The Role of Policies to Foster Oil Sector Investment in a Global Context, Remarks by John Lipsky, First Deputy Managing Director, IMF

April 21, 2008

Remarks by John LipskyFirst Deputy Managing Director of the International Monetary Fund

11th Energy Forum/ 3rd International Energy Business Forum

Rome, Italy, April 20-22, 2008

As Prepared for Delivery

| Download the presentation (820 kb PDF) |

1. Good afternoon. It is a great pleasure to participate in this forum. My remarks today will focus on ways in which the international community can foster investment in the oil sector-an issue that has taken on new urgency in light of the increasingly adverse impact of rapidly rising commodity prices.

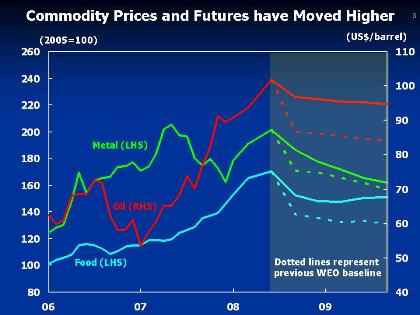

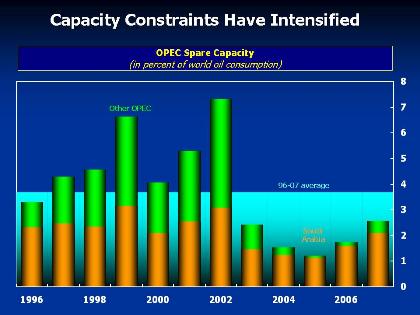

2. Let me begin by discussing the macroeconomic implications of the broad-based commodity price boom that is currently underway. To put this into context, oil prices have increased by about $40 per barrel from their 2007 average, which, according to IMF estimates, would by itself reduce annual global growth in 2008 by between ½ and 1 percentage point if the increase were sustained during the remainder of the year. More broadly, surging commodity prices are affecting budgets, trade balances, headline inflation, and, of course, standards of living almost everywhere.

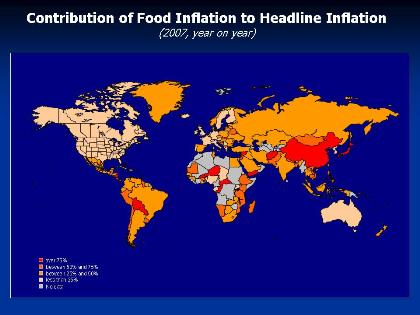

- Earlier this decade, rising commodity prices had only a modest macroeconomic impact as price increases were driven by a broad-based global expansion. Growth in advanced economies remained solid at 3 percent in 2006 and 2.7 percent in 2007 and inflation remained under control. This has, however, begun to change with the recent run-up in food and energy prices. In particular, real disposable income is being eroded, while headline inflation is becoming uncomfortably high—reaching 3.6 percent in the euro area and 4 percent in the United States in the most recent readings—at a time when economic activity is slowing notably. This is complicating monetary policy decision making as central banks tread a fine line between containing inflation and supporting demand.

- In emerging economies, rising commodity prices have had even larger effects on inflation, given their greater weight in consumption baskets. Across all emerging economies, headline inflation rose by one percentage point in 2007 and is expected to rise again by a full percentage point in 2008.

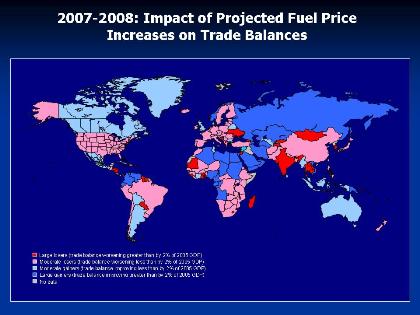

- Some countries, in particular commodity exporters, have clearly benefited on the income side. Budget and trade balances have improved, international reserves have been bolstered. In our latest World Economic Outlook, for example, we project that GDP in the Middle East and Africa will grow by 6.1 and 6.3 percent, respectively, led largely by high commodity prices, despite the sharp slowdown in advanced economies. For some of these economies however, the strong domestic demand and large foreign exchange inflows have raised concerns about overheating, particularly in countries with exchange rate regimes closely linked to the depreciating U.S. dollar.

