Piercing the Veil

Some $12 trillion worldwide is just phantom corporate investment

New research reveals that multinational firms have invested $12 trillion globally in empty corporate shells, and citizens of some financially unstable and oil-producing countries hold a disproportionately large share of the $7 trillion personal wealth stashed in tax havens.

Although Swiss Leaks, the Panama Papers, and recent disclosures from the offshore industry have revealed some of the intricate ways multinational firms and wealthy individuals use tax havens to escape paying their fair share, the offshore financial world remains highly opaque. Because of the secrecy that lies at the heart of the services offered by offshore banks, lawyers, and domiciliation companies, it is hard to know exactly how much money is funneled through tax havens, where the money is coming from, and where it is going.

These questions are particularly important today in countries where policy initiatives aiming to curb the harmful use of tax havens abound. The policies, with acronyms such as FATCA (Foreign Account Tax Compliance Act), CRS (Common Reporting Standard), and BEPS (base erosion and profit shifting), introduce a variety of new reporting requirements: multinational firms must report country-by-country information about their economic activity; banks must conduct thorough background checks of customers to identify foreign-owned accounts and report detailed account information to the tax authorities; and the tax authorities must share tax-relevant information with their foreign counterparts through comprehensive information exchange agreements.

This new wave of tax enforcement policies is controversial. Some welcome the ambitious attempts to fix what is perceived as a broken international tax system that allows global elites to get away with low effective tax rates. Others argue that the cost of enforcement could dwarf the benefits. Determining which view is closer to the truth is impossible without reliable measures of the scale of this offshore challenge. Fortunately, recently released statistics from the Organisation for Economic Co-operation and Development (OECD) and the Bank for International Settlements (BIS) on cross-border financial positions have allowed researchers to begin to pierce the veil of offshore secrecy.

Offshore shell games

Foreign direct investment is usually perceived as long-term strategic and stable investment reflecting fundamental location decisions of multinational firms. Such investment is often thought to bring job creation, production, construction of new factories, and transfer of technology. However, a new study (Damgaard and Elkjaer 2017) combines detailed statistics on foreign direct investment published by the OECD with the broad coverage of the IMF’s Coordinated Direct Investment Survey and finds that a stunning $12 trillion—almost 40 percent of all foreign direct investment positions globally—is completely artificial: it consists of financial investment passing through empty corporate shells with no real activity.

These investments in empty corporate shells almost always pass through well-known tax havens. The eight major pass-through economies—the Netherlands, Luxembourg, Hong Kong SAR, the British Virgin Islands, Bermuda, the Cayman Islands, Ireland, and Singapore—host more than 85 percent of the world’s investment in special purpose entities, which are often set up for tax reasons. The characteristics of these entities include legal registration subject to national law, ultimate ownership by foreigners, few or no employees, little or no production in the host economy, little or no physical presence, mostly foreign assets and liabilities, and group financing or holding activities as their core business. The significance of such offshore investment is growing. Foreign direct investment, unlike portfolio and other investment, has continued to expand in the aftermath of the financial crisis, driven primarily by its positions vis-à-vis financial centers as a result of the growing complexity of the corporate structures of large multinationals (Lane and Milesi-Ferretti 2018).

The use of pass-through entities in tax havens does not in itself imply tax avoidance, but it certainly implies more opportunities for tax avoidance and even tax evasion. Many of the most aggressive tax minimization strategies require that investments be structured in precisely this way, and it is well documented that multinational firms with a nominal presence in tax havens effectively pay lower taxes on their global profits.

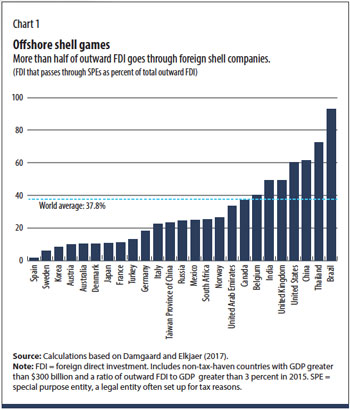

This type of financial tax engineering is a worldwide phenomenon that cuts across advanced and emerging market economies. In emerging market economies such as India, China, and Brazil, 50 to 90 percent of outward foreign direct investment goes through a foreign entity with no economic substance; the share is 50 to 60 percent in advanced economies such as the United Kingdom and the United States (see Chart 1). Globally, the average is close to 40 percent.

Even though the special purpose entity share is relatively low in some OECD countries, the tax challenge can still be significant, given developed economies’ generally relatively high outward foreign direct investment relative to their economic size.

