For technology to benefit everyone, private sector innovation needs to be supported by public goods

Digital technology is transforming the financial industry, changing the way payments, savings, borrowing, and investment services are provided and who provides them. Fintech and Big Tech companies now compete with banks and other incumbents across a range of markets. Meanwhile, digital currencies promise to transform the heart of finance: money itself.

But just how much has technology advanced financial inclusion? For sure, in the past year alone, digital finance has helped households and businesses meet the challenges posed by the COVID-19 pandemic. It has also given governments new ways of reaching those who need support.

Progress to date has been impressive. Yet if it is to realize its full potential in bolstering financial inclusion, private sector innovation must be supported by the appropriate public goods, as innovation has large spillovers to all aspects of economic activity. Public goods provide the underpinnings of financial inclusion.

Disruptive inclusion?

Financial inclusion can be understood as universal access to, and use of, a wide range of reasonably priced financial services. Inclusion made great strides in the decade between the global financial crisis and the pandemic. Despite a volatile global economy, World Bank data show that 1.2 billion adults gained access to a transaction account between 2011 and 2017. Much of this progress came directly from new digital technologies.

Mobile money is a case in point. Kenya’s M-Pesa and similar applications let users send and receive payments on all mobile phones. Over time, providers have broadened their services, offering microloans, savings accounts, and insurance against crop failures and other hazards. As of 2019, 79 percent of Kenyan adults had a mobile money account. Usage is rising fast across Africa, the Middle East, and Latin America.

In China, Ant Group and Tencent have reached a respective 1.3 billion and 900 million users with Alipay and WeChat Pay. Payment applications, based on mobile interfaces and quick response (QR) codes, have paved the way for a whole spectrum of financial services, ranging from small loans and money market funds to “mutual aid,” a form of health insurance.

In India, public provision of foundational infrastructure has been the main driver, with a far-reaching impact. The digital identity (ID) initiative Aadhaar (Hindi for “foundation” or “base”) has given 1.3 billion people access to a trusted ID so that they can open a bank account and access other services. Building on the initiative, a new system lets users make low-cost payments in real time. As Bank for International Settlements (BIS) research shows (D’Silva and others 2019), India has increased bank account access from 10 percent of the population in 2008 to more than 80 percent today. Technology achieved in a decade what might have taken half a century with traditional growth processes.

As COVID-19 imposed social distancing and lockdowns, digital payments became a lifeline for many people. Small businesses were able to continue accepting payments, and individuals could send money to their loved ones quickly and at low cost. While not everyone was able to access digital payments and financial services, technology helped fill the gaps. In the Philippines, 4 million digital accounts were opened remotely between mid-March and the end of April 2020.

Governments worldwide used new digital infrastructure to reach households and informal workers. In Peru, payments were made through Billetera Móvil, a project that fully integrated the country’s largest mobile operators and banks. In Thailand, the government’s PromptPay fast payment system fulfilled the same purpose. This success stood in sharp contrast to the practice in some advanced economies, such as the United States, of sending paper checks through the mail.

The economics of digital innovation

Although the pandemic will leave major economic damage and inequality in its wake, it will help drive the adoption of digital technologies that enable financial inclusion and economic opportunity. But these technologies will not succeed on their own. To understand how digital technology and policies can help, it is helpful to look first at the underlying economics.

At the heart of digital innovations stand a few technological enablers. First are mobile phones and the internet, connecting individuals and businesses with information and providers of financial services. A second enabler is the storage and processing of large volumes of digital data. Finally, advances like cloud computing, machine learning, distributed ledger technology, and biometric technologies play a role.

But at the core of all these innovations is the ability to gather information and reach users at a very low cost. Economists have assessed the range of specific costs that decrease with digital technologies (Goldfarb and Tucker 2019). Two economic features of digital technology help show why these factors have been so powerful and what risks they pose.

First, digital platforms are highly scalable. Platforms can be thought of as “matchmakers” that help different groups of users find one another. For instance, a digital wallet provider like PayPal brings together merchants and clients who want to make secure payments. The more clients use a particular payment option, the more attractive it is for merchants to accept it, and vice versa. This is an example of economies of scale, which allow providers to grow quickly.

Similarly, Big Techs such as Amazon or China’s Alibaba can serve as matchmakers to help buyers and sellers of goods find one another, but they can also link merchants with providers of credit and other services. Because of the range of services provided (including nonfinancial), they have information that can be very valuable for their financial offerings. This exemplifies economies of scope, which give the advantage to providers with multiple business lines.

