For economic recovery and crisis prevention, hidden liabilities and their terms must be revealed

As the COVID-19 crisis lingers, emerging market and developing economies are entering perilous waters that evoke memories of past debt defaults. Although all countries amassed debt to fight the pandemic, the economic recovery in these economies substantially lags their advanced economy counterparts. Tighter monetary policies in advanced economies are poised to push up international interest rates, which tends to put pressure on currencies and heighten the odds of default. To complicate matters, the extent of many emerging market and developing economy liabilities and their terms aren’t fully known. If they are to foster a sustained recovery and limit the risk of a crisis, they must make a full accounting of hidden debts, both public and private.

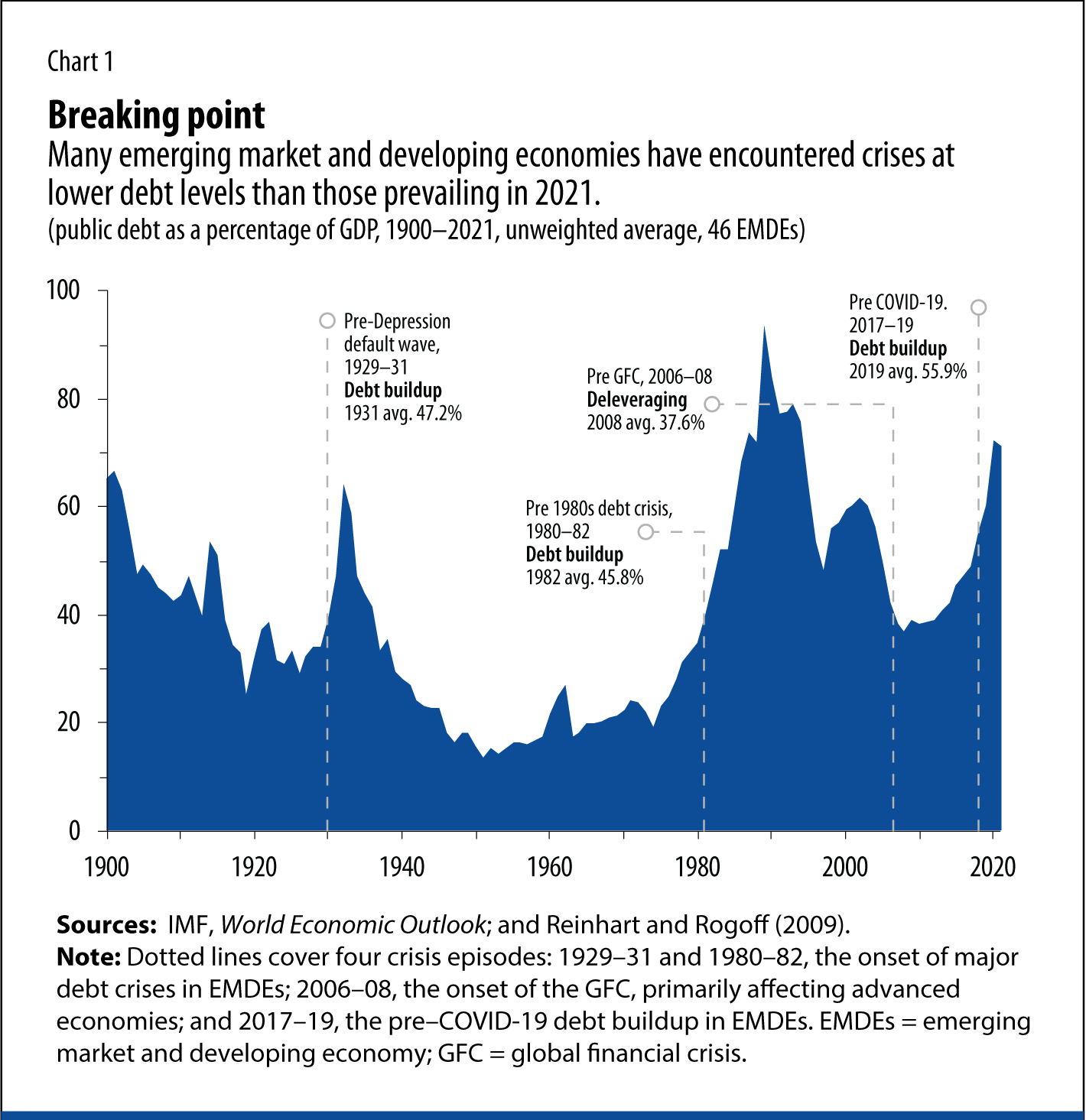

Emerging market and developing economies are facing complex challenges, with weaker growth prospects, limited fiscal space, and higher refinancing risks due to the shorter maturity of public debt, according to the IMF’s October 2021 Fiscal Monitor. Many are debt intolerant because, among other factors, of their credit history and greater macroeconomic volatility. Many have encountered crises at lower debt levels (Chart 1) than those prevailing in 2021 (Reinhart, Rogoff, and Savastano 2003).

A common feature of debt crises has been a sudden jump in debt levels, often driven by large exchange rate depreciations in countries with foreign currency debt, and governments’ assumption of so-called contingent liabilities amassed by state-owned enterprises, subnational governments, banks, or corporations. Because these crises are associated with lower growth, higher inflation, and setbacks in the fight against poverty and other development goals, protracted defaults are damaging to the economic and social fabric of the debtor country.

Public sector foreign currency debt remains a vulnerability (though perhaps less so than in the past). Sustained exchange rate depreciation could pressure governments to rescue private entities that have large foreign currency liabilities. Such rescues could trigger a sudden rise in public borrowing needs, as happened in numerous earlier crises in both advanced and emerging market and developing economies.

