World Economic Outlook

Contractionary Forces Receding But Weak Recovery Ahead

July 2009

The global economy is beginning to pull out of a recession unprecedented in the post–World War II era, but stabilization is uneven and the recovery is expected to be sluggish. Economic growth during 2009–10 is now projected to be about ½ percentage points higher than projected in the April 2009 World Economic Outlook (WEO), reaching 2.5 percent in 2010. Financial conditions have improved more than expected, owing mainly to public intervention, and recent data suggest that the rate of decline in economic activity is moderating, although to varying degrees among regions. Despite these positive signs, the global recession is not over, and the recovery is still expected to be slow, as financial systems remain impaired, support from public policies will gradually diminish, and households in countries that suffered asset price busts will rebuild savings. The main policy priority remains restoring financial sector health. Macroeconomic policies need to stay supportive, while preparing the ground for an orderly unwinding of extraordinary levels of public intervention. At the same time, given weak internal demand prospects in a number of current account deficit countries, including the United States, policies need to sustain stronger demand in key surplus countries.

Stabilization is uneven and recovery will likely be sluggish.

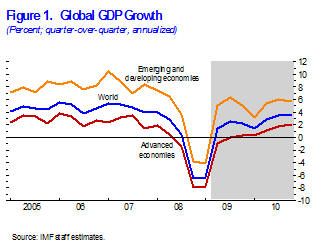

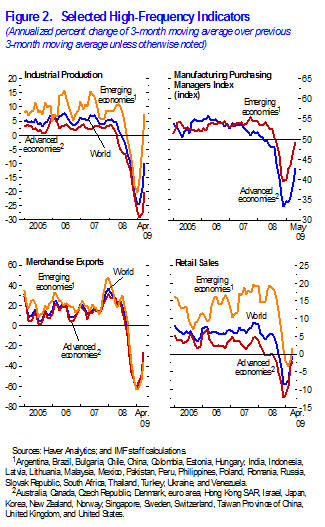

The world economy is stabilizing, helped by unprecedented macroeconomic and financial policy support. However, the recession is not over and the recovery is likely to be sluggish. Following a disappointing first quarter, during which the global economy contracted almost as fast as during the fourth quarter of 2008, (Figure 1, Data Figure 1), high-frequency data point to a return to modest growth at the global level (Figure 2, Data Figure 2). However, the advanced economies as a group are still projected not to show a sustained pickup in activity until the second half of 2010, consistent with the April 2009 WEO forecast.

Accordingly, global activity is forecast to contract by 1.4 percent in 2009 and to expand by 2.5 percent in 2010, which is 0.6 percentage point higher than envisaged in the April 2009 WEO (Table 1). The higher annual average growth rate for 2010 largely reflects carryover from a markup in growth during the final half of 2009. On a fourth-quarter-over-fourth-quarter basis, real GDP growth is projected at 2.9 percent in 2010, compared with 2.6 percent in the April WEO forecast.

Table 1.1. Overview of the World Economic Outlook Projections

(Percent change, unless otherwise noted)

