The SDR is an international reserve asset created by the IMF to supplement the official reserves of its member countries.

The SDR is not a currency. It is a potential claim on the freely usable currencies of IMF members. As such, SDRs can provide a country with liquidity.

A basket of currencies defines the SDR: the US dollar, Euro, Chinese Yuan, Japanese Yen, and the British Pound.

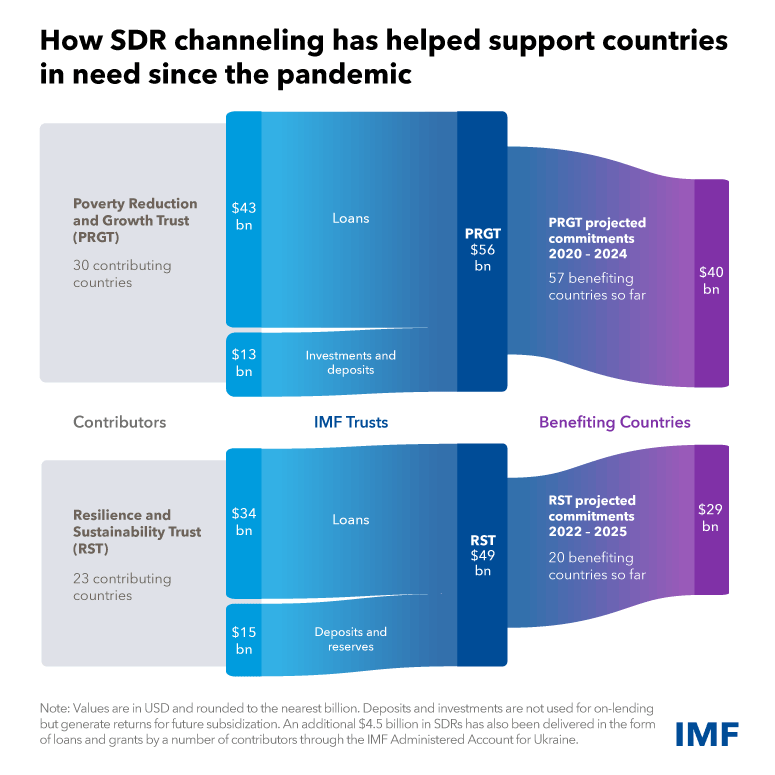

Since the onset of the pandemic, SDR channeling (and equivalent currency amounts) has helped many countries in need, especially those eligible for financial support from the IMF’s Poverty Reduction and Growth Trust (PRGT) and the Resilience and Sustainability Trust (RST).

Since 2020, channeling of about $56 billion is providing the PRGT with the capacity to mobilize $40 billion in interest-free loans to our poorest members through 2024. This financing helps support growth enhancing reforms in these countries. So far, these loans have benefited 57 countries and could benefit more in the years ahead.

Channeling has also supported the operations of the RST, which delivers affordable long-term financing to help vulnerable countries tackle long-term challenges including climate change. To date, 23 RST partners have channeled about $49 billion to the RST, which is expected to contribute toward meeting an estimated $29 billion in affordable financing.

After decades of increasing global economic integration, the world is facing a growing risk of geoeconomic fragmentation, with potentially far-reaching implications for the global economy and the international monetary system. Against this background, this paper studies how geopolitical proximity, along with other economic factors, affects the usage of five SDR currencies in cross-border transactions. Since World War II, the global currency landscape has remained relatively stable, with the U.S. dollar serving as the dominant currency. Using country-level SWIFT transaction data, our analysis confirms the importance of inertia, trade and financial linkages in shaping the currency landscape, consistent with existing studies. On geopolitical proximity, we find that closer proximity can boost the use of the euro and renminbi, notably among emerging market and developing economies, although the impact is rather muted in the full sample. The effect on RMB usage in the full sample is more pronounced during periods of heightened trade policy uncertainty. These findings suggest that in a more geoeconomically fragmented world, alternative currencies could play a greater role.

The 2024 Article IV Consultation explains that China’s economy has remained resilient despite the continued weakness in the property sector, with gross domestic product (GDP) growing by 5.2 percent in 2023, and 5 percent y/y in the first half of 2024. The authorities have taken incremental policy steps to achieve these objectives, but a comprehensive and balanced policy approach is needed to manage the challenges facing the economy. GDP growth is expected to remain resilient at 5 percent in 2024 despite the continued property sector adjustment, supported by strong public investment and the ongoing recovery in private consumption. Inflation has been low in recent quarters amid considerable economic slack and is expected to pick up gradually as the output gap closes and the impact of lower commodity prices wanes. Growth is expected to slow in the medium term amid declining productivity growth and aging. The immediate priorities are to facilitate a more efficient and less costly property sector adjustment and to provide adequate macroeconomic policy support amid continued slack and elevated downside risks. Tackling the debt overhang, preventing the build-up of new risks, and fostering high-quality and sustainable growth requires comprehensive structural reforms.

