The Fog of War Clouds the European Outlook

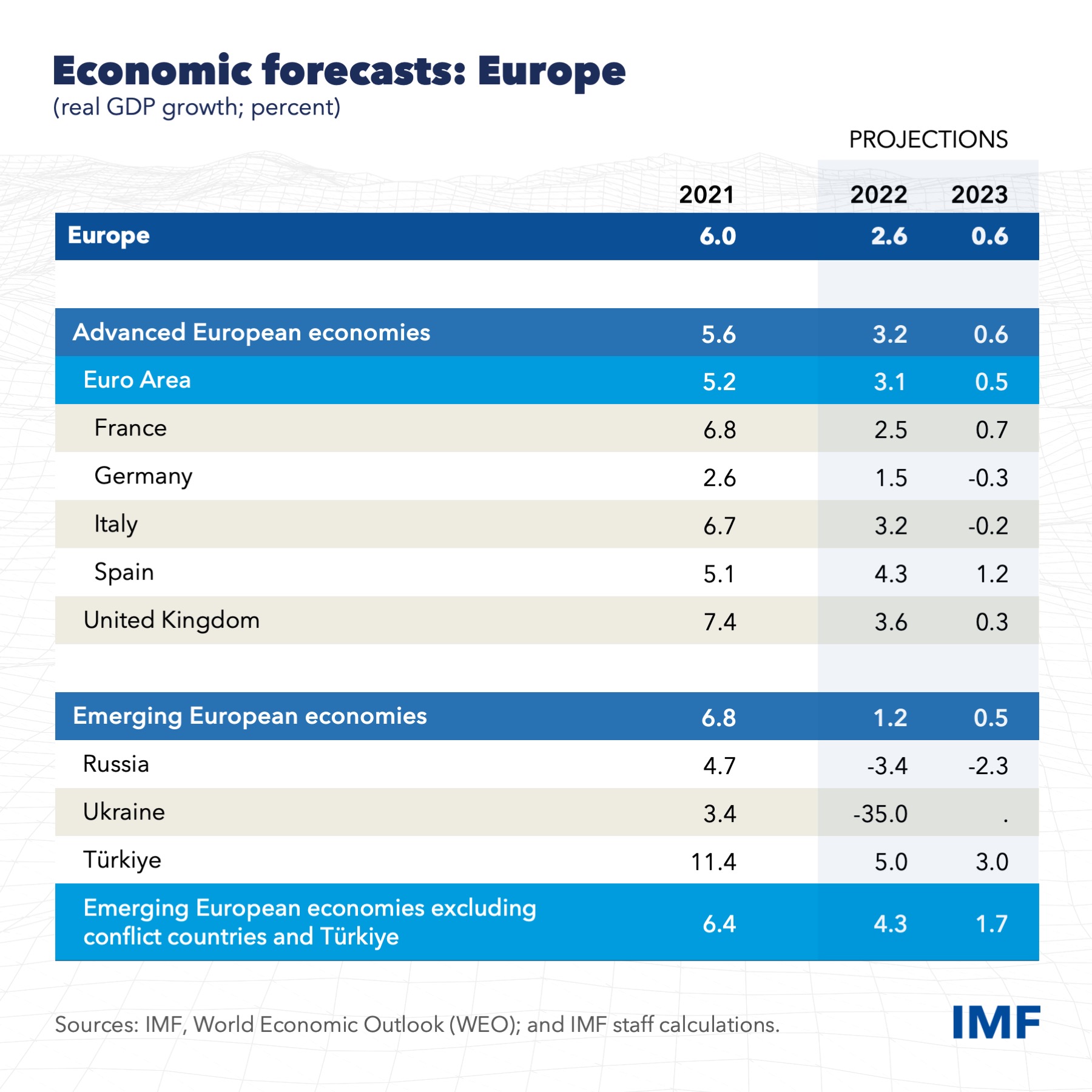

The war in Ukraine is taking a growing toll on Europe’s economies. The worsening energy crisis has depressed households’ purchasing power and raised firms’ costs, only partly offset by new government support. Central banks in the region and the world are acting more forcefully to bring high and persistent inflation down to targets, and global financial conditions have tightened. European policymakers are facing severe trade-offs and tough policy choices. A tightening macroeconomic policy stance is needed to bring down inflation, while helping vulnerable households and viable firms weather the energy crisis. But policies need to stay nimble and agile and adjust should additional shocks materialize.

The Fog of War Clouds the European Outlook

Europe was on its way to exit the pandemic at the end of 2021, with a broadly appropriate policy mix that supported a handover from public to private sector–led growth, while rising inflation was expected to subside as commodity prices and supply chain disruptions would ease. Russia’s war in Ukraine and its fallout changed this picture completely. Europe has been hit by a massive terms-of-trade shock that has weakened the growth outlook, further raised the level and persistence of inflation, and led to a cost-of-living crisis that threatens social cohesion. Furthermore, risks of medium-term output scarring, which was successfully avoided in the pandemic, are resurfacing. Risks to growth are on the downside, while those to inflation are on the upside, as epitomized by the energy crisis, which is fostering unusually high uncertainty and steep policy trade-offs. Policymakers will need to walk a fine line between tightening policy stances to bring down inflation and supporting vulnerable households and viable firms through the energy crisis, while standing ready to adjust the policy mix should additional shocks materialize.

Inflation in Europe: Assessment, Risks, and Policy Implications

Inflation in Europe has soared to multidecade highs. This chapter examines the drivers of inflation and the prospects and risks around its likely path. While soaring commodity prices account for much of the surge in inflation, empirical analysis finds that a sizable share of the recent uptick cannot be explained by conventional inflation drivers and points to the role of pandemic- and war-related forces, such as rising shortages in input markets. The prospective stabilization of commodity prices and the projected slowdown in growth should gradually bring inflation down, but the process will likely be slower than previously expected and highly uncertain. Inflation risks are on the upside. Central banks should thus keep raising policy rates in most European countries while remaining nimble and data-dependent, with fiscal policies focused on weathering the energy price shock without adding to inflation pressures.