| Year over Year | Q4 over Q4 | ||||||||||||

| Projections | Difference from April 2009 WEO Projections |

Estimates | Projections | ||||||||||

| 2007 | 2008 | 2009 | 2010 | 2009 | 2010 | 2008 | 2009 | 2010 | |||||

|

World output1 |

5.1 | 3.1 | -1.4 | 2.5 | -0.1 | 0.6 | 0.2 | 0.0 | 2.9 | ||||

|

Advanced economies |

2.7 | 0.8 | -3.8 | 0.6 | 0.0 | 0.6 | -1.8 | -2.2 | 1.3 | ||||

|

United States |

2.0 | 1.1 | -2.6 | 0.8 | 0.2 | 0.8 | -0.8 | -1.4 | 1.7 | ||||

|

Euro area |

2.7 | 0.8 | -4.8 | -0.3 | -0.6 | 0.1 | -1.7 | -3.8 | 0.6 | ||||

|

Germany |

2.5 | 1.3 | -6.2 | -0.6 | -0.6 | 0.4 | -1.8 | -4.6 | 0.0 | ||||

|

France |

2.3 | 0.3 | -3.0 | 0.4 | 0.0 | 0.0 | -1.7 | -1.9 | 1.3 | ||||

|

Italy |

1.6 | -1.0 | -5.1 | -0.1 | -0.7 | 0.3 | -3.0 | -3.3 | 0.4 | ||||

|

Spain |

3.7 | 1.2 | -4.0 | -0.8 | -1.0 | -0.1 | -0.7 | -4.1 | 0.3 | ||||

|

Japan |

2.3 | -0.7 | -6.0 | 1.7 | 0.2 | 1.2 | -4.4 | -1.8 | 0.9 | ||||

|

United Kingdom |

2.6 | 0.7 | -4.2 | 0.2 | -0.1 | 0.6 | -1.8 | -2.5 | 0.5 | ||||

|

Canada |

2.5 | 0.4 | -2.3 | 1.6 | 0.2 | 0.4 | -1.0 | -1.5 | 2.5 | ||||

|

Other advanced economies |

4.7 | 1.6 | -3.9 | 1.0 | 0.2 | 0.4 | -2.8 | -1.6 | 2.3 | ||||

|

Newly industrialized Asian economies |

5.7 | 1.5 | -5.2 | 1.4 | 0.4 | 0.6 | -4.9 | -0.9 | 2.6 | ||||

|

Emerging and developing economies2 |

8.3 | 6.0 | 1.5 | 4.7 | -0.1 | 0.7 | 3.3 | 3.3 | 5.1 | ||||

|

Africa |

6.2 | 5.2 | 1.8 | 4.1 | -0.2 | 0.2 | ... | ... | ... | ||||

|

Sub-Sahara |

6.9 | 5.5 | 1.5 | 4.1 | -0.2 | 0.3 | ... | ... | ... | ||||

|

Central and eastern Europe |

5.4 | 3.0 | -5.0 | 1.0 | -1.3 | 0.2 | ... | ... | ... | ||||

|

Commonwealth of Independent States |

8.6 | 5.5 | -5.8 | 2.0 | -0.7 | 0.8 | ... | ... | ... | ||||

|

Russia |

8.1 | 5.6 | -6.5 | 1.5 | -0.5 | 1.0 | 1.1 | -0.8 | -1.8 | ||||

|

Excluding Russia |

9.8 | 5.4 | -3.9 | 3.2 | -1.0 | 0.1 | ... | ... | ... | ||||

|

Developing Asia |

10.6 | 7.6 | 5.5 | 7.0 | 0.7 | 0.9 | ... | ... | ... | ||||

|

China |

13.0 | 9.0 | 7.5 | 8.5 | 1.0 | 1.0 | 6.9 | 8.4 | 8.6 | ||||

|

India |

9.4 | 7.3 | 5.4 | 6.5 | 0.9 | 0.9 | 4.8 | 5.8 | 6.7 | ||||

|

ASEAN-53 |

6.3 | 4.8 | -0.3 | 3.7 | -0.3 | 1.4 | 1.9 | 1.6 | 4.4 | ||||

|

Middle East |

6.3 | 5.2 | 2.0 | 3.7 | -0.5 | 0.2 | ... | ... | ... | ||||

|

Western Hemisphere |

5.7 | 4.2 | -2.6 | 2.3 | -1.1 | 0.7 | ... | ... | ... | ||||

|

Brazil |

5.7 | 5.1 | -1.3 | 2.5 | 0.0 | 0.3 | 1.3 | 1.5 | 2.5 | ||||

|

Mexico |

3.3 | 1.3 | -7.3 | 3.0 | -3.6 | 2.0 | -1.7 | -4.0 | 3.1 | ||||

|

Memorandum |

|||||||||||||

|

European Union |

