Out for a walk in a seaside village in Korea. Over the past year, Korea has been successful in containing both the health and economic effects of COVID-19. (photo: Ran Kyu Park by Getty Images)

Mountains after Mountains: Korea is Containing COVID-19 and Looking Ahead

April 29, 2021

Over the past year, the Korean government’s actions have been very successful in limiting the severity of the COVID-19 outbreak and lessening its economic impact.

According to the IMF’s latest annual assessment of Korea’s economy, the key priorities now are to nurture the ongoing recovery by maintaining supportive economic policies, while advancing reforms that will promote inclusive medium-term growth.

Related Links

The following charts help show the country’s economic story of the past year:

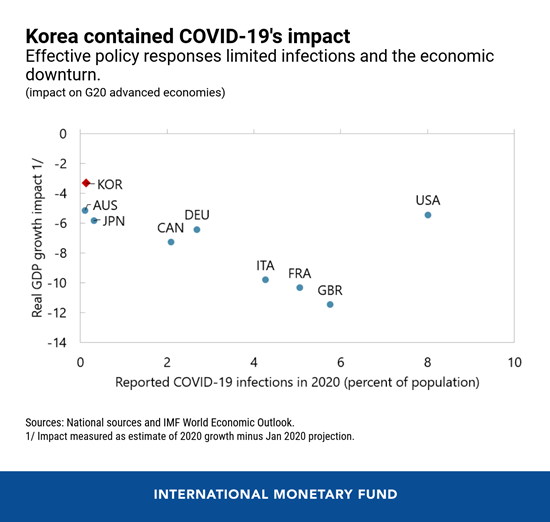

- Korea’s sound economic fundamentals and decisive policy response helped it navigate the COVID-19 shock well. The infection rate was kept below that of its peers, helped by an effective containment strategy featuring widespread testing, data-intensive contact tracing, and treatment tailored to the severity of each case. Korea also deployed a comprehensive economic response featuring fiscal support to help affected workers and businesses, and measures to rapidly stabilize financial markets and ensure ample availability of credit. These steps helped make the downturn the smallest among advanced G-20 economies, with real GDP growth in 2020 of -1.0 percent.

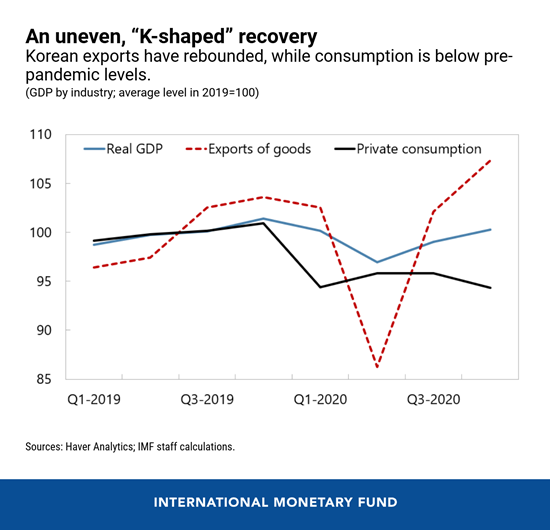

- The economy is recovering quickly, although the pace of recovery is uneven across sectors. Exports have rebounded, driven by pandemic-induced increases in online activities. This has also supported business investment. By contrast, services and consumption remain below pre-pandemic levels. Given this “K-shaped” recovery and remaining uncertainties surrounding the pandemic, the authorities are appropriately maintaining supportive fiscal and monetary policies. This includes the recent approval of additional targeted support through a supplementary budget of 0.8 percent of GDP. Given that Korea entered the COVID-19 shock with low public debt, this stimulus can be withdrawn gradually over the next few years.

