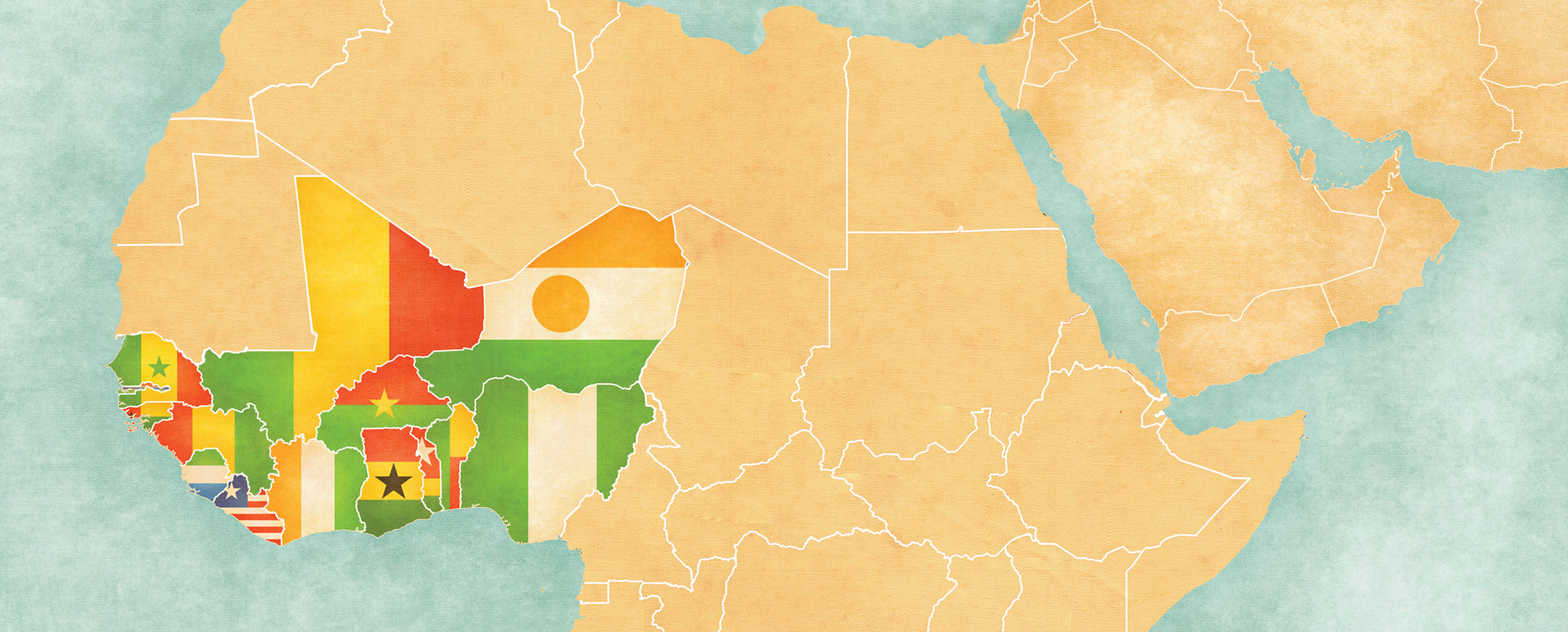

A currency union encompassing all of West Africa promises benefits but faces a multitude of obstacles

During the COVID-19 pandemic advanced economies have tapped their central banks for extensive liquidity support to their economies and to stave off an even deeper global economic crisis. African countries called for a $100 billion stimulus to respond to the pandemic but lacked the tools to finance such an injection of capital. Would strong regional central banks or even a continental central bank have helped? The regional experience of the Economic Community of West African States (ECOWAS) gives a glimpse of what is needed to accomplish monetary integration. But it also highlights the limits of such an approach, the difficulties the continent faces, and some fundamental issues that must be resolved to promote resilience in the region and foster alternative avenues to regional integration.

The leaders of the 15 ECOWAS member countries aimed to achieve a monetary and currency union by the end of 2020 but abandoned that timetable because the group was not ready. They were far from the macroeconomic convergence—especially similar levels of inflation and sufficiently low public-debt-to-GDP ratios—necessary for such a union to function well. The emergence of the COVID-19 pandemic, with its massive economic and health consequences, has pushed any proposed union to the back burner for countries in the 46-year-old ECOWAS.

