Published on May 24, 2022

Economists miscalculated the disruptions of the global financial crisis and the pandemic—and need to build better models

Does globalization enhance resilience? Or does it have no effect? Or the opposite effect?

For the two major economic disruptions so far this century—the global financial crisis starting in 2008 and the COVID-19 pandemic starting in 2020—economists’ answers to those questions were largely wrong. As for the financial crisis, most of them underestimated the risks of financial globalization, and when it came to the pandemic, most overestimated the risks of sprawling, intricate production networks and trade globalization.

As the Russian invasion of Ukraine and the sweeping sanctions that followed now threaten to ignite a third great crisis, it’s important to understand where economic analysis goes wrong and the adjustments practitioners need to make to get things right. The flawed predictions about the financial crisis and the pandemic certainly reflected inadequate understanding of the workings of financial and trade markets. And they most likely also grew out of overreliance on imperfect economic modeling.

Before the financial crisis, most economists had a positive view of financial globalization’s effects on resilience. The thinking was that the growth of the financial sector, especially international finance, would allow economic agents and countries to diversify risk through financial instruments. New financial products would fill missing markets. The expectation was that cross-border financial integration would lead to more risk sharing.

There were significant caveats and voices of doubt. In 2005, former IMF Chief Economist Raghuram Rajan warned that “even though there are far more participants who are able to absorb risk today, the financial risks that are being created by the system are indeed greater. ... They may also create a greater (albeit still small) probability of a catastrophic meltdown.”

Overreliance on self-correcting financial markets

In fact, the US subprime mortgage crisis did spill over to global banks and across borders precisely because of those same links that were supposed to provide insurance and resilience. Two years after he left office as chairman of the Federal Reserve, Alan Greenspan finally conceded that he was in error about regulation, in congressional testimony on October 23, 2008. “A humbled Mr. Greenspan admitted that he had put too much faith in the self-correcting power of free markets and had failed to anticipate the self-destructive power of wanton mortgage lending,” The New York Times reported.

More broadly, a vast literature has focused on why global finance proved so fragile and led to the global financial crisis. Incomplete knowledge about networks, global imbalances, loose monetary policies that led to excessive risk-taking, improperly aligned incentives, and gaps in regulation, perhaps in part for political economy reasons—among many factors—have all been cited by researchers.

A crisis whose initial magnitude was estimated at less than $200 billion wreaked havoc on the global financial system to the tune of several trillion dollars, resulted in devastating unemployment and social costs around the globe, and set off the worst recession since the Great Depression.

Overestimating the pandemic’s damage

What happened during the COVID-19 crisis? As the pandemic began, world production and trade seemed highly vulnerable. Over the past few decades, both have increasingly relied on just-in-time global value chains. In this system, key materials and components are produced in different countries or regions based on comparative advantages. While these production networks and global value chains have enhanced efficiency, they have also led to new fragility. A single missing input can block entire production chains. To capture the idea of “critical inputs,” economists used models with low elasticities of substitution between different inputs.

This line of thought seemed to be vindicated by disruptions following natural disasters, including Hurricane Katrina and New Orleans in 2005 and the Great East Japan Earthquake of 2011. A 2021 study of the Japanese case found that “even if average firm-level effects are not necessarily large, the potential propagation of shocks over the economy’s production network can impact a significant fraction of firms, thus resulting in movements in macroeconomic aggregates.” Other researchers suggested that similar logic could apply to the transmission of shocks across borders.

In the context of COVID-19, this implied that if the pandemic knocked out only one key country—or region within a country, or factory for that matter—it could break entire production chains. Given the diffusion of the pandemic around the world, trade could be particularly vulnerable. This view was not common only in academic circles. Emphasizing supply disruption, the World Trade Organization and several other groups warned that the pandemic would lead to a collapse in trade. Serious news outlets reported that such disruption was taking place, such as the Wall Street Journal in an August 2020 article, “Covid Crisis Drives Historic Drop in Global Trade.” Against this backdrop, it was expected that the pandemic would devastate global economies. For instance, the IMF’s World Economic Outlook (WEO) projections in April 2020 forecast a large drop in world trade, even as a share of world income.

