We Can Do Better

October 17, 2024

Five years ago in this hall I delivered my first curtain-raiser as head of the IMF.

At that time my main concern was a synchronized slowdown in global growth. Only months later it paled in comparison with the sudden shock of the pandemic, followed by other dramatic events—the tragic wars in Ukraine and the Middle East, the cost-of-living crisis, and a further fracturing of the global economy.

Next week, the world’s finance ministers and central bank governors will converge here to reflect on where we are, where we are headed, and what to do about it. Let me offer you a preview of what this conversation will look like.

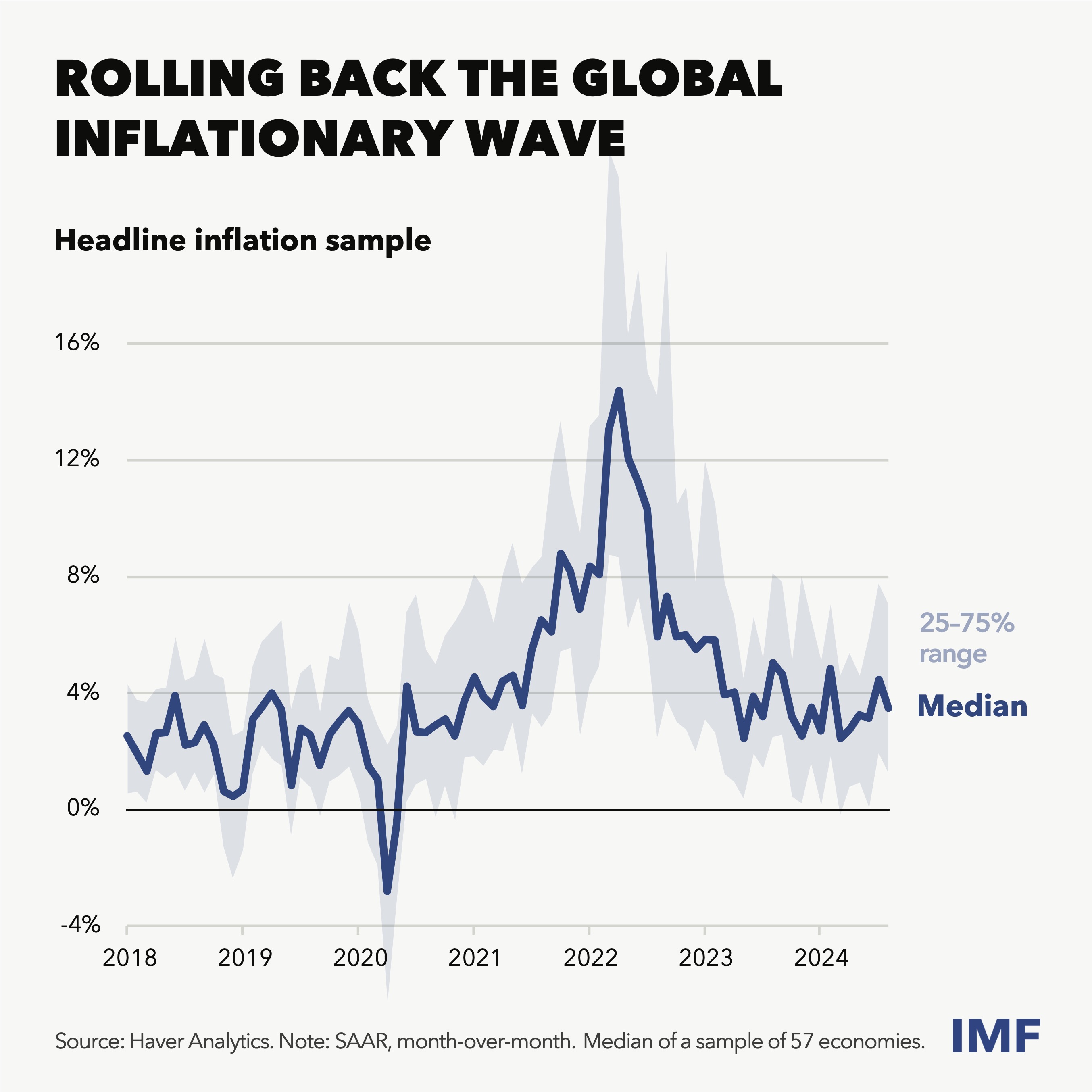

First, we will cherish the good news—and rightly so, because we haven’t had much of it lately. The big global inflation wave is in retreat. A combination of resolute monetary policy action, easing supply chain constraints, and moderating food and energy prices is guiding us back in the direction of price stability.

