Governments facing a fiscal crunch should seek out hidden assets

Almost a thousand years ago, in 1085, William the Conqueror commissioned a survey of his kingdom of England, acquired 19 years earlier. The goal: inventory all the assets and understand what revenue they should generate, and hence what was due to the Crown in rent or taxes.

In the vernacular of the time, because of its scale, finality, and authority, this work was called the Domesday Book. Today, we might call it an asset map. Importantly, even with 11th century technology, the Domesday Book took only a year to complete!

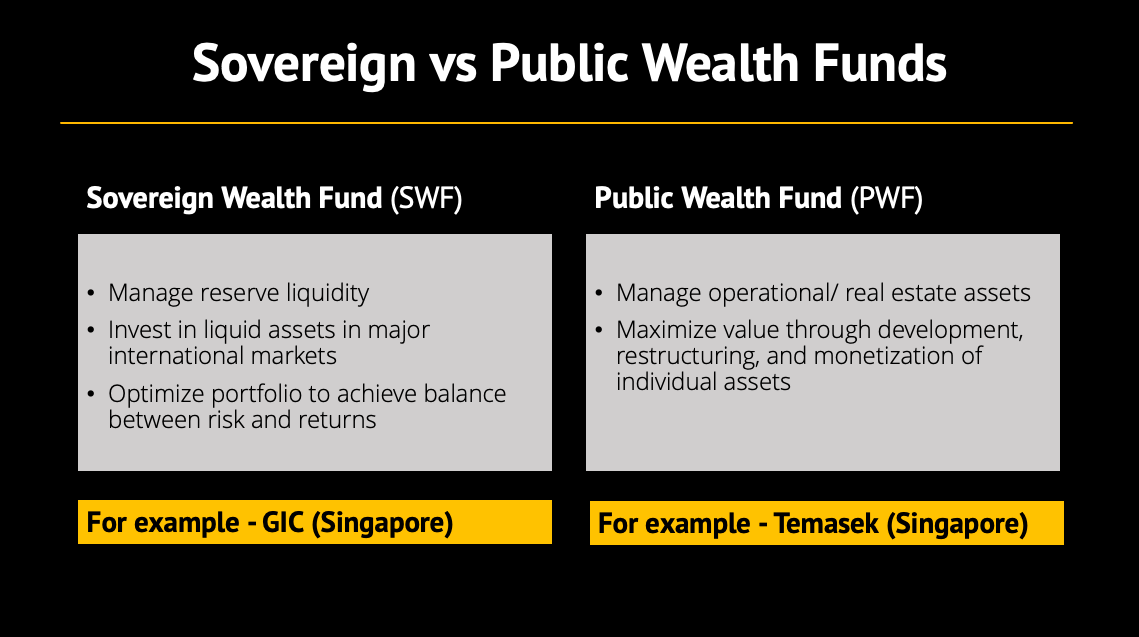

Today’s governments have largely forgotten the importance of an accurate inventory of their assets. This problem, rooted in government accounting systems, impedes valuation and efficient asset management. A quick, low-cost solution is to find the hidden assets by doing an asset map and to manage them through a public wealth fund (see Chart 1).