3.1 | 1.1 | -4.7 | -0.1 | -0.7 | 0.2 | ... | ... | ... | ||||

|

World growth based on market exchange rates |

3.8 | 2.0 | -2.6 | 1.7 | -0.1 | 0.7 | ... | ... | ... | ||||

|

World trade volume (goods and services) |

7.2 | 2.9 | -12.2 | 1.0 | -1.2 | 0.4 | ... | ... | ... | ||||

|

Imports |

|||||||||||||

|

Advanced economies |

4.7 | 0.4 | -13.6 | 0.6 | -1.5 | 0.2 | ... | ... | ... | ||||

|

Emerging and developing economies |

13.8 | 9.4 | -9.6 | 0.8 | -0.8 | 0.2 | ... | ... | ... | ||||

|

Exports |

|||||||||||||

|

Advanced economies |

6.2 | 2.0 | -15.0 | 1.3 | -1.5 | 0.8 | ... | ... | ... | ||||

|

Emerging and developing economies |

9.5 | 4.1 | -6.5 | 1.4 | -0.1 | 0.2 | ... | ... | ... | ||||

|

Commodity prices (U.S. dollars) |

|||||||||||||

|

Oil4 |

10.7 | 36.4 | -37.6 | 23.1 | 8.8 | 2.9 | ... | ... | ... | ||||

|

Nonfuel (average based on world commodity export weights) |

14.1 | 7.5 | -23.8 | 2.2 | 4.1 | -2.2 | ... | ... | ... | ||||

|

Consumer prices |

|||||||||||||

|

Advanced economies |

2.2 | 3.4 | 0.1 | 0.9 | 0.3 | 0.6 | 2.1 | 0.5 | 0.6 | ||||

|

Emerging and developing economies2 |

6.4 | 9.3 | 5.3 | 4.6 | -0.4 | -0.1 | 7.6 | 4.2 | 3.7 | ||||

|

London interbank offered rate (percent)5 |

|||||||||||||

|

On U.S. dollar deposits |

5.3 | 3.0 | 1.2 | 1.4 | -0.3 | 0.0 | ... | ... | ... | ||||

|

On euro deposits |

4.3 | 4.6 | 1.4 | 1.8 | -0.2 | -0.2 | ... | ... | ... | ||||

|

On Japanese yen deposits |

0.9 | 1.0 | 0.9 | 0.4 | -0.1 | -0.1 | ... | ... | ... | ||||

|

Note: Real effective exchange rates are assumed to remain constant at the levels prevailing during May 7-June 4, 2009. Country weights used to construct aggregate growth rates for groups of countries were revised. When economies are not listed alphabetically, they are ordered on the basis of economic size. | |||||||||||||

|

1The quarterly estimates and projections account for 90 percent of the world purchasing-power-parity weights. |

|||||||||||||

|

2The quarterly estimates and projections account for approximately 76 percent of the emerging and developing economies. | |||||||||||||

|

3Indonesia, Malaysia, Philippines, Thailand, and Vietnam. | |||||||||||||

|

4Simple average of prices of U.K. Brent, Dubai, and West Texas Intermediate crude oil. The average price of oil in U.S. dollars a barrel was $97.03 in 2008; the assumed price based on future markets is $60.50 in 2009 and $74.50 in 2010. | |||||||||||||

|

5Six-month rate for the United States and Japan. Three-month rate for the euro area. | |||||||||||||

