Conflict Compounding Economic Challenges

The conflict in Gaza and Israel is yet another shock to the Middle East and North Africa (MENA) region. It

is causing immense human suffering and exacerbating an already challenging environment for

neighboring economies and beyond. This Update covers economies in the MENA region and does not

discuss developments in Israel. Overall, the major factors weighing on regional growth in MENA are

(i) the impact of the conflict; (ii) oil production cuts (even as robust non-oil sector activity continues to

support growth in several oil exporters); and (iii) continued necessary tight policy settings in several

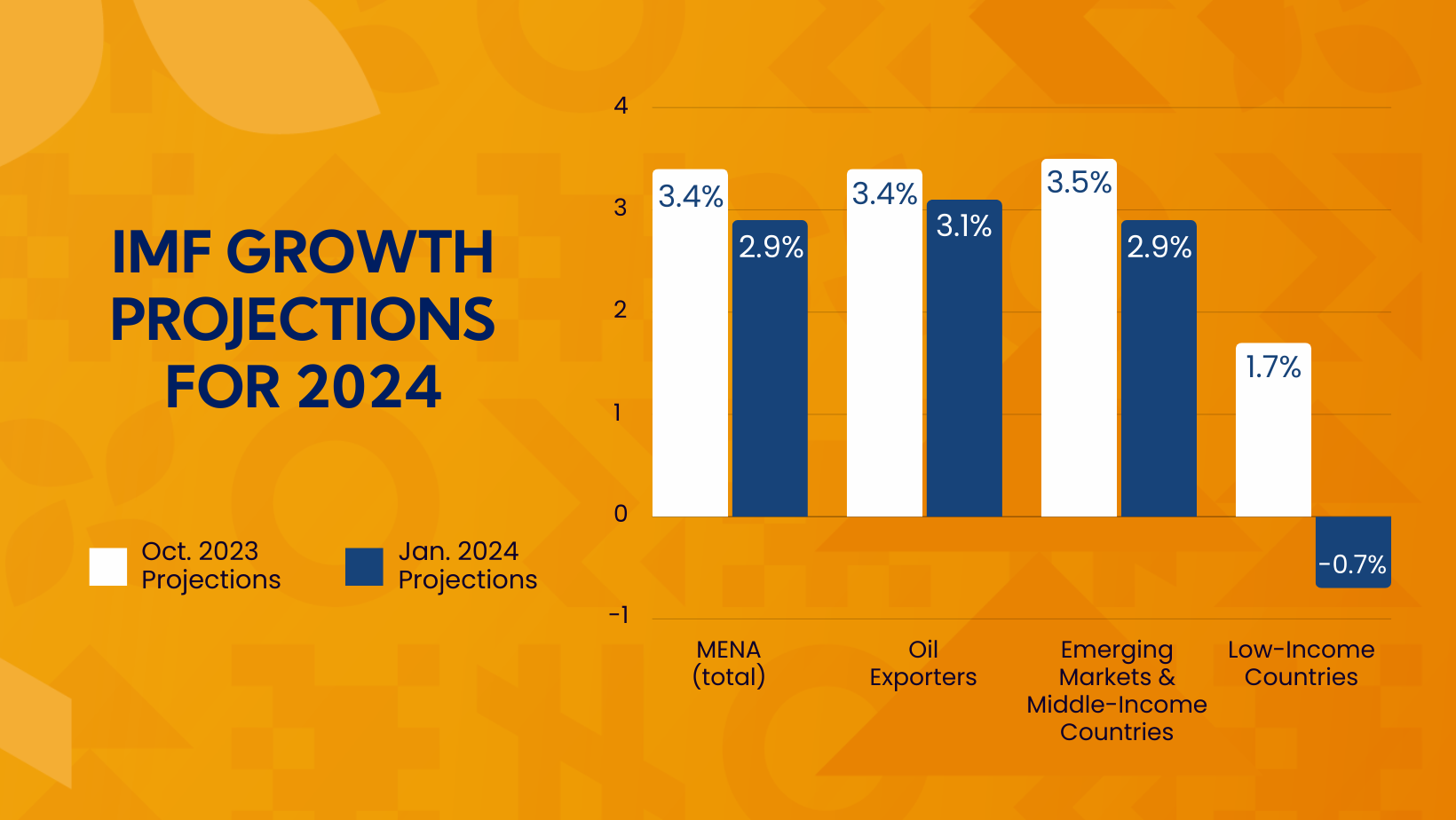

economies. Social unrest has also picked up. Projected growth in the MENA region this year is

downgraded by 0.5 percentage point to 2.9 percent (relative to the October 2023 Regional Economic

Outlook: Middle East and Central Asia), from already weak growth of 2.0 percent in 2023. Primarily driven

by the ongoing conflict in Sudan, average growth across low-income countries (LICs) in MENA is forecast

to remain negative this year, continuing the estimated sharp decline in 2023. Disinflation is expected to

continue in most MENA economies, although price pressures have proven persistent in some cases

because of country-specific factors.

The outlook for the MENA region is highly uncertain, and downside risks are resurgent. An escalation or

spread of the conflict beyond Gaza and Israel, as well as an intensification of the disruptions in the Red

Sea, could have a severe economic impact, including on trade and tourism.

The appropriate policy response will depend on countries’ exposure to the conflict, preexisting

vulnerabilities, and policy space. Crisis management and precautionary policies will be critical where the

impact is acute, or risks are elevated. Elsewhere, countries will need to continue to fortify buffers.

Monetary policy will need to remain focused on price stability, and fiscal policy should be tailored to

country needs and available fiscal space. Structural reforms remain critical to boosting growth and

strengthening resilience in both the near and longer terms.

Publications

-

September 2024

Finance & Development

- PRODUCTIVITY

-

September 2024

Annual Report

- Resilience in the Face of Change

-

Regional Economic Outlooks

- Latest Issues