Second, digital technologies can improve risk assessment, benefiting from the same data that are the natural by-product of their business. This is particularly relevant for services such as lending, as well as investment and insurance. Credit scores based on big data and machine learning can often outperform traditional assessments, particularly for “thin-file” borrowers, people or small businesses with little or no formal documentation.

Research by BIS economists and coauthors shows that almost a third of borrowers served by Mercado Libre, a Big Tech lender in Argentina, would have been unable to access credit from a traditional bank (Frost and others 2019). Moreover, firms that borrowed from Mercado Libre enjoyed greater sales and product offerings in the year after they borrowed. Research with data from Ant Group suggests that, by relying on big data, Big Tech lenders have less need for collateral (Gambacorta and others 2019). This can open up access to lending for borrowers who have no house or other assets to offer as collateral, and make loans less sensitive to asset price changes.

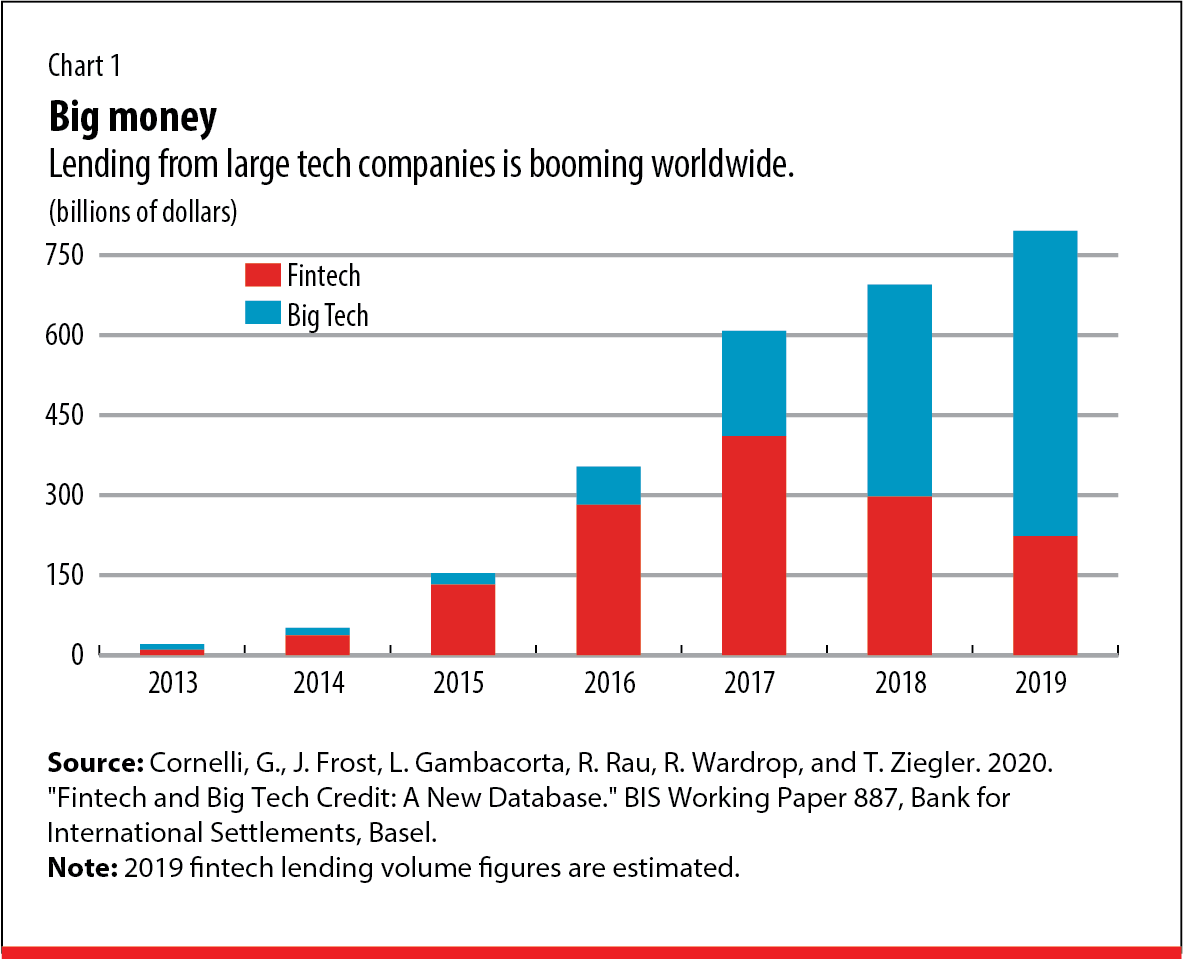

Such economies of scale and scope, together with improvements in predictive power, can drive financial inclusion forward by leaps and bounds. Indeed, Big Tech credit has boomed worldwide in the past decade, rising to an estimated $572 billion in 2019 (see Chart 1). Such lending is particularly important in China, Kenya, and Indonesia, compared with traditional credit markets. It is also growing rapidly elsewhere and may even have ticked up during the pandemic as some Big Techs helped distribute government lending to companies.

However, every silver lining has a cloud, and the advances made possible by big data have drawbacks—in particular, the tendency toward monopolies. In some economies, Big Tech payment providers and lenders have become systemically important (“too big to fail”). The tendency to buy up competitors may choke off innovation. Finally, there is a serious risk that sensitive data will be misused and privacy violated. Smart public policies are needed to mitigate these risks, while allowing the potential of digital technologies to be fulfilled.

