Transcript of Press Conference of the Intergovernmental Group of Twenty-Four on International Monetary Affairs and Development (Group of 24)

April 21, 2006

Washington, D.C., April 21, 2006Participants:

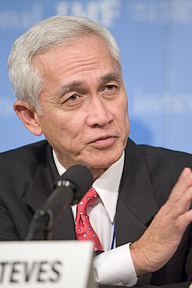

Mr. Margarito Teves, Finance Secretary of the Philippines;

Mr. Jeremias Paul, Alternate Executive Director to the World Bank, Philippines

Mr. Hector Torres, IMF Executive Director for Argentina;

Mr. Jean-Claude Masangu Mulongo, Governor of the Central Bank of the Democratic Republic of Congo; and

Mr. Ariel Buira, Director of the G24 Secretariat

Ms. Gita Bhatt, Sr. External Relations officer, External Relations Department, IMF

| View a Webcast of the press briefing. |

|

MS. BHATT: Good afternoon, ladies and gentlemen. I'm Gita Bhatt from the IMF's External Relations Department. Welcome to the press conference of the Chairman of the Ministers of the Group of Twenty-Four. Let me introduced the distinguished panel at the table. The Chairman of the Ministers of the G-24 at the center is Margarito Teves, Finance Secretary of the Philippines. Representing the Chairman of the Deputies of the G-24 is Mr. Jeremias Paul, Alternate ED at the World Bank. The First Vice-Chairman is Mr. Hector Torres, IMF Executive Director. And the Second Vice Chairman is Mr. Jean Claude Masangu Mulongo, Governor of the Central Bank of the Democratic Republic of Congo. And of course, to my right is the Director of the G-24 Secretariat, Mr. Ariel Buira.

|

We do have simultaneous translation into French and Spanish. Before we open the floor for questions, Mr. Teves will make some opening remarks.