Valuation unknown

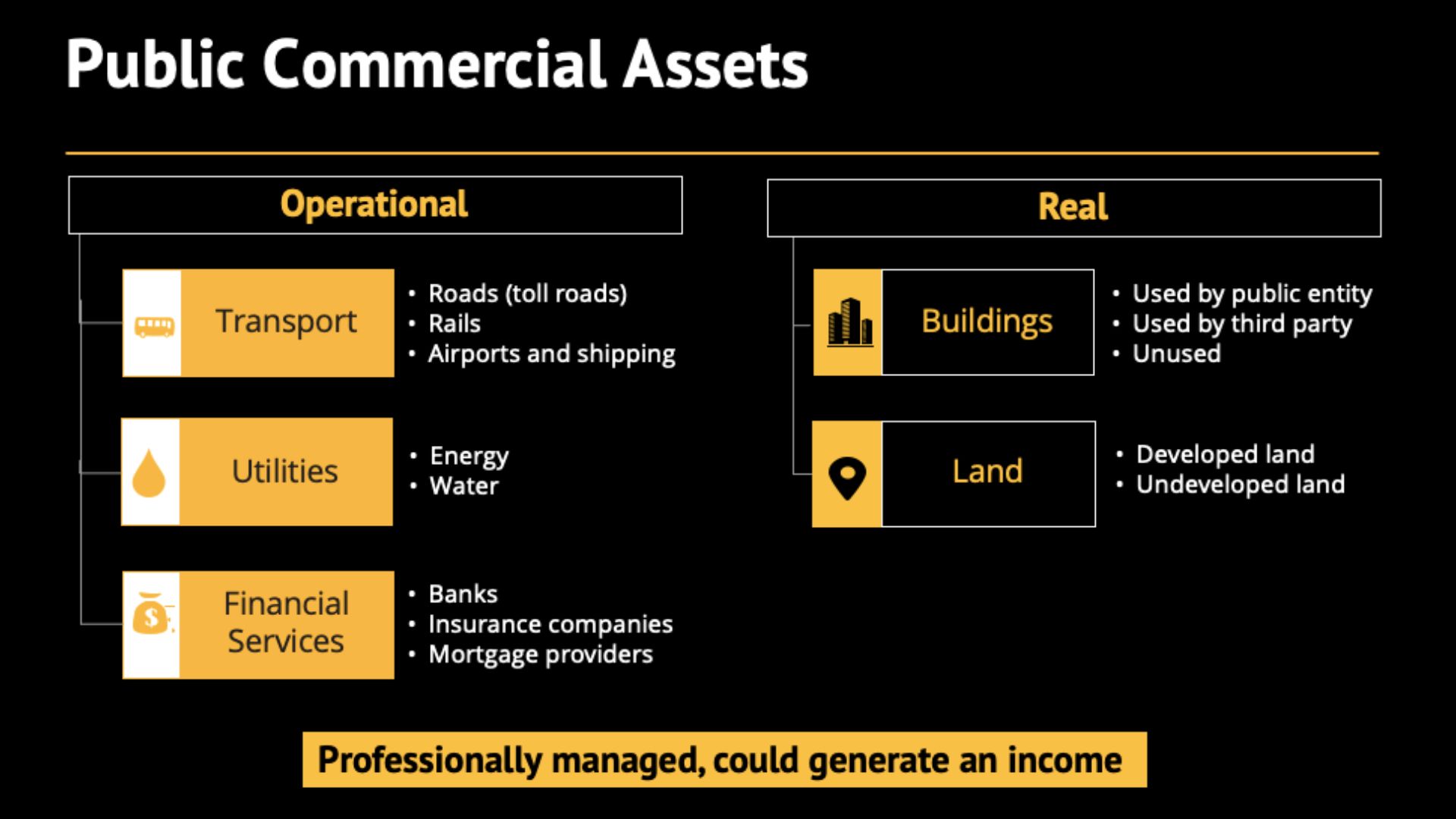

Public commercial assets—defined as any assets able to generate income if professionally managed—include operational assets (such as utilities) and transportation assets (such as airports, ports, and subway systems) as well as real estate (see Chart 2). They are perhaps the largest wealth segment in the world—and among the least well understood.

At more than $90 trillion, the value of the world’s publicly listed companies is roughly equal to that of global GDP. Governance is a huge industry with a vast array of agents—corporate managers and boards, accounting firms, stock exchanges, securities regulators, investment banks, investment managers—focused on efficiently managing these firms and allocating capital to them. Media channels constantly report how these businesses are performing.

Public commercial assets receive far less attention, yet the IMF has estimated global public assets at twice the value of global GDP. While these assets are owned in the public interest, even the most open and democratic governments offer little formal governance, oversight, or accountability. Indeed, few governments make any serious effort to record and value all their commercial assets, and those that do apparently omit large swaths of holdings, so the true value is probably much higher than the IMF’s assessment, which relies on government data.

Costly consequences

The dearth of information about public commercial assets promotes inefficiency, and an IMF study estimates a cost to this—about 1.5 percent of the total value of assets per year, equivalent to about 3 percent of global GDP. These inefficiencies include lower yield or the absence of yield from public commercial assets, due to poor accounting, mismanagement, waste, and corruption.

There also are important macroeconomic consequences, including government balance sheets that appear weaker than they should. IMF work published in August 2019 (Yousefi 2019) and in May 2021 (Koshima and others 2021) makes it clear that governments with stronger net worth (assets minus liabilities) recover faster from recessions and have lower borrowing costs.

Ignoring net worth is misleading, mismeasures debt sustainability, and creates a bias against investment (Ball and others 2021). In contrast, governments that focus on net worth have an incentive to invest in productive assets. Over the longer term, a net worth focus would make it easier to hold governments to account for decisions on spending, borrowing, and taxation—and the impact on intergenerational fairness. Perhaps most profoundly, this change would help governments make the investments needed to meet the challenges of the COVID-19 pandemic and climate change.

Failures and dangers

All commercial assets, whether public or private, can earn income. Yet government accounting standards often presume that public assets are unlike those in the private sector because their sole purpose is to fulfill a public policy or provide a specific public service. If you presume that the need for these assets will not change, their market value is irrelevant. Thus, governments often value public assets at historical cost, or sometimes assign them no value at all. With each year, the reality of how public assets are used and what they are worth diverges further from their historical use and value. Given the time involved—decades, or even centuries—it is not surprising that government accounting can fail to capture the value of public real estate and other assets.