Closing the gaps with smart policy

How should policymakers adapt to this brave new world? How can they reap the benefits of digital innovation for financial inclusion, while mitigating the (very real) risks to financial stability and consumer rights? Five sets of policies are needed.

Building inclusive digital infrastructures: Initiatives such as India’s Aadhaar digital ID are a stepping-stone to accounts and more sophisticated services. Fast retail payment systems based on open public infrastructure that ensure a level playing field are essential. Examples include the Faster Payments System in Russia, CoDi in Mexico, and PIX in Brazil—these facilitate instantaneous and low- or zero-cost digital payments between individuals and businesses or governments. Central bank digital currencies, now being tested in China and other countries and already operational in The Bahamas, can play a similar role as a common platform on which private providers can build services.

Introducing common standards to bolster competition: Many countries have countered digital monopolies with standards that let users carry their data across various platforms. This makes different providers “interoperable,” supporting consumer choice and competition. Much like the basic protocols at the heart of the internet, these common standards are a critical public good that allows private markets to flourish.

Updating competition policies: In the digital age, traditional measures of competition in markets, and traditional antitrust tools, may no longer be adequate. For instance, monopoly behavior may manifest itself through capture of data rather than high prices. Without regulatory intervention, markets may see new barriers to entry and new anticompetitive practices. As the growing scrutiny of mergers and acquisitions and of digital gatekeepers shows, there may be a need for new and more forward-thinking ways of keeping digital finance markets competitive and contestable.

