Speech at the 44th SEACEN Governors' Conference, by Dominique Strauss-Kahn, Managing Director, IMF

February 7, 2009

Kuala Lumpur, Malaysia, February 7, 2009As Prepared for Delivery

| Download the presentation (108 kb PDF) |

It's a great honor to take part in the SEACEN Governors' Conference and in the celebrations of the 50th Anniversary of Bank Negara Malaysia. The bank's reputation as a careful policymaker and a proactive and innovative supervisor is well known. I would like to thank Governor Zeti for inviting me here today and for her longstanding leadership at Bank Negara and in the international community.

The State of the Global Economy

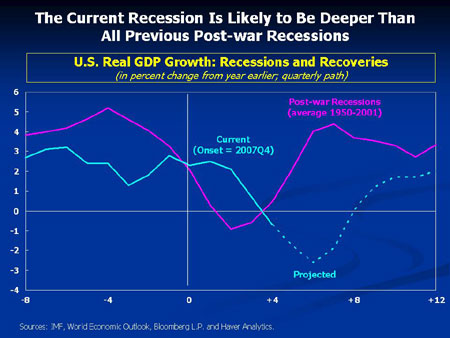

We are meeting at a very grave time in the world economy. Last week the IMF released projections that show that global growth will be close to zero, the worst performance in most of our lifetimes. We are forecasting recessions in most of the advanced economies. There are some prospects of a recovery in 2010, but even this will depend on strong policy action.

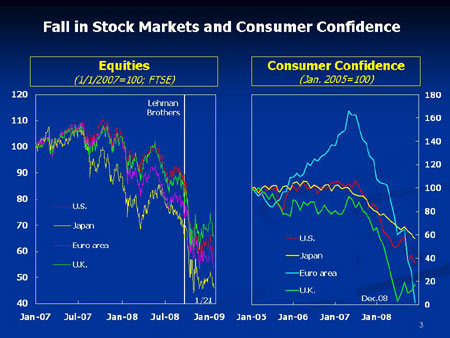

The psychology that lies behind these forecasts is even more disturbing. Around the world, confidence is faltering. Investors have lost confidence in many companies, and especially banks, because they fear that there are further losses to be realized. Consumers are holding back from buying cars and from other big discretionary purchases, because they fear for their jobs.

Loss of confidence is now the central problem. Our central goal should be to restore it. At a global level, this means that governments and central banks need to act decisively so that investors once again feel confident about the solvency of financial institutions. And they should credibly commit to measures sufficient to eliminate the risk of a repeat of the Great Depression.

All governments need to act. Measures to clean up the banks and revive the housing market in the United States are an important part of the solution, and are needed urgently. But they are no longer enough.

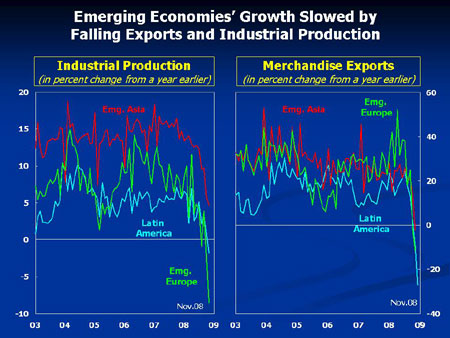

This is because the crisis is now much broader, and it is having profound effects on both advanced and emerging economies. Consider what is happening here in Asia. Every day we hear dire news about exports and industrial production—mirroring the remarkable collapse in global trade and industrial activity.

We have halved our Asian growth forecast for 2009, to about 2½ percent. Why? Because Asia's open economies are especially export-dependent and therefore vulnerable to the ongoing decline in demand in the United States and Europe. So even though Asian countries did not originate this problem they are feeling its consequences intensely.

To contain this crisis we need a coordinated global response. We saw in 2008 that piecemeal responses are not enough. This does not mean that all countries should do the same things, or that there is a "one size fits all" solution. But policy responses have to take into account the interconnectedness of national economies, and the fact that decisions taken in one country can have profound effects on others. Protectionism is a clear danger. Let me give you an example.