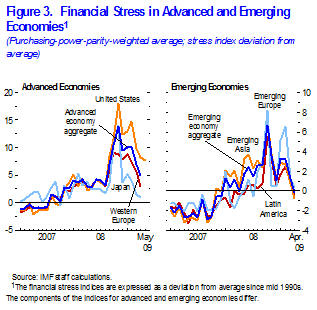

Going forward, the pace of recovery will depend on the balance between opposing forces. The downward drag exerted by the financial shock, the sharp fall of global trade, and the general increase in uncertainty and collapse of confidence is gradually diminishing. However, supportive forces are still weak. Many housing markets have yet to bottom out. Importantly, financial markets remain impaired and bank balance sheets still need to be cleaned and institutions restructured. Cuts in policy interest rates, continued provision of ample liquidity, credit easing, public guarantees, and bank recapitalization have appreciably lowered concerns about systemic failure and have supported intermediation (as discussed in the July 2009 Global Financial Stability Report Market Update). Consistent with these developments, financial stress indexes for advanced and emerging economies have receded since the beginning of 2009 (Figure 3, Data Figure 3).1 However, the improvements are far from uniform across markets and countries. In particular, bank lending conditions are expected to remain tight and external financing conditions constrained for a considerable time.

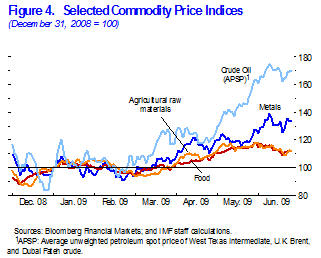

At the same time, commodity prices have rebounded ahead of the recovery (Figure 4, Data Figure 4). The recent rally in commodity prices has been strong and broad-based, reflecting improved market sentiment, U.S. dollar depreciation, and commodity-specific factors. In the oil market, prices have responded strongly to perceptions that market dynamics are shifting from significant oversupply to more balanced conditions. This owes in part to improving demand prospects but also Organization of Petroleum Exporting Countries (OPEC) members’ strict observance of lower production quotas. Forward markets project oil prices at $74.50 for 2010, not much above current levels, with high excess capacity expected to buffer growing demand.

In this setting, activity and credit growth are likely to remain subdued in many economies. Looking beyond 2010, it remains unclear how structurally weaker private consumption in the United States and other advanced and emerging economies that suffered asset price collapses will be compensated for by stronger demand elsewhere. Currently, expansionary macroeconomic policies and an inventory adjustment are supporting global activity but these are temporary forces.

Accordingly, GDP in the advanced economies is projected to decline by 3.8 percent in 2009 before growing by 0.6 percent in 2010. Although the projections are 0.6 percentage points higher than in the April WEO forecast, growth in 2010 would still fall short of potential until late in the year, implying continuing increases in unemployment. Among the major economies, growth rates have been marked up mainly for the United States and Japan.

- In the United States, high-frequency indicators point to a diminishing rate of deterioration, including in the labor and housing markets. Industrial production may be close to bottoming out; the inventory cycle is turning; and business and consumer confidence has improved. These developments are consistent with stabilization of output during the second half of 2009 and with a gradual recovery emerging in 2010.

- In Japan, following a dismal first quarter, there are signs that output is stabilizing. Improved consumer confidence, progress in inventory adjustment, aggressive fiscal policies, and strong performance by some other Asian economies are expected to lift growth in the coming quarters.

- In the euro area, consumer and business survey indicators have been recovering but data on real activity show few signs of stabilization and thus activity is projected to strengthen more slowly than elsewhere. Macroeconomic policies are providing support but much of the adjustment in the labor market still lies ahead. Rising unemployment will weigh on consumption and activity, as will the economy’s heavy dependence on a still-ailing banking sector.

Emerging and developing economies are projected to regain growth momentum during the second half of 2009, albeit with notable regional differences. Low-income countries are facing important challenges of their own because official aid has fallen and these economies are particularly vulnerable to swings in commodity prices.

- Growth projections in emerging Asia have been revised upward to 5.5 percent in 2009 and 7.0 percent in 2010. The upgrade owes to improved prospects in China and India, in part reflecting substantial macroeconomic stimulus; and a faster-than-expected turnaround in capital flows. However, the recent acceleration in growth is likely to peter out unless there is a recovery in advanced economies.

- Growth projections for Latin America have been lowered by 1.1 percentage points in 2009, primarily because production has been hit much harder by the global trade slowdown than initially expected. However, the region is benefiting from rising commodity prices, and growth projections have been revised up by 0.7 percentage points in 2010.