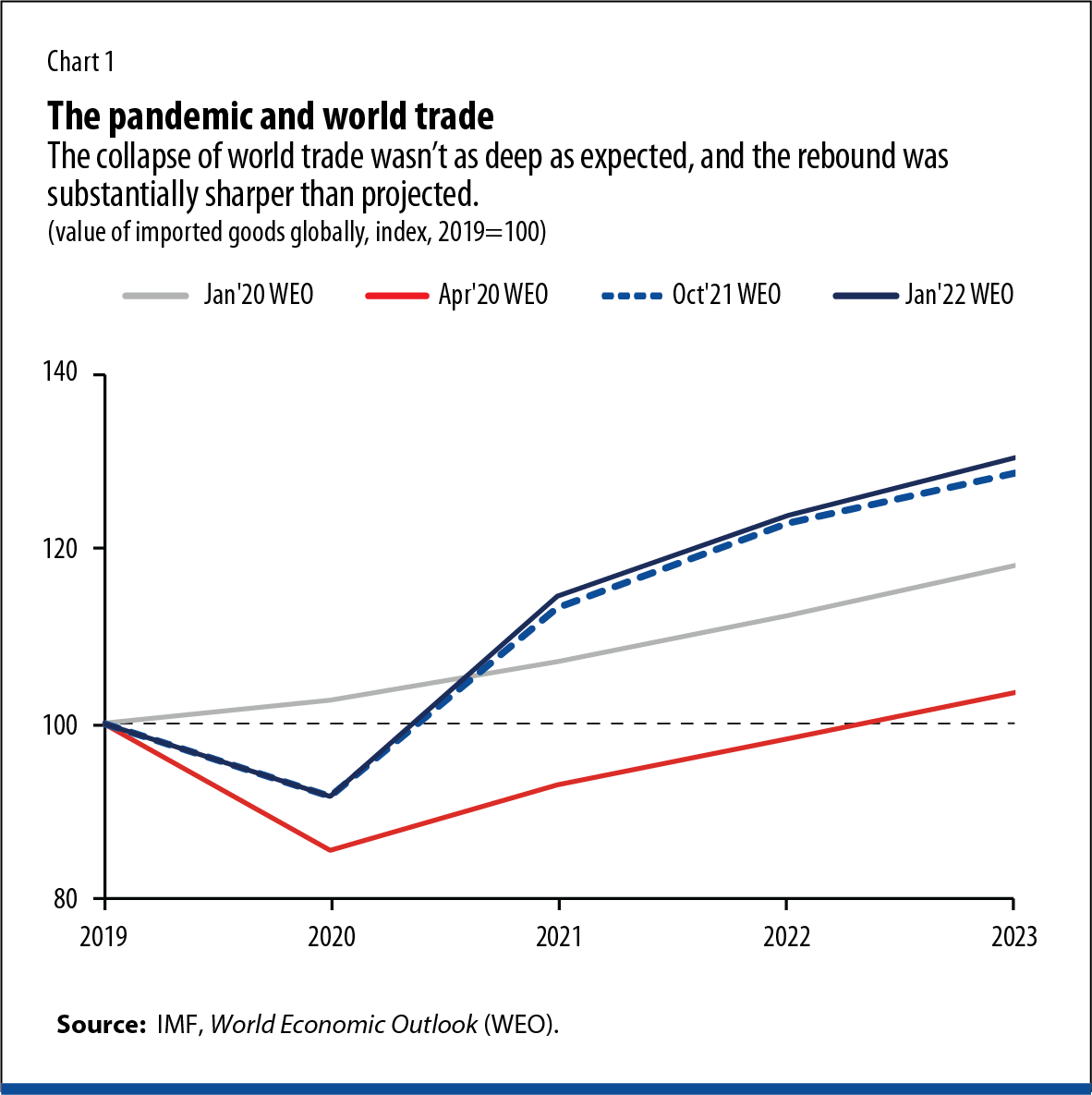

What actually happened was quite different. Chart 1 shows the evolution of projections of world merchandise imports by value. World merchandise imports are commonly used as a measure of trade globalization. The advantage of this measure is that several vintages of projections are readily available.

