Why Fiscal Transparency Matters

Fiscal transparency – the comprehensiveness, clarity, reliability, timeliness, and relevance of public reporting on the past, present, and future state of public finances – is critical for effective fiscal management and accountability. It helps ensure that governments have an accurate picture of their finances when making economic decisions, including of the costs and benefits of policy changes and potential risks to public finances. It also provides legislatures, markets, and citizens with the information they need to hold governments accountable. Greater fiscal transparency can also help strengthen the credibility of a country’s fiscal plans and can help underpin market confidence and market perceptions of fiscal solvency.

The Fiscal Transparency Code and Evaluation are the key elements of the IMF’s ongoing efforts to strengthen fiscal surveillance, policymaking, and accountability among its member countries.

Fiscal Transparency Code

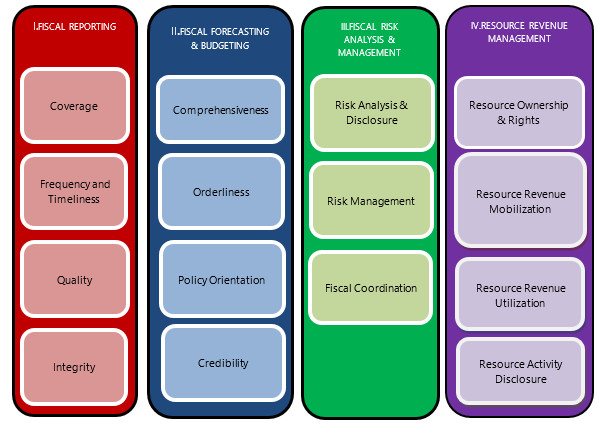

The IMF’s Fiscal Transparency Code (the Code) is the international standard for disclosure of information about public finances. The Code comprises a set of principles built around four pillars (Figure below): (i) fiscal reporting; (ii) fiscal forecasting and budgeting; (iii) fiscal risk analysis and management; and (iv) resource revenue management. For each transparency principle, the Code differentiates between basic, good, and advanced practices to provide countries with clear milestones toward full compliance with the Code and ensure its applicability to the broad range of IMF member countries. Pillars I-III were issued in 2014, while Pillar IV was finalized in January 2019, following two rounds of public consultation and testing in several countries.Four Pillars of the Fiscal Transparency Code

Fiscal Transparency Evaluation

Fiscal Transparency Evaluations (FTEs) are the IMF’s fiscal transparency diagnostic. FTEs provide countries with:

- a comprehensive assessment of their fiscal transparency practices against the differentiated standards set by the Code;

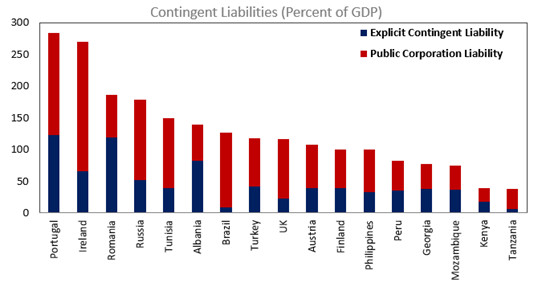

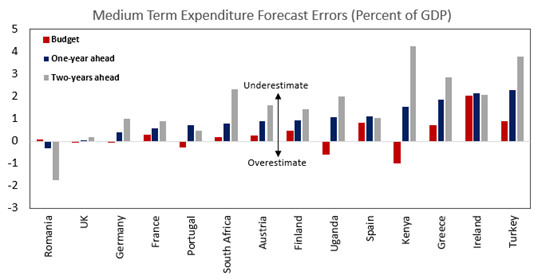

- rigorous analysis of the scale and sources of fiscal vulnerability based on a set of fiscal transparency indicators;

- a more complete picture of public sector activities, by estimating the financial position of the entire public sector;

- a visual account of their fiscal transparency strengths and reform priorities through summary heat maps;

- targeted recommendations to improve fiscal transparency and the option of a sequenced fiscal transparency action plan to help

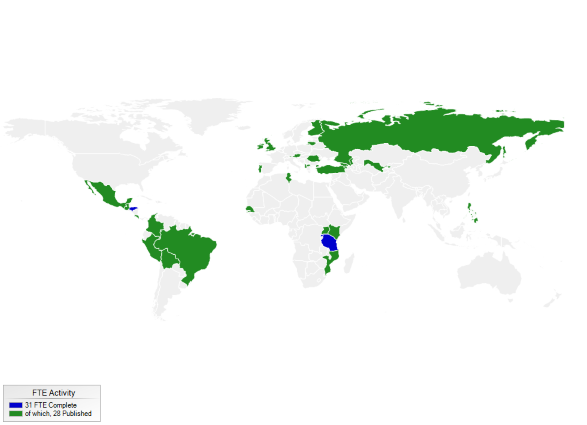

FTEs are carried out at the request of countries. They also support capacity building, including the prioritization and delivery of IMF technical assistance. FTEs have been conducted in over 30 countries to date, across a wide range of regions and income levels and additional FTEs are planned. The IMF’s Fiscal Affairs Department would welcome interest from countries interested in undertaking an FTE.

The results show there is scope for countries to improve their transparency practices, in particular by expanding the coverage of fiscal reports, strengthening the credibility of budget frameworks, and improving the disclosure and management of fiscal risks.