As Commodity Prices Surge Again, MENA Countries Can Draw Lessons from the Past

December 7, 2022

Policymakers have been more restrained in their response to surging commodity prices this time around

The current commodity price boom is affecting the region’s commodity exporters and importers differently. Commodity exporters are benefiting from a marked improvement in their terms of trade, while commodity importers are feeling the pain of higher imported energy and food prices. A key question is how countries are managing this boom relative to past experience, particularly as the current commodity price shock is occurring in a global and regional context that is distinct from previous episodes.

Our latest Regional Economic Outlook examines how MENA countries are responding to high commodity prices and protecting the vulnerable. This task is much harder for commodity importers, where fiscal space is limited. In contrast, the challenge for commodity exporters is to leverage the surplus from high energy prices to build buffers against future shocks and make progress with their transition and diversification plans.

We take a closer look at how MENA countries responded to commodity price surges in the past, the policy actions they are taking this time around, and what should be done next.

Previous responses proved costly

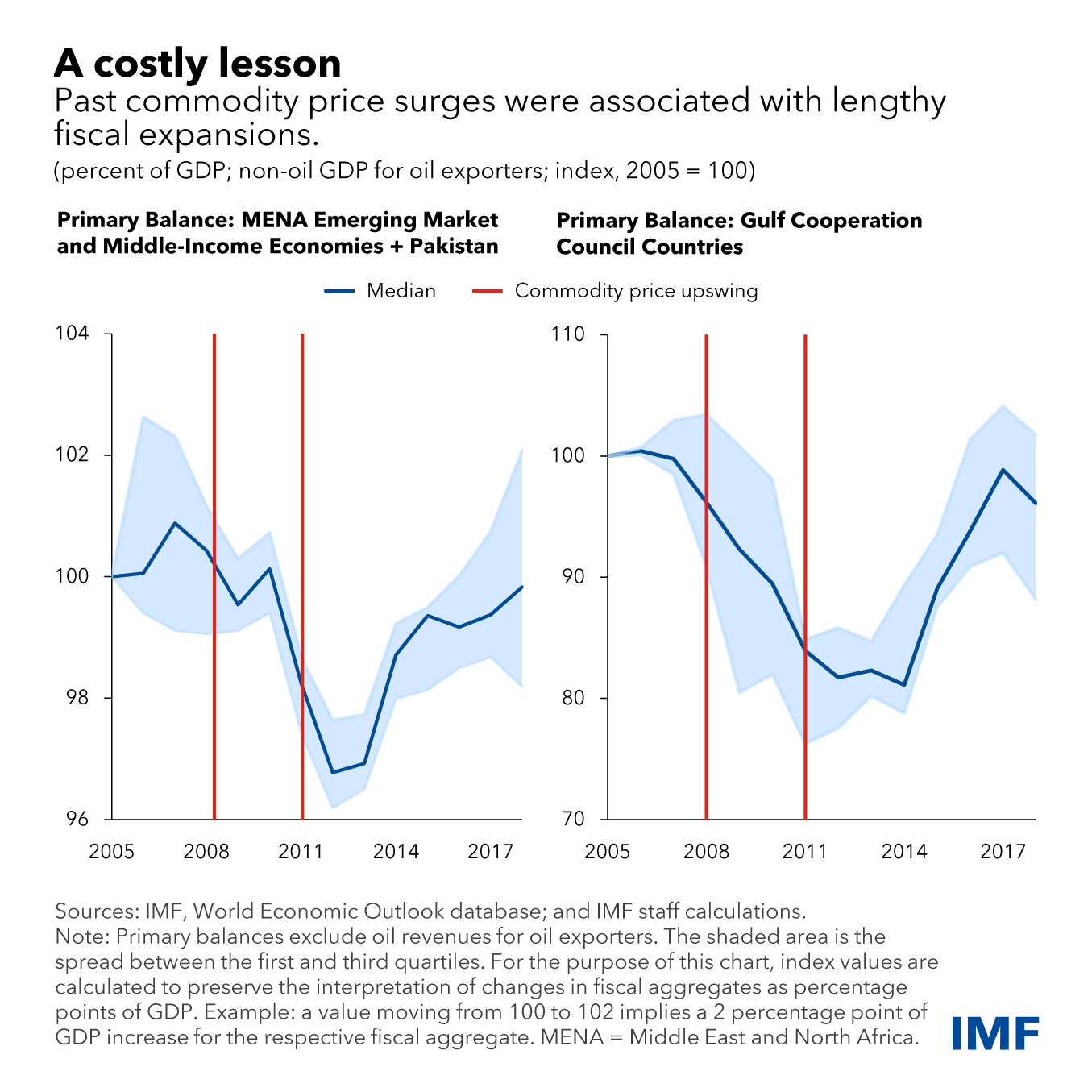

In the past, MENA emerging market and middle-income economies reacted to commodity price surges with increased government spending that often persisted for years, leaving them more indebted and less resilient to future shocks. Similarly, oil exporters experienced marked increases in spending at the time of oil price upswings to then face abrupt adjustments to their budgets when prices eventually fell. With social safety nets relatively weak, policymakers typically relied on subsidies, tax cuts, and public wage increases to offset real income losses. These policies were poorly targeted, failing to protect those most in need. For instance, past IMF studies found that the bottom 40 percent of the population in Egypt, Jordan, Lebanon, Mauritania, Morocco, and Yemen received less than 20 percent of funds spent on subsidies for diesel and gasoline. These policies were also hard to reverse—implying that government budgets became more rigid, and governments became locked in a vicious cycle of relying on costly fiscal interventions.

