Digital technology has been used in finance for some time, but advancements in connectivity and network development—together with the emergence of distributed ledger technology—have spurred the development and proliferation of new forms of digital money and other financial technology, or “fintech.” New digital money assets, both private and public, include central bank digital currencies (CBDCs), e-money, crypto assets, and stablecoins.

As the international organization created to promote international monetary cooperation and oversee the stability of the international monetary system, as well as contribute to countries’ economic and financial stability, the IMF will play a key role in the new era of digital money.

Cross-border payments are the lifeblood of the global economy, facilitating remittances, business transactions, and the movement of capital that fuels development. But the infrastructure is creaking. And it is missing for many people around the world. Today, with our existing technology, we can take a significant step forward to improve retail cross-border payments.

Fintech Notes offer practical advice from IMF staff members to policymakers on important issues. The views expressed in Fintech Notes are those of the author(s) and do not necessarily represent the views of the IMF, its Executive Board, or IMF management.

The IMF’s CBDC Virtual Handbook is a reference guide for policymakers and experts at central banks and ministries of finance. It serves as a basis for capacity development delivery, aiming to share knowledge, lessons, and frameworks to address policymakers’ most frequently asked questions concerning central bank digital currencies. As our body of knowledge and analysis grows, we will continue to add about five chapters every year aiming to provide about twenty chapters by 2026. Moreover, chapters will be periodically updated, reflecting evolving views.

19 countries in the Middle East and Central Asia are exploring issuing a CBDC

A cautious step-by-step approach would help the region explore new technologies effectively to deliver economic and social gains while managing risks

Prospects for growth, prices and interest rates enjoyed the greatest reader interest, followed by fossil fuel subsidies and the implications of geoeconomic fragmentation

Many of the world’s monetary authorities are seeking more guidance on how best to pursue digital forms of central bank money

This 45-minute talk will focus on capacity building conducted by the IMF to support financial authorities in harnessing the benefits of electronic money (e-money) while managing the risks.

As digitalization continues to impact the future of money and the exchange of value, effective policy and regulation are needed to ensure a stable and equitable financial system.

Tokenisation is making inroads into the regulated financial sector. Regulated private institutions and the public sector are investing in initiatives that cover a number of use cases, which is resulting in new infrastructures and platforms.

This session discusses how to improve cross-border payments including by facilitating links between fast payment systems, and will review experience and lessons from the field

A keynote address by the IMF Managing Director Kristalina Georgieva at the 2023 Singapore Fintech Festival.

As digitalization continues to impact the future of money and the exchange of value, effective policy and regulation are needed to ensure a stable and equitable financial system.

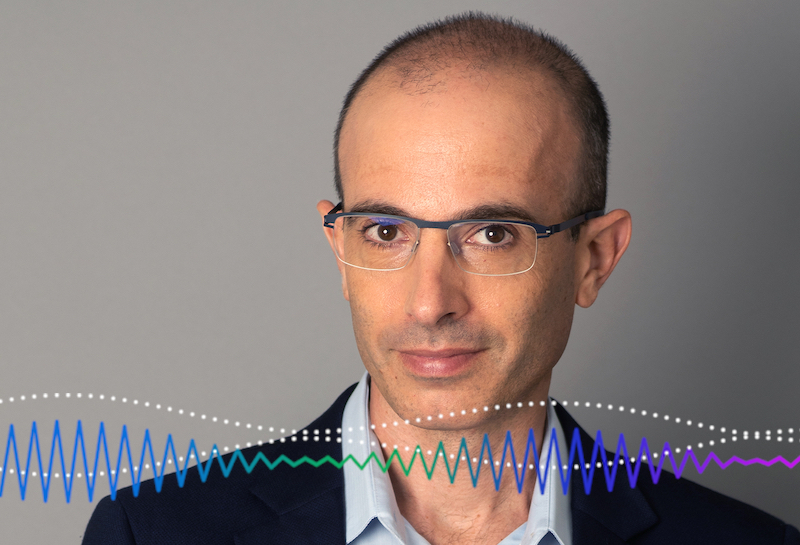

Stories can unify or divide but our ability to imagine them is uniquely human. Cooperation and trust, built through shared stories and narratives, are the foundation of human societies and economies. So what happens when humans no longer hold the pen? Yuval Noah Harari is a historian, philosopher, and author of several books on human evolution, including Sapiens, and Nexus: A brief history of Information Networks from the Stone Age to AI. In this podcast, Harari says artificial intelligence is a risk to humankind’s most valuable resource, trust. Transcript

It wasn’t that long ago when retiring in one’s 50s was an achievable goal. But with life expectancy steadily rising and pension systems doomed to fall short, the prospects for an early retirement are fading fast. Olivia Mitchell wrote the book on retirement and modern pension research and has spent her career helping people improve their financial literacy. Mitchell is a Professor of Economics and Public Policy at the Wharton School of the University of Pennsylvania. She sat down with journalist Rhoda Metcalfe to discuss the challenges of today’s economy for Americans planning their golden years. Transcript

Read Olivia Mitchell’s profile in the IMF’s Finance and Development Magazine

Nigeria’s eNaira was the first Central Bank Digital Currency in Africa and only the second in the world when it launched in October 2021, but a growing number of countries across the globe are now planning to follow suit with their own CBDCs. What can they learn from Nigeria’s experience? Jookyung Ree is an economist in the IMF African Department and assigned to Nigeria when the CBDC was introduced. Ree has since studied its impact on the economy and found that existing mobile money networks are proving a challenge to the eNaira’s adoptability. In this podcast, Ree says the eNaira will need to complement mobile money systems to convince more Nigerians to use it. Transcript

Read the paper

Since their inception in 2008, the contentious rise of crypto assets has been dramatic. Their market value has been as high as $3 trillion and about $50 million is transacted in crypto every day. But what does this brave new world of cryptographically-protected distributed ledgers mean for traditional tax systems? Ruud De Mooij is Deputy Director of the IMF Fiscal Affairs Department and heads its work on taxation. In this podcast, De Mooij says finding ways to tax crypto will mean significant revenue gains for governments and lead to a fairer global tax system. Transcript

Read the blog

Read the paper