This paper analyzes domestic revenue mobilization in the Democratic Republic of the Congo (DRC) and offers options to strengthen it. Domestic revenue mobilization (DRM) in the DRC has improved during the Extended Credit Facility ECF program, standing at 13.7 percent over gross domestic product (GDP) in 2023, though it remains persistently low relative to peer countries. The recent improvements in revenue mobilization have been driven by stronger corporate income taxation (particularly stemming from the extractive sector). A comparison between DRC’s and peer countries’ tax structure points to significant room for boosting domestic revenues with stronger mobilization of personal income taxes, taxes on international trade and transactions and goods and services. In addition, the country’s tax potential (estimated on the basis of its structural characteristics and a stochastic frontier model) points to significant scope for improving tax-to-GDP ratio, by about 10 percentage points under more efficient tax policy and tax collection. Finally, tax administration reforms based on recommendations from the recently published the Tax Administration Diagnostic Assessment Tool report can significantly contribute to boosting DRM, with particular focus on tax-avoidance in the mining sector.

This paper presents Union of Comoros’ Second Review under the Extended Credit Facility (ECF) Arrangement and Request for a Waiver of Nonobservance of Performance Criterion. Performance under Comoros’s economic reform program continues to be broadly satisfactory, and the authorities remain committed to the economic policies and reforms underpinning the ECF-supported program. Reforms are beginning to bear fruit, with visible signs of macroeconomic stabilization. However, Comoros continues to face the challenges of a small, fragile island state which requires steadfast program implementation and continued support from international partners. Monetary policy has contained inflation and ensured sufficient external buffers for Comoros and the stability of the peg. Continued efforts to stabilize the financial sector, including through the restructuring of the state-owned postal bank, addressing credit quality in the banking system, and strengthening banking supervision and resolution capacities are welcome. Support from international partners continues to be important for addressing the country’s large development needs and climate-related risks.

This paper highlights Central African Republic’s Second Review under the Arrangement under the Extended Credit Facility, Requests for a Waiver of Nonobservance of Continuous Performance Criterion, Augmentation of Access, and Financing Assurances Review. The economy is projected to grow by 1.4 percent in 2024, up from the 0.7 percent posted in 2023, while inflation gradually declines in subsequent years. These projections hinge on expediting reforms to the fuel market. Program implementation was broadly satisfactory considering significant fragilities and uncertainties. Performance under the program has been broadly satisfactory. All but one of the quantitative performance criteria were met, reflecting the authorities’ efforts last December to recover past due taxes and delay spending. The exception was the continuous performance criterion on the nonaccumulation of external arrears, which was missed due to liquidity pressures and the lack of coordination between cash and debt management units. An increase in revenue mobilization in 2024 will hinge on adhering to the action plan. The latter aims to improve the transparency of fuel price structures, align policy reforms with program goals, enhance collaboration among stakeholders, and bolster regulatory enforcement.

The 2024 Article IV Consultation discusses that Panama grew very rapidly in the two decades preceding Coronavirus disease 2019 but was hit very hard by the pandemic. Between 1994 and 2019, gross domestic product (GDP) per capita increased from 33 percent of US GDP per capita to 48 percent. Rapid growth was driven by an unprecedented construction and investment boom that included major construction projects, such as the enlargement of the Panama Canal and the Tocumen airport, and the expansion of the services and logistics sectors that benefited from those projects. The government aims to reduce the fiscal deficit to 2.0 percent of GDP in 2024. As budgeted spending is not consistent with this target, the government intends to meet the target by keeping public investment well below the budget, but this would require an unduly large compression of investment when unemployment is expected to increase and growth to slow down. In order to maintain room for investment, increased revenue mobilization is needed. In order to safeguard financial stability, it is essential that banks remain well capitalized and liquid. Strengthening human capital and governance will help sustain convergence. Continued implementation of the national statistical plan will improve the quality and timeliness of key macroeconomic data.

After decades of increasing global economic integration, the world is facing a growing risk of geoeconomic fragmentation, with potentially far-reaching implications for the global economy and the international monetary system. Against this background, this paper studies how geopolitical proximity, along with other economic factors, affects the usage of five SDR currencies in cross-border transactions. Since World War II, the global currency landscape has remained relatively stable, with the U.S. dollar serving as the dominant currency. Using country-level SWIFT transaction data, our analysis confirms the importance of inertia, trade and financial linkages in shaping the currency landscape, consistent with existing studies. On geopolitical proximity, we find that closer proximity can boost the use of the euro and renminbi, notably among emerging market and developing economies, although the impact is rather muted in the full sample. The effect on RMB usage in the full sample is more pronounced during periods of heightened trade policy uncertainty. These findings suggest that in a more geoeconomically fragmented world, alternative currencies could play a greater role.

