Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Resilient Growth in Sub-Saharan Africa, Despite Strong Headwinds

April 28, 2015

- Growth still robust but at lower end of range by recent standards

- Sharp decline in oil prices poses formidable challenges for oil exporters

- Achieving sustained, high, inclusive growth the overarching priority

Growth in sub-Saharan Africa should remain robust but decelerate in the wake of the decline in oil and commodity prices.

Workers build bridge on Trans-Africa Highway in Kenya: tackling infrastructure gap is critical for sustained, high, inclusive growth (photo: Michael Wirtz/Newscom)

REGIONAL ECONOMIC OUTLOOK

The IMF’s latest Regional Economic Outlook for sub-Saharan Africa projects that the economy of the region is set to register another year of solid performance , expanding at 4½ percent in 2015. While this rate will be at the lower end of the range experienced over the last few years, sub-Saharan Africa will remain among the fastest growing regions of the world.

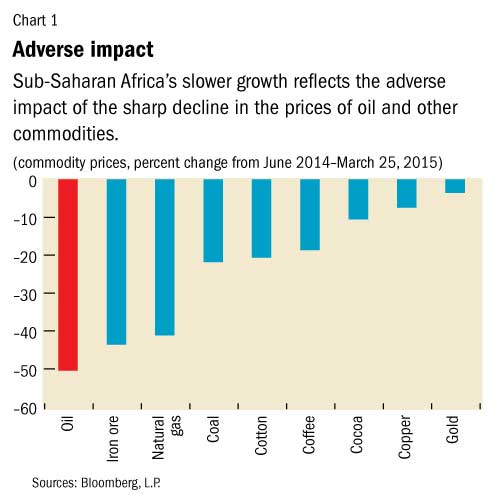

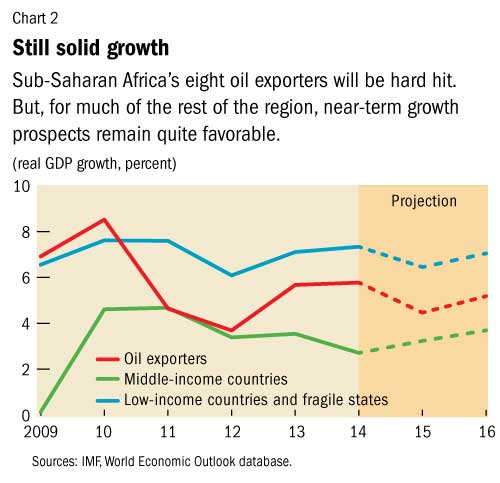

The deceleration in growth reflects the adverse impact of the sharp decline in the prices of oil and other commodities (see Chart 1). However, this impact will be highly differentiated across the region (see Chart 2).

On the one hand, growth among oil importers will remain strong, notably in low-income countries, driven by investment in mining and infrastructure and by strong private consumption. Excluding South Africa—where growth is expected to remain lackluster, held back by continuous problems in the electricity sector—and Guinea, Liberia, and Sierra Leone—where the Ebola outbreak continues to exact a heavy economic and social toll—growth among oil importers is still expected to reach close to 6 percent in 2015 and 6½ percent in 2016.

On the other hand, the eight oil-exporting countries in the region, hard hit and with limited savings to fall back on, are expected to undertake significant fiscal adjustment, with adverse implications for growth. Growth among these countries is now expected at 4 ½ percent in 2015, some 2½ percentage points lower than what had been expected six months ago.

Fiscal deficits are set to remain high or worsen in several countries. Among oil exporters, fiscal adjustment efforts will offset only partially the impact of lower oil prices, while in some other countries fiscal deficits are expected to remain close to the elevated levels of 2014. In the countries hit by Ebola, worsening fiscal positions reflect the efforts to combat the disease.

Downside risks

In that context, the outlook is subject to various downside risks. Countries depending on external financing to cover large deficits are vulnerable to a steep increase in their financing costs that could be triggered, for instance, by the normalization of monetary policy in the United States.

Further weaknesses in Europe and Japan and an abrupt slowdown of growth in China could also lower the demand for sub-Saharan Africa’s products, driving growth lower and widening fiscal imbalances. Meanwhile, further dollar appreciation would make imports more expensive, lower investment and growth, and fuel inflationary pressures.

Region-specific risks also exist. Security-related risks have recently come to the forefront in a number of countries; should these risks escalate, they would generate serious fiscal costs, hamper growth, and deter domestic and foreign investors. In addition, elections in a number of countries in 2015 could complicate the implementation of politically difficult policies; and while there are indications that the Ebola epidemic is coming under control, the situation remains fragile.

Fiscal adjustment and economic diversification

In the short term, faced with a massive shock and limited external reserves and fiscal savings, oil exporters will have no choice but to undertake fiscal adjustment. Where feasible, allowing exchange rate flexibility will be important to help preserve scarce external reserves. In addition, low oil prices provide a unique opportunity to introduce politically difficult energy subsidy reforms across the region.

The current shock is also a powerful reminder of the need to make more rapid progress toward economic diversification. To that end, addressing the infrastructure gap remains critical to allow new higher-productivity sectors to develop and to achieve sustained, high, and inclusive growth. In scaling up investment spending, though, countries should remain mindful of the need to preserve debt sustainability.

Harnessing the demographic dividend

The Regional Economic Outlook also discusses, in two background studies, how countries in the region may benefit from current demographic trends and how they can become more integrated in global trade.

The first study considers the implications of the rapid increase in the sub-Saharan African population, projected to grow to 2 billion by 2050 and 3.7 billion by 2100. As a consequence, the region will become the main source of new entrants into the global labor force over the next 20 years. The experience of East Asia and Latin America, which underwent a similar transition in the past, suggests that these trends could yield a valuable “demographic dividend.”

However, the magnitude of this dividend will critically depend on the speed of decline in fertility rates and on the strength of accompanying policies. The study finds that the largest dividend will be gained if policies are focused on a set of interlinked actions, including fostering private sector development outside agriculture, bridging the infrastructure and human capital gaps, tackling labor market rigidities, and supporting stronger trade ties.

Effectively mobilizing the increase in domestic savings arising from the demographic transition could also spur higher investment and growth. Implementing these policies could lift sub-Saharan Africa’s GDP per capita by as much as 50 percent by 2050.

Better integrating into global value chains

The second study reviews the region’s integration into the global economy, with a special focus on trade and participation in the global value chains. It finds that sub-Saharan Africa has become significantly more open to trade since the 1990s, developing new partnerships with China and other emerging markets as well as trade within the region. However, while the expansion of trade has contributed significantly to growth, productivity gains have lagged those recorded in other regions.

Looking ahead, the study finds that there are still substantial opportunities for further regional and global trade integration. Even after accounting for factors such as low levels of income, small economic size, and distance, trade flows from sub-Saharan Africa are still significantly smaller than in the rest of the world.

Likewise, the region still has some way to go to better integrate into global value chains—a process that in other regions has been associated with higher growth over time. In countries where progress in integrating into value chains has been largest, manufacturing, agriculture and agro-business, tourism, and transport have been the largest contributors.

To leverage this potential and tap the region’s comparative advantages, the study emphasizes the need to improve infrastructure, reduce tariff and nontariff barriers to trade, improve the business climate and access to credit, and improve education.