Carbon taxes have a central role in reducing greenhouse gases

Deterring the burning of fossil fuels is crucial to reducing the accumulation of heat-trapping greenhouse gases in the earth’s atmosphere. A carbon tax could discourage the use of fossil fuels and encourage a shift to less-polluting fuels, thereby limiting the carbon dioxide (CO2) emissions that are by far the most prevalent greenhouse gas.

According to the World Meteorological Organization, without measures to reduce greenhouse gases, global temperatures are projected to rise by about 4°C above preindustrial levels by the end of the century (temperatures have already increased by 1°C), with rising and irreversible risks of collapsing ice sheets, disruption of ocean circulatory systems, inundation of low-lying island states, and extreme weather events.

The case for carbon taxes

Carbon taxes, levied on coal, oil products, and natural gas in proportion to their carbon content, can be collected from fuel suppliers. They in turn will pass on the tax in the form of higher prices for electricity, gasoline, heating oil, and so on, as well as for the products and services that depend on them. This provides incentives for producers and consumers alike to reduce energy use and shift to lower-carbon fuels or renewable energy sources through investment or behavior.

While addressing climate change by reducing greenhouse gases, carbon taxes can also generate more immediate environmental and health benefits, particularly by reducing deaths that result from local air pollution. They can also raise significant revenue for governments, revenue they can use to counteract economic harm caused by higher fuel prices. For example, governments could use carbon tax revenue to ease the burden of taxation on workers by lowering personal income and payroll taxes. Carbon tax revenue could also fund productive investments to help achieve the United Nations Sustainable Development Goals, including reducing hunger, poverty, inequality, and environmental degradation.

Other policies are less effective than carbon taxes. For example, incentives for renewable power generation do not promote switching from coal to gas or from these fuels to nuclear, do not reduce electricity demand, and, not least, do not promote emission reductions beyond the power-generation sector.

International appeal

Carbon taxes are generally straightforward to administer because they can be piggybacked on existing fuel taxes, which most countries already collect with ease. It is also possible to integrate carbon taxes into the royalties paid by coal mining and oil and gas drilling industries. In fact, the fiscal and administrative case for carbon taxes may be especially appealing in developing economies, where large informal sectors of the economy constrain revenue that can be collected from broader taxes on income and profits. With the establishment of emission-monitoring capacity, variants of carbon taxes can be applied to other sources of greenhouse gases, such as emissions from forestry, international transportation, cement manufacturing, and mining and drilling activities.

Carbon taxes can play a key role in achieving countries’ pledges under the 2015 Paris Agreement, which lays the foundation for international action to combat global warming. These commitments must be updated every five years.

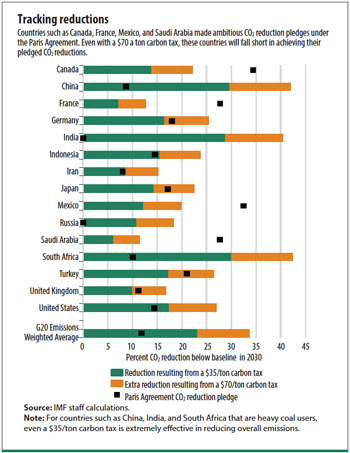

The chart provides a broad sense of the effectiveness of different levels

of carbon taxes. Reductions in emissions produced by a $35 a ton carbon tax

(green bars) would be more than sufficient to meet the total commitments of

the Group of Twenty countries. Those commitments, shown by the black

squares in the chart,

represent percentage reductions in projected fossil fuel CO2

emissions in 2030 below baseline levels (that is, levels in the absence of

new mitigation measures) implied by Paris pledges.

A $35 a ton carbon tax would be particularly effective in reducing emissions in heavy coal users such as China, India, and South Africa. The tax would roughly double coal prices but would increase pump prices for road fuels only moderately. In contrast, even a $70 a ton carbon tax falls short of what is needed in other cases, such as Canada and some European countries. In part, this reflects the more stringent pledges made by these countries.

These findings may make the case for some degree of international price coordination. A group of large-emitting countries could agree to impose a minimum price on carbon. These price floors guarantee a certain level of mitigation effort among participants while also providing some assurance against losses in competitiveness. A prototype for this sort of approach is Canada, where provinces and territories must phase in a minimum carbon price, rising to Can$50 (US$38) a metric ton by 2022. Advanced economies could accept more responsibility for mitigation through a higher minimum price requirement. And the regime could be designed flexibly to accommodate carbon taxes, emission trading systems, or other approaches.

Domestic push

The most immediate challenge, however, is moving mitigation policy forward

at the national level: carbon taxation can be politically very difficult.

Carbon taxes should be introduced gradually, with targeted assistance for

low-

income households, trade-dependent industries, and vulnerable workers. The

rationale for reform and the use of revenues must be clearly communicated

to the public. Other instruments may be needed to reinforce carbon pricing,

or substitute for it. One potentially promising approach avoids a

politically difficult increase in fuel prices by implementing

revenue-neutral tax subsidies to promote incentives for cleaner power

generation, shifting to cleaner vehicles, and improvements in energy

efficiency.

A good first step has already been taken. More than 50 carbon tax and emission trading systems now operate at the regional, national, and subnational levels, but the global average carbon price is only $2 a ton, far short of what is needed. Ministries of finance will need carefully crafted policy packages to provide broader and stronger mitigation incentives, accounting for national efficiency, distributional, and political economy considerations.