Albania: Staff Concluding Statement of the 2019 Article IV Mission

November 26, 2019

The authorities have consented to the publication of this statement. The views expressed in this statement are those of the IMF staff and do not necessarily represent the views of the IMF’s Executive Board. Based on the preliminary findings of this mission, staff will prepare a report that, subject to management approval, will be presented to the IMF Executive Board for discussion and decision.

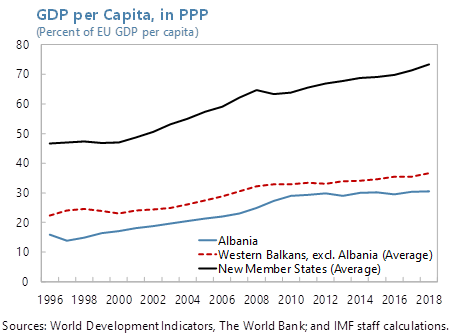

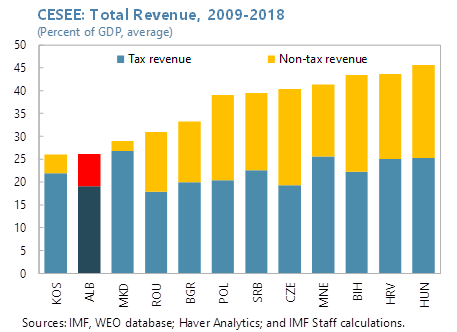

While Albania has maintained economic stability, growth this year has fallen mainly due to lower electricity production and, looking ahead, the slowdown in key partner countries and heightened political uncertainty present important downside risks. At the same time, with per capita income at a quarter of the EU average, much stronger growth is needed. Weaknesses in Albania’s infrastructure and economic institutions impede a broad and sustained improvement in living standards. Better governance can help attract investment, reduce emigration, and limit crisis risks.

The authorities should seize the opportunity to reinvigorate their reform agenda:

- First of all, they need to create more room for pro-growth government spending. This can be done by removing complexities and distortions from the tax system and improving revenue administration, while keeping tax rates at moderate levels. To set a positive example for tax compliance, the practice of running VAT refund arrears must stop.

- Second, it will be critical to implement current plans for improving the management of public investments, which includes public private partnerships, to enhance their quality and mitigate the rising fiscal risks.

- Third, a continued reduction in the fiscal deficit is needed, to keep debt on its downward path. This can protect the country against future shocks.

- Finally, financial sector reform should continue, to foster credit growth, accelerate financial inclusion, and maintain financial stability.

An International Monetary Fund (IMF) mission, led by Mr. Jan Kees Martijn, visited Tirana during November 12-26, 2019 for the annual Article IV consultation discussions. At the end of the visit, the mission issued the following statement:

We would like to express our deepest sympathies to the government and people of Albania for the loss of life and damage as a result of today’s earthquake.

Stronger economic governance and fiscal institutions to reach higher living standards

1. The authorities recognize the importance of macroeconomic stability for sustainable growth, which provides an important anchor for policy-making. The authorities have demonstrated commitment to keeping inflation and the fiscal deficit under control. Inflation remains below the 3 percent target and we support the Bank of Albania’s accommodative policy stance and flexible exchange rate policy. The fiscal deficit is expected to remain under control and reach 1.9 percent in 2019 and 2020 (including borrowing in 2020 by the energy and water sectors with a government guarantees of 0.4 percent of GDP). This would reduce public debt to less than 65 percent of GDP in 2020 (including public sector arrears at 0.4 percent of GDP, from 1.8 percent at end-2018)—almost 10 percentage points lower than five years ago. Over the medium term, the deficit should come down further, because lower public debt will provide more room for absorbing fiscal risks and offsetting adverse shocks through fiscal policy.

2. However, the structure of the budget and the quality of fiscal institutions need much improvement to help the country shift to a higher growth path. Growth is expected to recover from 3 percent in 2019 to 3.5 percent in 2020 and 3.7 percent over the medium term, which is too low for tangible convergence with living standards in the EU. At the same time, the eroding revenue base and weak institutions, with limited capacity and bottlenecks in hiring skilled staff, constrain the provision of vital public goods including infrastructure, high-quality education and health care. This is an ongoing problem, as the 2020 budget does not envisage an increase in capital spending as a share of GDP. In addition, we project significant revenue shortfalls that will put even further pressure on these critical expenditures.

