Published on April 7, 2022

The Future of Inflation Part III: The final piece in our future of inflation series discusses how a move to an electronic money standard can lower the inflation target toward zero

A world with lower inflation (and even zero inflation) and no persistent recessions may sound like a pipe dream, but we argue that it is possible by transitioning to an “electronic money standard.” Such a transition requires eliminating the zero lower bound, which central banks can achieve using readily available tools. Breaking the zero lower bound implies that the optimal rate of inflation will be lower than in the presence of the lower bound. This will empower central banks to quickly restore full employment and, over the medium term, possibly move toward targeting full price stability with zero inflation.

A 2 percent target

In addition to the presence of nominal wage rigidities, the main reason major central banks have settled on a long-term inflation target of 2 percent or more is the danger of the zero lower bound. We see the zero lower bound—whether as a hard or soft constraint that allows slightly negative rates—as a self-imposed limitation. (Hence, we talk about “zero lower bounds” in the plural: each central bank imposes a different version on itself and faces a different legal situation in relation to negative interest rates.

Before zero lower bounds became a problem, advanced economy central banks typically cut nominal rates by 5 to 6 percentage points to restore the economy to its full potential. The real interest rate is the nominal interest rate adjusted for inflation. Given expected inflation, a cut in nominal rates translates into a cut in real rates that increases spending both by tilting incentives toward spending now rather than later and via a constellation of wealth effects in favor of the borrowers in every borrower-lender relationship—borrowers who are likely to spend more freely than the corresponding lenders. This logic applies to households, firms, and governments.