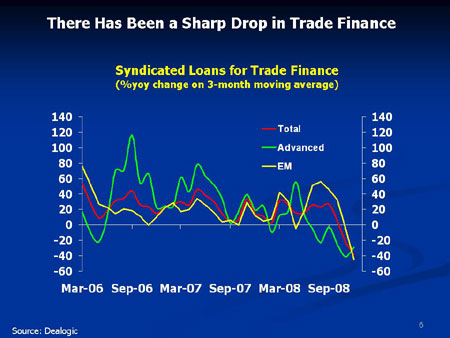

Some countries are trying to make government support of banks conditional on their giving priority to domestic borrowers, to the detriment of financing across borders. This will hurt emerging economies, whose growth depends on access to foreign bank financing. It is protectionism in the financial markets, and its consequences could be as damaging and dangerous as the trade protectionism of the 1930s.

In fact, even without government intervention, we are already seeing a very sharp fall in financing for emerging markets.

These developments should leave no doubt that we need urgent action. We need financial market measures, in order to get credit flowing again. We need monetary and fiscal policy measures, to offset the abrupt fall in private demand. And we need liquidity support for some emerging market countries, to reduce the risk that growth in these countries grinds to a halt if key financing needs are not met. Let me take these issues in turn.

Restoring Stability to Financial Markets

Financial stability is essential to the recovery of the global economy. Policy makers have already acted to address the immediate threats to systemic stability, through massive liquidity support. They have also extended deposit insurance and other guarantees, something that we have learned from past crises, including the Asian crisis, is essential to maintain public confidence.

But more must be done to address the underlying lack of confidence in the solvency of the system, which stems from a lack of confidence that past losses have been properly recognized, and now also concern about new losses—extending well beyond real estate—as the economy turns down.

The task for governments is therefore to push the bank restructuring process forward—with an emphasis on cleansing balance sheets—using its authority to:

• Re-examine bank balance sheets on a worst-case basis, determine the viability of various institutions, and restructure them if required. Authorities need to be ready to respond as needed, including full-fledged intervention.

• Provide public support where necessary to banks that can be rehabilitated, in the form of capital, bad asset carve outs, and guarantees.

• Sell or wind-up insolvent banks quickly, depending on whether any franchise value remains.

• Establish new public resolution agencies to manage "bad assets" to maturity or sale. On this last point, the United States and Western Europe can learn from the previous experience of countries like Korea, Malaysia, Thailand, and also Sweden, which set up such agencies, and often recovered a lot of public money.

Even with these measures, it will take time to restore credit growth. They will also be expensive for governments. But you know very well that the costs of banking crises increase if problems are not addressed quickly. This is not the time for hesitation.

Supporting Aggregate Demand

Fixing the financial sector is essential but it is not enough, given the damaging feedback loop from weaker growth to financial stress. To restore aggregate demand we also need supporting monetary and especially fiscal policies. I have been really impressed with the speed and determination with which central banks have acted—not just the Fed and the ECB but central banks around the world.

For example, the Monetary Authority of Singapore eased monetary policy early in the crisis, and the Reserve Bank of India and the Bank of Korea have perhaps been most aggressive in cutting interest rates. Indeed, central banks across Asia, including here in Malaysia, have been among the most alert to the risks of the crisis, and have acted decisively.

But monetary policy will not be enough to offset the disruption in financial markets and the severity of the downturn. For a year now, since I spoke at Davos last January, the Fund has advocated fiscal stimulus to restore global growth. There is now a broad consensus on this.

Of course, not every country can undertake fiscal stimulus. Some countries—both emerging and advanced economies—cannot finance higher deficits without great risk to their creditworthiness. Some will need to contract their budgets rather than expand them.

But the fact that some advanced and emerging economies cannot or should not engage in fiscal stimulus, makes it all the more important that other countries do their part.

Fiscal stimulus is one way to increase domestic demand, but of course there are others. China is an important case in point. It has room for further fiscal stimulus, and could also rebalance demand toward private consumption by improving the social safety net, and especially social insurance and pensions, so that its citizens do not need such high precautionary savings. Allowing greater flexibility for its currency to appreciate over time would also help. In doing so, China could support both domestic demand and intra-regional trade, because more domestic demand from China would mean more exports for other Asian countries.

Support for Crisis-hit Countries

All countries are affected by the current crisis, but some are affected much more than others, especially by the cut-off in new financing, and by reduced demand for their exports.

