Fragmentation of critical mineral markets would slow the shift to clean energy

A scramble by competing powers to secure strategic minerals could add to price pressures and increase the costs of the climate transition. New trade restrictions in commodity markets more broadly have doubled since Russia’s invasion of Ukraine as producers impose curbs on shipments. Critical minerals used to make everything from electric vehicles (EVs) to solar panels and wind turbines are highly vulnerable to more severe trade restrictions. A slide toward opposing trading blocs could substantially delay the energy transition.

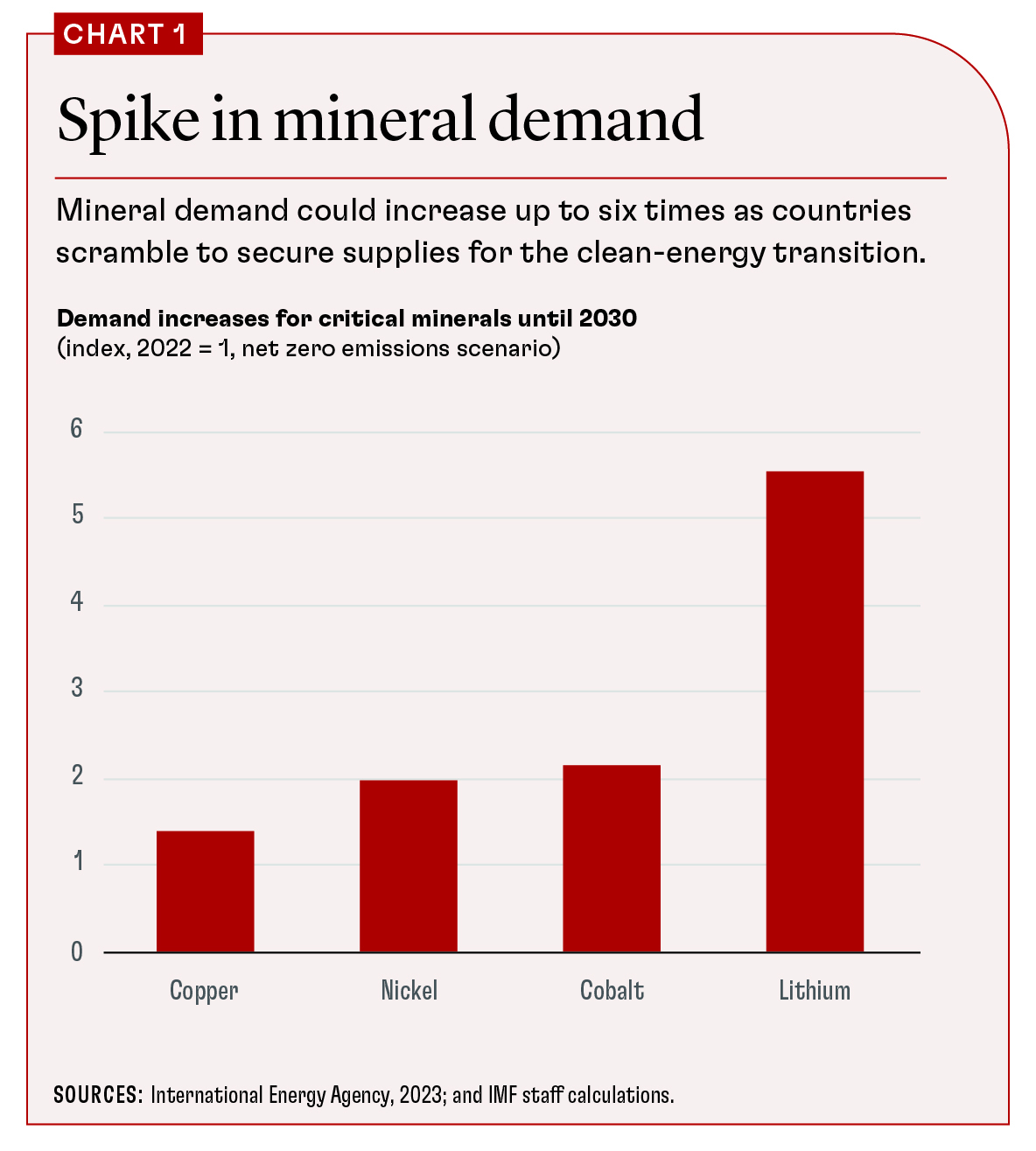

Even without the added complication of geopolitically motivated export controls, countries will need unprecedented supplies of critical minerals to stave off the worst effects of climate change and reach net zero emissions. The International Energy Agency predicts that demand for copper will need to grow by a factor of 1.5, for nickel and cobalt to double, and for lithium to increase six times by 2030 (Chart 1). This will drive up prices and could make these minerals as important as crude oil for the world economy over the next two decades (Boer, Pescatori, and Stuermer, forthcoming).