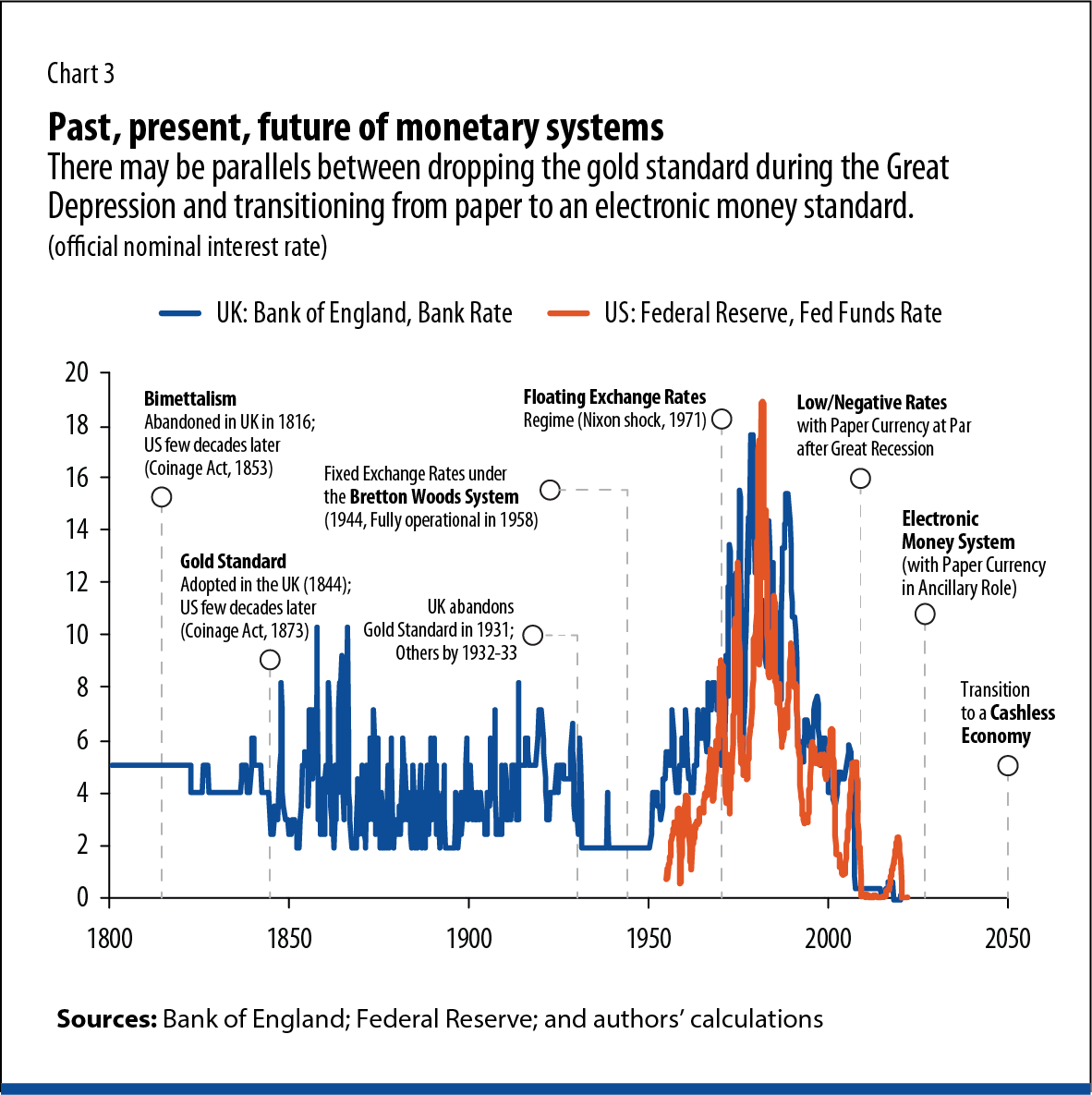

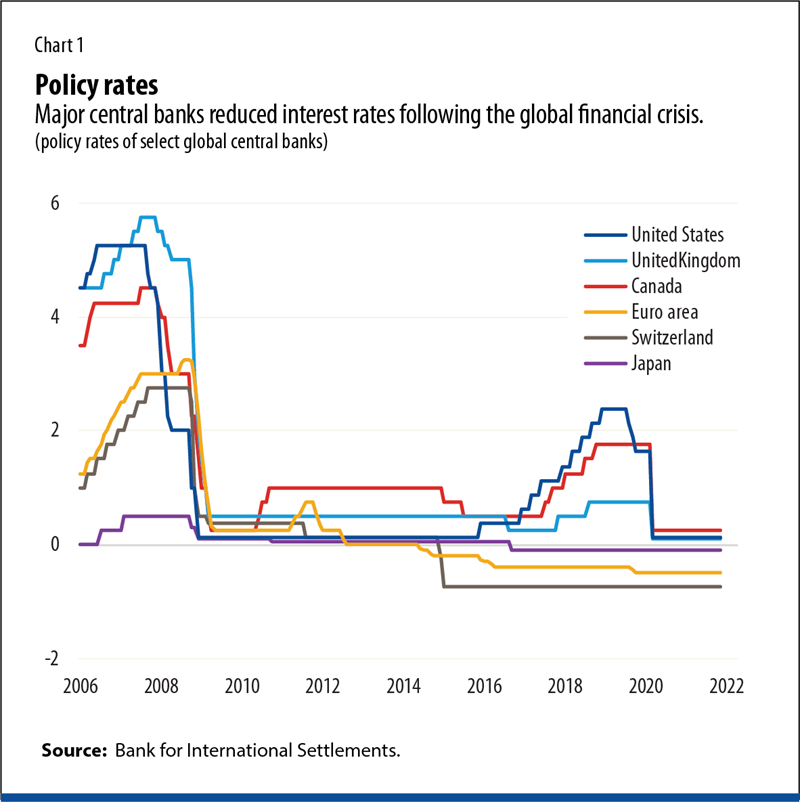

A variety of factors, including an aging population that has raised the saving rate, have led to a decline in productivity—and greater demand for safe assets—and the “natural” real rate of interest has trended downward worldwide. Thus, for a given rate of expected inflation, the level of nominal interest rates set by central bankers has also declined (Chart 1). Inflation has also trended down, adding to the downward trend in nominal interest rates.

