Middle East and Central Asia

Regional Economic Outlook: Middle East and Central Asia Update

April 2019

Growth for countries in the Middle East, North Africa, Afghanistan, and Pakistan (MENAP) region has weakened but remains broadly stable in the Caucasus and Central Asia (CCA). Volatile oil prices, restrained oil production, and tighter domestic monetary conditions in most oil exporters add to headwinds from slowing global growth. Elevated public debt in oil importers limits capacity to address critical infrastructure and social needs, restrains growth, and leaves economies vulnerable to external shocks. A more challenging external environment increases the urgency across all regions of further growth-friendly fiscal consolidation and structural reform efforts to enhance resilience and deliver higher and more inclusive private-sector-led growth.

MENAP Summary

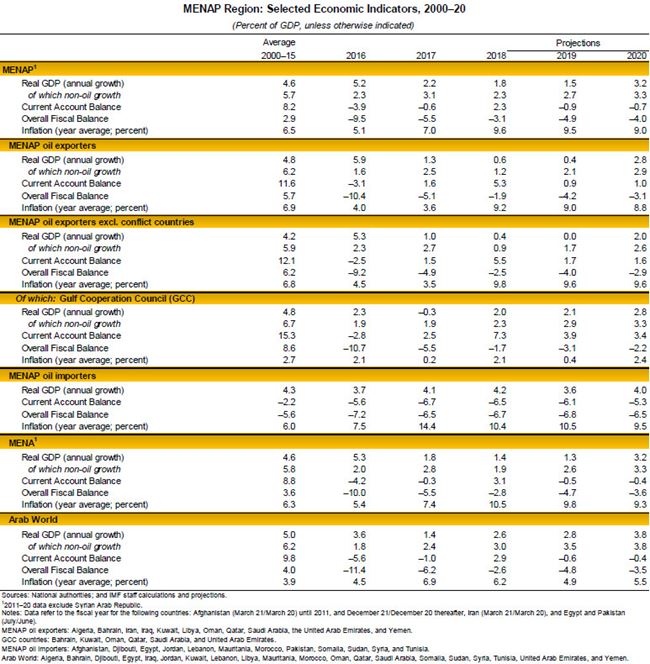

Slowing global growth and elevated trade and geopolitical tensions are posing economic challenges for countries of the Middle East, North Africa, Afghanistan, and Pakistan (MENAP) region, according to the IMF’s latest update to the Regional Economic Outlook. In addition, low and volatile oil prices are negatively affecting some countries, while others grapple with rising public debt.

Growth for oil exporters is projected to dip slightly in 2019 to 0.4 percent from 0.6 percent the previous year, driven by an economic contraction in Iran following the renewal of sanctions. Meanwhile, growth in Gulf Cooperation Council countries is expected to be 2.1 percent in 2019, only a modest improvement from 2 percent growth the year before. Oil production cuts and ongoing fiscal consolidation in countries such as Bahrain, Oman, and the UAE are contributing to this more subdued growth outlook.

Global Developments : Implications for the Middle East and Central Asia Regions

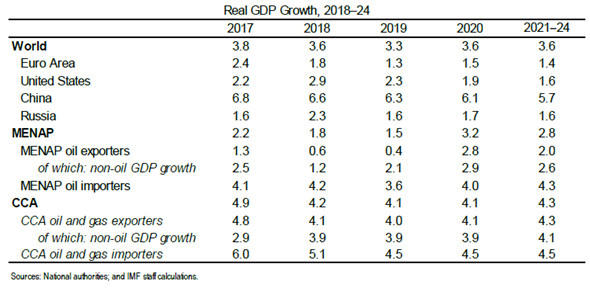

Global growth is projected to slow this year to 3.3 percent, followed by a precarious recovery in 2020 (see the April 2019 World Economic Outlook). Prospects for growth have deteriorated over the past year, and the forecast for 2019 is over half a percentage point lower than projected one year ago. Although the magnitude of the expected slowdown is broadly similar worldwide, its drivers are varied and country-specific (see table). In Europe, disruption to automobile production in Germany, fiscal concerns, protests, and uncertainty about Brexit dampen the outlook. In China, growth is hindered by trade tensions and needed regulatory tightening to rein in shadow banking. And in Russia, lower oil prices and uncertainties from sanctions will likely reduce future growth.

Weaker external demand, particularly from key trading partners (China, Europe, and Russia), represents a key challenge to countries across the Middle East and Central Asia. The recent decline in oil prices will also adversely impact oil-exporting countries. In October, prices peaked at over $80 a barrel. And with supply disruptions in Iran, Libya, and Venezuela further increases seemed possible. Since then, oil prices have declined sharply because of weaker global growth, strong production in the United States, and temporary sanctions waivers for some Iranian oil exports. As a result, prices fell as low as $50 a barrel in January, although they have recovered recently to nearer $65 (see figure). At the same time, oil prices became increasingly volatile.

While over the very long term the outlook for oil is largely unchanged, prices are projected to remain lower than in the fall forecast for several years. The impact on output and fiscal positions is another common challenge for countries across the region, particularly for some oil exporters (Algeria, Bahrain, Oman).

MENAP Oil-Exporting Countries : Feeling the Impact of Lower and More Volatile Oil Prices

Growth in oil exporters of the MENAP region is projected to remain subdued relative to 2018 amid lower oil prices, restrained oil production, and slowing global growth. Policymakers will face the challenging task of resuming fiscal consolidation while sustaining growth in a more uncertain external environment, including bouts of oil price volatility that are likely to persist in the near term. Anchoring fiscal policy in a medium-term framework would help insulate economies from oil price volatility and gradually rebuild fiscal space; addressing structural weaknesses and tackling corruption, including better access to finance for small and medium enterprises (SMEs), will help diversify economies, create jobs, and promote higher and more inclusive growth.