Why are critical mineral markets particularly vulnerable in the event of fragmentation? And what could be the impact on the energy transition?

Extreme vulnerability

Minerals such as copper, nickel, cobalt, and lithium are critical inputs for the energy transition. They are used in EVs, batteries and wiring, and renewable-energy technologies such as solar panels and wind turbines. A typical EV battery pack, for example, needs about 8 kilograms of lithium, 35 kilograms of nickel, and 14 kilograms of cobalt. Charging stations require substantial amounts of copper.

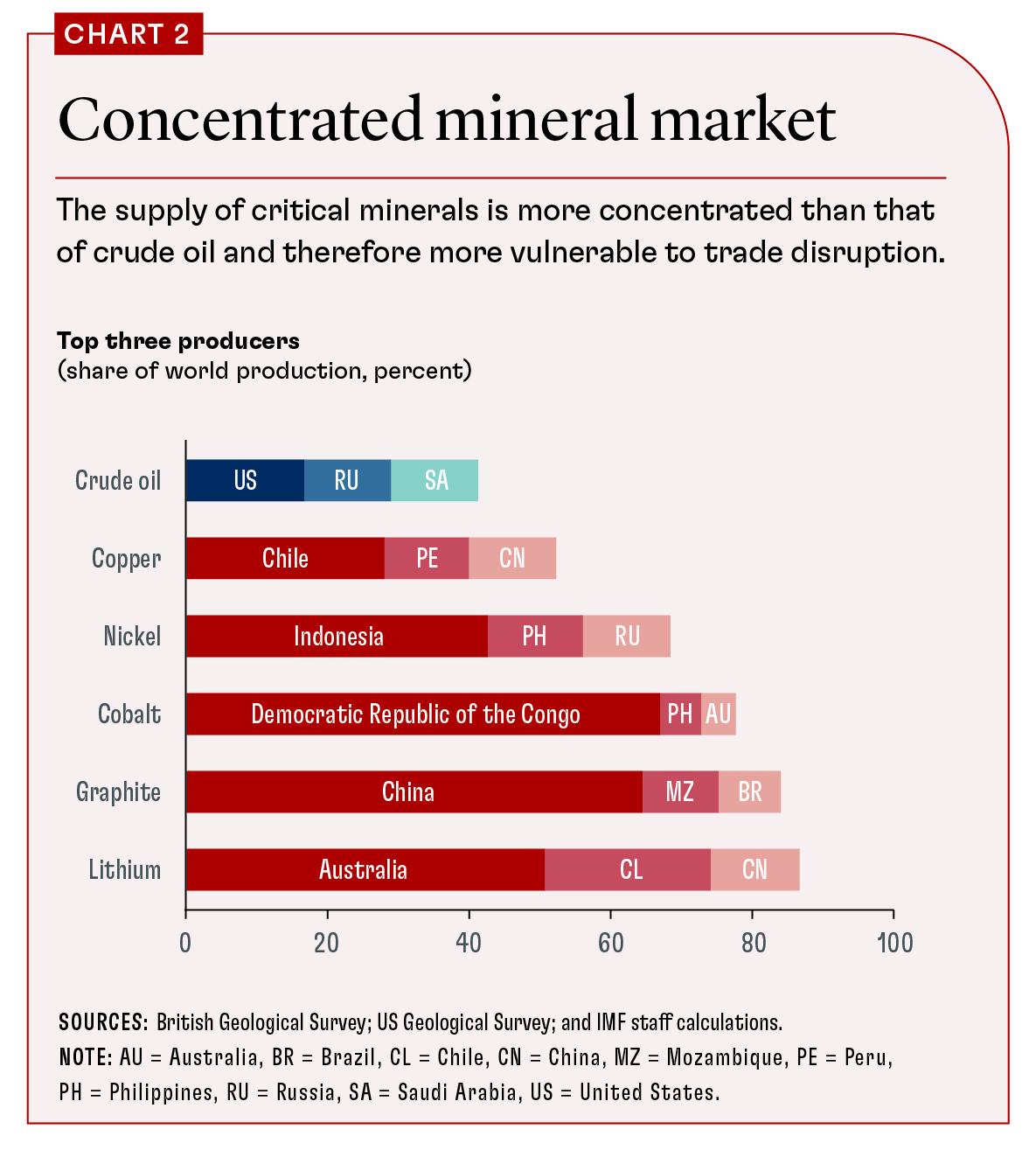

Critical minerals are extremely vulnerable in the event of trade disruptions because their global production is highly concentrated. Two-thirds of the world’s cobalt is mined in the Democratic Republic of the Congo alone. The top three producers of nickel and lithium control more than 60 percent of supply. Crude oil production is, by comparison, much more diversified (Chart 2).

The combination of concentrated supply and widespread demand has led to extensive commodity trading. Many countries rely heavily on imports from only a handful of suppliers. To make matters worse, mining production can be difficult to relocate. Even where there are deposits, it takes time and expensive investment to extract them from the ground. Minerals are often hard to substitute. For example, lithium is essential for many EV batteries. As a result, demand for them responds only slowly when prices rise amid shortages.

This trifecta of high concentration of production and low reactivity of supply and demand makes critical minerals for the energy transition highly vulnerable in the event of trade restrictions.

Transition delay

How would more severe fragmentation of critical mineral markets affect the energy transition? For illustrative purposes, a team of IMF researchers divided the markets for four critical minerals into two hypothetical blocs that refuse to trade with each other, along the lines of a 2022 UN vote on Ukraine.

Results show that the inability of the hypothetical China-Russia+ bloc to import copper, nickel, lithium, and cobalt from mining countries such as Chile, the Democratic Republic of the Congo, and Indonesia would lead to an additional price increase of 300 percent, on average. Acquiring minerals would be more expensive, which would lead to lower investment in solar panels and wind turbines and fewer EVs.

In the hypothetical US-Europe+ bloc, meanwhile, fragmentation would cause an oversupply of most of these mined minerals. However, the bloc’s use of minerals would be constrained by the length of time it takes to scale up refining capacity. Fragmentation, therefore, generates only small gains in the US-Europe+ bloc by 2030: the bloc would produce slightly more EVs, but there would be no gains in renewable-energy capacity.