- For other emerging economies, the commodity boom has had a negative impact. Net commodity importers have experienced deteriorating budget and trade balances and declining disposable income as well as rising inflation,. The recent surge in food prices has been particularly damaging as food accounts for over 40 percent of the consumption basket in many poor countries.

3. Overall, commodity prices, especially those for foods and energy, have now reached levels where they risk becoming a destabilizing force in the global economy. This is a global problem that requires a globally coherent response. National policy decisions must be viewed in a multilateral context. Two examples of the unfortunate international consequences of actions directed at domestic markets are the price spillovers that have resulted from the recent tightening of export restrictions by major rice exporters and from subsidies and protectionist barriers aimed at stimulating the production of biofuels.

4. Another important dimension is the need to achieve a stronger supply response to rising prices. This brings me to the topic of this session-how to foster investment in the oil sector. Policies aimed at improving investment in the oil sector have taken on new urgency. Oil is a critical input at every stage of the production and distribution of goods and other commodities. Thus, measures to increase the supply of oil and improve stability in oil markets should have a salutary effect on other commodity prices as well as the global economy more broadly.

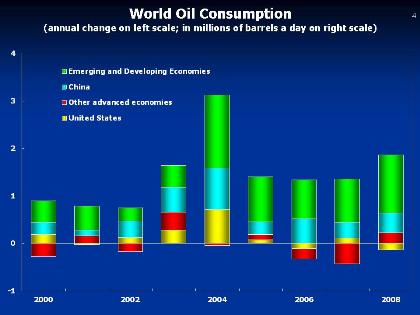

Current Conditions in Oil Markets

5. The sharp surge in oil prices since the beginning of 2007, on top of substantial increases since 2002, has been a wake-up call for public officials and market participants. With global growth slowing, markets expected oil prices to decline below $80 per barrel as late as October of last year. Instead, prices have continued to surge to over $115 per barrel, as after almost two decades of substantial spare capacity, demand has fully caught up with production capacity. While advanced economies are now slowing, emerging market economies have been the main drivers of demand growth, with China, India, and the Middle East alone accounting for almost two thirds of the growth in oil consumption over much of the past decade. So even as the global economy slows by over one percentage point in 2008, we expect oil demand from emerging markets to continue growing at a robust pace.

6. While oil demand has remained robust, the supply side response to rising prices has been disappointing. Supply projections have routinely been revised downward in recent years, particularly for non-OPEC oil producers, including Mexico, Russia, and the United Kingdom. As buffers have dwindled, the oil market has become highly sensitive to news of supply disruptions or geopolitical events.

7. This year, financial factors also appear to have boosted oil prices. The combination of U.S. dollar depreciation, falling short-term interest rates, and disruptions in global credit markets have further strengthened already growing investor interest in oil and other commodities as an alternative asset class. Indeed, inflows into commodity funds and assets have risen markedly in the first quarter of 2008, in a classic investor response, as investors typically buy assets whose price is rising.

8. Looking forward, we expect oil prices to ease modestly as the global economy slows. But the expected declines would only partially reverse the significant cumulative price increases we have seen over the past few years and oil prices would remain around $95 per barrel in 2009. Fundamentally, oil prices are likely to stay at high levels because market conditions are likely to remain tight. In fact, OPEC spare capacity is now about half of its 1996-2007 average level and about one-quarter of its 2002 level and is expected to remain limited for some time.