Still, a monetary union for the region remains an aspiration with myriad potential benefits. An ECOWAS currency union could improve trade and investment flows in the region, bring added discipline to the macroeconomic and structural policies of member countries, and enhance stability against external shocks. A currency union with a strong central bank could have helped the region better weather the damaging economic effects of the COVID-19 pandemic. It could also serve as an anchor for inflation expectations within the area and as a catalyst for beneficial labor and product market reforms. In addition, a currency union can exert external discipline on fiscal policies.

The desire for a monetary union also speaks to a deep-seated desire for greater economic integration among the countries in the region and, indeed, for the continent as a whole—as evidenced by the advent of the African Continental Free Trade Area (AfCFTA). Whatever the timing, and perhaps even the outcome, of the monetary union project, there are many other elements to integration on which these countries could make progress, and for a few there is already progress to report.

Impediments to integration

The closer economies are in areas such as growth and inflation, the more appropriate a common monetary policy. In ECOWAS many differences present major obstacles to uniting 15 countries under a common currency—differences in their levels of development, the size of their economies, population, and economic structure, among others.

Six of the fifteen can be classified as middle-income countries (with annual per capita income of at least $1,000, based on market exchange rates); the others are low-income countries.

The disparity in the size of the economies is enormous. Nigeria, the continent’s largest economy, accounts for about 67 percent of the ECOWAS GDP, while the five smallest members together total less than 2 percent.

Population differences are only slightly less pronounced. Three countries—Nigeria, Ghana, and Côte d’Ivoire—constitute about 67 percent of the 350 million people in ECOWAS, while six countries, each with fewer than 10 million people, together represent 7 percent of the ECOWAS population.

Economies in the region are structured differently too. There are oil exporters and oil importers. Many countries rely heavily on agriculture and extractive industries for most of their GDP and exports, while some have a manufacturing component.

Because of these differences, GDP growth and inflation do not move simultaneously across countries. Changes in the relative prices of exports and imports account for a significant share of the variation in GDP growth and inflation in ECOWAS countries, but these so-called terms-of-trade shocks are not symmetric across the region. For example, the effect of a change in petroleum prices on oil exporter Nigeria is very different from the effect on oil importers.

These disparities pose important technical and governance challenges to a unified currency among the 15 countries. Because member countries have different production and economic structures, the loss of an adjustment mechanism—that is, an independent currency and monetary policy—puts a significant burden on tax and spending policies to maintain stability. Shocks such as the COVID-19 pandemic that put varying stresses on economies in the region point to the difficulties posed by the loss of a key policy instrument. Nigeria, for instance, suffered far more than others from plunging oil prices in the early stages of the pandemic.

Moreover, eight ECOWAS countries, largely francophone, are already members of a currency union—Benin, Burkina Faso, Côte d’Ivoire, Guinea-Bissau, Mali, Niger, Senegal, and Togo. These members of the West African Economic and Monetary Union (WAEMU) share a monetary policy and a currency, the CFA franc, which is linked to the euro. That currency union has worked well, in part because its members have a similar economic structure and, because they are all small, they benefit from a common central bank.

The countries in ECOWAS are more disparate, adding a number of technical, operational, and political obstacles to a well-functioning and durable monetary union that can deliver economic benefits to the ECOWAS community. There have been some calls for a broader, pan-African monetary union. These obstacles would be magnified in such an arrangement because disparities would be even greater.

At the same time, it should be recognized that the countries of the ECOWAS region are already integrating through flows of people, goods, and services. Another perspective on the issues discussed earlier is that they are about ways to build on and intensify this integration.

Tightening linkages

The AfCFTA—formally ratified by 36 of the 54 signatory countries as of February 2021—substantially reduces tariff and nontariff barriers to the free movement of commodities, goods, and services across Africa. It gives Africa a common voice on global trade policy issues in multilateral forums. The AfCFTA will promote integration among ECOWAS countries and strengthen their trade ties with other countries on the continent.

ECOWAS has also taken steps to promote trade integration among its members, including the ECOWAS Trade Liberalization Scheme and the common external tariff, introduced in 2015. But there are still some barriers—countries apply tariffs in an uneven manner and leave in place other restrictions on trade across their borders. There has been progress: national authorities have taken measures at the country level—complemented by ongoing work at the regional level—to remove obstacles to trade flows. But more needs to be done to remove explicit and implicit barriers to trade within the region.

