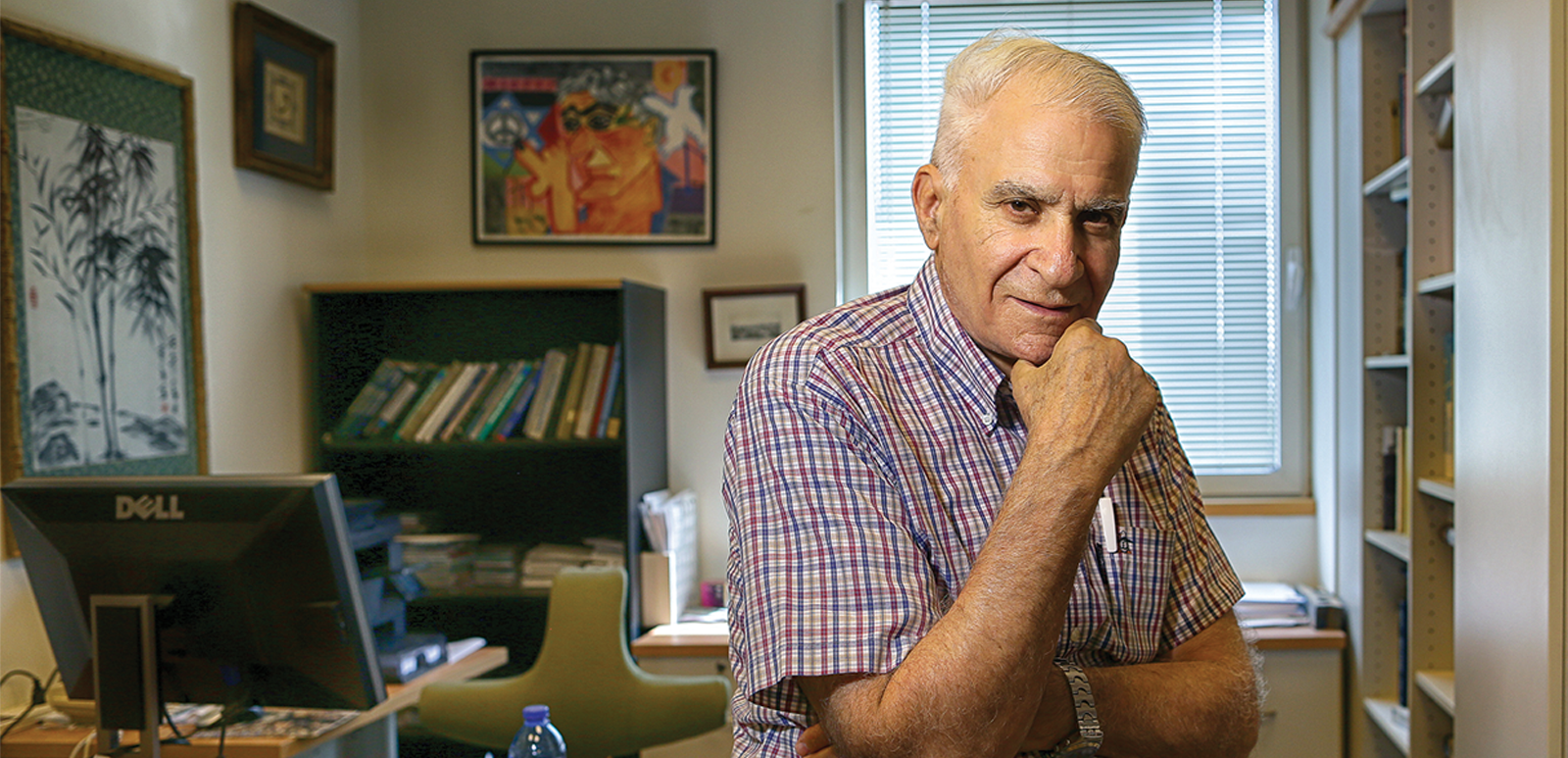

Prakash Loungani profiles Tel Aviv University’s Assaf Razin, early scholar of the promise and perils of globalization

In 1958, 17-year-old Assaf Razin suffered a near-fatal injury from friendly fire while fulfilling his draft requirement in the Israeli army. He was hospitalized for a year, during which it became evident that an active life toiling in the fields of Kibbutz Shamir, the community on the slopes of the Golan Heights where he was born, was not to be. He turned instead, he has written, toward “the remarkable opportunities the modern global world offers to so many,” in his case graduate school at the University of Chicago and then to a stellar career as a leading exponent of how countries can make the most of globalization. With Tel Aviv University as a secure home base, he has been “a most welcome visitor” at institutions all over the world, says Lars Svensson of the Stockholm School of Economics. In 2017, Razin was awarded the EMET Prize, Israel’s highest award for “excellence in academic and professional achievements that have far-reaching influence and make a significant contribution to society.”