- The growth projections for central and eastern Europe and the Commonwealth of Independent States (CIS) have been revised downward by 1.3 and 0.7 percentage points in 2009 and upward by 0.2 and 0.8 percentage points in 2010, respectively. Developments differ appreciably across countries but many have been badly affected by the global financial crisis, with capital flows reversed and commodity exports sharply contracted, although the recent recovery of commodity prices is forecast to raise demand in key CIS economies.

- Growth projections for emerging Africa and the Middle East have been revised downward by 0.3 and 0.5 percentage points in 2009, respectively, while those for 2010 are broadly unchanged. Both regions have been more negatively affected by the drop in global trade than previously expected, with Middle Eastern oil exporters using their financial reserves to prop up domestic demand.

Inflation pressures to remain low.

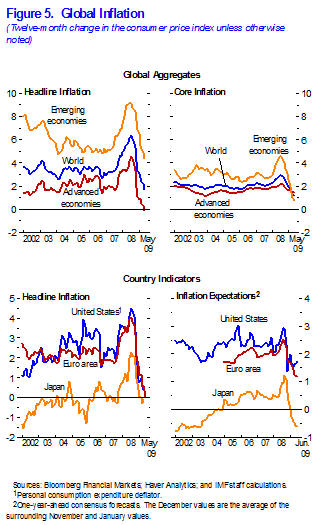

Inflation pressures have continued to ease with the continued weakness of the global economy. Year-over-year inflation moderated to 1.7 percent in May, down from around 6 percent one year earlier (Figure 5, Data Figure 5). In the advanced economies, headline inflation fell below zero percent in May as oil prices remained far below levels one year earlier, despite their recent pickup. Core inflation is still running around 1½ percent, down from 2 percent one year earlier. Similarly, headline and core inflation in the emerging markets have moderated, falling below 4½ percent and to around 1 percent in May, respectively. However, developments have been uneven, with inflation falling more in China and the Middle East than elsewhere.

Despite upward pressure from recovering commodity prices, global inflation is expected to remain subdued through 2010, held back by significant excess capacity. Risks for sustained deflation are small, as core inflation and inflation expectations in most major economies are still holding in the 1–2 percent range. In the advanced economies, potential output growth rates have taken a hit, with activity in the housing and financial sectors slumping and a need for a reallocation of resources toward other sectors. Nonetheless, the weakness of demand implies a noticeable widening of excess capacity that will keep inflation close to zero percent in 2009. Inflation rates have been marked up by about ½ percentage point for 2010 from the April WEO forecast, owing to somewhat stronger demand and commodity prices than earlier projected. Unemployment rates will reach double digits in some countries, holding back wages and household spending and presenting significant policy challenges. In the emerging economies, stronger disinflationary forces in some regions have prompted modest markdowns to the April projections for inflation, notwithstanding the upward revisions to output growth.

Risks have moderated but remain to the downside.

The risks to the outlook are still tilted to the downside, although tail risks have diminished noticeably. In the advanced economies, rising unemployment and a loss of confidence in the stability of the financial sector (possibly resulting from a larger-than-anticipated wave of corporate bankruptcies) could put renewed downward pressure on asset prices and potentially trigger a deflationary episode. Moreover, rising questions about public debt sustainability in some countries could add to upward pressure on bond yields, with negative effects on the recovery of housing markets. Falling house prices are another important risk that could undermine confidence in bank capital bases. At the same time, a number of emerging economies remain quite vulnerable to intensified financial stress, with potential feedback effects on advanced economies. More generally, if higher unemployment and social discontent were to prompt governments to introduce trade and financial restrictions and roll back reforms to other sectors, there would be confidence and productivity would suffer. However, there are also some upside risks, including a larger-then-expected drop in risk aversion and stronger internal demand dynamics in some major emerging economies.

Strong policy implementation remains key for a durable recovery.