MENAP Oil-Importing Countries : Managing Vulnerabilities When the Economic Outlook Is Uncertain

Growth in oil importers of the MENAP region is projected to remain relatively modest, constrained by persistent structural rigidities. Elevated public debt in many countries limits the fiscal space needed for critical social and infrastructure spending and leaves economies vulnerable to less favorable financial conditions. The outlook remains clouded by mounting global trade tensions and financial market uncertainty. Social tensions are rising in many countries as unemployment remains high and socioeconomic conditions worsen. Continued growth-friendly fiscal consolidation is needed to rebuild buffers and enhance resilience, along with intensified structural and governance reforms to improve competitiveness, boost private investment, and generate jobs. Increased regional integration will also help support medium-term growth.

MENAP Online Annex

This annex describes the construction of a new Reported Social Unrest Index (RSU). This is a timely and high-frequency indicator that seeks to consistently quantify social unrest in seven countries: Algeria, Egypt, Jordan, Lebanon, Morocco, Sudan and Tunisia, since 2005.

The RSU is constructed using the monthly count of articles which mention keywords related to protest or social unrest in 17 leading US, U.K. and Canadian newspapers and broadcasting companies. The primary source is Dow Jones’ Factiva news aggregator, which contains around 27 million articles from these sources between January 2005 and February 2019. Data is available daily up to the previous day, although we aggregate by month.

The construction of an index based on automated text-searches naturally raises some concerns about the accuracy and the influence of media bias. We address these concerns in several ways. First, by acknowledging directly that this is an index of reported social unrest, encouraging the user to account for bias as they see fit. Second, by implementing a human audit process to check that articles captured genuinely do refer to protest. And third, running a broad battery of robustness tests examining alternative specifications for the search terms, language and news sources. We also compare the RSU to other measures of social conflict and mass mobilization, finding broad agreement with alternate measure, but with much-improved coverage and timeliness.

CCA Summary

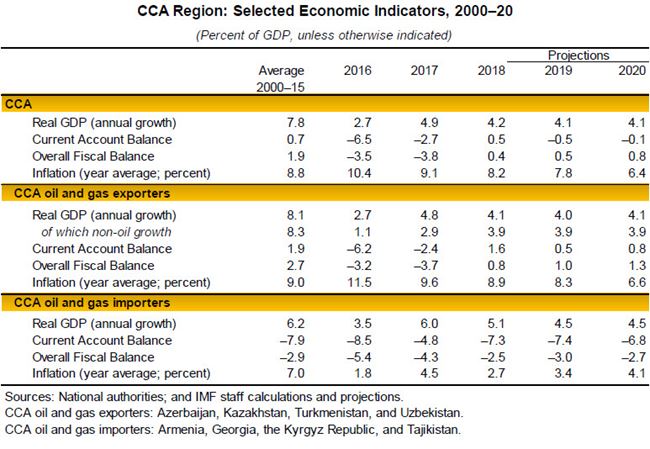

Growth in the Caucasus and Central Asia (CCA) region remains stable but is still too low to lift living standards over time, according to the IMF’s latest update to its Regional Economic Outlook. What’s more, addressing the region’s legacy challenges and finishing structural reforms has taken on greater urgency amid a weaker global economic outlook.

With growth projected at 4.1 percent in 2019 and 2020, the CCA region’s outlook is little changed from the 4.2 percent growth seen last year. While lower oil prices and weaker economic prospects for key trading partners are expected to result in a deceleration of oil-related growth, that will mostly be offset by a recovery in non-oil growth in Kazakhstan as well as gas production in Azerbaijan. Inflation pressures are also easing, with nearly every country in the region expected to see a moderation in prices.

Caucasus and Central Asia : Addressing Legacy Challenges amid Global Uncertainties

Growth in the CCA region stabilized after recovering from large external shocks during 2014–16, benefiting from efforts to strengthen macroeconomic policy frameworks. Nevertheless, growth remains too low to raise the region’s living standards. Legacy challenges from banking system risks and incomplete institutional and structural reforms hinder investment and productivity gains, restraining activity and threatening the region’s medium-term growth potential. Addressing vulnerabilities is more urgent amid global growth and policy uncertainty. Decisive policies to repair financial systems, complete transitions to modern monetary policy frameworks, remove structural rigidities, and improve governance are key to boosting economic resilience, enhancing competitiveness, and ensuring higher medium-term inclusive growth.

Statistical Appendix

Tables | ExcelThe IMF’s Middle East and Central Asia Department (MCD) countries and territories comprise Afghanistan, Algeria, Armenia, Azerbaijan, Bahrain, Djibouti, Egypt, Georgia, Iran, Iraq, Jordan, Kazakhstan, Kuwait, the Kyrgyz Republic, Lebanon, Libya, Mauritania, Morocco, Oman, Pakistan, Qatar, Saudi Arabia, Somalia, Sudan, Syria, Tajikistan, Tunisia, Turkmenistan, the United Arab Emirates, Uzbekistan, the West Bank and Gaza, and Yemen.

The following statistical appendix tables contain data for 31 MCD countries. Data revisions reflect changes in methodology and/or revisions provided by country authorities.