The 2024 Article IV Consultation explains that China’s economy has remained resilient despite the continued weakness in the property sector, with gross domestic product (GDP) growing by 5.2 percent in 2023, and 5 percent y/y in the first half of 2024. The authorities have taken incremental policy steps to achieve these objectives, but a comprehensive and balanced policy approach is needed to manage the challenges facing the economy. GDP growth is expected to remain resilient at 5 percent in 2024 despite the continued property sector adjustment, supported by strong public investment and the ongoing recovery in private consumption. Inflation has been low in recent quarters amid considerable economic slack and is expected to pick up gradually as the output gap closes and the impact of lower commodity prices wanes. Growth is expected to slow in the medium term amid declining productivity growth and aging. The immediate priorities are to facilitate a more efficient and less costly property sector adjustment and to provide adequate macroeconomic policy support amid continued slack and elevated downside risks. Tackling the debt overhang, preventing the build-up of new risks, and fostering high-quality and sustainable growth requires comprehensive structural reforms.

This paper analyzes domestic revenue mobilization in the Democratic Republic of the Congo (DRC) and offers options to strengthen it. Domestic revenue mobilization (DRM) in the DRC has improved during the Extended Credit Facility ECF program, standing at 13.7 percent over gross domestic product (GDP) in 2023, though it remains persistently low relative to peer countries. The recent improvements in revenue mobilization have been driven by stronger corporate income taxation (particularly stemming from the extractive sector). A comparison between DRC’s and peer countries’ tax structure points to significant room for boosting domestic revenues with stronger mobilization of personal income taxes, taxes on international trade and transactions and goods and services. In addition, the country’s tax potential (estimated on the basis of its structural characteristics and a stochastic frontier model) points to significant scope for improving tax-to-GDP ratio, by about 10 percentage points under more efficient tax policy and tax collection. Finally, tax administration reforms based on recommendations from the recently published the Tax Administration Diagnostic Assessment Tool report can significantly contribute to boosting DRM, with particular focus on tax-avoidance in the mining sector.

This paper presents Union of Comoros’ Second Review under the Extended Credit Facility (ECF) Arrangement and Request for a Waiver of Nonobservance of Performance Criterion. Performance under Comoros’s economic reform program continues to be broadly satisfactory, and the authorities remain committed to the economic policies and reforms underpinning the ECF-supported program. Reforms are beginning to bear fruit, with visible signs of macroeconomic stabilization. However, Comoros continues to face the challenges of a small, fragile island state which requires steadfast program implementation and continued support from international partners. Monetary policy has contained inflation and ensured sufficient external buffers for Comoros and the stability of the peg. Continued efforts to stabilize the financial sector, including through the restructuring of the state-owned postal bank, addressing credit quality in the banking system, and strengthening banking supervision and resolution capacities are welcome. Support from international partners continues to be important for addressing the country’s large development needs and climate-related risks.

This paper highlights Central African Republic’s Second Review under the Arrangement under the Extended Credit Facility, Requests for a Waiver of Nonobservance of Continuous Performance Criterion, Augmentation of Access, and Financing Assurances Review. The economy is projected to grow by 1.4 percent in 2024, up from the 0.7 percent posted in 2023, while inflation gradually declines in subsequent years. These projections hinge on expediting reforms to the fuel market. Program implementation was broadly satisfactory considering significant fragilities and uncertainties. Performance under the program has been broadly satisfactory. All but one of the quantitative performance criteria were met, reflecting the authorities’ efforts last December to recover past due taxes and delay spending. The exception was the continuous performance criterion on the nonaccumulation of external arrears, which was missed due to liquidity pressures and the lack of coordination between cash and debt management units. An increase in revenue mobilization in 2024 will hinge on adhering to the action plan. The latter aims to improve the transparency of fuel price structures, align policy reforms with program goals, enhance collaboration among stakeholders, and bolster regulatory enforcement.

The 2024 Article IV Consultation discusses that Panama grew very rapidly in the two decades preceding Coronavirus disease 2019 but was hit very hard by the pandemic. Between 1994 and 2019, gross domestic product (GDP) per capita increased from 33 percent of US GDP per capita to 48 percent. Rapid growth was driven by an unprecedented construction and investment boom that included major construction projects, such as the enlargement of the Panama Canal and the Tocumen airport, and the expansion of the services and logistics sectors that benefited from those projects. The government aims to reduce the fiscal deficit to 2.0 percent of GDP in 2024. As budgeted spending is not consistent with this target, the government intends to meet the target by keeping public investment well below the budget, but this would require an unduly large compression of investment when unemployment is expected to increase and growth to slow down. In order to maintain room for investment, increased revenue mobilization is needed. In order to safeguard financial stability, it is essential that banks remain well capitalized and liquid. Strengthening human capital and governance will help sustain convergence. Continued implementation of the national statistical plan will improve the quality and timeliness of key macroeconomic data.