While policies still have much work to do in dealing with the crisis, there will also be a need to increasingly shift from providing short-term support to laying the foundations for a return to strong medium-run growth. This will depend crucially on fostering stronger potential output growth, particularly in advanced economies, and rebalancing global demand. Financial, monetary, fiscal, and structural policies all have a role to play in this regard.

Financial policy

The overarching policy priority remains restoring financial sector health. While major progress has been made in restoring bank solvency, it is not yet sufficient to stop the deleveraging. Accordingly, continued efforts to restore financial sector health, deployed in a multilaterally consistent way, will be key determinants of the durability of recent improvements in financial conditions and the strength of the recovery in the real economy. In the United States, addressing problem assets remains a key priority for putting the financial sector on a firmer footing. Although many of the largest U.S. banks are again able to raise private capital and, in some cases, to repay government capital, major downside risks continue in the banking sector. In the European Union and elsewhere, authorities are also actively assessing banking system soundness by conducting stress tests. While good progress has already been made, achieving credible recapitalization together with appropriate restructuring or resolution of financial institutions where needed, remains of overarching importance. Forceful and suitably transparent implementation of these steps would help rebuild confidence and reaccelerate credit growth.

Overall, short-term measures to support financial systems need to be consistent with long-term objectives to strengthen incentives and improve market discipline. Progress with respect to the latter will determine the extent to which the financial sector can effectively perform its role of allocating savings to competing projects and thereby sustain productivity growth.

Monetary and fiscal policy

Monetary policy should remain supportive until growth resumes and deflationary risks dissipate. Remaining room to cut policy rates should be exploited, while nonconventional policy measures to support credit flows should continue to be explored. At the same time, exit strategies for withdrawal of exceptional conventional and nonconventional monetary policy support should be developed and explained, so as to contain inflation fears. Additionally, it would be helpful to develop tools to facilitate a smooth unwinding of the significantly expanded central bank balance sheets.

Rising concerns about fiscal sustainability underline the need for stronger medium-run fiscal policy frameworks. Although fiscal policy should stay supportive through 2010, plans should be made for rebuilding fiscal balances and ensuring sustainable debt paths after growth is firmly reestablished. Relevant reforms should aim at strengthening fiscal rules and institutions and reducing the buildup of future pension and health liabilities. Commitments to raise statutory retirement ages in line with life expectancies and to slow down health services costs through efficiency improvements could help to achieve the latter objective.

In the emerging economies, macroeconomic policy has to strike a balance between the need to support demand and the risk of exacerbating capital outflows and undermining fiscal sustainability. To this end, where underlying inflationary pressures are easing, central banks should reduce their policy rates cautiously to avoid a disorderly adjustment in exchange rates as well as large capital outflows. Emerging economies also need to assess the soundness of their banking systems, especially where important segments of the corporate sector are struggling to meet payments, for example, because of sharply declining export revenues and loss of external financing.

Rebalancing global demand

Looking beyond the next year, the crisis is likely, on the supply side, to have reduced the global economy’s sustainable output. Falling investment and widespread bankruptcies are lowering the level and perhaps also the rate of growth of potential output. Moreover, rising cyclical unemployment may translate into higher structural unemployment as workers lose market attachment.

Turning to the demand side, public demand will have to recede and private demand increase. In countries such as the United States, which posted large current account deficits in the recent past, this may require a shift from internal to external demand. By implication, the reverse will be required in countries that posted large current account surpluses.

The extent to which these supply and demand side developments will weigh on the recovery beyond 2010 depends on many factors. However, of critical importance will be the success of policies in rebuilding financial sectors in advanced economies and in supporting private consumption in emerging economies with large current account surpluses.

1 The Financial Stress Index captures episodes of impaired financial intermediation by assessing market responses in securities markets, exchange markets, and the banking sector (see Balakrishnan, Danninger, Elekdag, and Tytell, 2009, The Transmission of Financial Stress from Advanced to Emerging Economies, IMF Working Paper No. 09/133).