People in front of an oil company in Rio de Janeiro, Brazil that went bankrupt: emerging market economies in Latin America have more work to do to improve their corporate governance (photo: Mario Tama/Getty Images)

Stronger Emerging Market Corporate Governance Enhances Financial Resilience

September 29, 2016

- Improved corporate governance over past two decades

- Governance bolsters resilience to financial shocks

- Corporate governance can strengthen firms' balance sheets

Stronger corporate governance and investor protection can enhance the resilience of emerging market economies to global financial shocks, and strengthen corporate balance sheets, according to new research from the International Monetary Fund.

Corporate governance and investor protection encompass rules and practices at both the country and firm level, which help ensure that the suppliers of finance to companies get a return on their investment.

In the latest research for the Global Financial Stability Report, the IMF said that corporate governance and investor protection have generally improved in emerging market economies over the past two decades, and that these developments have helped bolster the resilience of their financial systems. Although this new study focuses on emerging market economies, corporate governance and investor protection issues are also of importance for advanced economies, according to the IMF.

Improving emerging market corporate governance and investor protection

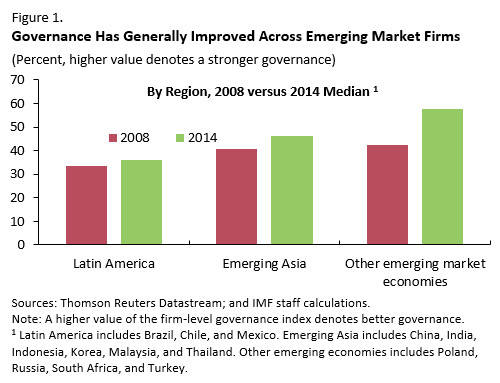

The IMF created a new firm-level governance index, and found that emerging market firms outside of Latin America and Asia show the largest improvements since 2008 (see Figure 1). Even so, there are important differences across emerging market economies, and there is room for further improvement. At the country level, indices compiled by other institutions suggest that investor protection, property rights enforcement, disclosure rules, as well as auditing and reporting standards could be enhanced in most emerging market economies.

Corporate governance, investor protection, and financial resilience

The IMF analysis finds that corporate governance improvements make emerging markets more resilient to financial downturns, and fosters deeper and more liquid capital markets, which allows them to absorb shocks better.

“Corporate governance also enhances stock market efficiency, thereby making equity prices less sensitive to external shocks and less prone to crashes,” said Gaston Gelos, Chief of the Global Financial Stability Analysis Division at the IMF.

Moreover, poorly governed firms experienced sharper declines in the price of their stock when financial markets are in turmoil; for example, around the reaction to the U.K.’s “Brexit” vote (see Figure 2).

Using the new index, the IMF finds that moving from the lower to the upper end of the firm-level governance index reduces the impact of global shocks by about 50 percent for emerging market firms, on average.

“Emerging markets with better corporate governance and investor protections generally have stronger corporate balance sheets,” said Selim Elekdag, the lead author of the report. “In particular, better-governed firms typically display lower short-term debt ratios and default probabilities, and are able to borrow at longer maturities.”

Enforcement, transparency, and the rights of all investors key

The financial stability benefits associated with improved corporate governance strengthen the case for further reform. Although there is no single model, good corporate governance practices have some common characteristics.

“Emerging market economies should continue to reform their legal, regulatory, and institutional frameworks to foster the effectiveness and enforceability of corporate governance regimes,” said Elekdag.

Most emerging market economies should continue to bolster the rights of all investors, in particular minority shareholders. Many emerging market economies need to bring disclosure requirements fully in line with international best practice. Promoting greater board independence is also likely to yield benefits.

The IMF will release further research from the Global Financial Stability Report on October 5.