Hidden wealth

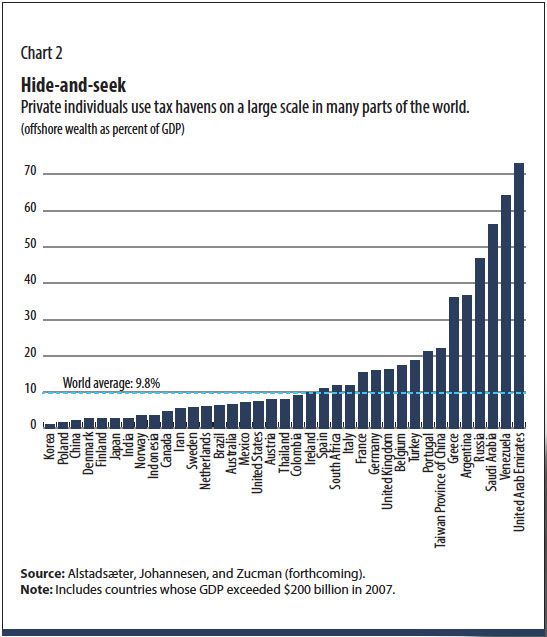

In many parts of the world, private individuals also use tax havens on a grand scale, as evidenced in a new study by Alstadsæter, Johannesen, and Zucman (forthcoming). Analyzing recently released statistics from the BIS on cross-border bank deposits, the study documents distinct differences across countries in the amount of wealth held in personal offshore accounts. Globally, individuals hold about $7 trillion—

corresponding to roughly 10 percent of world GDP—in tax havens. However, the stock of offshore wealth ranges from about 4 percent of GDP in Scandinavia to about 50 percent in some oil-producing countries, such as Russia and Saudi Arabia, and in countries that have suffered instances of major financial instability, such as Argentina and Greece (see Chart 2).

These patterns suggest that high taxes are not necessarily associated with high levels of offshore tax evasion: the Scandinavian countries have some of the highest income tax rates in the world, but at the same time have relatively little offshore personal wealth. The findings also suggest that individuals sometimes stash money in offshore accounts for reasons entirely unrelated to tax evasion, particularly in the context of emerging market economies. For instance, tax haven banks may serve to circumvent capital controls during a currency crisis, as suggested by the exceptionally high levels of offshore personal wealth in Argentina, and to launder the proceeds from corruption in resource-

extraction industries, as suggested by the statistics for countries such as Russia and Venezuela.

The study also highlights dramatic changes in tax havens’ share in the global wealth management market: the proportion of the world’s hidden wealth managed by Swiss banks has dropped from almost 50 percent on the eve of the financial crisis to about 25 percent today with the expansion of Asian tax havens such as Hong Kong SAR, Macao SAR, and Singapore. This development may indicate that international cooperation on tax matters by Switzerland and other European tax havens is deterring tax evaders. Alternatively, it may be a sign that a larger share of the world’s superrich are Asians who do offshore banking in nearby tax havens.

Out of the shadows

The international tax challenge will grow in the coming years because of increased digitalization and mobility of assets (think Facebook, Google, Tencent). New studies shed light on the money passing through tax havens and reveal striking cross-country differences in exposure to the offshore challenge, but these analyses are based on incomplete evidence, since multinational firms and private individuals can also use other methods to shelter wealth abroad. For this reason, even more data are needed to fully pierce the veil of offshore financial secrecy.

First, more countries should begin regularly reporting detailed financial data broken down by instrument, domestic sector, counterpart sector and country, currency, and maturity. Second, traditional macroeconomic statistics, which are based on the concept of a national economy as the only relevant boundary, are increasingly challenged by financial globalization. These statistics should be supplemented with data on global interconnection that look beyond holdings of financial wealth across borders to find their ultimate owners. Such data will make it possible to weigh the costs and benefits of various policy initiatives: informed decisions must be based on rich, detailed, and reliable evidence.

ART: ISTOCK.COM/PHOTO5963

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.

References:

Alstadsæter, Annette, Niels Johannesen, and Gabriel Zucman. Forthcoming. “Who Owns the Wealth in Tax Havens? Macro Evidence and Implications for Global Inequality.” Journal of Public Economics.

Damgaard, Jannick, and Thomas Elkjaer. 2017. “The Global FDI Network: Searching for Ultimate Investors.” IMF Working Paper 17/258, International Monetary Fund, Washington, DC.

Lane, Philip R., and Gian Maria Milesi-Ferretti. 2018. “The External Wealth of Nations Revisited: International Financial Integration in the Aftermath of the Global Financial Crisis.” IMF Economic Review 66 (1): 189–222.