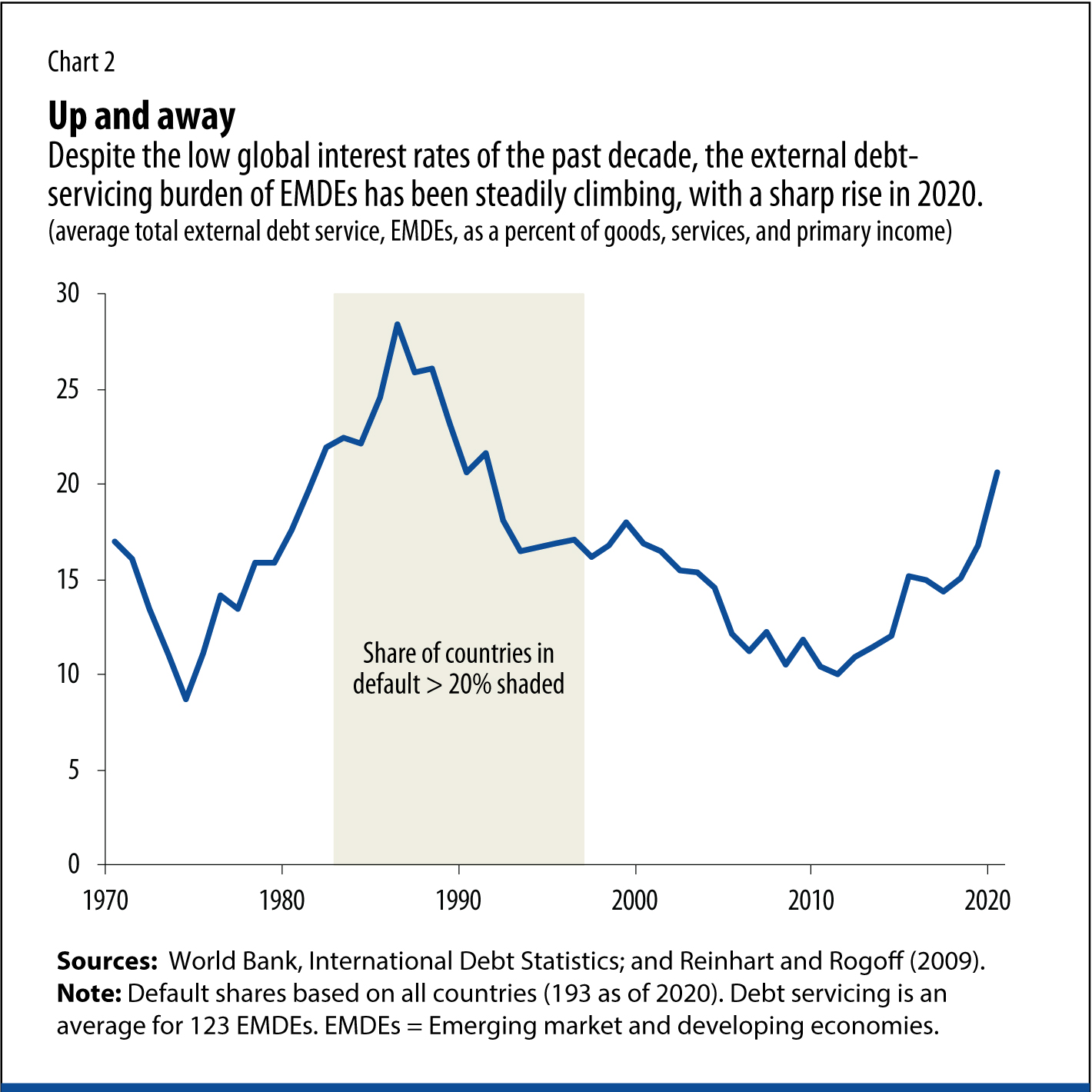

Emerging market sovereign spreads are, on average, close to their pre-pandemic levels even as public debt levels have risen and sovereign credit ratings have been marked down. However, despite the low global interest rates of the past decade, emerging markets’ external debt-servicing burden has been steadily climbing (Chart 2), with a sharp rise in 2020, as exports slumped, debt spiked, and borrowing terms deteriorated for many of these economies.

Global financial conditions are set to deteriorate as central banks in advanced economies tighten policy to fight unexpectedly persistent inflation pressure. Declining overseas lending by China is poised to reinforce this trend as China deals with its own property sector bankruptcies and the souring of many of its loans to emerging market and developing economies.

Furthermore, the share of sovereign domestic debt in these economies has increased sharply in the past two decades (IMF 2021). Governments turned to the domestic banking system to meet their financing needs as overseas investors withdrew during the pandemic. The increase in government debt held by emerging market domestic banks implies that sovereign debt distress could spread to banks, pension funds, households, and other parts of the domestic economy.

Debt risks are high and are likely to remain so for several years, as the pandemic has increased the gross financing needs of the public sector on a sustained basis among emerging market and developing economies. Many have run down domestic sources of financing. And their ability to borrow from domestic central banks—which some countries have done extensively since early 2020—will be more limited if inflation pressure persists. These developments may make emerging market and developing economies more dependent on external financing and expose them to greater risks of a sudden stop in external financing. Last, but not least, financing needs—and debt—have a habit of coming in higher than expected.