3. International and regional comparisons suggest that Albania has ample room to generate additional revenues. Over time, the tax system has become increasingly fragmented and complex, with many exemptions and preferential treatments. This has narrowed the tax base, especially for VAT, and created arbitrary differences in the income tax burden that weaken compliance. A simpler and more equitable tax system can generate higher revenues while maintaining moderate tax rates. Reducing informality is an important aspect of these efforts. The authorities’ ‘fiscalization’ and informality campaigns should be supported by a broader strategy for the Tax Administration to improve voluntary tax compliance, while easing the tax administration processes for small businesses. Implementing such reforms requires continuity in the leadership of the tax administration. The preparation of a Medium-Term Revenue Strategy (MTRS) will offer a welcome opportunity to address these issues.

4. The government should set an example for tax compliance by eliminating all its arrears related to VAT refunds. We welcome the authorities’ plan (prepared together with the World Bank) to avoid new VAT refund arears and eliminate the entire stock by mid-2021. A permanent solution to the arrears problem calls for disentangling VAT repayments from collection and addressing weaknesses in budgetary controls and cash management.

5. Stronger institutions are needed to contain increasing fiscal risks, especially from the rapid increase in Public-Private Partnerships (PPPs) . To ensure value-for-money and contain risks to the budget, shortcomings in project management need to be addressed across government entities. The recently amended PPP law strengthens the gatekeeping role of the Ministry of Finance and Economy (MoFE), which now needs to build the capacity to perform this task. In addition, the execution of recent plans for rigorous monitoring and risk assessments will be critical for all PPPs (including those without regular government payments). Finally, we reiterate our call to create a unified process for preparing, prioritizing, and evaluating all public investment projects.

6. We remain concerned that the Albania Investment Corporation (AIC) will result in new fiscal risks . Its regulations and practices should ensure that the AIC will have a strictly commercial focus and will not depend on repeated capital injections by the government to cover losses. In line with earlier Fund advice, we also emphasize the importance of limiting the possible functions of the AIC to its original purpose of supporting economic development through the exploitation of idle public assets.

7. The ongoing financial weakness of the state-owned electricity sector calls for the careful implementation of bold reforms. The sector has been afflicted by repeated financial losses, inter-company arrears, weak corporate governance, and half-hearted reforms. Building on a financial recovery plan coordinated by the World Bank, the authorities foresee a far-reaching restructuring in 2020—establishing a power exchange and unbundling the electricity distribution company. The viability of this plan, in particular if at the same time the sector is hit by another drought, relies on stronger preparation and coordination than has been demonstrated thus far.

8. Given these weaknesses in fiscal policies and institutions, a stronger fiscal rule is needed to safeguard further fiscal consolidation. We recommend a medium-term rule that constrains the annual (primary or overall) fiscal balance and that could underpin the legislated target of reducing public debt to no more than 45 percent of GDP.

9. While the ongoing lengthening of the average maturity of public debt is welcome, debt and liquidity management need strengthening . The MoFE should reconsider the virtual elimination of short-term debt, which is an important instrument for active liquidity management and for correctly pricing a full yield curve (and hence for developing new financial products, including for hedging). In this context, we recommend strong coordination between the BoA and MoFE.

Unlocking the financial sector’s potential to support economic growth, without jeopardizing stability

10. Albania’s new financial landscape offers opportunities for financial deepening and stronger credit growth. Credit growth is finally picking up, as changes in bank ownership and a reduction in the number of banks lead to more competition, and NPLs have been reduced from a peak of 24.9 to 10.2 percent. Nonetheless, further reforms remain necessary to support bank lending through resolving the impasse in the bailiff system, addressing the weaknesses in property rights, and effectively implementing the insolvency law. Moreover, the much broader reform of the judiciary system and the fight against informality will be key. A more favorable credit environment will also strengthen the transmission of monetary policy, together with further actions to reduce the extensive use of euros.

11. At the same time, a more competitive financial system demands continued vigilance in regulation and supervision. The BoA has rightly stepped up its supervision of systemic banks and those that have changed ownership. Completing the alignment of the regulatory and supervisory framework with EU standards will be an important achievement, as will full implementation of the Basel III framework, including for consolidated supervision.

12. Effective regulation and supervision of the nonbank financial sector also needs ongoing attention. In this context, we urge the responsible authorities to ensure that legislation to promote operations related to crypto-assets is consistent with AML/CFT international standards.

Finally, we want to thank the authorities and all our other counterparts for the excellent collaboration and for their hospitality.

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER: Gediminas Vilkas

Phone: +1 202 623-7100Email: MEDIA@IMF.org