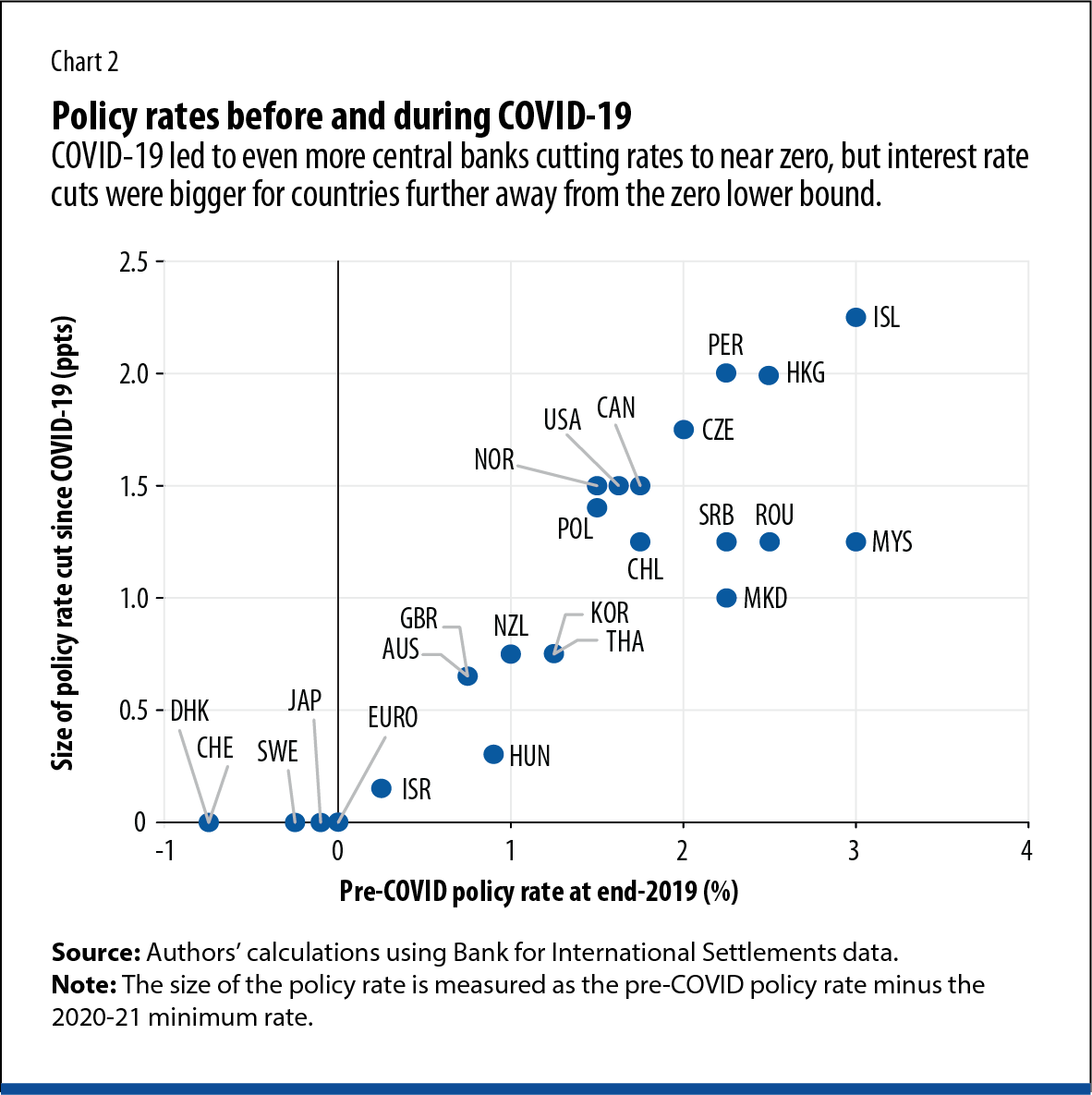

The slide in nominal interest rates has made zero lower bounds serious obstacles to monetary policy. During the Great Recession, several advanced economy central banks quickly cut their policy rates to near zero and kept them there for years. A few went even further by cutting rates into mildly negative territory. But the rate cuts were not large enough, so the downturn lasted much longer than previous slumps, and recovery was slow. Recently, the COVID-19 pandemic led even more central banks to trim rates to near zero, and cuts were bigger in countries further away from the zero lower bound (Chart 2). This suggests that many of those that cut rates less felt constrained by zero lower bounds.

