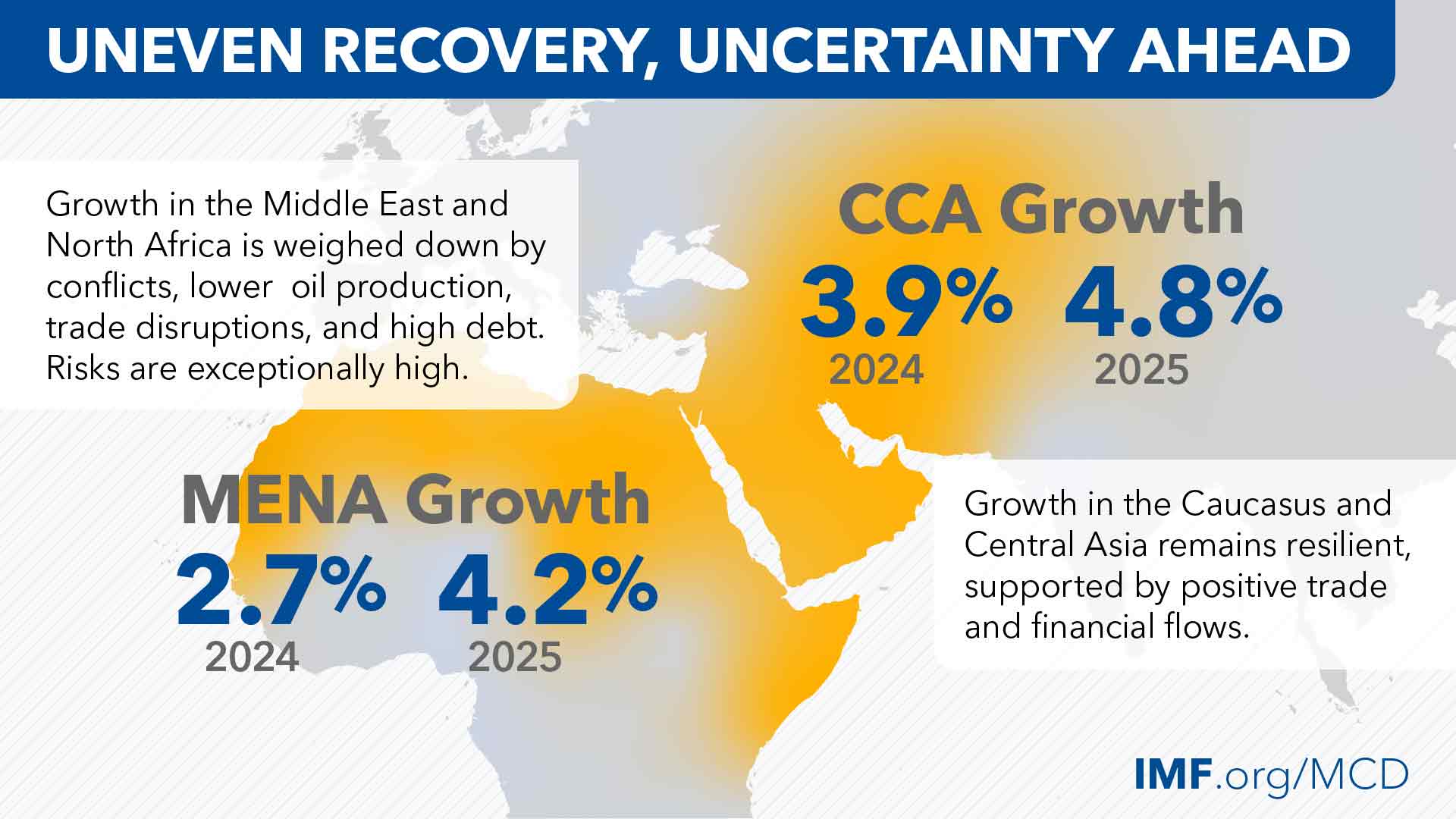

An Uneven Recovery amid High Uncertainty

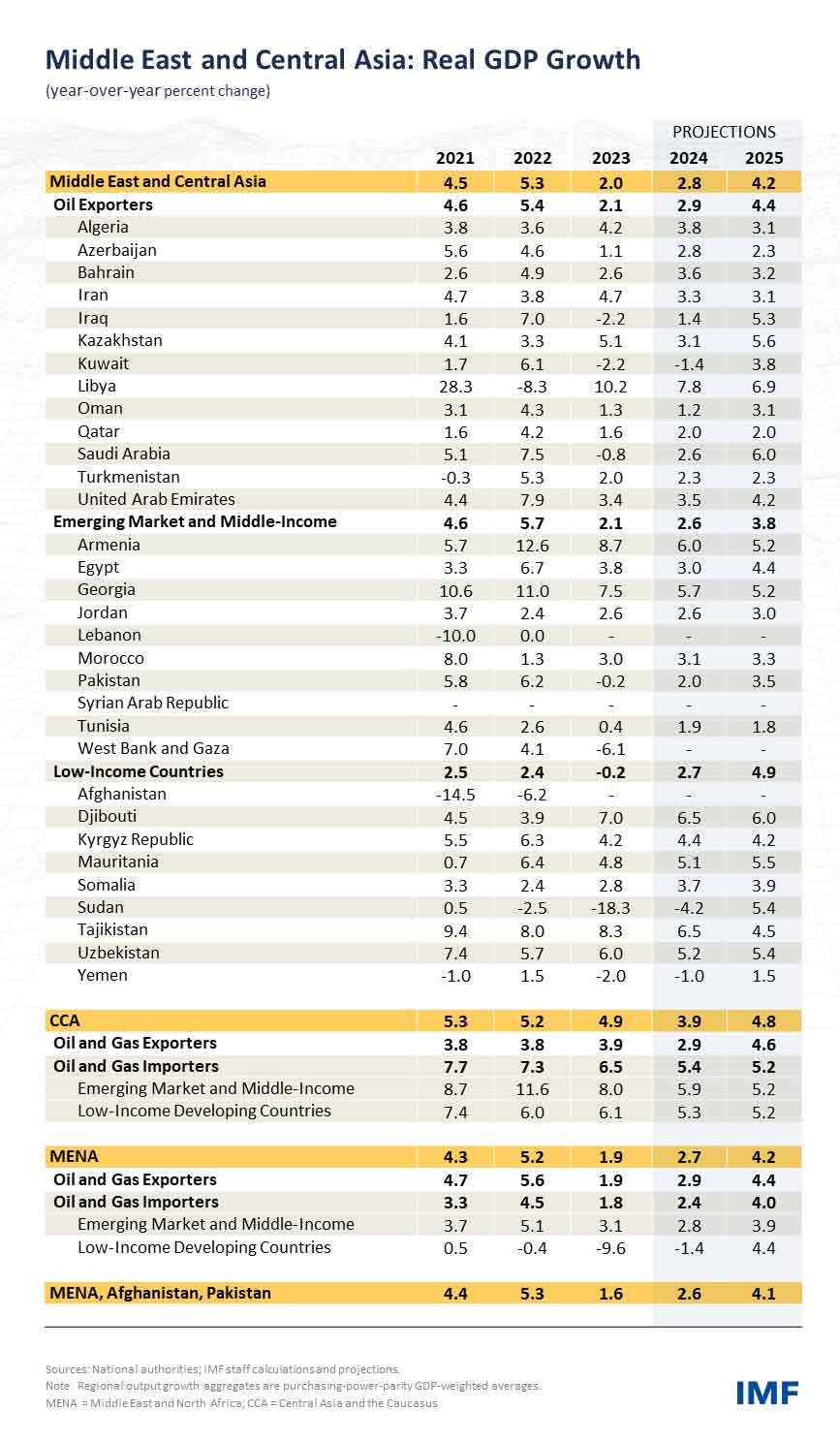

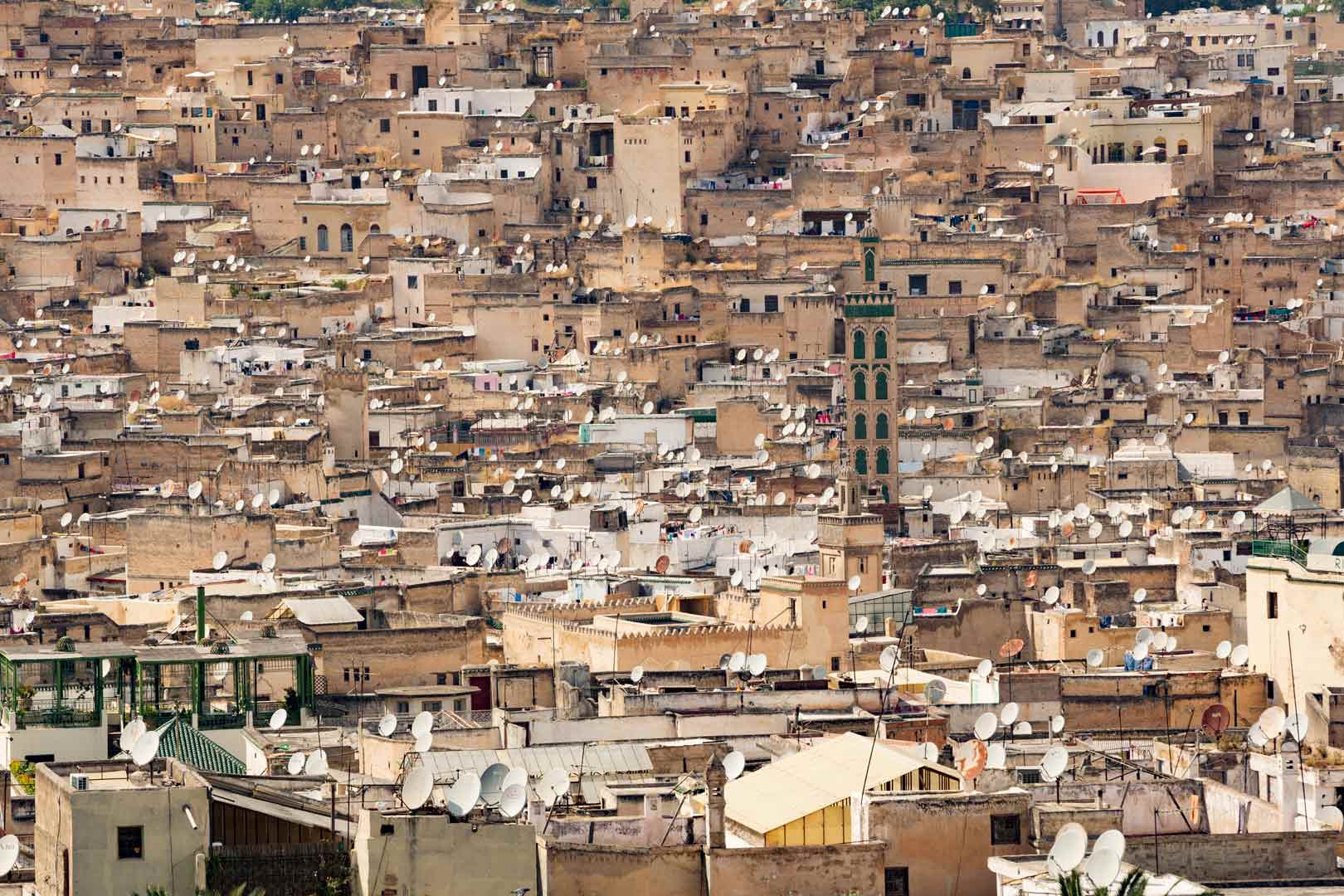

The Middle East and North Africa and the Caucasus and Central Asia regions are positively impacted by the resilience of the global economy. Lower global commodity prices and vigilant policy responses have helped ease inflation in most countries. However, uncertainty and risks have risen amid ongoing conflicts, shipping disruptions, and reduced oil production. This is leading to an uneven recovery across the Middle East and Central Asia, with growth rates varying this year.

Policymakers need to ensure economic stability and debt sustainability while navigating geopolitical risks and improving medium-term growth prospects. Amid high uncertainty, it is essential that countries implement reforms to enhance their fundamentals, including by strengthening institutions. Additionally, countries can seize potential economic opportunities amid shifting trade patterns by reducing long-standing trade barriers, diversifying products and markets, and improving infrastructure.

Chapter 1: An Uneven Recovery amid High Uncertainty in the Middle East and Central Asia