MR. TEVES: Thank you very much. Ladies and gentlemen of the press, our colleagues, Ministers of the different G-24 Members are around and also Deputy Ministers. Good afternoon to all of you. The Ministers of the Group of Twenty-Four met today to discuss issues of common concern. Our communiqué has been distributed to you. There will also be translation into French and Spanish, as pointed out earlier. The following are the highlights of our discussion: first, we welcomed the continued favorable global economic prospects. Nonetheless, we cautioned against complacency, given that high levels of poverty persist in many countries, and important risks to the global economic outlook remain, particularly in connection with the continued widening of global imbalances. These imbalances could unwind in a disorderly manner and lead to sharp movements in interest and exchange rates, an increase in protectionist pressures, and possibly a global recession. Against this background, we reiterated our call for early and meaningful efforts to address the global imbalances and strongly urged a timely, coordinated response on the part of systemically important industrial and developing countries. We called on the IMF to take a more proactive role in coordinating a cooperative solution, including a more focused policy advice on multilateral surveillance. In the area of trade, Ministers were gravely concerned that a successful conclusion to the Doha Round is at risk. We underscored the need to deepen the political commitment on the part of both developed and developing countries to a successful outcome to the Round. We urged the IMF and the World Bank to support the negotiations and cautioned that the recent proposals related to the aid for trade agenda should not be viewed as a substitute for an ambitious Doha Round. Ministers remained concerned that many developing countries are still off track in meeting the Millennium Development Goals. Greater effort is needed to implement the vision of global action and mutual accountability forged in the 2002 Monterrey Consensus, which will require a significant increase in the level of aid and financing. Ministers affirmed their commitment to the principle of mutual accountability, recognizing that increased aid flows must coincide with sound policy formulation and measures to ensure that aid is used effectively. Further efforts are required to improve governance and fight corruption. Ministers welcomed the Medium-Term Strategy for the IMF proposed by the Managing Director. The IMF must exercise much firmer surveillance over systemically important economies and do more to identify and promote effective responses to risks to total global stability, including from global imbalances, currency misalignments, and financial market disturbances. The institution must also do more to help prevent crises. In this regard, we welcomed the Managing Director's proposal for high-access contingent financing, to be provided through a new type of arrangement, a facility that the G-24 has advocated over the past years. Ministers reiterated the need to make rapid progress in increasing the representation of developing countries in the Bretton Woods Institutions in order to improve the credibility and legitimacy of these institutions. This is one of the most pressing issues facing the membership. Concrete progress by the 2006 Annual Meetings will be imperative. We took note of the proposal by the Managing Director of the IMF for a two-stage process, but we have reservations about the lack of clear timelines. We continue to have a strong preference for a comprehensive package that would deal with all the major issues simultaneously within a firm deadline. The comprehensive package should include a new quota formula that reflects more accurately the relative economic size of developing countries in the world economy and a substantial increase in basic votes. Ministers welcomed the World Bank's efforts to develop an investment framework for clean energy and development. They agree that climate change is a serious issue that will have a disproportionately large impact on the economic growth and human development of the poorest countries. Ministers stress that the costs of related measures should not fall disproportionately on the developing world. They also called for continued cooperation between oil consuming and oil producing countries, increased investment in refinery capacity, and efforts to promote alternative energy sources. Thank you. I will now take your questions, and as I reiterated earlier, we have some of the Ministers here, and they are also encouraged to respond to some of these questions. QUESTION: I have a question about the IMF quotas. You said that you have reservations about the lack of timelines. Now, Managing Director de Rato has said that he is hoping to get consensus here tomorrow which could then lead to the whole proposal being signed off in Singapore in September. Are you optimistic that what he is hoping to achieve will be possible here tomorrow and that we will have some decision on the quota issue by September? MR. TEVES: Well, we will be working on this. As indicated, we expressed our preference, but we will have to continuously work on this, and we are hoping that eventually, it will lead to what the G-24 Ministers have indicated in the communiqué. MR. BUIRA: I would perhaps just add a word. You see, there is a concern. The Managing Director proposed a two-stage increase. The first stage would give quota increases, ad hoc increases, to a very few countries that certainly merit them; their quotas are out of line. But the concern is that once you do this, some countries will say you have done the reform, and we don't have to go back to this subject for another 10 or 20 years. And the fact is that the quota increases, the ad hoc increases, could be very small and to a very few countries, and we should like to see a more fundamental review of the whole issue. Let me just bring to your attention one aspect of this: you will see that the communiqué speaks of a new quota formula that reflects more accurately the relative economic size of developing countries in the world economy, taking into account purchasing power parity. Now, what does that mean? It means that you don't measure GDP, you don't convert GDP at market exchange rates. You measure it in terms of purchasing power parity. Now, the difference is very significant, because if this bottle of water is worth $2 in Washington and 20 cents in Guatemala, you will count the GDP of Washington as 10 times bigger for the same bottle. Now, if you put everything, measured it on the same scale, then, you would value it at the same prices everywhere. And let me add a very interesting note to this: in the past, industrial countries who have benefited from the measuring of GDP at market exchange rates have resisted the measuring of the GDP in terms of purchasing power parity. And the fact is that when you measure it at market exchange rates, you introduce a bias against developing countries, because services, you know, if a haircut is $20 or $30, and it's $5 in Ecuador, you would say GDP is so much bigger percent. But the interesting note that I want to call to your attention is that the ambassadors of the U.S. and Japan have now proposed that for purposes of United Nations quotas or contributions to the U.N. budget, countries' GDP should be measured in purchasing power parity. Why is this? Because they realize that when you measure the GDP of a developing country in purchasing power parity, it is much bigger than when you measure it in market exchange rates. So one would have to ask for a little bit of consistency on this matter. QUESTION: How much of a concern are high oil prices, and do you think that your group is particularly affected by them? MR. TEVES: Well, of course, there are countries that are dependent on oil prices more than others among the G-24. For those countries that are largely dependent on oil prices, of course, the adjustments will be very difficult. But as they continue to strengthen their own macroeconomic fundamentals, as they also look for alternative sources of energy, then, to that extent, they will be in a better position to handle large increases in oil prices. However, like most things, we would also welcome the moderation on the part of the oil producing countries with respect to oil price adjustments for the sake of the global economy. QUESTION: Particularly over the last 12 months, we've seen an increase in protectionism, particularly from the U.S. and the EU. I mean, a couple of big instances seen of trying to buy into Unocal, for instance. I was wanting to ask, how much of a threat does the G-24 actually see this rise in protectionism from the big developed countries? Protectionism specifically from the EU and the U.S. MR. TEVES: Actually, protectionism to me is a reaction to the inability of markets from opening up to each other and also to the extent that some countries are facing serious economic difficulties. So again, in our discussions and particularly in relation to the Doha Round, we are hoping that more and more countries, including the developed ones, would open and that a lot of the problems related to global imbalances can be addressed, and countries will continue to strengthen their [inaudible] so they can withstand competition from each other. So I'm hoping that the protectionist tendencies will not prevail over a long period and that more countries will really be open to more trade. MS. BHATT: Mr. Torres, do you have something to add on that? MR. TORRES: Well, protectionism is definitely a challenge and a problem, and a similar phenomenon could be characterized as good or bad depending on from where they're coming. Something could be beneficial FDI if it is investment coming from the industrial world into developing countries, but sometimes, if the money flows in the other sense, it is seen as a challenge, as something you don't want, and presented as, I would say, something negative for the economy. Of course, this is of our concern, and we believe that in order to run across protectionism, the Fund should, and that's what we're trying to do, coordinate action to unwind global imbalances. There is a lot of resentment and misunderstanding, and this is growing. If we let it go ahead, protectionism will have its day. MS. BHATT: Thank you very much. |

IMF EXTERNAL RELATIONS DEPARTMENT

| Public Affairs | Media Relations | |||

|---|---|---|---|---|

| E-mail: | publicaffairs@imf.org | E-mail: | media@imf.org | |

| Fax: | 202-623-6220 | Phone: | 202-623-7100 | |

(From left to right) Mr. Mulongo, Mr. Torres, Mr. Teves, and Mr. Paul

(From left to right) Mr. Mulongo, Mr. Torres, Mr. Teves, and Mr. Paul Mr. Teves

Mr. Teves