More cautious this time around

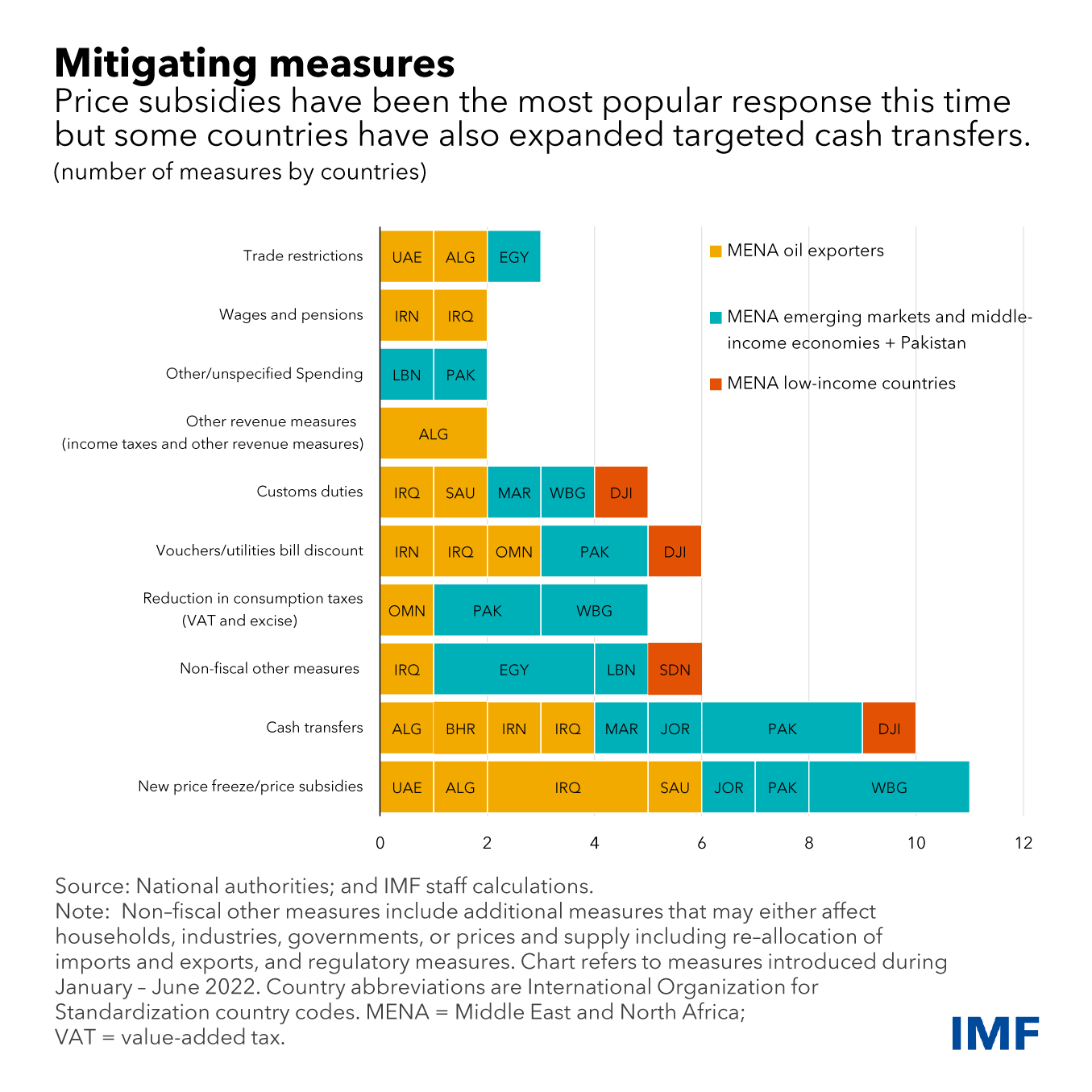

Amid the current commodity price shock, MENA countries have again resorted to the policy responses of the past, particularly subsidies and tax cuts, to shield their economies from high commodity prices. But this time, the response has been on a smaller scale.

