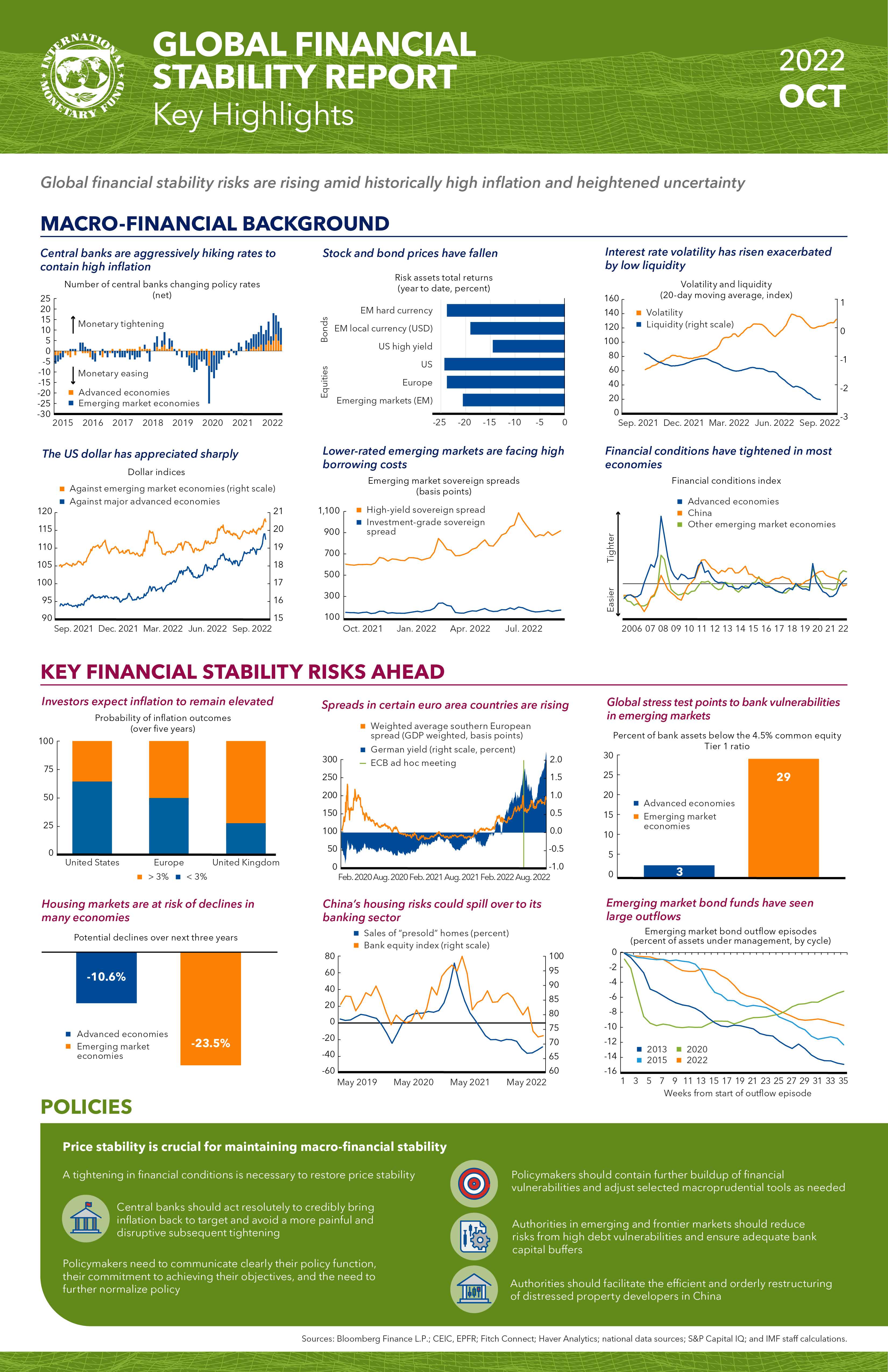

Global financial stability risks have increased amid a series of cascading shocks

Chapter 1: Financial Stability in the New High-Inflation Environment

Financial stability risks have increased amid the highest inflation in decades and the ongoing spillovers from Russia’s war in Ukraine to European and global energy markets. Amid poor market liquidity, there is a risk that a sudden, disorderly tightening in financial conditions may interact with preexisting vulnerabilities. In emerging markets, rising rates, weak fundamentals, and large outflows have pushed up borrowing costs, particularly for frontier economies, with a heightened risk of additional defaults. In China, the property downturn has deepened as sharp declines in home sales have exacerbated pressures on developers, with heightened risks of spillovers to the financial sector.

Chapter 2: Scaling Up Private Climate Finance in Emerging Market and Developing Economies: Challenges and Opportunities

Emerging market and developing economies need significant climate financing to mitigate and adapt to climate change. This chapter examines the key role of private finance in achieving these objectives. It finds that innovative finance instruments can overcome some of the challenges and help broaden the investor base. The involvement of multilateral development banks is crucial to leverage private investment and provide risk-absorption capacity. The IMF can play a catalytic role through its policy advice, surveillance, and capacity development, as well as through financing from its new Resilience and Sustainability Trust, which could help tackle longer-term structural challenges arising from climate change.

Chapter 3: Asset Price Fragility in Times of Stress: The Role of Open-End Investment Funds

Chapter 3 analyzes the contributions of open-end investment funds to fragilities in asset markets. Open-end investment funds play a key role in financial markets, but those offering daily redemptions while holding illiquid assets can amplify the effects of adverse shocks by raising the likelihood of investor runs and asset fire sales. This contributes to volatility in asset markets and potentially threatens financial stability. The impact of these vulnerabilities could also spillover to emerging markets and lead to a tightening of financial conditions. To correct course, policymakers should ensure that liquidity management tools are available, calibrated appropriately, and utilized by funds.

Publications

-

September 2024

Finance & Development

- PRODUCTIVITY

-

September 2024

Annual Report

- Resilience in the Face of Change

-

Regional Economic Outlooks

- Latest Issues