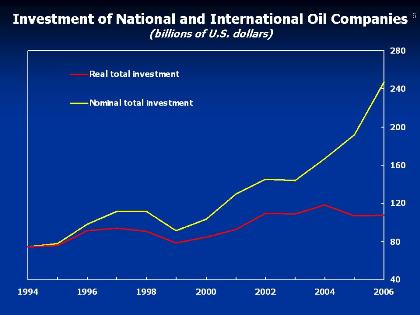

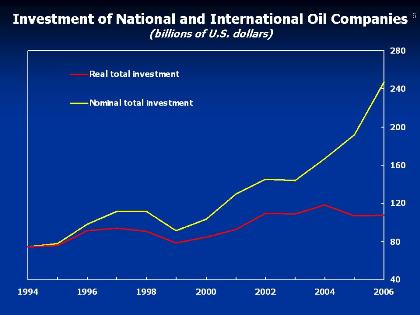

9. Against this background, increased investment in the oil sector has a crucial role to play in improving the supply-demand balance and bringing greater stability to the market. In recent years, capital expenditures have begun to rise more rapidly, as one would have expected, given price developments. However, research by IMF staff shows that this has translated into only modest increases in capacity. Specifically, while nominal oil investment grew by about 60 percent during 2002-06, in real terms investment remained broadly unchanged over this period.

Explaining the Sluggish Investment Response

10. What explains the sluggish real investment response? In short, investment has been constrained by a confluence of cyclical, technological, geological, and policy factors. Turning first to cyclical factors, exploration and development costs have skyrocketed, reflecting in part sector-specific capacity constraints in oil services and other inputs after a 15 to 20-year period of low net investment and stagnating capacity. General capacity constraints associated with the exceptionally strong global expansion and broad-based commodity boom of the past few years have only added to cost pressures. Higher costs imply that less of the higher capital expenditure in current dollars translate in actual capacity additions.

11. Other cost increases are related to technology and geology. As the U.S. National Petroleum Council has noted, new oil fields are smaller in size and involve greater technological and geological challenges, while the decline rates of existing fields in key regions may be higher than earlier estimated. This means development and exploration costs per barrel in new fields are higher in constant dollar terms than they were when older fields were developed-market estimates suggest that average field exploration and development costs have doubled, from $5 a barrel in 2000 to $10 a barrel in 2007, while these costs for marginal fields are now closer to $20 a barrel. Moreover, a greater share of overall investment goes into maintaining production in maturing fields, and the share adding to overall capacity is smaller.

12. Recent IMF studies on oil investment also highlight some policy factors behind the sluggish investment response.

- First, the investment climate and governance in the host country matter. In particular, our work-based on a staff analysis of investment across oil companies-shows that these companies invest at higher rates in countries with better indicators on investment climate and governance. This relationship is apparent even when exploration and production costs are higher than in other countries.

- Second, policy uncertainty is a deterrent to investment. Staff work suggests that the increasing risks of resource nationalization and more frequent changes in the terms of contracts for foreign investors in recent years have had important negative effects on actual output. While this does not always affect current investment and projects, it is bound to affect future investment since expectations of output disruptions will reduce the profitability of projects. In an industry with such long planning horizons, the longer-term effects on investment can be large. The effects are likely to be particularly sizeable if policy changes are perceived to be arbitrary or specifically targeted against partnerships and foreign direct investment.

- Third, corporate constraints can affect investment behavior across different types of firms. IMF research has found that investment rates are not significantly affected by whether the company was publicly or privately owned. Indeed, some of the large, outwardly-oriented national oil companies are investing very rapidly, in some cases with support from their home governments. By contrast, smaller companies-whether private or public-are struggling to ramp up real investment, given cost escalation and geological challenges. At the same time, some more traditional, inward-oriented national oil companies have struggled to scale up investment to increase or, in some cases, just to maintain capacity. In many cases, the problem has been that overly rigid policies have prevented cooperation with foreign partners, which, in turn, has prevented technology transfer.