The chart shows two striking facts. First, at the onset of the pandemic in April 2020, the IMF forecast a collapse in world trade. It materialized at first but wasn’t as deep as expected. Second, the rebound was substantially sharper than estimated, and by the third quarter of 2020 trade was well above the levels projected before the pandemic. The October 2021 and January 2022 issues of the WEO projected that the upsurge was likely to continue. Thus, the collapse that the supply-chain theory seemed to predict turned out to be rather short-lived.

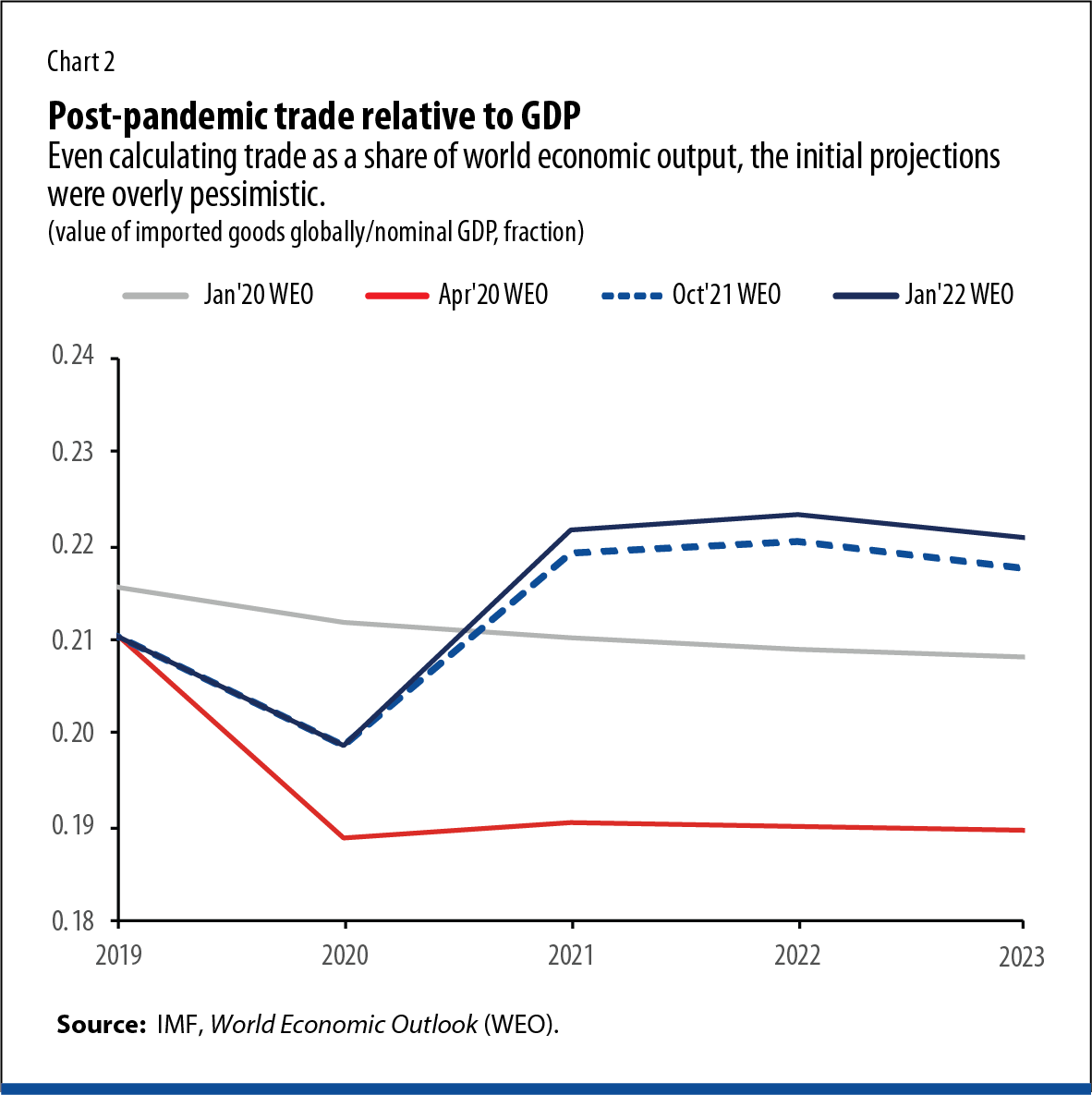

This pattern was not simply a reflection of assumptions about world GDP. Chart 2 shows that even as a share of GDP the initial projections from April 2020 were unduly pessimistic. On that basis, trade soared well above pre-pandemic projections by the third quarter of 2020. The picture doesn’t change when we exclude imports of oil, whose price rose sharply. And the pattern holds even when we focus on trade volumes rather than values.

