To meet future challenges, the IMF must have strong backing from its members

“Protection will lead to great prosperity and strength.”

—US President Donald Trump, inaugural address, January 20, 2017

“We have come to recognize that the wisest and most effective way to

protect our national interests is through international

cooperation—that is to say, through united effort for the attainment of

common goals.”

—US Treasury Secretary Henry Morgenthau, Jr., closing address

at Bretton

Woods Conference, July 22, 1944

“For everything to stay the same, everything must change.”

—Giuseppe Tomasi di Lampedusa,

The Leopard

The world is changing. The IMF is changing with it. The question, however, is not only how it needs to change if it is to remain relevant. It is also whether the political environment will allow it to remain relevant. The IMF is built on a commitment to cooperation among member countries. That commitment is on the wane. But the countries of the world might rediscover its importance. If so, they will find the Fund an invaluable instrument. The IMF cannot ensure that outcome. But it can, and must, prepare for it. To its credit, it is doing so.

The world that surrounds the Fund has changed, or is changing, in several crucial respects.

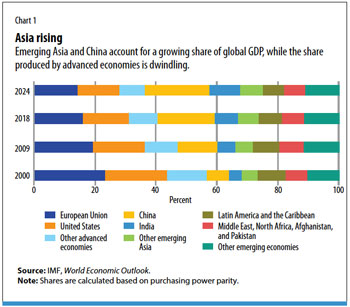

The first and most important change is a shift in global economic, and therefore political, power. In 2000, advanced economies generated 57 percent of global output, measured by purchasing power parity. By 2024, according to IMF forecasts, that share will fall to 37 percent. Meanwhile, China’s share will jump to 21 percent from 7 percent, and the rest of emerging Asia will account for 39 percent of global output, compared with 14 percent for the United States and 15 percent for the European Union (see Chart 1).

The second transformation is an increase in great-power rivalry as relations deteriorate between Western powers and a rising China. The United States has labeled China a “strategic competitor.” The European Union, more narrowly, has called it an “economic competitor in the pursuit of technological leadership.” Either way, cooperation seems certain to become more difficult.

The third change is a turn toward populist politics, not least within advanced economies. One feature of this populism is suspicion toward technocratic expertise. This affects not just the credibility of domestic technocratic institutions, including independent central banks and finance ministries, but also of international technocratic institutions, among which the IMF is arguably the most significant.

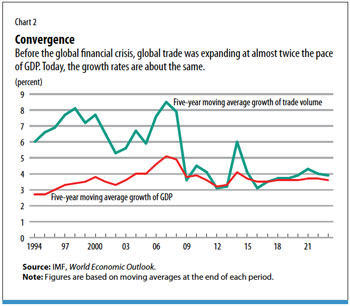

The fourth change consists of the slowdown, or even reversal, of globalization. This is markedly true in some areas of finance, such as a dramatic decline in the foreign claims of euro area banks (Lund and others 2017). But it is also true in trade: prior to the transatlantic financial crisis, the volume of world trade grew almost twice as fast as world output. Now trade and output are growing at about the same rate. Recently we have even seen the emergence of outright protectionism in the United States (see Chart 2).

The fifth change involves technology. Technological progress has been the driving force of economic growth. But the role of the internet and recent advances in artificial intelligence have brought new vulnerabilities and upheavals, including cyberattacks and massive shifts in labor markets.

The sixth change is an increase in financial fragility. This has been gathering over decades. Substantial efforts have been made to reduce this fragility, not least by the IMF. But the ratio of debt to gross output has increased, and debt has shifted from the private to the public sector and to some degree from advanced to emerging market economies. Further financial disruptions are quite possible (see Chart 3).

The seventh change is the phenomenon dubbed “secular stagnation” by Harvard University’s Lawrence Summers at an IMF conference in 2013. Weak demand, indicated by a combination of low inflation and ultralow real and nominal interest rates, appears to be structural and so is likely to persist. Room for an effective conventional—or even conventionally unconventional—policy response to a downturn might be very limited.

The final change is the rising salience of climate change as a policy issue. This is likely to have important effects on development strategies and macroeconomic policies in all countries, particularly in poorer and more vulnerable ones.

All this creates a highly challenging environment for the IMF, which has also been changing. Indeed, its most durable characteristic has been its ability to adapt to successive changes in the world. This partly reflects the high quality of its staff and its usually competent management.

Yet the IMF is also handicapped by a limited capacity to influence the actions either of countries with robust balance of payments positions or of the United States, the issuer of the world’s reserve currency, the dollar. This is not a new issue: it was recognized—and remained unresolved—at the Bretton Woods conference in 1944 (Steil 2013). The Fund also makes mistakes, not least because it is heavily influenced by the conventional wisdom of professional economists and powerful countries. It seriously underestimated the perils of financial liberalization, both domestic and external. This was true despite the prescient warnings of Raghuram Rajan, the IMF’s economic counsellor from 2003 to 2006.

Learning from mistakes

It is, however, reasonable to expect the Fund to learn from mistakes. It has done so. After the transatlantic crisis, it reevaluated the impact of government spending cuts and tax increases on growth. The quality of its surveillance of financial risks has also vastly improved in its flagshipGlobal Financial Stability Report and World Economic Outlook and in work on member countries. An important step has been its recognition that liberalizing flows of capital across borders carries risks as well as benefits.