Policy Challenges

13. This brings me to the policy challenges related to oil investment. As in other commodity markets, a fundamental policy objective must be to foster sustainable supply-demand balances by strengthening the frameworks needed for market forces to operate properly. In this regard, it will be essential to allow oil prices to play their signaling role to influence both supply and demand. I believe there are four central lessons from our analysis.

- First, stable and predictable investment regimes will help encourage adequate investment and ensure future supply. The efforts by the Extractive Industry Transparency Initiative are very helpful in this regard. Regardless of whether production takes place in the private or public sector, governments should strive to ensure that regulatory and tax regimes are transparent and predictable and provide adequate returns for expanding energy supply and infrastructure. Abrupt changes to the contracts or tax regimes by host governments can increase policy uncertainty and be damaging to future investment, in particular for an industry with such long investment cycles. While some contract renegotiations may be unavoidable when contract or tax regimes were not set up flexibly to allow for changing general market conditions, the renegotiations should be conducted in a transparent and businesslike manner.

- Second, acknowledging the changing structure of the oil industry, there are advantages to greater cooperation and synergies between national and international oil companies. Well-designed partnerships could take advantage of their different strengths, thereby increasing investment in the oil industry as a whole. Given that national oil companies today own the majority of the world's reserves, international oil companies are coming to terms with the reality that their future activity may have to increasingly take place in partnerships in which they provide technical expertise in return for a share of returns. In turn, governments will have to work to provide a more stable and transparent investment environment and improve governance standards of their national oil companies.

- Third, reducing imbalances in the oil market requires an orderly, predictable, and transparent market. Data concerning supply and demand conditions need to be readily available, which will enable investors to better anticipate future trends in production, and allow prices to truly signal the scarcity of the resource. It would also help reduce large price swings associated with over- or under-investment. Improved dissemination of data on oil derivatives transactions, as well as better fiscal data from oil-producing countries are essential ingredients for market participants, investors and policy-makers alike to make the right decisions. In this regard, we fully support efforts by the Joint Oil Data Initiative.

- Fourth, the fact that geological and technical challenges are likely to endure suggests that we should not only rely on supply-side policies alone to foster better balance between demand and supply in world oil markets. Policies to strengthen the demand response to price changes will be important as well. Full pass-through of changes in international oil prices to domestic prices would help promote the demand response to changing market conditions, while well-targeted subsidies could protect the most vulnerable groups. Moreover, prices should reflect environmental costs and encourage conservation efforts. Relatively low gasoline taxes in the U.S., low domestic prices in China, and heavily subsidized and controlled prices in many oil-exporting and other developing countries discourage conservation with potentially adverse environmental implications. Policies to increase energy efficiency (for example, through better fuel-efficiency standards) can also go a long way to strengthen the demand response. Clearly, such policies should be implemented in a predictable and transparent fashion so as to avoid potential increases in demand uncertainty that would undermine incentives for higher oil investment.

Concluding Remarks

14. Let me conclude by emphasizing the urgency of policy actions in the area of oil investment, not only for stability in oil markets, but also for stability in the global economy. Oil markets are linked to most industries, and affect all households and all countries. Oil market conditions and policies-as well as those for other commodities-must therefore be considered in a global context. The supply response can be enhanced by improving the stability and predictability of investment regimes, encouraging greater cooperation between national and international oil companies, and increasing transparency through better oil market data. For consumers, policies should aim to achieve full pass-through of international oil prices to domestic prices and to signal environmental costs. Actions are most likely to be successful if undertaken in a multilateral context where everyone does their share to improve the supply-demand balance in oil markets, which in turn would make these markets less vulnerable to shocks and therefore more stable. A more stable oil market is critical to attaining a more stable global economy.

IMF EXTERNAL RELATIONS DEPARTMENT

| Public Affairs | Media Relations | |||

|---|---|---|---|---|

| E-mail: | publicaffairs@imf.org | E-mail: | media@imf.org | |

| Fax: | 202-623-6220 | Phone: | 202-623-7100 | |