Recovery Unabated amid Uncertainty

April 13, 2023

(As prepared for delivery)

Good morning to everyone here in Washington DC and good evening to everyone in Asia. Thank you very much for joining our Press Briefing for Asia and Pacific. Please allow me to make a few opening remarks.

Global growth is expected to decelerate and bottom out in 2023, as rising interest rates and Russia’s war in Ukraine weigh on activity. Global inflation is easing but remains stubbornly high, and banking strains in the US and Europe have injected greater uncertainty into an already complex economic landscape.

But despite the somber backdrop of a challenging year for the world economy, Asia and the Pacific remains a dynamic region.

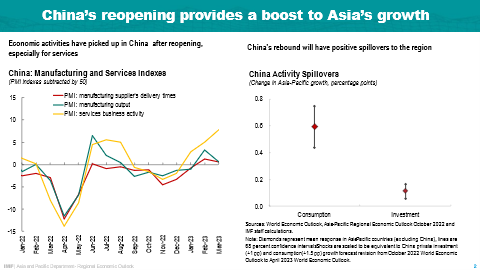

China’s reopened economy is rebounding strongly, and this will generate positive spillovers to its trading partners, providing fresh momentum for Asia’s growth. The Chinese economy is expected to expand by 5.2 percent in 2023, as the economic reopening generates a strong recovery in private consumption. In the past, the strongest spillovers to regional growth have been from Chinese demand for investment goods. But this time, we expect the biggest spillover effect will be from China’s increased demand for consumption goods.

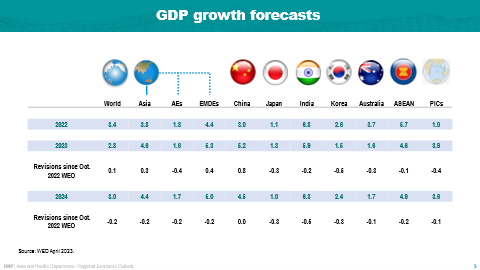

Growth in Asia-Pacific is projected to increase this year to 4.6 percent. This is 0.3 percentage points higher than we expected last October, and this upward revision largely reflects China’s reopening. This forecast implies that the region will contribute over 70 percent of global growth this year.

In Asia’s advanced economies, growth will slow this year to 1.6 percent. This is slower growth than we were expecting in October.

In Asian EMDEs, we see a lot of strong dynamism in 2023. This will be driven primarily by the recovery in China and resilient growth in India. These two economies alone will account for about half of global growth. Growth in most other economies is expected to bottom out in 2023, in line with other regions.

Now let me go into specific forecasts for a few major economies:

In Japan, growth is expected to tick up slightly to 1.3 percent in 2023, supported by expansionary monetary and fiscal stances; the downgrade relative to last October reflects weaker external demand and investment and carry-over from disappointing growth in the last quarter of 2022.

In India, growth momentum will begin to slow as softening domestic demand offsets strong external services demand; growth is expected to moderate slightly from 6.8 percent in 2022 to 5.9 percent this year.

Korea’s growth for 2023 is revised down to 1.5 percent. This reflects a slowing growth momentum partly due to the downturn in the technology cycle, and the weak outturn in Q4 2022.

In Australia, weakening domestic demand linked to monetary tightening, rising mortgage payments, and lower real disposable income is expected to dampen growth prospects.

The ASEAN economies are expected to see growth decreasing from 5.7 percent in 2022 to 4.6 percent in 2023, due to a slight moderation in domestic demand momentum, monetary tightening, lower commodity prices, and weaker external demand from the United States and Europe.

And among the Pacific Island Countries, the full reopening of borders both domestically and in China will help boost tourism, with growth expected to accelerate to 3.9 percent this year.

Despite the solid growth outlook for Asia Pacific this year, policymakers in the region can’t be complacent. The region is still facing four significant policy challenges:

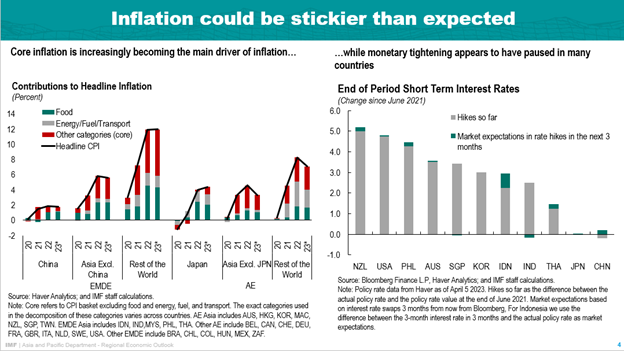

1. Inflation is still above target. Core inflation remains sticky and has become a more important driver of headline inflation recently, which may lead to more persistent inflation and wage pressure. Output gaps for Asian economies are either closing or already closed, and currency depreciation last year is still passing through to domestic prices. These factors suggest that the battle to contain inflation is not yet over. And yet, monetary tightening has slowed down or paused in most countries in the region. Given the still substantial inflation risk, we think monetary policy in the region may need to stay tighter for longer.

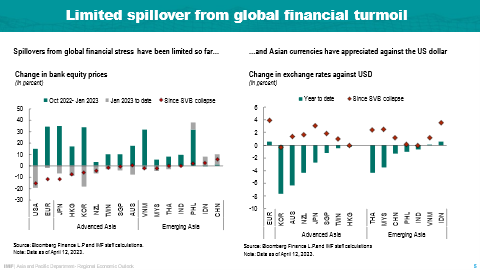

2. On financial risks, the global banking stress has had a limited impact on Asian markets so far. Direct exposures of Asian banks and investors to SVB were minimal, and we see Asian financial systems as being well-capitalized and profitable. In addition, as markets reprice the path for the Federal Funds rate, the US Treasury yield curve has fallen substantially. This has led to falling yields on Asian local-currency bonds and a strengthening of Asian currencies. Still, pockets of vulnerability remain, linked to high leverage and risks in the real estate sector. Financial supervisors will need to remain alert.

3. On fiscal policy, there are risks associated with high debt and rising interest rates. Public debt levels in the region have increased significantly compared to before the pandemic. Most governments in the region are expected to tighten fiscal budgets this year and next. However, the projected consolidation may not be enough to stabilize debt, and rising interest rates make the debt burden even more onerous.

4. Finally, there’s the challenge of medium-term growth. Productivity growth in Asia is projected to decline. China’s growth, though rebounding strongly this year, is expected to drop over the medium term. This will have important implications for the region, especially for those economies with significant trade links to China.

As Asia faces these four important challenges, we advise policy makers to stay vigilant. Policymakers should keep a close eye for financial stress and develop contingency plans. Unless strains increase and raise broad-based stability concerns, central banks should separate monetary policy objectives from financial stability goals. To do so, they should use available tools—such as lending and discount facilities—to ease any liquidity constraints in the banking sector, allowing them to keep policy rates tighter for longer until inflation falls durably back to target.

In addition, fiscal consolidation may need to be more aggressive to ensure sustainability over the medium term. Policy makers must strike a balance between supporting growth, protecting the vulnerable, and addressing debt concerns.

Asian economies must also prioritize policy initiatives that foster long-term growth. Structural reforms are needed to boost innovation and digitalization, accelerate the green energy transition, reduce risks from fragmentation, and ensure food security.

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER:

Phone: +1 202 623-7100Email: MEDIA@IMF.org