Opaque balance sheets

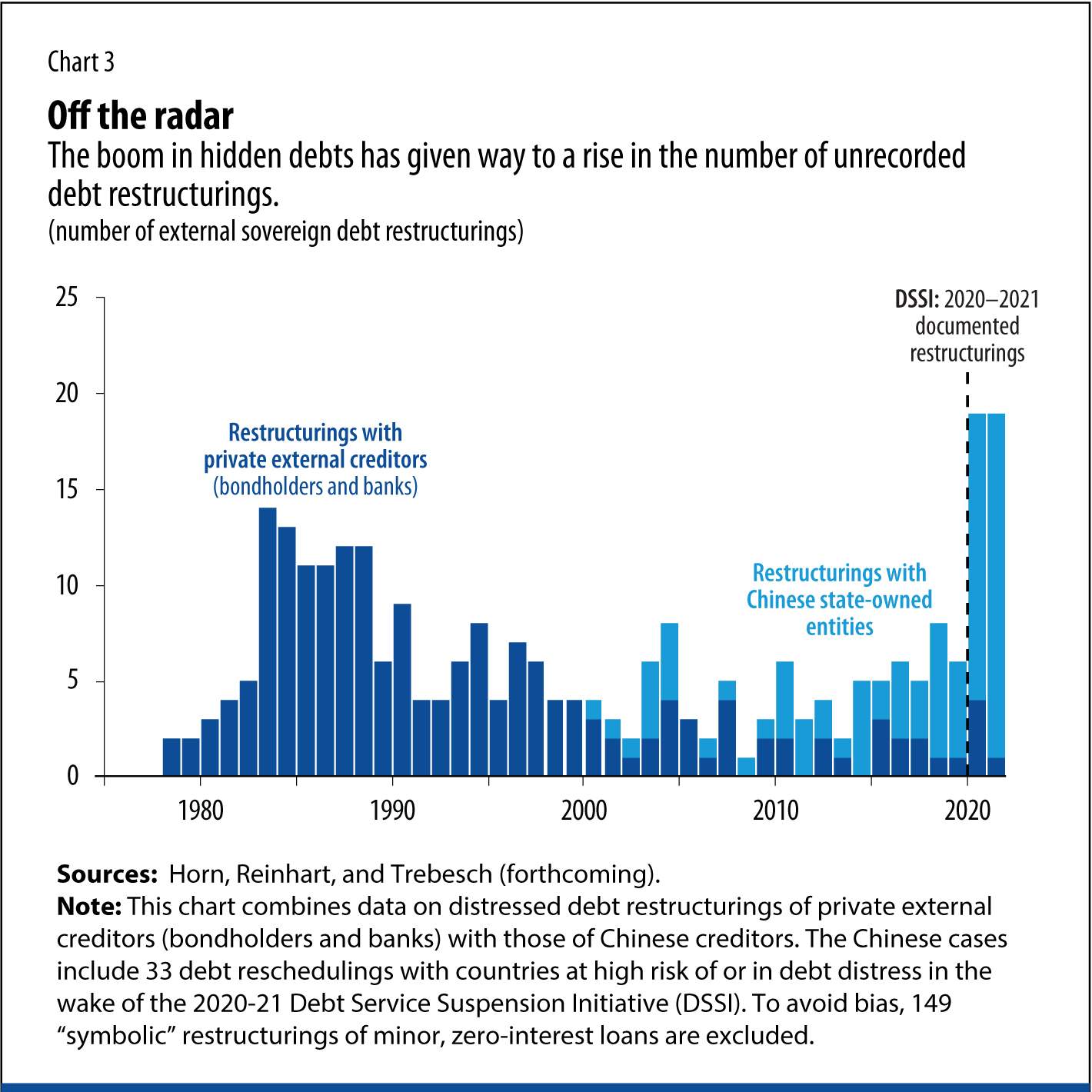

Many debtor governments, seeking to avoid a disorderly and protracted default, face a major obstacle: the true extent of their liabilities or terms is often not fully known to many of their creditors or the international financial institutions that support them. During the period of high global commodity prices and relative prosperity that lasted until about 2014, many emerging market and developing economies looked beyond the Paris Club of official creditors and borrowed heavily from other governments, particularly China. A substantial share of these debts went unrecorded in major databases and remained off the radar of credit-rating firms. External borrowing by state-owned or guaranteed enterprises, which have uneven reporting standards, also escalated. The boom in hidden debts has given way to a rise in unrecorded debt restructuring (Chart 3) and hidden defaults (Horn, Reinhart, and Trebesch, forthcoming). Comparatively little is known about the terms of these debts or their restructuring terms. Historically, opacity derails crisis resolution or, at a minimum, delays it.

The lack of balance sheet transparency extends beyond the public sector. As the 2022 World Development Report highlights, many countries introduced accounting and regulatory forbearance and guarantees to mitigate the impact of the pandemic on the economy. The unintended consequence of these measures is the potential for an increase in nonperforming loans that are not yet reflected on banks’ balance sheets. The rise in hidden nonperforming loans, together with increased sovereign debt holdings, has reinforced the so-called sovereign-bank nexus, in which the financial soundness of banks has become increasingly intertwined with that of governments. Banking and sovereign debt crises have often erupted in close succession (Reinhart and Rogoff 2011). The pandemic has strengthened this “doom loop” while increasing the opacity of private and public balance sheets.

Detection, transparency, and resolution

An encompassing strategy to increase the transparency of the public, financial, and corporate sectors and assess and address identified balance sheet risks is a first step in both supporting economic recovery in emerging market and developing economies and resolving sovereign debt problems in countries already in distress. More than a year has passed since the Group of Twenty introduced the Common Framework for Debt Treatments to deal with sovereigns facing sustained debt problems; to date, not a single country restructuring has been achieved. As in earlier episodes, the nature of delays is varied and traces to both creditors and debtors, and urgent action is needed by all relevant stakeholders to ensure that the Common Framework delivers. That includes clarifying steps and timelines on the Common Framework process and suspending debt-service payments until negotiations are completed.