In the current crisis, the Fund has already provided substantial support to Hungary, Ukraine, Pakistan, Iceland, Latvia and Belarus. We have increased support to many low-income countries and are ready to do more.

But we are very conscious that the worst effects of the crisis on emerging economies, including Asian countries, are probably still to come, as the cuts in exports and drying up of capital flows that I talked about earlier feed through into countries' economies.

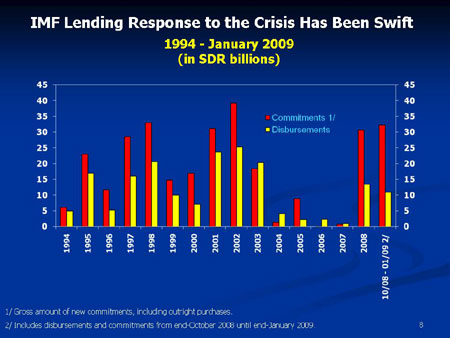

The Fund needs to be ready for this in two ways. First we need enough resources. In November last year the Fund lent more than it has in any single month in its history.

But if this crisis gets worse, the world is going to need to supply much more liquidity to affected countries. Japan has already offered to add $100 billion to the resources of the Fund. We need other countries to follow this generous example and provide the Fund with the means to address the challenges arising from this global crisis.

Second, the Fund needs to adapt to the different circumstances countries face. For example, here in Asia we have to acknowledge and get past the sense of stigma that seems to be attached to a country coming to the Fund for support. One way I see of doing this is for the Fund to collaborate very closely with regional groupings like this one, and like the ASEAN + 3, including through cofinancing.

Policies to Avoid a Future Crisis

Before closing, let me say a few words about some of the changes that we might see in global economic and financial governance.

It is now widely recognized that financial market regulation has to change. Given the globalization of financial markets, we will also need greater international coordination, and all countries—especially those with growing financial centers—must play their part in that.

The IMF has a special role in this process, because of its expertise in assessing the linkages between financial sector and financial market rules and macroeconomic outcomes. This perspective is critical for designing regulatory frameworks and conducting oversight.

Another key issue concerns early warnings. Although there was some prescient analysis before the crisis, in general the warnings were too scattered and unspecific to attract much by way of a domestic—let alone collective—policy response.

We need a less fragmented and more pointed early warning system to bring together the expertise scattered across institutions and to understand key issues well. The past year has made it very clear that risks are not confined to emerging markets. So we should look at all sources of systemic risk, in advanced and emerging market countries alike. This will require better financial and macroeconomic oversight in advanced countries and a stronger response to asset prices surges.

Another issue is how to generate action once warnings are given. Before the crisis, there was almost no international policy coordination. And during the crisis, the initial policy response was far from collaborative, let alone coordinated. For example, countries rushed to protect their own banks with guarantees, at the risk of causing runs in less protected systems in neighboring countries, while liquidity provision has been mostly directed at domestic financial institutions.

There is a need for a central body to assume leadership for responses to systemic risks in the global economy. The G-20 is beginning to play this role, but it does not represent all countries. Can the IMF play this role? I think it can, but first we would need to address deficits in ownership and efficiency. Specifically we need to implement recent agreements on rebalancing quota shares, and also to agree on a timetable for the next stage of quota reform. I hope that we will be able to do both of these things this year.

Conclusion

In concluding, let me return to our present situation. It is easy with hindsight to see some of the causes of the current crisis: the opacity of financial markets, the greed of some bankers, the complacency of regulators and policy makers. I have talked about some of the institutional changes that might make future crises less likely. But first we need to get out of the present danger. It will take clear thinking and a new willingness to cooperate. I see some hopeful signs in this meeting. For 50 years, Bank Negara Malaysia has been a tower of intellectual strength. For 40 years, SEACEN has been an example of cooperation between countries. So let me end by saying again that I am very pleased to be with you today, and I am looking forward to our discussion this morning.

Thank you very much.

IMF EXTERNAL RELATIONS DEPARTMENT

| Public Affairs | Media Relations | |||

|---|---|---|---|---|

| E-mail: | publicaffairs@imf.org | E-mail: | media@imf.org | |

| Fax: | 202-623-6220 | Phone: | 202-623-7100 | |