Two women enjoy a stroll in Tehran, Iran. COVID-19 has exacerbated fiscal challenges in the Middle East and Central Asia. (photo: FarzadFrames iStock by Getty)

Seven Things to Know About Fiscal Challenges in the Middle East and Central Asia

October 27, 2020

The COVID-19 pandemic and the ensuing economic crisis have required emergency fiscal measures as revenues have dried up. Many countries in the Middle East and Central Asia, which were already vulnerable before the pandemic, are now in a precarious fiscal position.

Here, from the IMF’s latest Regional Economic Outlook: Middle East and Central Asia, are seven things to know about the fiscal challenges ahead for the region:

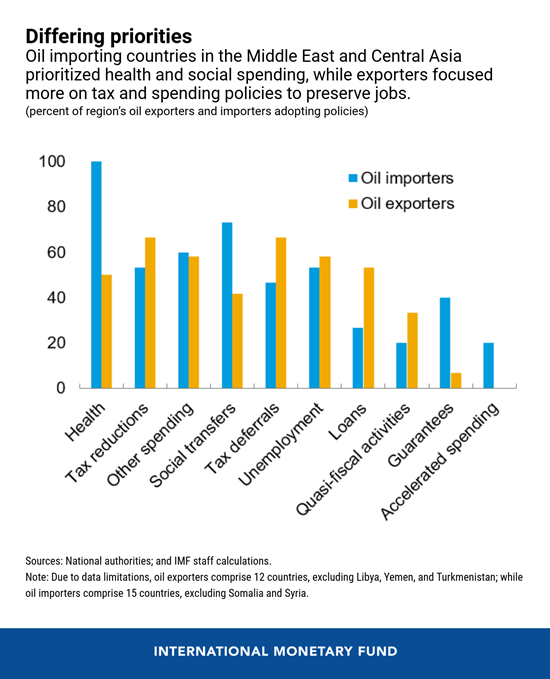

- Countries implemented a variety of fiscal measures to address the pandemic. The unprecedented nature of the crisis required swift action. Oil importers in the Middle East and Central Asia region focused on boosting health spending and targeted social transfers, while oil exporters prioritized temporary tax reductions, extending payment deadlines, and increasing other spending, such as partial salary payments to preserve jobs (see box).

- The average fiscal response in the Middle East and Central Asia was below the average of emerging market economies, mainly reflecting constrained fiscal space. The median size of revenue and expenditure packages in the region’s oil importing countries this year is double that of oil exporters (2 percent of GDP versus 1 percent of GDP). Some oil exporters with strong health and welfare systems had less need to increase spending. Others had little leeway to increase spending—in other words, limited fiscal space. However, spending increases were broadly offset by cuts in other categories, particularly capital spending.

- Fiscal deficits and public debt are expected to rise. The cost of emergency measures coupled with the significant projected decline in revenues will have an impact across the region. That’s particularly pronounced in oil-exporting countries, which are also grappling with the collapse of oil demand and prices. Their revenue is expected to decline by about $224 billion this year, which amounts to more than 8 percent of their projected GDP. Government debt is also expected to rise significantly. For countries in the Middle East, North African, Afghanistan, and Pakistan (MENAP) region, for instance, median government debt is projected to rise from 64 percent of GDP in 2019 to above 75 percent by 2022, and above 80 percent in about one-third of the countries.

