Fiscal Analysis of Resource Industries (FARI)

Good tax policy design requires evaluating fiscal regimes for extractive industries (EI) with economic and financial analysis at the project level. This website introduces key concepts and methodology used by the Fiscal Affairs Department (FAD) in its fiscal analysis of resource industries (FARI) framework. FARI is used in advisory and capacity development work by FAD on fiscal regime design. In parallel to that, FARI has also been used for revenue forecasting and management (including quantification of fiscal rules), integrated in the country macroeconomic frameworks, and revenue risk assessments. In 2016, the IMF published a Technical Note on the FARI methodology and the simplified FARI model. In 2021, updated versions of the simplified models were published with enhanced user-friendliness, transparency, analytical capability, and usability in English, French and Spanish. The IMF also offers an online training course on Macroeconomic Management in Resource-Rich Countries (MRCx) including a FARI module.

Fiscal Modeling of Resource Projects

A. Stages in the life of a resource project

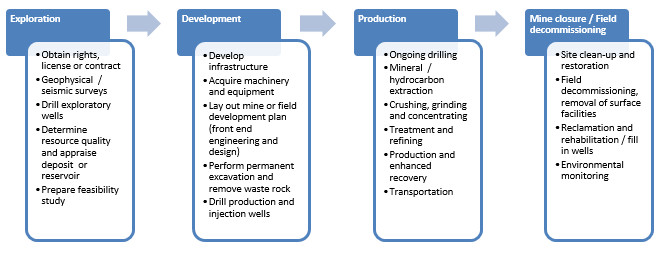

The lifecycle of a resource (both mining and petroleum) project can be divided into four main phases: (i) exploration; (ii) development; (iii) production; and (iv) mine closure or field decommissioning:

B. FARI framework for fiscal modeling

FARI follows a project-level modeling approach to estimate the government’s share of a resource project’s total pre-tax net cash flows (in effect, the economic rent when calculated in discounted terms at a rate equal to the minimum return to capital), as well as the effect of the interactions among the different parameters constituting the fiscal regime. FARI is a simple Excel-based, discounted cash flow (DCF) model set up to reflect tax accounting rules and specific tax payments to the government.

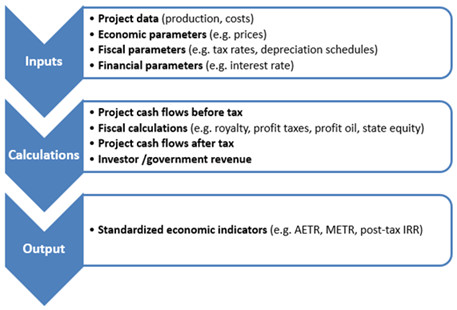

The model inputs include fiscal regime parameters, annual project costs and production volumes, economic assumptions (prices, inflation, interest and discount rates), as well as financing assumptions. The model calculations are done on an annual basis (but could be adapted to shorter intervals if necessary), starting with the calculation of the project net cash flows before any fiscal impositions. Then, the model calculates each fiscal payment according to the fiscal regime parameters. These individual payments are added up to calculate the total government revenue from the project. The results are then used to estimate different indicators that allow for the evaluation of the fiscal regime along relevant criteria.

Fiscal Calculations

A. Project cash flows before fiscal impositions: The cash flows of a resource project mainly reflect the costs associated with the different project phases and its production profile. These constitute the base on which the fiscal calculations are made.

B. Typical calculations for a Tax/Royalty regime: Tax/royalty schemes are more often found in the mining sector, generally comprising taxes on production (commonly known as “royalties”); corporate income tax (CIT); and in some cases, additional rent or profits taxes which in practice come under different names (such as variable income tax, tax surcharge on cash flows, or windfall taxes, to list a few).

C. Typical calculations for Production Sharing Systems: Under a production sharing contract (PSC), the government retains the ownership of the resource in the ground but appoints the investor as “contractor” to develop the resource at its own risk. In return for meeting the exploration and development costs, the contractor receives a share of production, part to recover costs incurred in the project (“cost petroleum”), part as payment for its work (“profit petroleum”). Profit petroleum is what remains from production after the allocation of cost petroleum, and is divided between the government and the contractor according to different production or profitability indicators. In case of unsuccessful discovery, the contractor is not paid anything.

D. Time Profile of Government Revenue: In addition to the net present value (NPV) of total government revenue over the life of the project, it is also important to observe the annual revenue flows. Different types of instruments will ensure different timing of government revenues and the choice among these instruments will determine the sharing of risk between the government and investor. At one end of the spectrum, royalties ensure early and stable receipts to the government but they are usually relatively modest. At the other end of the spectrum, rent-related taxes are triggered later in the life of the project, but are more responsive to increases in profitability.

Results and Implications

A. Fiscal Regime Design and Evaluation with FARI: In its technical assistance work, FAD uses several metrics for fiscal regime evaluation. From an investor’s perspective, key indicators are the post-tax NPV of the project, the post-tax internal rate of return (IRR), the payback period, and the breakeven price. From a government’s perspective, key indicators are the average effective tax rate (AETR), a measure of “government take”, the marginal effective tax rate (METR), and the progressivity of the fiscal regime. These indicators are particularly useful in policy decision making when comparing the existing regime in a country with alternative regimes.

B. International Comparisons: Fiscal regimes can be compared internationally and across alternative scenarios on their AETR, METR, and progressivity. However, as any model, it represents a simplification of reality. FARI focuses on the evaluation of the fiscal regime assuming all other factors remain constant. In cross-country comparison, there are many conditions that affect the decision to invest, such as differences in the size and quality of the deposits across locations, the maturity of the EI sector, or the general business and operating environment. The fiscal regime is just another, though very important, factor that affects investment. The purpose of any comparative analysis in FARI is to examine the properties of different fiscal regimes, as they are packaged in different countries, not to determine the actual government take or investor returns in those locations. Further, the model assumes full efficiency of revenue collection, no international tax planning, and no ring fencing issues. Results thus should be interpreted with care and taking into account all these caveats.

C. Revenue Forecasting: Where fiscal terms, underlying historical data and reliable projections are available, it is possible to interpret with some degree of accuracy the timing and amount of payments that the government should expect to receive from an EI project. The FARI modeling approach has particular value for countries where the resource sector is concentrated around a few large-scale projects. Relevant information can then be extracted and fed into the macro-fiscal model of the country, to include not only resource revenue projections but also data on exports, prices, portfolio and foreign direct investment, interest and debt amortization, and production volumes.

D. Tax Administration: Analysis can be done also on a backward-looking basis, using historic data and actual project outcomes. Where data on actual revenue collection is available by project and, ideally, by fiscal instrument, the FARI framework can be used in revenue administration for tax gap analysis. This is done by reconciling the EI revenues effectively paid to or collected by the government with what the model predicts should have been paid. The benefits of using FARI for tax administration are three-fold: first, discrepancies between the model predictions and actual tax collections may provide useful information on possible sources of revenue leakage, such as accounting manipulation and abusive tax planning; second, it allows the tax authority to set realistic tax collection targets and monitor performance more closely; and third, the exercise allows a better calibration of the FARI model itself improving its revenue forecasting power.