War slows recovery

The war in Ukraine has triggered a costly humanitarian crisis that demands a peaceful resolution. At the same time, economic damage from the conflict will contribute to a significant slowdown in global growth in 2022 and add to inflation. Fuel and food prices have increased rapidly, hitting vulnerable populations in low-income countries hardest.

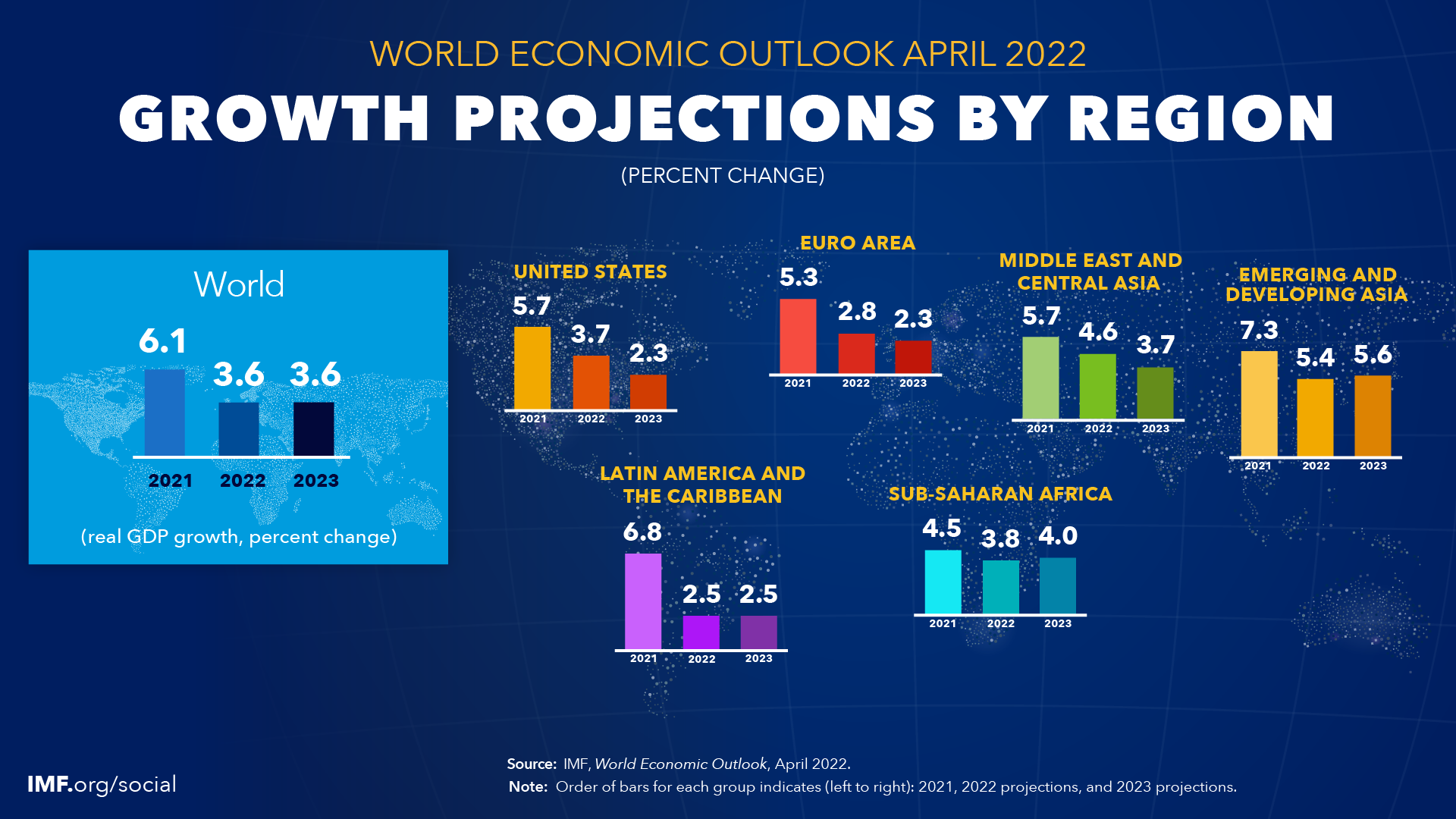

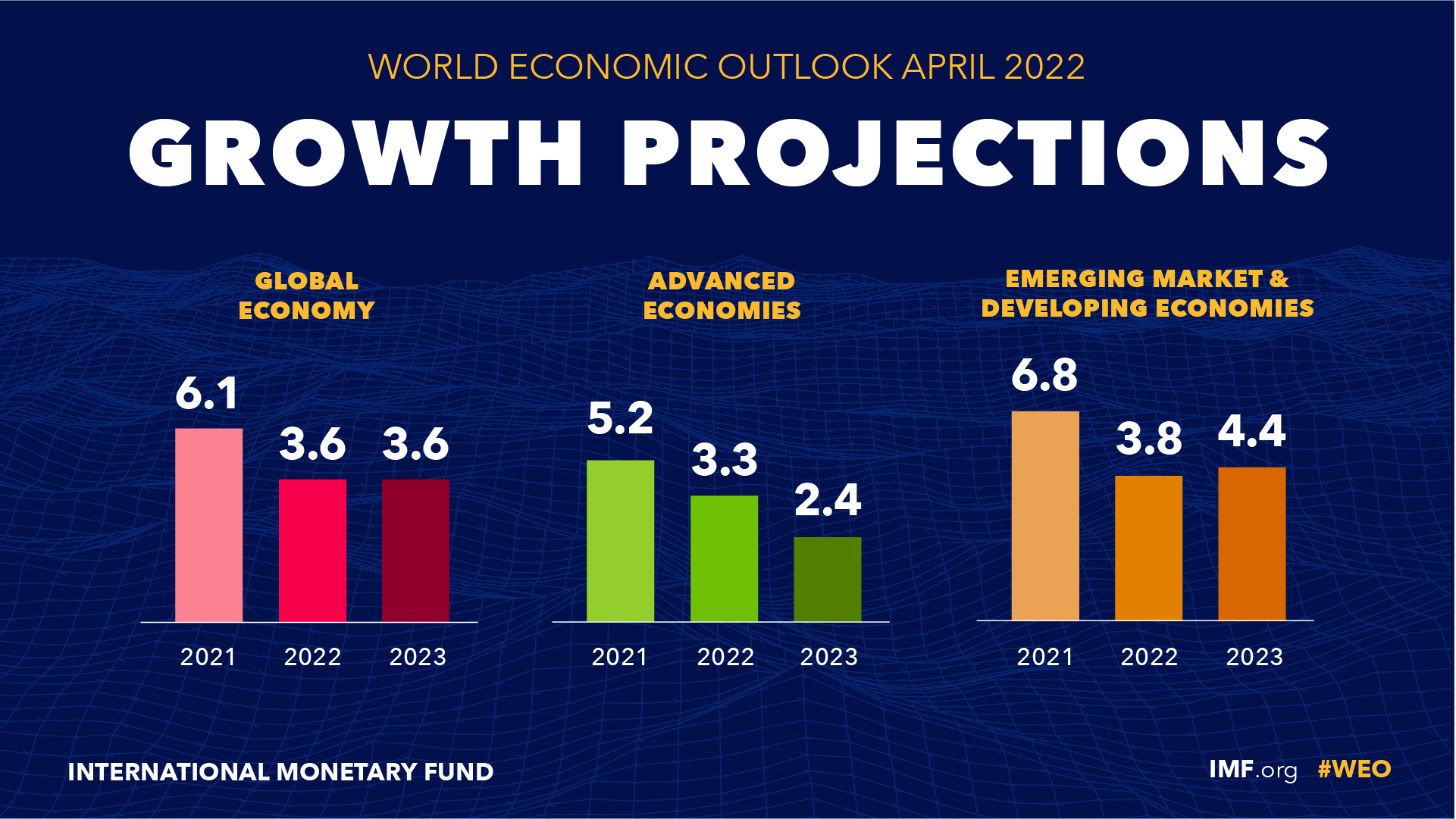

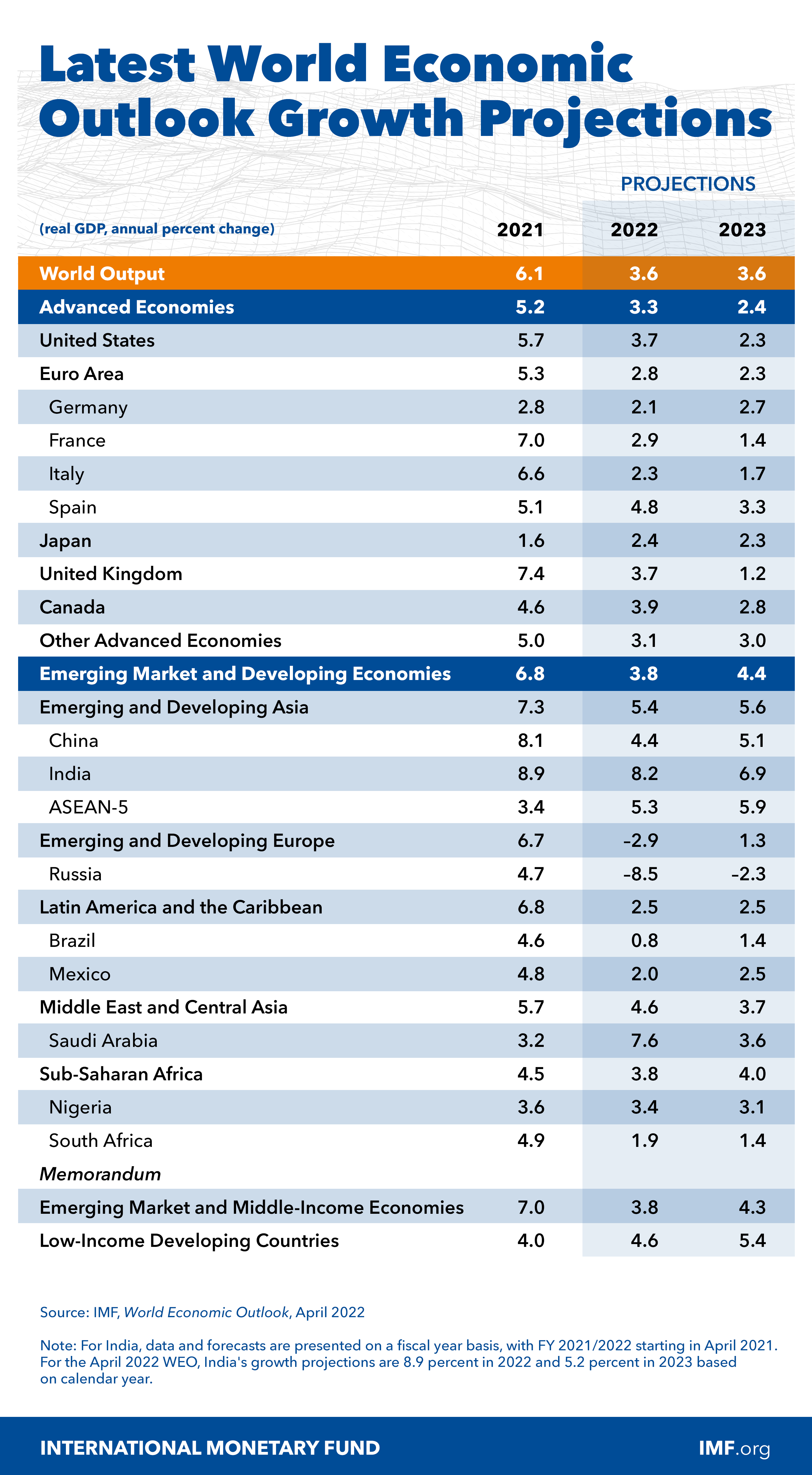

Global growth is projected to slow from an estimated 6.1 percent in 2021 to 3.6 percent in 2022 and 2023. This is 0.8 and 0.2 percentage points lower for 2022 and 2023 than projected in January.

Global Prospects and Policies

Global growth is expected to slow significantly in 2022, largely as a consequence of the war in Ukraine. A severe double-digit drop in GDP is expected in Ukraine due to fighting. A deep contraction is projected for Russia due to sanctions and European countries’ decisions to scale back energy imports. The economic costs of war are expected to spread farther afield through commodity markets, trade, and—to a lesser extent—financial interlinkages. Fuel and food price rises are already having a global impact, with vulnerable populations—particularly in low-in me countries—most affected.