Governments are without exception the biggest landowners in every country, yet they pay scant attention to the value of their holdings or to managing them to best deliver value to taxpayers. These failures carry real costs. It is difficult for anyone in government, opposition political parties, or the electorate to hold anyone accountable for the management of these “invisible” assets or ask whether they are still needed at all. As a result, cash-strapped public bodies avoid decisions they would face in the private sector—for instance, about whether they can meet their needs through better use or sale of existing assets.

Why is there so little appetite to challenge government over its asset management? Perhaps political leaders simply have enough on their plates handling known problems and resources. There might also be perverse incentives: what government department will look for invisible assets if it fears that finding them will create demands to spend more or be a mandate to sell them or manage them better? And perhaps the task is too big, or too protracted, to appeal to elected officials with shorter-term horizons.

Solutions at hand

Moving government accounting from a cash to an accrual basis, in line with private sector norms and International Public Sector Accounting Standards, offers a solution to this problem—provided it also becomes the basis of government financial management. This means governments should show assets, especially property, at their fair market value, rather than historical or zero cost. It also means at least annual assessments of public net worth, a powerful measure of whether government is building or destroying its financial position—and hence, whether future generations are being treated fairly.

It can be done. Almost two decades ago, the IMF shifted its Government Finance Statistics Manual from a cash to an accrual basis, and more than three decades ago, New Zealand introduced accrual-based accounting and a government financial management framework driven by that accounting method. In doing so, New Zealand moved from two decades of government deficits and declining net worth to 30 years of value creation with very few deficit years.

Many countries claim to be following suit, and industry bodies predict that in a few years, almost half the world’s governments will adopt accrual-based accounting (IFAC and CIPFA 2021). Far fewer, however, are putting accrual information at the heart of their financial management and budget systems. For example, the UK’s Whole of Government Accounts, which reports its public sector real estate assets, does not have a mandate to assign a fair market value to the assets, and its financial management framework pays very little attention to net worth creation. It will take consistent pressure from the IMF and others interested in efficient financial management for accounting reform to yield better financial management.

Driving development

There is a way to expedite the process: transfer public commercial assets to public wealth funds that in effect bring the same governance, management, accounting, and accountability to specific asset pools that is used in the private sector. With public wealth funds, the benefits of efficient management can be realized quickly, within a year or two, in contrast to the time it would take to implement accrual-based public sector accounting and effectively use the information it generates.

Asia offers examples of how public wealth funds can transform—or transcend—government finances and drive economic development. Singapore’s onshore public wealth fund, Temasek, was founded in 1974 to manage key government holdings, including in financial services, transport, telecom, and industrials. Capital Land, Temasek’s flagship real estate company, has become one of Asia’s largest real estate companies. Singapore’s success as an investor has gone hand in hand with its development as one of the most livable cities in the world. And in Hong Kong SAR, the transit company MTR built a subway system the size of New York City’s solely through internally generated resources—particularly through capturing the value generated by developing the properties adjacent to its stations (Leong 2016).

In Europe, Sweden was the first to introduce active management of public assets with a clear financial purpose. Over a designated three-year period, from 1998 to 2001, Sweden managed its public portfolio as if it were owned by corporate shareholders, introducing an equity culture and private sector discipline. It turned around its telecom, electricity, railway, and postal service monopolies within the three-year timetable, improving vital services, generating a substantial financial dividend, and boosting economic growth. Real estate played an important role, as Sweden’s vast portfolio of properties helped support the turnaround without injecting external capital. Finland followed in 2008, launching a public wealth fund that has generated a solid return since inception and a separate public wealth fund for real estate owned by the national government.

At a local level, Hamburg and Copenhagen used their respective urban wealth funds to modernize outdated ports and build new residential housing, workspaces, schools, parks, and retail and cultural facilities. With the financial surplus from its operations, Copenhagen was able to fund part of the extension of the local metro system. Similarly, London and Continental Railways, in the UK, and Jernhusen, in Sweden, have successfully developed areas around city train stations without using taxes.

Creating public wealth funds offers the benefits of private sector finance, for example, through direct access to debt and equity markets, engagement with specialist equity funds, or corporate partnerships. This can take place at the public wealth fund (holding company) level or at the level of individual assets. Of course, such efforts must deliver value to voters and taxpayers, the ultimate beneficiaries of public wealth funds. But funds that have strong governance and make decisions for commercial, rather than ideological or purely political, reasons can deliver such value, as the previous examples demonstrate.

Domesday Book revisited?