Debt contracts are a critical area that needs more transparency. Beyond the usual terms (maturity, interest rates, currency), key features (collateral, cross-default, secrecy clauses, and so on) of many emerging market debt contracts are often undisclosed. Collateralized external public debt has risen in recent years, but accurate measures of its prevalence are limited. Reliance on collateralized syndicated bonds and loans from private creditors is concentrated in a few countries, including opaque contracts with oil traders. There is also some evidence to suggest that many of China’s bilateral infrastructure loans are collateralized (Gelpern and others 2021).

As we have argued elsewhere, transparency cannot overcome all the challenges, but it can go a long way toward increasing the odds of faster and orderly debt restructuring by building trust among creditor groups, which at present is rather low. Disclosure must come from all creditors and debtors—multilaterals continue to expand their coverage of data gaps in existing databases, while building new ones that are more all-encompassing, and revise their lending policies to enhance disclosure requirements.

Fiscal, monetary, and financial sector policies have supported financial stability during the pandemic. The eventual withdrawal of these measures may uncover vulnerabilities that could lead to banking sector stress. Timely action is critical and will require improving the transparency of banks’ asset quality, including exposures to the sovereign and contingent liabilities, through asset quality reviews as well as stress testing exercises to prepare contingency plans. An accurate diagnosis of risks is a first step toward problem resolution and asset restructuring where needed.

Muddling through by evergreening—renewing loans indefinitely—which has been replayed many times before, is a recipe for delayed recovery. When the assessments call for credible recapitalization plans or restructuring of liabilities, these should be carried out swiftly in ways that do not markedly worsen sovereign debt burdens. Conditions in some countries may require government intervention, including targeted programs to alleviate debt overhangs in the household and commercial real estate sectors. Importantly, to avoid “zombification,” asset restructuring must be driven by market forces, supported by tighter regulations—including in the areas of loan-loss classification, provisioning, and disclosure—and enhanced supervision.

The IMF and the World Bank will continue to support the transparency agenda through data dissemination, capacity building, and lending policies to assist with sovereign debt restructuring. In an ongoing review of IMF policies for lending to countries in arrears or undergoing restructuring, the staff is proposing a new policy under which the IMF can lend only if countries share comprehensive information about their debt stock and debt terms (in the aggregate) with all creditors. Such information sharing would be expected regardless of whether countries are already in arrears or seeking to avoid arrears.

Debt coverage in the World Bank’s International Debt Statistics has increased substantially in the most recent year. The latest edition identified and added almost $200 billion in previously unreported loans to past statistics, the single largest increase in debt coverage in the 50-year history of the World Bank’s debt report publications (Horn, Mihalyi, and Nickol 2022). About 60 percent of low-income countries are now at high risk of or already in debt distress, compared with fewer than 30 percent in 2015. While the transparency gaps are particularly acute in these countries, these challenges are also widespread among emerging market and developing economies. The risks of not addressing these gaps promptly are both significant and rising rapidly.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.

References:

Gelpern, Anna, Sebastian Horn, Christoph Trebesch, Scott Morris, and Bradley Parks. 2021. “How China Lends: A Rare Look at 100 Debt Contracts with Foreign Governments.” Peterson Institute for International Economics Working Paper Series WP21-7, Washington, DC.

Horn, Sebastian, David Mihalyi, and Philipp Nickol. 2022. “Hidden Debt Revelations.” Unpublished. World Bank, Washington, DC.

Horn, Sebastian, Carmen M. Reinhart, and Christoph Trebesch. Forthcoming. “Hidden Defaults.” American Economic Review: Papers and Proceedings, May 2022.

International Monetary Fund (IMF). 2021. “Issues in Restructuring of Sovereign Domestic Debt.” Policy Paper 2021/071, Washington, DC.

Reinhart, Carmen M., and Kenneth S. Rogoff. 2009. This Time Is Different: Eight Centuries of Financial Folly. Princeton, NJ: Princeton University Press.

Reinhart, Carmen M., and Kenneth S. Rogoff. 2011. “From Financial Crash to Debt Crisis.” American Economic Review 191 (5): 1676–706.

Reinhart, Carmen M., Kenneth S. Rogoff, and Miguel A. Savastano. 2003. “Debt Intolerance.” Brookings Papers on Economic Activity 1 (Spring): 1–74.