Private Sector Debt and the Global Recovery

Soon after the pandemic hit, exceptional measures were deployed to maintain private access to credit, staving off a deeper recession in 2020. While highly effective in supporting the economy, these policies also led to a surge in consumer and business indebtedness. This chapter examines whether that increased borrowing may affect the recovery’s pace. Empirical analysis based on macro- and micro-level data reveals that aggregate private debt figures do not tell the whole story, and the recovery could be weaker in some countries due to a variety of factors. Because future monetary and fiscal tightening often have a larger effect on the most vulnerable, careful attention will be needed when unwinding pandemic-era policy support.

A Greener Labor Market: Employment, Policies, and Economic Transformation

This chapter examines the labor market implications of the green economic transition. Analyzing a sample of largely advanced economies, the empirical analysis indicates that both greener and more polluting jobs are concentrated among small subsets of workers. Individual workers face tough challenges in moving to greener jobs from more pollution-intensive jobs. Stronger environmental policies help green the labor market and appear more effective when reallocation incentives are not blunted. Model simulations suggest that a policy package incorporating a green infrastructure push, carbon prices, an earned income tax credit, and training, could put an economy on a path to net zero emissions by 2050 with an inclusive transition.

Global Trade and Value Chains in the Pandemic

When COVID-19 hit, the combined supply and demand shock was expected to lead to a dramatic collapse in trade. However, trade in goods bounced back quite rapidly, although trade in services still remains sluggish. Disruptions in key international networks of production and trade have also prompted calls to relocate that production domestically. In this context, this chapter finds that pandemic-specific factors had a key role in the rotation of demand from services to goods; and while there were significant negative spillover effects of pandemic containment policies on trade partners, these were short-lived, and trade and value chains proved resilient overall. However, to guard against future shocks, those international production and trade networks can be strengthened by increasing diversification, and enhancing substitutability, in input sourcing.

Publications

-

September 2024

Finance & Development

- PRODUCTIVITY

-

September 2024

Annual Report

- Resilience in the Face of Change

-

Regional Economic Outlooks

- Latest Issues