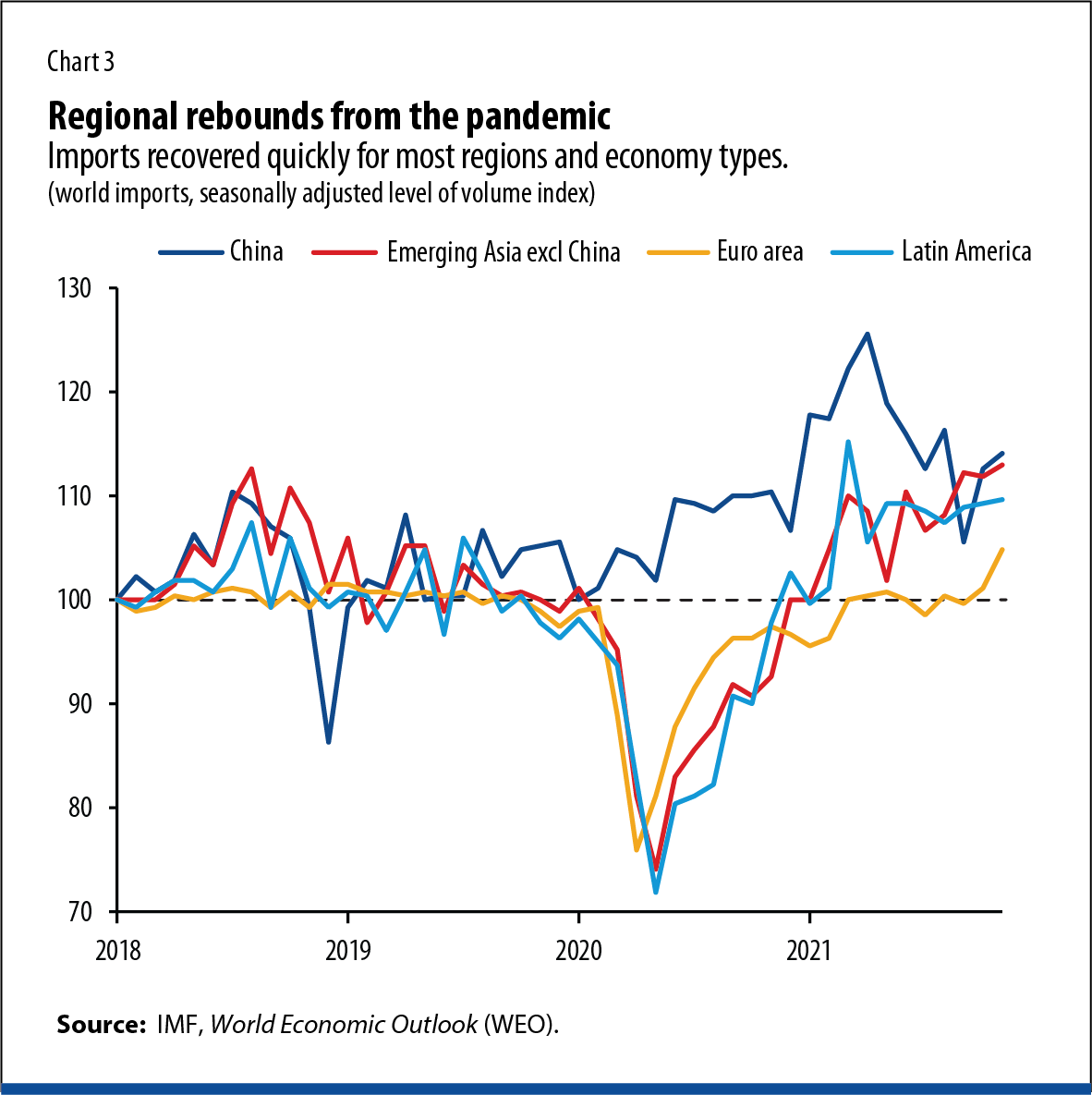

Trade rebounded extremely quickly in all regions even as the pandemic raged on. This was especially true in Asia, a region where complex value chains are common. Chart 3 shows the sharp bounce-back in global merchandise trade for advanced economies and emerging markets.