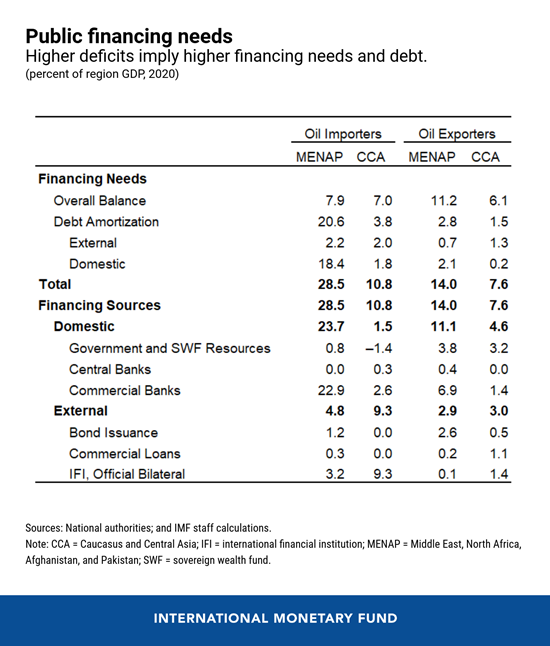

- Higher deficits mean higher financing needs. With deficits rising, the region’s median financing needs are expected to increase by more than 4 percent of GDP because of the pandemic, bringing the projected total public financing needs to $613 billion this year, which will go down to $571 billion in 2021. The MENAP region will have greater requirements than the Caucasus and Central Asia (CCA), as will oil importers compared to oil exporters. MENAP countries are also expected to rely more on domestic resources, while CCA economies are more dependent on external financing.

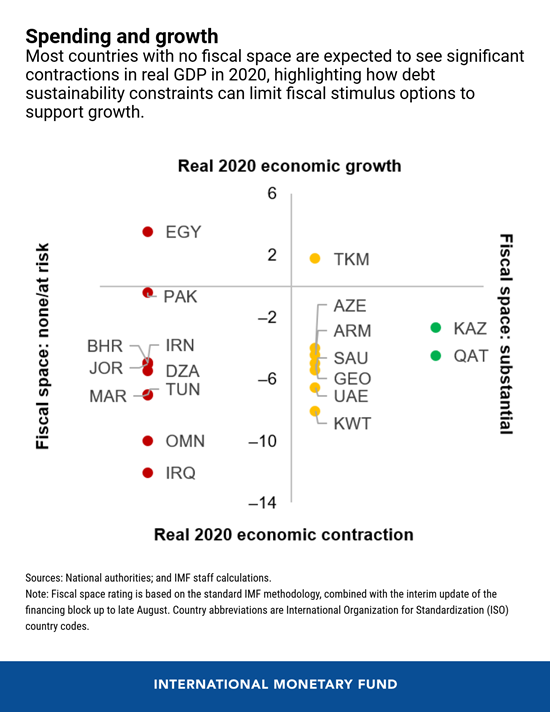

- Higher debt will erode fiscal space and raise fiscal risks. Many countries in the region, particularly MENAP oil importers, entered the crisis with very little or no fiscal space already. The combined effect of higher debt, elevated financing demands, and the challenges of implementing fiscal adjustments will limit their ability to support the recovery.

- Expanding fiscal space will be critical to support the recovery. With COVID-19 still posing a significant threat to public health and the normalization of economic activity, fiscal support for companies in hard-hit sectors as well as vulnerable households will still be needed. How, then, can countries both provide needed assistance in the short term and broaden their fiscal space in the medium term? Prioritizing spending to protect health, education, and the vulnerable while restoring taxpayer compliance to pre-crisis levels will be key in the immediate future. Over the medium term, expenditure and revenue measures that focus on equity and efficiency would help to expand fiscal space, such as more progressive tax systems. Governments should also work on gradually reducing fuel subsidies, containing public wage bills, and cutting non-priority spending.

- Medium-term budget plans and improved governance would not only help expand fiscal space, but also mitigate fiscal risks. A medium-term budget plan will help countries account for the full cost of their policies and boost the credibility of envisaged fiscal adjustments. These plans should be supported by fiscal rules that set numerical limits on budgetary aggregates and ensure medium-term fiscal sustainability. Only one-third of countries in the region currently have such rules in place. Finally, improving governance and curbing corruption will be essential as countries work to expand their fiscal space and become more resilient. Increasing transparency can mitigate fiscal risks, while reducing tax evasion and avoidance will help boost government revenues.

Oil Exporters and Oil Importers in the Middle East and Central Asia

Fifteen countries in the Middle East and Central Asia region are classified as oil exporters (Algeria, Azerbaijan, Bahrain, Iran, Iraq, Kazakhstan, Kuwait, Libya, Oman, Qatar, Saudi Arabia, Turkmenistan, United Arab Emirates, Uzbekistan, and Yemen), while 17 are classified as oil importers (Afghanistan, Armenia, Djibouti, Egypt, Georgia, Jordan, Kyrgyz Republic, Lebanon, Mauritania, Morocco, Pakistan, Somalia, Sudan, Syria, Tajikistan, Tunisia, and West Bank and Gaza).