Whatever the true optimum long-term inflation target in the presence of the zero lower bound, it seems unlikely that many central banks would brave a still-present zero lower bound by lowering their inflation target. Most worry that raising the inflation target is difficult without losing hard-won credibility. So, for many central banks, any adjustment of the long-term inflation target (away from the 2 percent prevailing in advanced economies) seems fraught with danger if the zero lower bound remains.

Further indicating the importance of zero lower bounds for inflation targets, the Bank of Canada’s ability to rely on negative rates—thereby reducing the frequency of hitting a binding effective lower bound—was one reason it did not raise its inflation target (Bank of Canada 2016). Ben Bernanke made a similar point when he compared negative interest rate policy to raising the inflation target (Bernanke 2016). The extent to which a central bank in the future may be able to revise its inflation target down will depend on its view of the effective lower bound.

The electronic money standard

Why is there a zero lower bound? It is not a law of nature, but a policy choice. The zero lower bound arises when a government issues pieces of paper (or coins) guaranteeing a zero nominal interest rate, over all time horizons, that can be obtained in unlimited quantities in exchange for money in the bank. This acts as an interest rate floor, making people unwilling to lend at significantly lower rates. There is now a growing body of work developing mechanisms to expand the central bank toolkit to overcome the zero lower bound. We have presented new options and reviewed existing ones on how to eliminate the zero lower bound and discussed how its elimination opens the possibility of a zero inflation target (Agarwal, and Kimball 2015; Agarwal, and Kimball 2019).

Breaking the zero lower bound requires eliminating the arbitrage opportunity between cash that guarantees a zero nominal interest rate and money in the bank that would earn negative interest rates if policy rates were cut into negative territory. All mechanisms to break zero lower bounds modify paper currency policy, making electronic money more central to the monetary system.

By “electronic money” we mean money that is instantiated as an entry in a bank’s computer. We include the use of checks, credit cards, and debit cards in transactions. Given this definition of electronic money, the alternative to the “paper standard” can be called the “electronic money standard” (Agarwal, and Kimball 2015).

A zero lower bound can be broken through a combination of (1) adopting or strengthening an electronic money standard in which electronic money is the unit of account and (2) implementing a time-varying interest rate (or more generally, rate of return) on paper currency (cash). Then, as the interest rate on cash moves in line with the official policy rates, there is no arbitrage between cash and money in the bank. Operationally this can be done while remaining quite close to the current monetary system, but there are several legal, communication, and political challenges to a transition to such an electronic money standard (Agarwal, and Kimball 2019).

An essential element of an electronic money standard is that it does not require the elimination of paper currency to enable deep negative rates. It is enough to modify paper currency policy. Any arbitrage between cash and electronic money is at the expense of a central bank’s balance sheet. This balance sheet hit results from transactions at the central bank’s “cash window”—where funds in electronic accounts are exchanged for paper currency and back again. Fees or limits that prevent taking advantage of the central bank cash window in this way to earn arbitrage profits are enough to avoid any lower bound arising from paper currency. (Even less problematic is making sure that private entities cannot lend unlimited amounts to the government at above-market zero rates in other ways.) There is more than one way to modify paper currency policy to prevent arbitrage profits from cash window transactions (Agarwal, and Kimball 2015; Agarwal, and Kimball 2019).

Those who see a cashless economy as a likely eventual outcome of monetary evolution (Rogoff and Rogoff 2017) consider the electronic money standard a transitional system. The key difference is that, unlike eliminating cash—which is likely to take decades—altering cash window policies can be done by any central bank within a matter of weeks.