“So the unfortunate event of my injury turned out to be transformational,” Razin says, displaying a trait his friends and family say is “classic Assaf”: never dwell on personal tragedies but move ahead resolutely to fulfill your obligations. Marxist ideals ruled in the kibbutz—his father, one of its founding members, made it a point to visit Karl Marx’s grave when in London—and, after his injury, the kibbutz elders thought he could best serve the community by gaining expertise in agriculture through courses at Hebrew University. Razin however became fascinated with economics and, with a strong recommendation from a mentor, won a fellowship to pursue graduate studies at the University of Chicago, then as now a bastion of free market economics.

“What a remarkable journey from a Marxist commune to capitalist Chicago, then to a career of tremendous achievements, all the while being humble and helpful to everyone,” says Jonathan Ostry, deputy director in the IMF’s Asia and Pacific department, who has known Razin since his own graduate school days at Chicago in the 1980s. Ostry, along with Tom Krueger—also now a deputy director at the IMF—wrote the companion guide for Razin’s noted 1987 book Fiscal Policies and the World Economy. “It was a vade mecum [an essential guide] for the international economics community” to navigate a rapidly changing world, says Ostry, with flexible exchange rates and increased capital flows. Relationships among countries’ policy choices were becoming “incredibly complicated,” he says; “today we would turn to computer simulations to understand the complex channels that in those days were clear in Assaf’s mind and book.”

Promise and perils

The book, written with Jacob Frenkel (a future chief economist at the IMF), bears the hallmark of Razin’s work: laying out the promise and perils of globalization, a world of countries bound together not just by international trade but by flows of capital and labor across national boundaries. To trace the channels of an integrated world, Razin and his coauthors frequently had to cross boundaries between fields of economics, which raised the work’s practical value, according to Atish Ghosh, the IMF’s historian. “Policy issues don’t fall neatly within one field of economics. And topics that Assaf and his coauthors worked on in one decade seem somehow to have become hot policy issues over subsequent decades,” says Ghosh.

With Elhanan Helpman (then at Tel Aviv University and now at Harvard), Razin studied how capital flows could affect the pattern of international trade. Helpman characterizes their 1978 book, A Theory of International Trade under Uncertainty, as an early attempt to break the silos between the study of international trade (considered part of microeconomics) and of capital movements (within the realm of macroeconomics): “it was silly to think independently of trade and macro,” he says. Through an integrated treatment of the two, the book shows that greater risk sharing among countries because of capital mobility in turn enabled greater specialization in trade, which was good for productivity. But greater interdependence as a result of increased specialization also meant countries were more vulnerable when there were disruptions to the global system—because of financial crises, say, or political turmoil in major countries. Razin developed this theme with other authors in subsequent work that stress-tested economists’ belief that some capital flows, such as foreign direct investment, confer greater benefits than others, such as “hot money” (short-term portfolio flows).

In the 1980s, Razin’s research with Frenkel showed how in an integrated world, the monetary and fiscal policy choices of one country could affect and constrain policy choices of other countries—policy “spillovers” in today’s jargon. National governments jealously guard their independence to tax and spend, but to gain the benefits of globalization they must give up some of this precious sovereignty. “This demonstration of the need for fiscal policy coordination in a world with capital mobility is a defining contribution,” says Ghosh, noting the echoes of this theme in many policy debates. Indeed, the issue is one that countries of the European Union are grappling with today, as they seek to agree to fiscal rules that will succeed once they fully unify their economies under a single capital market.

Current and capital accounts

In the 1990s, Razin worked on the interaction between capital and labor mobility, on the one hand, and tax and welfare systems, on the other. Razin did much of this work with Efraim Sadka, another colleague at Tel Aviv. While the mobility of capital can be beneficial to countries, the desire to attract foreign capital by lowering taxes can lead to a “race to the bottom”; lower tax revenues can prevent governments from offering the public services their societies need. The relevance of Razin’s early work on this topic has come to the fore as countries compete for foreign capital through tax breaks that deplete their finances, leading many to question how well foreign capital serves the general good.

Razin’s work on the benefits and costs of capital flows made him a welcome visitor to the IMF in the 1990s. After the 1994 Mexican “tequila crisis,” it was feared that other countries might be at risk. In times past, economists had used simple rules to measure vulnerability, such as a current account deficit (a close cousin of the trade deficit) that exceeded 5–6 percent of a country’s income. But with countries tapping into foreign capital, it seemed that they could run higher current account deficits as long they enjoyed the confidence of foreign investors.