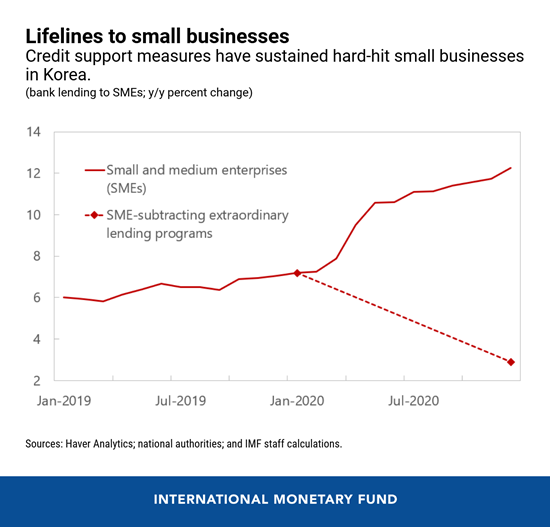

- The Korean authorities have been proactive in providing support for troubled economic sectors. Building on experiences in addressing previous crises, the government promptly set up several lending facilities and expanded guarantees to ensure ample credit supply, especially to small and medium enterprises (SMEs). These policies have helped contain corporate defaults and build up corporate sector cash balances. The challenge in 2021 is to sustain credit support until the green shoots of recovery are seen more broadly across sectors, and then proceed with a calibrated withdrawal, so that support measures do not impede the needed post-COVID-19 reallocation of resources across the economy.

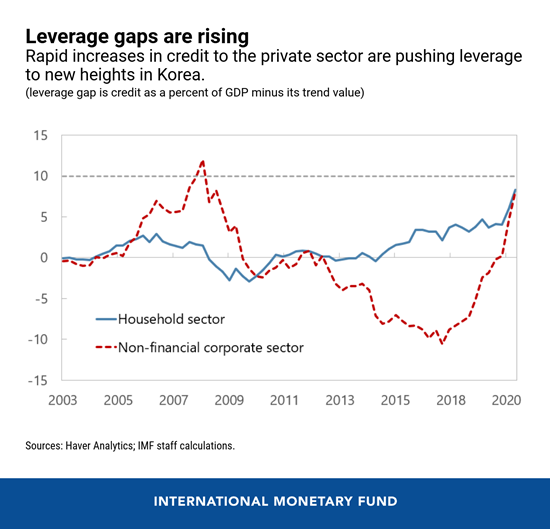

- Korea’s financial system has weathered the COVID-19 shock relatively well, a testament to years of sound macro-financial policy management. Among systemically important banks, loan repayment rates are very high, and there are ample capital and provisioning buffers to guard against potential losses. However, the Korean proverb ‘mountains after mountains’ serves as a reminder about how challenges always lie ahead. Korean household debt is among the highest in the OECD at over 190 percent of disposable income, a significant portion of which is secured by real estate. In addition, around half of the total stock of SME bank credit (around 22 percent of GDP) has been extended to firms with earnings that are insufficient to cover interest payments. Lending has grown quickly across all sectors since the pandemic outbreak, pushing credit as a percent of GDP further above its trend value.

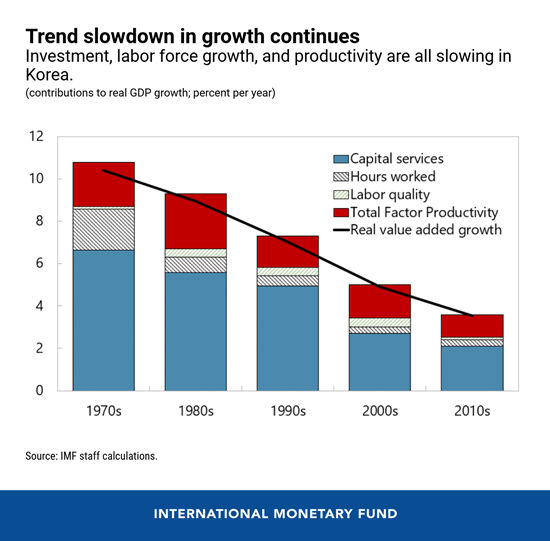

- As economic activity normalizes, reforms are needed to boost growth potential and enhance inclusiveness. Korea has a track record of exceptional economic growth, but the improvement in living standards has slowed in recent decades and productivity remains below advanced-economy peers. The Korean New Deal, the authorities’ five-year development strategy, rightly aims to help boost inclusive growth and facilitate post-COVID-19 structural transformation by promoting digitalization, accelerating the transition to a low-carbon economy, and strengthening the social safety net. These measures should help boost productivity in the service sectors and reduce remaining inequalities faced by women, youth, and the elderly. Still on the agenda are reforms to reduce barriers to entry for new firms, stimulate innovation, and tackle remaining labor market rigidities. Strengthening carbon pricing to provide robust incentives for green investment will also be important to achieve the objectives of the green pillar of the Korean New Deal.