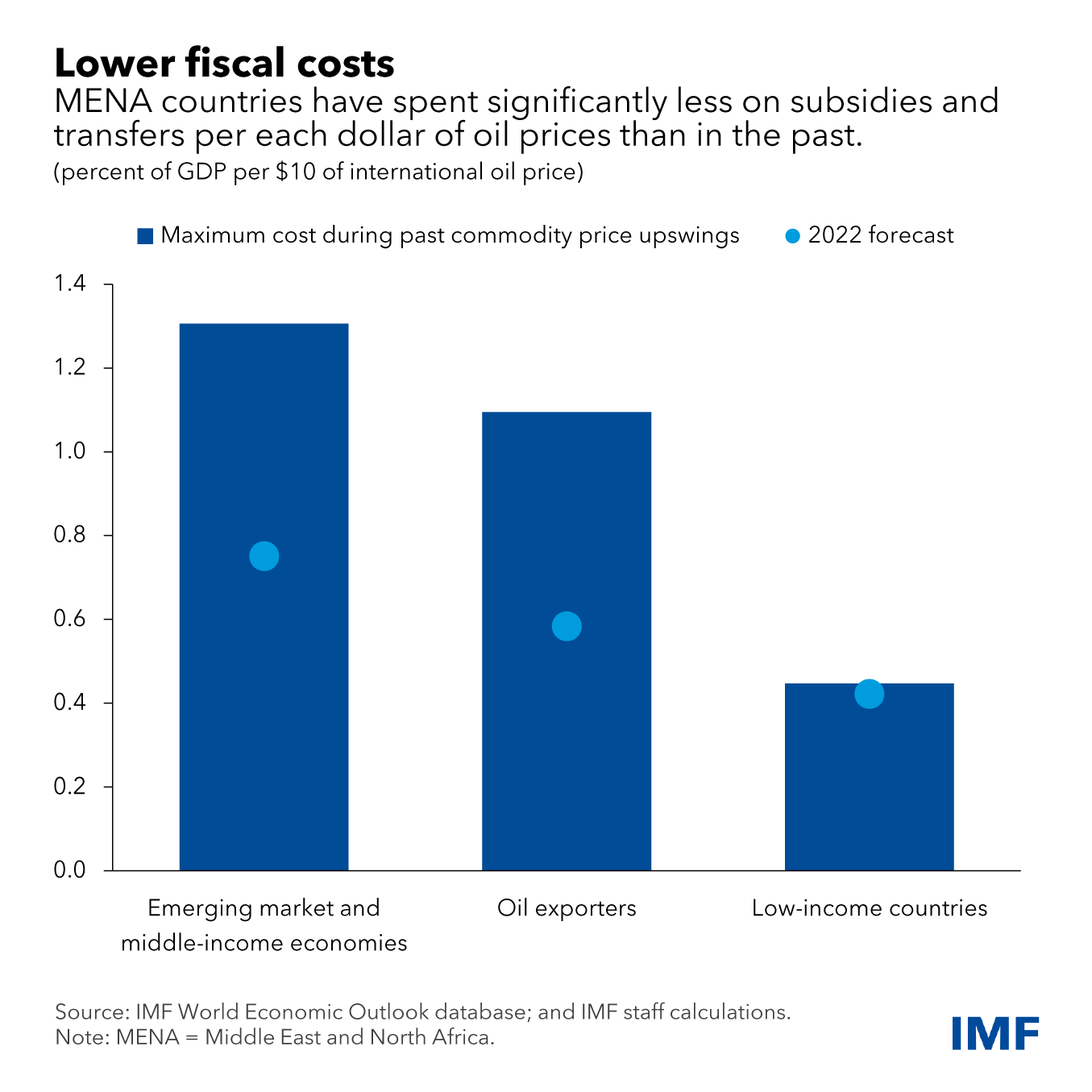

Although the current commodity price upswing is broadly comparable to those observed in 2008 and 2011, in 2022, subsidies are projected to increase by less than in past episodes—roughly 50 percent of their peak during these past episodes for the region’s oil exporters and emerging market and middle-income economies. This reflects limited fiscal space in the latter, improved targeted support in some countries, and progress on subsidy reform. For example, Jordan, Mauritania, Morocco, Pakistan, Saudi Arabia, Tunisia, and the United Arab Emirates have allowed domestic gasoline prices to increase. And, importantly, most oil exporters have saved their oil profits so far.

An opportunity to draw lessons from the past

The outlook is highly uncertain. Risks include commodity prices remaining high for longer, tighter and volatile financing conditions, and a sharper-than-expected slowdown in external demand. If not managed properly, price shocks could threaten social stability. Meanwhile, oil exporters may face pressures to spend the surplus from oil revenues, particularly in areas that would be difficult to reverse once oil prices fall, such as public sector hiring and wage increases.

Past experience underscores the importance of responding differently this time to provide the most effective protection to the vulnerable while ensuring debt sustainability and avoiding new budgetary rigidities, given the challenges of rolling them back. Thus, it will be important to break the unsustainable cycle of relying on higher, untargeted government spending and instead opt for measures focused on the neediest to cushion the impact of eroded real incomes.

At the same time, enacting reforms would improve resilience to future commodity price shocks. These include gradually removing regressive energy subsidies while strengthening social safety nets, which will enhance equity and create fiscal space for pro-growth capital spending; transitioning toward a greener and more efficient energy utilization to reduce energy dependency and exposure to oil price fluctuations; and bolstering revenue mobilization through tax reforms to increase fiscal space for oil importers and diversify revenue away from hydrocarbons for oil exporters.

Finally, MENA countries should continue enhancing governance and public financial management by improving transparency and accountability, moving toward medium-term fiscal frameworks, and adopting fiscal rules. These actions will prevent the costly and untargeted fiscal expansions of the past while creating the needed fiscal space to enhance social spending.

****

Filippo Gori is an Economist and Jeta Menkulasi is a Senior Economist. Both authors are in the IMF's Middle East and Central Asia Department.