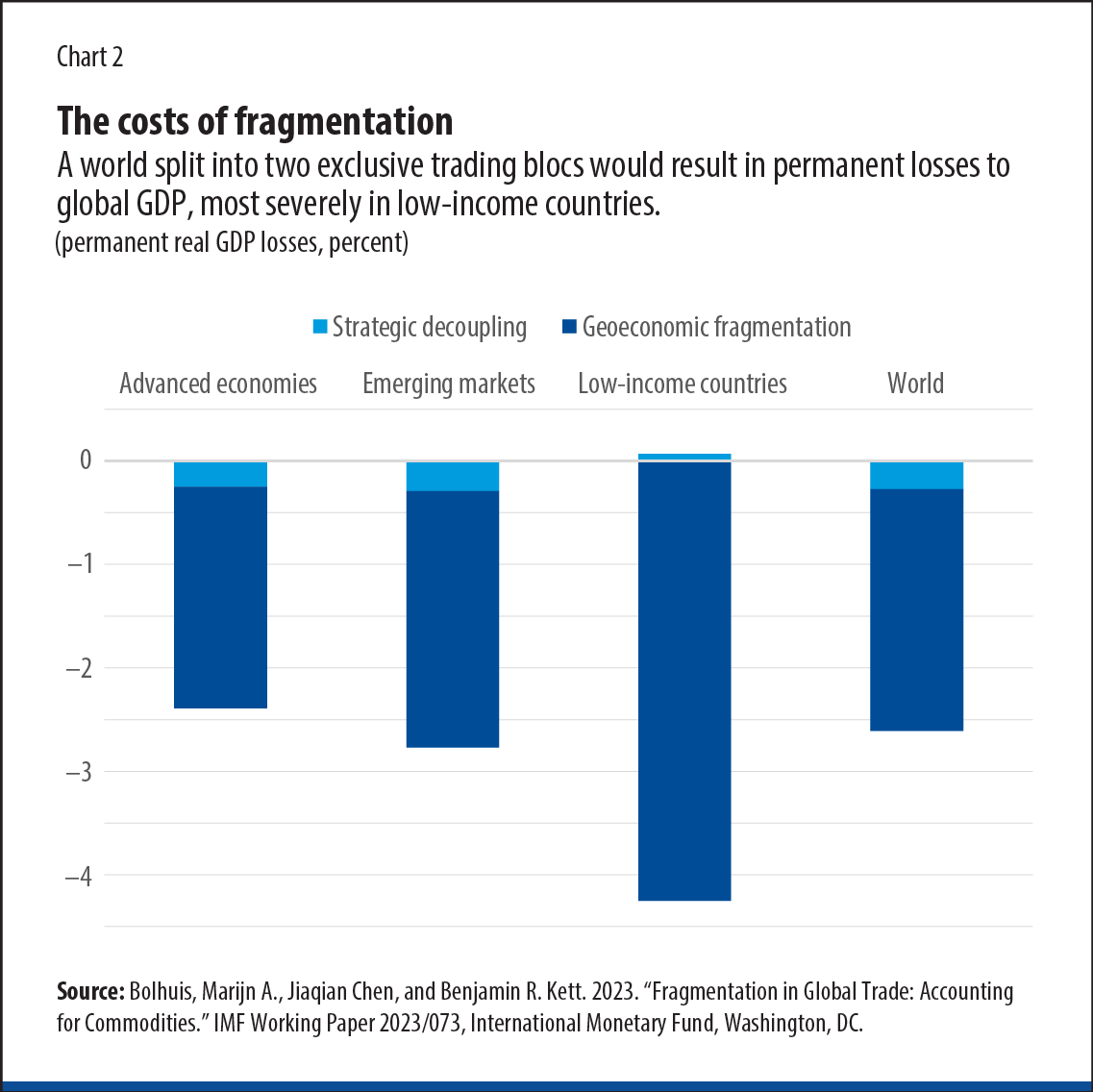

Such a strategic decoupling would lead to permanent GDP losses of 0.3 percent globally, roughly equivalent to the annual output of Norway (Chart 2).This global negative impact masks some heterogeneity. Indeed, as long as the rest of the world keeps trading freely with Russia, China, the United States, and the European Union, some countries may even see small gains. Commodity exporters, for example, that can eventually replace Russia as a key supplier, would see their incomes increase. Some Asian countries would benefit if semiconductor supply chains were relocated from China.

Second, we look at a more severe scenario, geoeconomic fragmentation, in which all countries are forced to choose between either the United States–European Union or the China-Russia blocs, with no trade between these two blocs. In this illustrative scenario, countries are grouped based on how much they trade with either the United States or China.

In this case, global output losses would be substantial, at 2.3 percent of global GDP, equivalent to the size of the French economy (Chart 2).

Permanent losses for advanced economies and emerging markets would be on the order of 2 to 3 percent.

And low-income countries would come under significant pressure, losing more than 4 percent of GDP. These losses would deepen risks of debt crises and exacerbate social instability and food insecurity. Poorer countries are typically most at risk from geoeconomic fragmentation because they are heavily dependent on the imports and exports of key products, including commodities, for which it is more costly to find new suppliers.

How large are these losses relative to historic events? To provide some comparison—global GDP losses would be on the order of the 2020 output losses due to COVID. However, these losses would be permanent.

How bad things get would depend not only on the extent of trade restrictions and how countries divide into blocs. The adjustment process itself can be challenging. If fragmentation occurs quickly, it will be very costly for supply chains to adapt. This will also imply greater global GDP losses, as high as 7 percent if adjustment costs are particularly large.

So what can be done to prevent the worst losses from runaway fragmentation, including for the most vulnerable economies? A recently published IMF Staff Discussion Note outlines possible modalities of international cooperation that could help limit the risk of, and the damage from, trade fragmentation when geopolitical tensions are high.

To avoid a proliferation of unilateral trade barriers, the World Trade Organization, including its dispute resolution mechanism, should be reinforced. Multilateral efforts should focus on reforms with high impacts where preferred economic policies of countries are broadly aligned.

Yet in the current environment, progress through multilateral consensus may not always be possible. In areas where countries’ preferences are not well aligned, deeper integration through regional trade agreements, along with an open and nondiscriminatory stance toward other countries, can be a way forward.

Low-income countries, which are the most vulnerable to the adverse growth effects of runaway fragmentation, must not become caught in the crossfire. If and when countries undertake unilateral actions, credible guardrails will be needed to protect the vulnerable and mitigate global spillovers. These guardrails could include, for example, safe corridors for food and medicine, along with multilateral consultations to assess the economic impact of unilateral actions and identify their unintended consequences.

The trend toward geoeconomic fragmentation is a significant challenge that will have far-reaching economic consequences for countries across the world. But by strengthening and modernizing the global trading system, we can overcome these challenges and preserve the large benefits of economic integration.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.