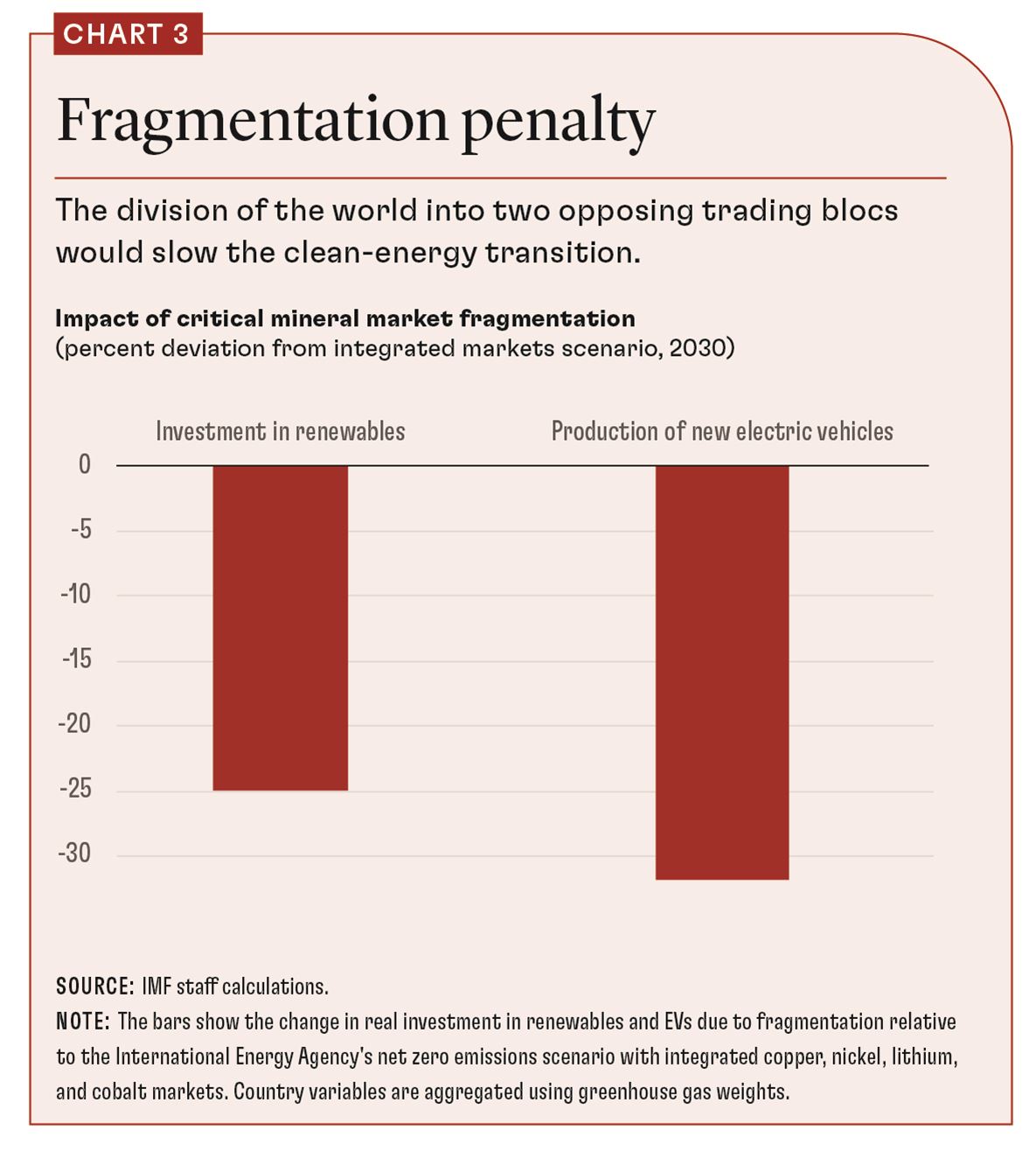

Decarbonizing the global economy would be more difficult if the market for minerals were fragmented. On balance, global net investment in renewable technology and production of EVs would be about 30 percent lower, if greenhouse gas emissions are used as weights to aggregate region-specific results (Chart 3). This measure accounts for the greater emissions intensity of activity in the China-Russia+ bloc and hence the greater effort needed to achieve global emissions mitigation goals.

International initiatives

Multilateral cooperation is essential to prevent vicious spirals where countries impose trade restrictions as a risk management tool. An agreement on enhanced World Trade Organization rules on export restrictions and tariffs as well as discriminatory subsidies would be the best solution.

If full cooperation is impossible, multilateral efforts should prioritize establishing a “green corridor,” consisting at a minimum of agreement to maintain the free flow of critical minerals and not to discriminate between firms from different countries.

An international initiative to improve data sharing and standardization in mineral markets could also reduce market uncertainty. The international community should establish an institution or platform, similar to the International Energy Agency or the Food and Agriculture Organization, focused solely on critical minerals.

Individual countries can take proactive steps, too. Strategies could include diversifying sources of commodity supplies; greater investment in mining, exploration, and storage; and critical mineral recycling.

Industrial policies, meanwhile, must be designed carefully to ensure equal treatment of firms across competitive markets to prevent adverse cross-country spillovers, minimize distortions and inefficiencies, and mitigate fiscal risks and harmful political economy outcomes. “Friend-shoring” policies and local-content provisions can also distort markets and raise costs. Developing a framework for international consultation on friend-shoring could help identify negative cross-border spillovers and mitigate adverse consequences.

Fragmentation in critical mineral markets could make the clean energy transition more costly and potentially delay much-needed policies to mitigate climate change. Multilateral cooperation on trade policies and more data sharing would thwart additional obstacles to a cleaner global energy system. Critical minerals may someday be as important to the world economy as oil is today. We need a better understanding of their complex value chains.

This article draws on

Chapter 3 (“Fragmentation

and Commodity Markets: Vulnerabilities and Risks”) of the IMF’s October

2023 World Economic Outlook.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.

References:

Boer, Lukas, Andrea Pescatori, and Martin Stuermer. Forthcoming. “Energy Transition Metals: Bottleneck for Net-Zero Emissions?” Journal of the European Economic Association.