Razin worked with Gian Maria Milesi-Ferretti, who recently retired as deputy director of the IMF’s research department, to understand when a current account deficit might be suddenly reversed. They looked at factors such as low foreign exchange reserves or deteriorating terms of trade—Razin had done pioneering work with Lars Svensson on understanding the microfoundations of the link between terms-of-trade changes and the current account when there is capital mobility. “I had many conversations with Stan Fischer [then the IMF’s first deputy managing director],” says Razin. “Fischer understood that, despite all the insights from my theoretical work and Gian Maria’s diligence with the data, it was difficult to predict exactly when certain countries would face a sudden reversal and crisis.” Indeed, the timing of current account reversals in some Asian economies in 1997–98 proved difficult to predict, and the quest for a reliable early warning system remains elusive to this day.

Razin’s research also forewarned of the interaction between labor mobility and welfare systems, an issue relevant today in the United States and Europe, where populists often accuse migrants of “welfare shopping”—taking advantage of destination countries’ generous support.

Tragedy amid triumph

This remarkable research activity and intensive engagement with policy issues played out against the backdrop of another personal tragedy, his son Ofair’s death in 1996 at the young age of 30 after a courageous battle with progressive multiple sclerosis. Displaying his father’s tenacity, Ofair had managed in the days before his death to complete his PhD dissertation in economics at Georgetown University. Razin says he cried during entire long plane journey to Washington, DC, after he got the news, but tried to do so “in a nonvisible way” to avoid bothering others.

Razin has honored Ofair’s memory by establishing a prize for the best research paper by a Georgetown economics graduate student and a lecture series in which he himself has spoken, as has his son Ronny (now a professor at the London School of Economics). Other speakers among the elite of the profession include Stanley Fischer, Cecilia Rouse, Jeff Sachs, Dani Rodrik, and Nobel Laureate Paul Krugman, who has called the annual event a “family reunion” of Razin’s wide circle of admirers.

In 2001, Razin’s 60th birthday celebration attracted the profession’s leading international economists to Tel Aviv—including Krugman and Anne Krueger (former IMF first deputy managing director). Deflecting the praise heaped on him at the celebration, Razin quipped that he wished his parents had been on hand: “my father would have liked to hear all this praise, and my mother would have believed all of it.” He said he had no intention of retiring but was merely taking a “a wonderful break between semesters.” True to his word, he has been very active over the past 20 years, teaching in the graduate program at Cornell University (he retired in 2016), continuing with research, and publishing several books, including a well-received analysis of how Israel has made the most of globalization.

He has been intimately following and writing on economic developments in Israel for decades, and he put his ideas together in a 2018 book, Israel and the World Economy. Phillip Swagel, head of the US Congressional Budget Office and a research collaborator of Razin’s, praised the book’s clear exposition of why other countries had “experienced problems with globalization [but] Israel had found success.” Unlike many other countries, Israel was able to guide large foreign capital flows toward its growth industry—start-ups in its high-tech sector. And Israel absorbed a million immigrants—about 20 percent of its population—from the former Soviet Union in the 1990s in a way that helped its high-tech sector and overall growth. But Swagel also notes “Razin’s frankness on the potential pitfalls” of globalization, including growing inequality within Israel—the highest in the developed world.

Secrets of success

Razin turns 80 this year and, true to form, is marking the occasion with a new book on how globalization can get back on track after setbacks from populism and the pandemic. In an interview with F&D, Razin attributed his successful career to the “good fortune to be surrounded by great people … and to discover and stick to my comparative advantage.” At Chicago, his professors included future Nobel laureates such as Milton Friedman and Robert Mundell, and his classmates were a future who’s who in the field of international finance, including Rudi Dornbusch and also Frenkel and Michael Mussa, both future IMF chief economists. At the University of Minnesota, his first job after graduation, he “learned ‘GE’ [general equilibrium]—since Chicago didn’t teach it—from the finest minds,” Razin says. GE refers to the study of the interactions of the various sectors that comprise an economy, which often yields insight not apparent from the study of the workings of one sector alone (“partial equilibrium”). From Krueger, who was also teaching at Minnesota at the time and has been “a lifelong friend and influence,” Razin learned the importance of taking theory to the data.

Stints at other jobs convinced him that he was best suited for academia. From time to time, he took on administrative jobs at Tel Aviv University, but he says that he “was never in my element” in those jobs. He did not take to government jobs either. In 1979, he was appointed to one of the top positions in Israel’s Treasury. The government had been on a spending spree that had fueled inflation and threatened to bring Israel to the verge of hyperinflation. Razin was public in his warnings about the need to reverse the course of policies, which led to his ouster after only six months on the job. “It was akin to Marty [Martin Feldstein] having to leave his job under Reagan because he warned about the dangers of deficits,” says Razin. The brief stay in government convinced him that “academic life was my comparative advantage.”

While staying out of government, he has remained active in commenting on developments in Israel. His mind is “always preoccupied” with the prospects of peace between Israel and its neighbors. He is reconciled to the likelihood that “peace will come not in my time but in the time of my children and grandchildren.” But it is important not to give up the hope of a better world, however utopian that seems, he urges, citing the last line of a poem by his young grandson: “The kingdom of Utopia is hidden hope amongst a heartless world.”

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.