Eliminating cash would also be highly controversial among the public. The key issue is that the existence of cash limits government power somewhat. Other privacy issues are easy to deal with in other ways. Rogoff and Rogoff (2017) argue that it is good to increase government’s power to suppress cash-intensive activities that are illegal, such as trade in deadly drugs and tax evasion. However, while most favor suppressing illegal activity, not everyone is in favor of doing so by eliminating cash.

Articulating a long-term goal of a cashless economy may be helpful in navigating the politics of moving paper currency from a central to a peripheral role in the transitional system; alternatively, an electronic money standard with cash still in the picture may persist as a long-lasting compromise between a paper standard and a cashless economy.

Overall, much as during the Great Depression—when countries were able to revive their economies by going off the gold standard—moving from a paper standard to an electronic money standard can empower monetary policy to cut interest rates as much as needed for economic stimulus during recessions while enabling a gradual shift to a zero inflation target (Chart 3).

Future monetary system

There are at least four benefits of a transition to the electronic standard and adoption of a lower (or zero) inflation target:

Benefit #1: True price stability with restored firepower to end recessions—The zero lower bound on interest rates has proved to be a serious obstacle for monetary policy. Once the transition to the electronic standard eliminates the zero lower bound, a central bank can enable deep negative rates, if and when needed—thus maintaining monetary policy’s power to end recessions quickly. A transition to the electronic money standard also allows for a lower inflation target—or even zero inflation (that is, true price stability).

Returning to traditional interest rate policy avoids the side effects of quantitative easing, and it has two key advantages over traditional fiscal policy. First, it does not add to the national debt. Second, although it is a matter of degree, many countries have been willing to hand over the monetary policy reins to an independent and technocratic central bank. Under a return to traditional interest rate policy, monetary policy would not be doomed to get tangled up in politics to the same extent discretionary fiscal policy inevitably does. Achieving desired levels of aggregate demand through interest rate policy allows fiscal policy to focus on long-term structural challenges.

Benefit #2: Avoid episodes of high inflation by enabling vigorous use of interest rates in either direction—Despite the surge in inflation worldwide, central banks have been behind the curve in raising rates. One reason is the reliance on forward guidance instead of negative interest rate policy. At the onset of the COVID-19 crisis, most advanced country central banks lowered their rates to the effective lower bound (but not deeper into negative territory) and thus had to deploy ‘forward guidance’—by committing to maintain the near-zero rates until they were confident that the economy was on track to achieve employment targets. However, such forward guidance tied the hands of several central banks when faced with rising inflation—leading to a sluggish interest response to record-high inflation. Tying their hands with a forward guidance promise was especially unfortunate given the unprecedented nature of the shock.

Benefit #3: Minimized nominal illusion—“Money illusion” is cognitive bias that causes people to think of money in terms of its face value instead of its real purchasing power. Money illusion distorts behavior in many areas of daily life (for example, saving, price setting, wage negotiations). With zero inflation we can minimize money illusion because average nominal rates will equal real rates (once inflation expectations adjust)—which depend only on inflation in the unit of account being zero. Inflation from the viewpoint of a defunct paper standard—which is what is needed to break the zero lower bound—is relatively harmless (Agarwal, and Kimball 2015). The confusion costs of inflation are minimized by a zero inflation rate in the electronic unit of account and do not depend on the “inflation rate” in terms of paper currency. The electronic money standard thus allows for elimination of cognitively costly inflation in the unit of account while leaving paper currency policy free to match the rate of return on paper currency to the policy rate.

Benefit #4: A simple price-level-targeting approach—A key advantage of a zero inflation target is that it can make price-level targeting easy to explain. Price-level targeting refers to central bank targeting of the level of prices—instead of the rate of inflation. Even in the absence of a zero lower bound, standard models of optimal monetary policy suggest that price-level targeting is beneficial relative to inflation targeting as it reduces uncertainty about future price levels (Svensson 1999). But a price-level-targeting policy can be hard to communicate in an inflationary environment in which inflation is salient since such policy entails “catch-up inflation” if inflation has been too low and “catch-down below-normal inflation” if inflation has been too high. Difficulty in explaining these elements can undermine central bank credibility.