Such integration would benefit the region by reducing impediments to cross-border flows of goods, capital, and labor and would help prepare the region for a possible monetary union. Of course, freer flows have costs. They can complicate domestic policymaking. Unfettered financial flows within a region can contribute to boom-bust cycles in property and other asset markets in certain countries. Moreover, workers moving from one ECOWAS country to another in search of better opportunities can cause social and political tension.

Steps to greater integration

ECOWAS leaders must decide what level of economic union is necessary to promote the stability of a monetary union. There are important lessons for both ECOWAS and the rest of Africa from the experiences of the euro area. Large net fiscal transfers to economically weaker countries, particularly during and after the euro area debt crisis, generated enormous political and economic stress that threatened to tear the monetary union apart. Because banking regulations differed across euro area countries, financial system problems in some of the countries with high borrowing spreads added to system-wide stress.

Full economic union is certainly not essential for the successful operation of a monetary union. But without macroeconomic convergence and strong institutional frameworks, a partial union could generate enormous stress. Differences in productivity growth between countries, for instance, could require fiscal transfers that in turn generate political tension if other adjustment mechanisms, such as equilibrating flows of capital and labor, do not compensate. Tension in the euro area between core and stressed economies highlights this problem.

There are other issues that affect both the strength and sustainability of growth in the ECOWAS region and the equitability of its distribution, regardless of whether there is a monetary union. These include regional financial market development and integration, especially as it relates to markets for government and corporate bonds and money markets. Making financial services available to more people (financial inclusion) through traditional and new technologies—such as mobile banking—is also important. Coordinated regulation of financial markets—including banks and nonbank financial institutions, which have become more closely linked in the region—is beneficial as well.

A strong institutional framework is needed at the regional level. A key element is the uniformity of regulations on current account and capital account transactions to facilitate the freer flow of goods, services, and capital. A regional payment system that is well integrated with domestic and global payment systems and that expedites settlement of cross-border transactions would facilitate commerce across the region. Harmonized banking supervision and regulation that takes into account both institution-specific and systemic risks are also top-priority.

An effective regional mechanism for gathering macroeconomic and financial data, along with multilateral surveillance that cross-checks the policy stances of ECOWAS countries, could help countries maintain good discipline even in the face of domestic pressure for looser policies. A risk-pooling mechanism among members to deal with external shocks (such as commodity price shocks and even unique events such as the COVID-19 pandemic) that affect some countries more than others would be worthwhile.

Alternative approaches

Alternative approaches that generate greater regional trade and financial integration are also worth considering. For instance, Asian countries have an extensive set of trade and financial arrangements, but each retains monetary policy autonomy. Regional risk-sharing mechanisms such as the Chiang Mai Initiative, which includes some pooling of foreign exchange reserves among the participating countries, have taken on some of the proposed functions of a currency union.

Whether such regional trade and financial agreements would be as beneficial as a currency union when it comes to trade flows and broader economic integration is an open question. But the experience of Europe—where the currency union has benefited trade and investment flows but also fostered economic and political tension among euro area countries—cautions against moving hastily toward a currency union. Moreover, in light of Asia’s approach and the progress on the AfCFTA, it is worth considering whether a set of arrangements to promote trade and financial integration would serve as a useful—and perhaps even necessary—precursor to a more durable and resilient ECOWAS currency union.

The path forward

ECOWAS leaders must consider carefully the significant costs, operational issues, and transitional risks of a currency union. Member countries’ different production and economic structures mean that the loss of an independent currency and monetary policy puts a significant burden on other policies in each country.

The recent experience of the euro area suggests that a currency zone would be fortified by a broader economic union—including a banking union, a unified financial regulatory system, and harmonized institutions that underpin the functioning of labor and product markets. These are long-term considerations for ECOWAS leaders. Robust and sustainable growth and spreading the benefits of growth more evenly in the ECOWAS region also call for regional financial market development and integration and increased financial inclusion through traditional and new technologies.

A single ECOWAS currency would be a major and ambitious undertaking, with many potential benefits. If leaders commit to building resilient policy and institutional frameworks that can create positive benefit-risk trade-offs, it could boost the economic well-being and prosperity of ECOWAS countries.

The COVID-19 pandemic has reignited discussion across Africa about monetary instruments to deal with the crisis and is likely to generate renewed interest in the African Monetary Fund. The lessons of the ECOWAS experience will be invaluable if such an agency becomes a reality.

This article draws extensively on a forthcoming book by the authors, Regional Integration in West Africa: Is There a Role for a Single Currency?” Brookings Institution Press, July 2021.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily represent the views of the IMF and its Executive Board, or IMF policy.