Uncertainty has risen amid ongoing conflicts, shipping disruptions, and reduced oil production. In turn, economic growth in 2024 is projected to be uneven across the Middle East and Central Asia. In the Middle East and North Africa, conflicts continue in several economies. Meanwhile, emerging market and middle-income countries face financing pressures and stubbornly high inflation rates. Some oil exporters are diversifying their economies and strengthening nonhydrocarbon sectors while continuing to make voluntary oil production cuts. In the Caucasus and Central Asia, growth momentum remains robust despite diminishing real and financial inflows related to the war in Ukraine, and oil and gas importers are generally growing faster than exporters due to stronger domestic demand. Inflation is close to historical averages or targets for many economies and is projected to continue easing.

Chapter 2: Fragile Foundations: The Lasting Economic Scars of Conflict in the Middle East and Central Asia

The ongoing conflict between Gaza and Israel is a stark reminder of the persistent challenges posed by regional conflicts in the Middle East and Central Asia. This chapter looks at the economic impact of conflicts in the Middle East and Central Asia compared to other parts of the world over the past 30 years. We find that conflicts have significant negative effects on both near- and long-term economic performance, characterized by higher inflation and lower consumption, investment, exports, and fiscal revenues. Critically, these effects can become entrenched by damaging institutions. Furthermore, the negative economic impact of conflicts in the Middle East and Central Asia tends to be larger and longer lasting than elsewhere, and these adverse effects spill over into neighboring countries.

Chapter 3: Trade Patterns amid Shocks and a Changing Geoeconomic Landscape

The trade landscape is changing within the Caucasus and Central Asia and the Middle East and North Africa regions amid heightened global trade barriers and shocks. Since 2022, increased transit trade and trade diversion have led to a notable increase in overall trade activity in the Caucasus and Central Asia. Similarly, trade patterns, particularly for energy products, have shifted in parts of the Middle East and North Africa. Recent tensions in the Red Sea area have led to considerable trade disruptions in several countries. Our analysis suggests that countries in these regions could continue benefiting from increased trade flows or face trade and GDP losses, depending on the fragmentation scenarios considered. Reducing trade barriers, upgrading infrastructure, and strengthening regulatory frameworks could help Middle East and Central Asian countries reduce risks and harness the gains from trade. Over the medium term, diversifying trade and developing alternative trade routes can build resilience to trade shocks.

Publications

-

September 2024

Finance & Development

- PRODUCTIVITY

-

September 2024

Annual Report

- Resilience in the Face of Change

-

Regional Economic Outlooks

- Latest Issues