When William the Conqueror dispatched clerks in 1085 to record his kingdom’s assets, he was interested primarily in land holdings. Even today, property remains the largest single asset class, with extensive government holdings. In most developed economies, land registries, relatively transparent transaction information, and web-based survey techniques make it quite straightforward to construct an asset map identifying and valuing government property holdings within any given locale—in effect, to generate a local Domesday Book without the Domesday pain.

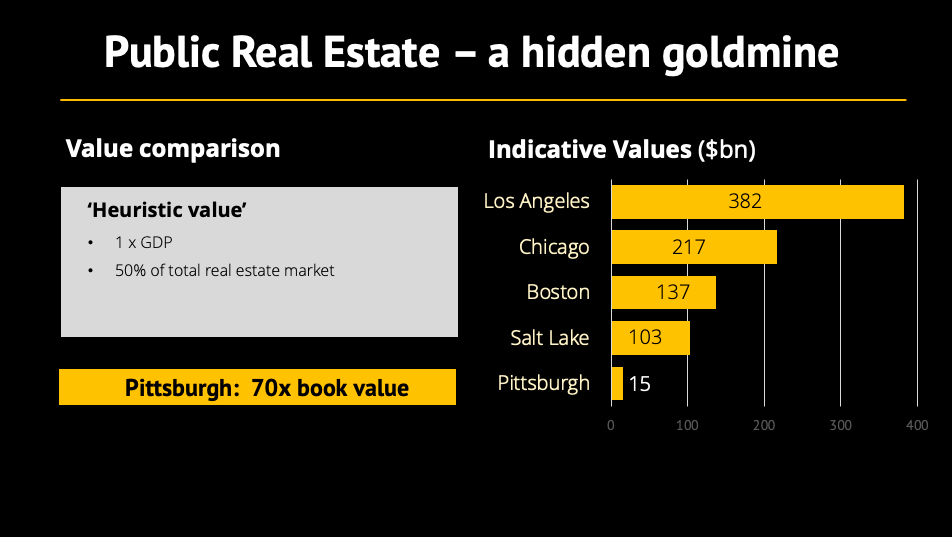

The US city of Pittsburgh offers an interesting case study. Before mapping its assets, Pittsburgh’s mayor thought the city had some 400 public properties, valued in the city’s accounts at about $57 million. Pittsburgh employed a specialist firm to conduct a simple asset mapping exercise, which took two weeks to complete and cost about $20,000. It demonstrated that the actual number of city-owned properties was closer to 11,000, most of which were not needed to deliver public services. Pittsburgh’s real estate portfolio was valued at $3.9 billion—70 times its book value. If professionally managed, these holdings could generate additional income well beyond what the city currently raises in taxes. Alternatively, assets not needed to deliver public services could be sold and proceeds used to finance new investment— without increasing taxes or borrowing (pdf).

In less developed economies and political systems, there might be a different set of challenges. For example, the quality of information about property ownership varies widely between countries, and any steps taken must be geared toward promoting transparency and accountability. On the other hand, as the Asian examples demonstrate, in less developed economies effective use of state assets, especially property, can be an important driver of economic and institutional development.

Avoiding austerity

For too long, many countries have ignored asset valuation and management, and the resulting impact of this neglect. The need to address both the COVID-19 pandemic and climate change, which together will strain public finances for at least a generation, demands radical action. Given that the alternative in many countries could be a prolonged period of austerity, rethinking how governments view public assets is now a moral as much as an economic goal. Making this change will be difficult, but the evidence is clear: identifying public commercial assets—especially real estate—and sustainably managing them through public wealth funds can deliver enormous windfalls to governments as they seek to meet today’s challenges to benefit both current and future generations.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.

References:

Ball, Ian, Dag Detter, Yannis Manuelides, and Wang Yan. 2021. “Why Public Assets are Key to Debt Sustainability: A Moral Goal”. IMF Blog. International Monetary Fund, Washington, DC. International Federation of Accountants (IFAC) and Chartered Institute of Public Finance and Accountancy (CIPFA). 2021. “International Public Sector Financial Accountability Index: 2021 Status Report.” New York.

Koshima, Yugo, Jason Harris, Alexander F. Tieman, and Alessandro De Sanctis. 2021. “The Cost of Future Policy: Intertemporal Public Sector Balance Sheets in the G7.” IMF Working Paper 21/128, International Monetary Fund, Washington, DC.

Leong, Lincoln. 2016. “The ‘Rail Plus Property’ Model: Hong Kong’s Successful Self-Financing Formula.” McKinsey Insights, McKinsey & Company, Washington, DC. Yousefi, Seyed Reza. 2019, “Public Sector Balance Sheet Strength and the Macro Economy.” IMF Working Paper 19/170, International Monetary Fund, Washington, DC.