No crisis has been more troublesome than the one in the euro area. It put the IMF in the difficult position of dealing with a central bank and countries it could not control. The Fund worked with euro area institutions on country programs that had some successes but also significant shortcomings, notably in the case of Greece. One result was to reform the IMF’s lending framework for countries with high sovereign debt and, above all, to end exemptions—in the case of systemic crises—from mandatory debt sustainability as a condition for Fund support.

The IMF’s stepped-up engagement with fragile states is significant as well. It requires new and imaginative approaches to securing necessary political and institutional transformation.

With these steps, the Fund has updated its old agenda of maintaining macroeconomic stability. But it has also taken up several new challenges, including income and wealth inequality, gender inequality, corruption, and climate change. These challenges are outside the Fund’s historical areas of competence. But they are vital in themselves and to important constituencies in member countries, and they have important macroeconomic implications. Softening the IMF’s image can be helpful, especially in a political environment that has become difficult for international financial institutions. And, in some respects, the Fund’s work has been vital, especially on fossil fuel subsidies and the cost of corruption.

Challenges to come

If the world of cooperative globalization is to survive and the IMF is to maintain its role within it, a great deal must change. Some of these changes are within the Fund’s control. Others call for a new global consensus.

A big internal task is to take on the intellectual challenges of our unstable world economy. Particularly significant is the need to reconsider monetary, fiscal, and structural policies, globally and within influential countries, in the context of ultralow interest rates, low inflation, large debt overhangs, and secular stagnation. What are policymakers to do when the next downturn comes? How—if at all—might mass restructuring of private or sovereign debt be managed? Is there any validity in unorthodox perspectives such as “modern monetary theory”? The Fund needs to become even more deeply engaged in these topics if it is to prepare for what lies ahead. But it must also get more closely engaged in other difficult areas. The political economy of protectionism is one example. The impact of artificial intelligence is another.

Above all, the IMF must remain relevant to all its members. The only plausible way to do that is to produce work of the highest intellectual quality and integrity, especially in surveillance. This may irritate the subjects of the Fund’s judgments from time to time. But it will sustain the reputation and influence of the IMF among its members. A question in this context is whether it needs more staff expertise in the politics of change: it is all very well to preach the ending of subsidies, but how is that to be accepted? Another question is whether more staff should reside permanently in member countries. A detailed review of the IMF’s way of working would make good sense.

The most important challenges for the IMF of tomorrow are, however, those created by our changing world. Three stand out.

First, voting shares should be aligned with each member’s economic importance. EU members (including the United Kingdom) currently have 29.6 percent of votes; the United States, 16.5 percent; Japan, 6.2 percent; and Canada, 2.2 percent. By contrast, China has a mere 6.1 percent and India 2.6 percent. These figures are wildly out of keeping with the relative weight of these economies. True, advanced economies still dominate global finance and issue all the significant reserve currencies. But this will probably not last. If institutions such as the IMF are to remain globally relevant, voting shares must be reweighted, especially toward Asia, as Edwin Truman (2018) of the Peterson Institute for International Economics has persuasively argued. Otherwise, China will surely establish its own version of the IMF, just as it has already launched the Asian Infrastructure Investment Bank and the New Development Bank.

Second, the IMF’s financial firepower must be increased substantially, particularly in a world of relatively free capital flows. Its lending capacity is currently just $1 trillion. Compare that with global foreign exchange reserves of $11.4 trillion. The disparity demonstrates the inadequacy of IMF resources and the perceived costliness of gaining access to them. Of course, there is moral hazard associated with expanding the safety net. But moral hazard does not eliminate the case for insurance, fire brigades, or central banks. The same applies to the Fund.

Finally, if the institution is to be credibly global, its top job cannot be permanently left in the hands of a European, however admirable some of those Europeans have been. Global institutions need the best global leaders. Those leaders should be chosen not by a process of lowest-common-denominator horse trading, but openly and transparently, with candidates required to submit their platforms for the future development of the institution.

Will to cooperate

As IMF Managing Director Christine Lagarde has said, “The 44 nations gathering at Bretton Woods were determined to set a new course—based on mutual trust and cooperation, on the principle that peace and prosperity flow from the font of cooperation, on the belief that the broad global interest trumps narrow self-interest.” It is the marriage of professionalism with this will to cooperate that has made the IMF a cornerstone institution.

Perhaps the Fund’s most striking quality is its adaptability. It will surely need that adaptability in the years to come. But even more, it will need a world where the dominant powers believe in what the IMF embodies: professionalism, multilateralism, and above all, cooperation. If this is not the world in which it operates, it will struggle. In the end, the Fund is the world’s servant. It can guide, but it cannot shape the world. As the world goes, so will the IMF.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.

References:

Lund, Susan, Eckart Windhagen, James Manyika, Philipp Härle, Jonathan Woetzel, and Diana Goldshtein. 2017. “The New Dynamics of Financial Globalization.” McKinsey Global Institute, New York.

Steil, Benn. 2013. The Battle of Bretton Woods: John Maynard Keynes, Harry Dexter White, and the Making of a New World Order . Princeton, NJ: Princeton University Press.

Truman, Edwin M. 2018. “ IMF Quota and Governance Reform Once Again.” PIIE Policy Brief, Peterson Institute for International Economics, Washington, DC.