Asia and Pacific

Regional Economic Outlook: Asia Pacific, October 2017: Making the Most of the Upswing

October 2017

Summary

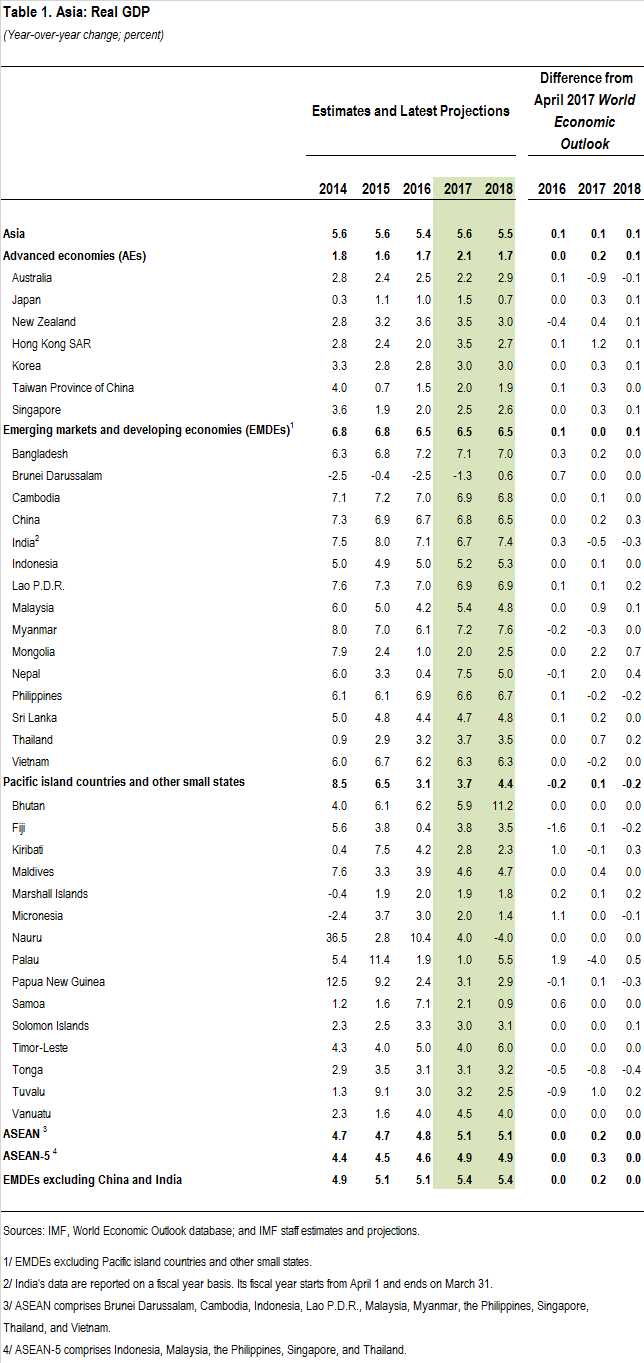

The pickup in growth in Asia anticipated in the April 2017 Regional Economic Outlook: Asia and Pacific remains broadly on track, with stronger-than-expected growth in China, Japan, Korea, and Association of Southeast Asian Nations economies helping to compensate for the weaker outlook in Australia and India. Regional output is projected to grow by 5.6 percent in 2017 and 5.5 percent in 2018, 0.1 percentage point higher than expected in April, driven by strong consumption and investment. Capital inflows to the region continued to be sizable in the first half of 2017, and financial conditions are expected to remain supportive. Inflation has been weaker than projected, partly on account of lower commodity prices, and projections have been revised downward in most countries. The region is thus currently in a favorable position, but how long this will last is uncertain. Near-term risks to the regional outlook are broadly balanced, but medium-term risks are skewed to the downside. Key downside risks include geopolitical tensions, sudden capital outflows, a shift toward inward-looking policies, policy uncertainty, and a sharp adjustment in China. In addition, the region continues to face serious longer-term challenges including population aging and lagging productivity. Overall, the favorable combination of circumstances provides a window of opportunity to pursue difficult structural reforms to boost growth and make it more inclusive, while addressing imbalances and risks. Fiscal policy recommendations vary across countries, depending on their cyclical positions and fiscal space, while subdued inflation pressures allow for continued accommodative monetary policies in much of the region. Stronger financial policies, however, may be needed in some countries to reduce vulnerabilities, especially from capital flow reversal.

Recent Developments: Stronger Growth and Benign Inflation

Growth outturns in the first half of 2017 surprised on the upside in many Asian countries and European countries, supported by a cyclical upturn in manufacturing and investment, and stronger trade growth. Looking ahead, the global economy remains healthy, but key drivers have shifted. Relative to the April 2017 World Economic Outlook (WEO), the previous assumption of fiscal stimulus in the United States has been revised to a more neutral stance, but momentum in Europe appears to be stronger than previously envisaged. The China forecast now incorporates increased policy support and therefore higher near-term growth.

Global growth is projected to accelerate to 3.6 percent in 2017 and further to 3.7 in 2018, up 0.1 percentage point in both years from the April WEO, with improved prospects for both advanced and emerging economies (Figure 1). With the notable exceptions of India and Australia, most countries in the Asia and Pacific region have seen growth outturns in the first half of 2017 that were better than anticipated in the April 2017 Regional Economic Outlook: Asia and Pacific, on the back of strong domestic demand. Asia’s exports rebounded, partly as a result of restocking in high-tech sectors (see Box 1), and current account balances have remained strong in most countries.

Global financial conditions remain accommodative, amid market optimism and low volatility. Equity markets in advanced economies are at record highs, bond spreads are tight, and market volatility is unusually low (Figure 2). The US Federal Reserve raised its monetary policy rate in June 2017 to 1.25 percent, but with large fiscal stimulus less likely and the US growth outlook consequently weaker, markets expect a more gradual normalization of monetary policy. Most other advanced-economy central banks have kept policy rates unchanged. Asian stock markets have strengthened during 2017 (Figure 3), while sovereign bond yields have generally declined, except in China (Figure 4), and credit growth in the region has moderated but remains robust (Figure 5). Financial conditions are assumed to remain accommodative as the gradual normalization of policy rates in the United States is offset by further strengthening in risk appetite.

Commodity prices have fallen by about 10 percent this year—about 14 percent for fuels and 5 percent for other commodities (Figure 6)—driven by a mix of supply and demand factors including stronger-than-expected US shale production and lower metals demand from China. Headline inflation in the Asia-Pacific region has softened, influenced by the path of commodity prices (Figure 7) and stronger local currencies, and unlike in most other regions, core inflation is now above headline. Weak inflation pressure allows room for continued accommodative monetary policy.

The US dollar has depreciated by about 7 percent in real effective terms since end 2016 given lower interest rates, while the euro has strengthened by a similar amount on increased confidence in the euro area recovery and a decline in political risk. Asian currencies have generally appreciated against the US dollar this year, but the picture is more mixed in real effective terms: while the Australian dollar and the Malaysian ringgit appreciated by about 2 percent, the Vietnamese dong and the Philippine peso depreciated by more than 4 percent (Figure 8). The region experienced a brief period of net capital outflows following the US election in late 2016, but inflows resumed in early 2017 reflecting the region’s strong fundamentals, including favorable growth differentials (Figure 9). These inflows, combined with still strong current account balances, and sizable valuation effects, resulted, in part, in an increase in foreign exchange reserves in most countries in the region, including China, during 2017.