Balance Sheet Approach (BSA)

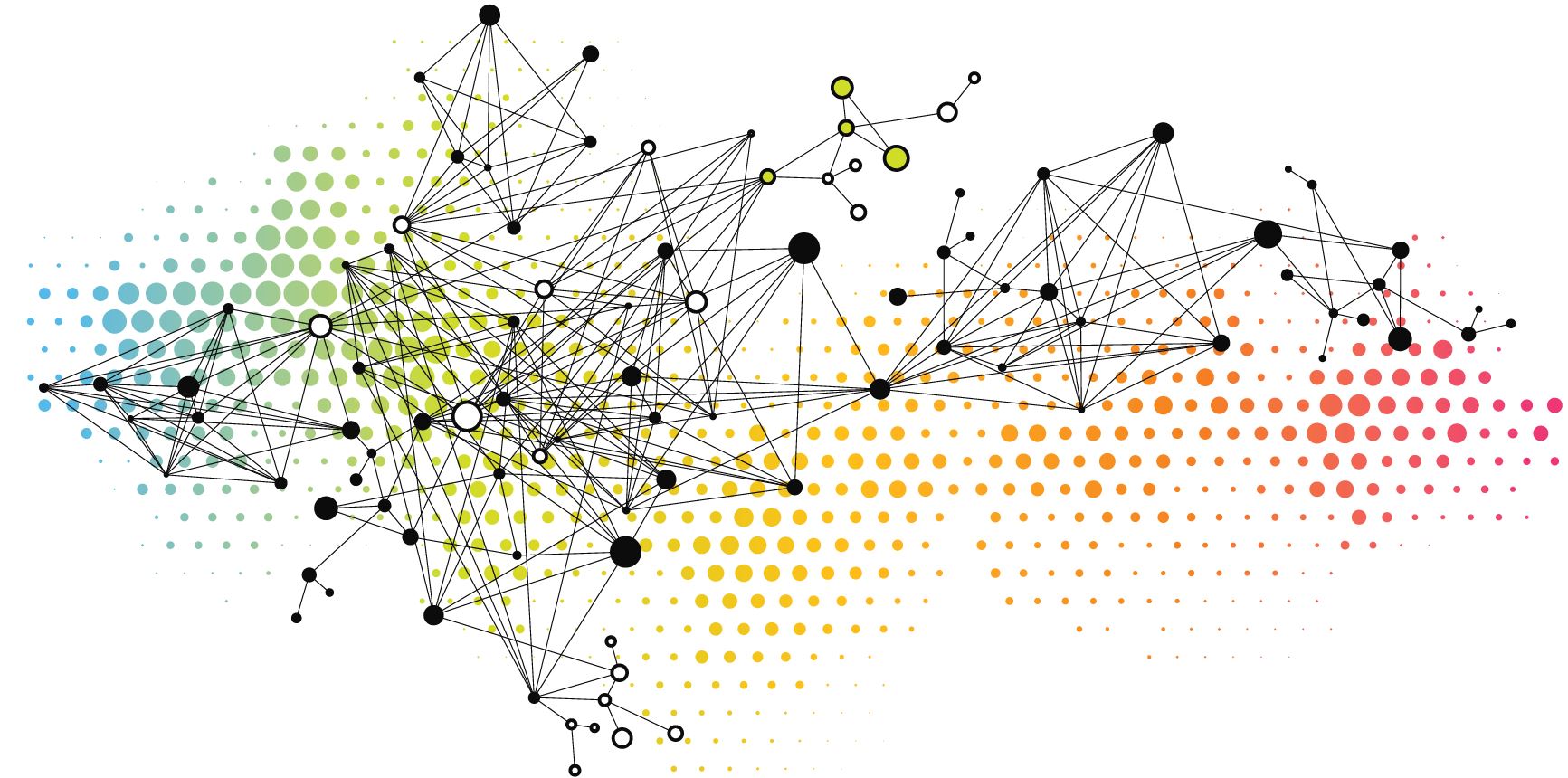

This course, presented by the Statistics Department (STA), provides participants with the necessary skills to compile and analyze the BSA matrix – a three-dimensional financial statistics. STA has developed a BSA tool, which combines the balance sheets of the main sectors of an economy, namely the financial sector, central government, nonfinancial corporate and household sectors, and the external sector into a single matrix to generate a sectoral distribution of claims and liabilities in a “from-whom-to-whom” basis. The course will guide country officials through the process of generating a BSA matrix using financial, fiscal, and external sector statistics. By analyzing the BSA matrix, officials can understand overall balance sheet linkages and identify specific exposures and vulnerabilities, such as excessive reliance on external funding, leverage buildup in the corporate sector, and overreliance on the banking sector for sovereign debt placement.

Target Audience

Officials at central banks, ministries of finance and other agencies responsible for (i) compiling monetary and financial statistics, government finance/debt statistics, and external sector statistics; (ii) the supervision and regulation of financial institutions; and (iii) conducting financial stability or macro-financial analyses.

Qualifications

Participants are expected to have a degree in economics or statistics, or equivalent experience.

Course Objectives

Upon completion of this course, participants should be able to:

- Compile the BSA matrix using monetary, government, and external sector data.

- Review and summarize the source data used for preparing the BSA matrix and identify critical data gaps for their respective countries.

- Prepare work plans for addressing these data gaps over the medium-term, in order to provide national policy makers with an analytically useful BSA matrix.

- Use the BSA matrix information for the identification of balance sheet imbalances, exposures, and risks to shocks such as sudden capital outflows or sharp exchange rate depreciation.

Upcoming Offering

| Start date | End date | Location | Delivery Method | Session No. | Primary & (Interpretation) language | Apply |

|---|---|---|---|---|---|---|

| November 4, 2024 | November 8, 2024 | Singapore, Singapore | In-person Training | ST 24.25 | English | Apply online by August 30, 2024 |

| January 6, 2025 | January 9, 2025 | Abu Dhabi, United Arab Emirates | In-person Training | CE 25.02 | English (Arabic) | Apply online by October 28, 2024 |

| February 10, 2025 | February 14, 2025 | Washington, D.C., United States | In-person Training | HQ 25.03 | English | Apply online by September 1, 2024 |

Nowcasting (NWC)

English (French, Portuguese) | September 16-27, 2024 | In-person Training | Ebene, Mauritius

Apply online by August 16, 2024

Fintech Market Development and Policy Implications (FINTECH)

English (French) | October 14-18, 2024 | In-person Training | Ebene, Mauritius

Apply online by August 16, 2024

Macro-Stress Testing (MST)

English | November 25-29, 2024 | In-person Training | Singapore, Singapore

Apply online by August 16, 2024

Sovereign Risk and Debt Sustainability Framework for Market Access Countries (SRDSF-MAC)

English | October 14-18, 2024 | In-person Training | Singapore, Singapore

Apply online by August 18, 2024

Exchange Rate Policy (ERP)

English | October 27, 2024 - November 7, 2024 | In-person Training | Kuwait City, Kuwait

Apply online by August 18, 2024