By contrast, if inflation is zero, price-level targeting is easy to explain: return to the previous level of prices. Because of this communication advantage, a central bank with a zero long-term-inflation target might find it easier to implement price-level targeting. Given the communication advantage of absolute price stability (a zero inflation target plus price-level targeting) and the benefits of inflation very close to zero, we predict that in fact, if the zero lower bound is broken, many central banks will eventually choose to target inflation rates of zero, despite some concerns about the possible benefits of positive inflation—all of which, we argue, are achievable in other ways.

Complementary tools

The transition to an electronic standard with a zero inflation target will benefit from the use of several complementary tools:

Subsidies: The interest-on-reserves formula can be used to subsidize zero rates on small deposit accounts. In addition to encouraging banks to protect small depositors, this subsidy insulates commercial banks from a hit to profitability from zero rates to small depositor accounts. Essentially this tool makes it possible to address what would be both a sore point for voters and a potential stress point for banks.

Macroprudential measures: Since the global financial crisis, central banks have become concerned about the effect of lower rates on financial stability. However, the ability to get economic stimulus from lower rates makes it possible to increase capital requirements and toughen other macroprudential measures to alleviate these financial stability concerns without worrying about the aggregate demand consequences of those macroprudential measures. Hence, we view macroprudential measures and negative rates as complementary, including raising capital requirements and imposing stricter amortization requirements to ensure that firms effectively pay back a portion of the principal in each period (mitigating the risk of irrational bubbles, Ponzi schemes, or zombie firms).

Measures to overcome downward wage stickiness, particularly by creating incentives for firms to pay a substantial fraction of compensation in the form of bonuses that can vary from year to year. This is an old idea that looks even better now than when Martin Weitzman proposed it in his essential 1986 book The Share Economy. In addition, once zero lower bounds are broken, central banks can use vigorous interest rate cuts to shorten recessions enough that downwardly sticky nominal wages will present less of a problem.

But this all comes with a warning. One form of electronic money is central bank digital currencies (CBDCs). Discussions of CBDCs often miss a critical design requirement for central banks that wish to break free of any lower bound on rates: to allow negative rates, a CBDC must be interest-bearing, with the possibility of bearing negative rates (Agarwal, and Kimball 2015). An example of this oversight is the high-profile 2021 report on CBDCs to the Group of Twenty prepared by the Bank for International Settlements, IMF, and World Bank, which features the word “interest” only twice, and not even in relation to CBDCs. If CBDCs are not interest-bearing they will be nothing but digital versions of cash—leading to a “digital zero lower bound,” and with large welfare consequences.

Closing thoughts

A transition to an electronic money standard holds the dual promise of providing monetary policy firepower to restore full employment quickly while targeting full price stability with zero inflation. A combination of key trends—including central bankers’ experience with mildly negative rates, progress in CBDCs (if appropriately designed), the rise of digital transactions and online marketplaces, and virtual work practices—will keep nudging us closer to that future of money.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.

References:

Agarwal, R., M. Kimball. 2015. “Breaking through the Zero Lower Bound.” IMF Working Paper 15/224, International Monetary Fund, Washington, DC.

Agarwal, R., M. Kimball. 2019. “Enabling Deep Negative Rates to Fight Recessions: A Guide.” IMF Working Paper 19/84, International Monetary Fund, Washington, DC.

Bank of Canada. 2016. Bank of Canada Review: Special Issue on the Renewal of the Inflation Target. Ottawa.

Bernanke, B. S. 2016. “Modifying the Fed’s Policy Framework: Does a Higher Inflation Target Beat Negative Interest Rates?” Blog post, September 13.

Rogoff, K., and K. S. Rogoff. 2017. The Curse of Cash. Princeton, NJ: Princeton University Press.

Svensson, L. E. 1999. “Price-Level Targeting versus Inflation Targeting: A Free Lunch?” Journal of Money, Credit and Banking 31 (3): 277–95.