Where forecasts went wrong

The prediction that expanding production networks and trade globalization would make the world economy less resilient turned out to be wrong. Why? The question has two components: (1) Why did demand for traded goods boom? (2) How could supply increase to satisfy this unprecedented expansion of demand?

Regarding the first question, massive government fiscal stimulus increased demand for traded goods, and the composition of demand tilted toward durable imports. The pandemic shifted consumption patterns from services such as travel, transportation, and entertainment to goods such as electronics and other durables, which are trade-intensive and global-value-chain-intensive. This pro-trade composition effect was the opposite of what happened during the financial crisis, when uncertainty depressed trade-intensive investment.

As for the second question of how supply was able to catch up and lead to a sharp rebound in global trade, it could be that rather than a source of fragility, global value chains have hidden strengths. Participation in these linkages could have raised exporters’ vulnerability to foreign shocks, but it may also have made them less susceptible to domestic shocks—a largely unnoticed effect. During the COVID-19 crisis, we have observed both mechanisms at work. Whatever the reason, the collapse in trade was short-lived, and commerce quickly surpassed pre-pandemic levels as supply at least partially kept up with booming demand. We call this the “resilience of global trade.”

Reports of widespread shortages and bottlenecks are now common. This is to be expected to some extent in the context of surging trade. With global commerce projected to be close to 25 percent higher in 2022 than predicted soon after the pandemic hit, shortages were bound to occur. The October 2021 WEO noted that the rise in shipping costs during the early phases of the recovery were driven predominantly by increasing demand. This does not mean that supply disruptions do not matter or that they have been fully mended. The point is rather that supply ultimately must match demand to lead to higher realized outcomes. Less severe supply shortages could have meant an even greater rebound in trade.

Lessons for economists

What lessons can economists learn from this double error?

The mistaken assessments of the global financial crisis and the pandemic may in part reflect an imperfect understanding of the microstructure of financial and trade markets. In the case of financial markets, economists were mesmerized by the narrative that the development of missing markets would automatically lead to risk diversification. Nobel laureate Joseph Stiglitz argued in 2009 that the belief that markets are efficient–—and that efficient markets rule out the possibility of a bubble—gave the Federal Reserve the confidence to ignore mounting evidence that there was indeed a bubble. In the case of trade, economists were perhaps captivated by the logic of comparative advantage, economies of scale, and production networks. In the case of both blunders, what may have led economists astray was that they put too much faith in stylized models.

What should have been just modeling or strategies for simplification became the lens to analyze the effect of globalization on resilience. And although the mistakes pointed in opposite directions, they may oddly enough have had the same origin. Economic models are ultimately a simplified description of the real world. Although such models help us better understand how economies work, their true test lies in flagging risk or lack of risk to guide preemptive policy responses.

From a forward-looking perspective, the questions are, Can the profession lead, and how can it encourage a more critical view of prevailing paradigms? In a 2021 lecture, Pierre-Olivier Gourinchas, currently IMF research department director and economic counsellor, discussed post-financial-crisis progress toward understanding the implications of the microstructure of financial markets. He argued that the global financial crisis powerfully reminded the world of the importance of financial frictions and linkages and showed how economic research in the past two decades aimed to address this problem.

It is still early to draw definitive conclusions about the economic effects of the COVID-19 pandemic, but clearly “it is already a powerful illustration of the role of sectoral production frictions and linkages, especially across borders,” as a speaker at the IMF Annual Research Conference put it in 2021. Nobel laureate Michael Spence argues that “we need better models for predicting how supply chains will evolve, including their likely responses to shocks.” Apart from the humanitarian tragedy, the war in Ukraine is also a reminder of the importance of trade and financial linkages in today’s integrated global economy. Future research should no doubt focus on such linkages, especially when analyzing long-term effects on the global economy.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.