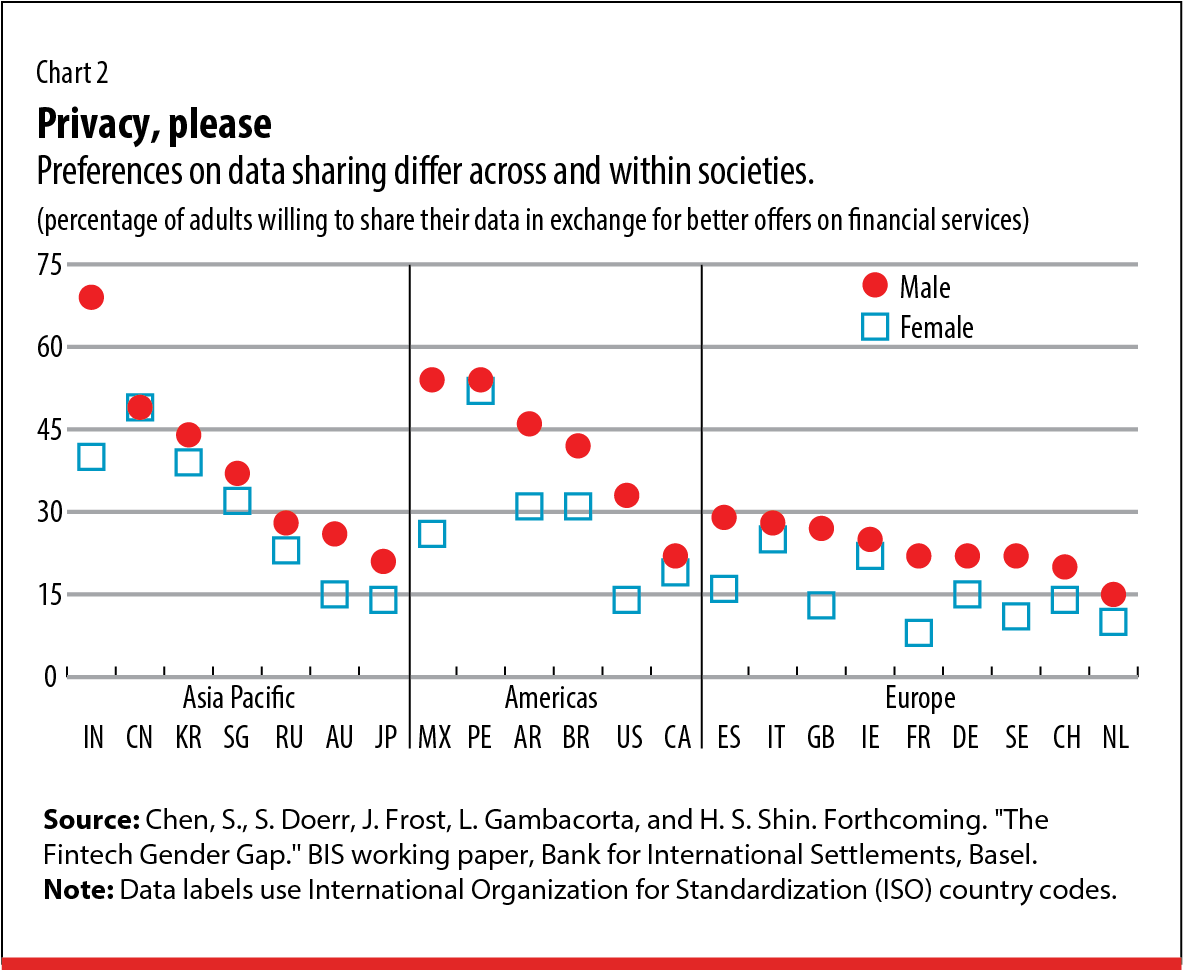

Strengthening data privacy: Laws on data generated by digital services are often not well-defined, meaning that tech companies have de facto control over sensitive data. Users must be given more control and agency. Privacy laws enacted in the European Union and practices regarding user control of data embedded in India Stack offer potential models. Recent research finds that men are generally more willing than women to share their data in exchange for better financial services offers (Chen and others, forthcoming) (see Chart 2). Younger users are also more open to sharing than older users. Defining rules for data use that fit all of society will be a challenge—and will likely require legislation.

Getting policymakers of all stripes to work together: Digital technologies in finance concern not only central banks and regulators but also those in charge of competition and data protection. Central banks and financial regulators must work hand in hand with competition authorities and data privacy authorities. Moreover, policies in one country are very likely to affect users in other countries. By coordinating their policies within and across borders, authorities can work to harness the benefits of digital technology and ensure that these accrue to all.

If public goods are appropriately designed, and if policymakers cooperate, digital technology can be harnessed to bring more people—particularly the poorest—into the financial system. Broad diffusion of technology may help make societies not only more efficient, but more equitable and better prepared for the digital future. Innovation must be shaped to benefit everyone.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.

References:

Chen S., S. Doerr, J. Frost, L., Gambacorta, and H. S. Shin. Forthcoming. “The Fintech Gender Gap.” BIS Working Paper, Bank for International Settlements, Basel.

D’Silva D., S. Filkova, F. Packer, and S. Tiwari. 2019. “The Design of Digital Infrastructure: Lessons from India.” BIS Paper 106, Bank for International Settlements, Basel.

Frost J., L. Gambacorta, Y. Huang, H. S. Shin, and P. Zbinden. 2019. “BigTech and the Changing Structure of Financial Intermediation.” Economic Policy 34 (100): 761–99.

Gambacorta L., Y. Huang, Z. Li, H. Qiu, and S. Chen. 2019. “Data vs Collateral.” BIS Working Paper 881, Bank for International Settlements, Basel.

Goldfarb A., and C. Tucker. 2019. “Digital Economics.” J ournal of Economic Literature 57 (1): 3–43.