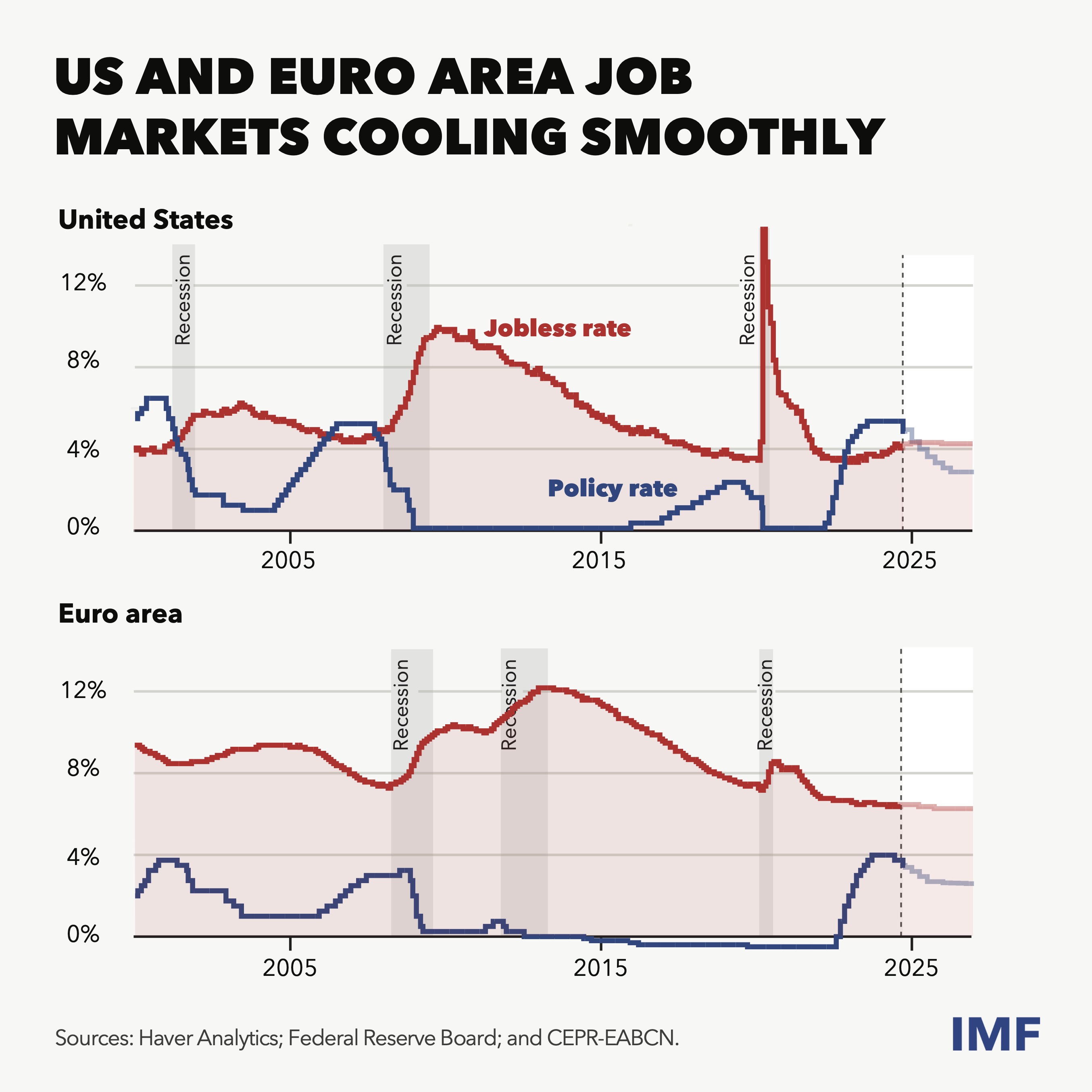

And this has been done without tipping the global economy into recession and large-scale job losses—something we saw during the pandemic and after past inflation episodes, and which many feared we would see again. Both the US and euro area labor markets, to take two examples, are cooling in an orderly manner.

This is a big achievement.

Where did this resilience come from? Answer: from strong policy and institutional foundations built over time, and from international policy cooperation as countries learned to act fast and act together. We are benefiting from central bank independence in advanced economies and many emerging markets; years of prudential reforms in banking; progress made in building fiscal institutions; and capacity development worldwide.

But, despite the good news, don’t expect any victory parties next week—for at least three reasons:

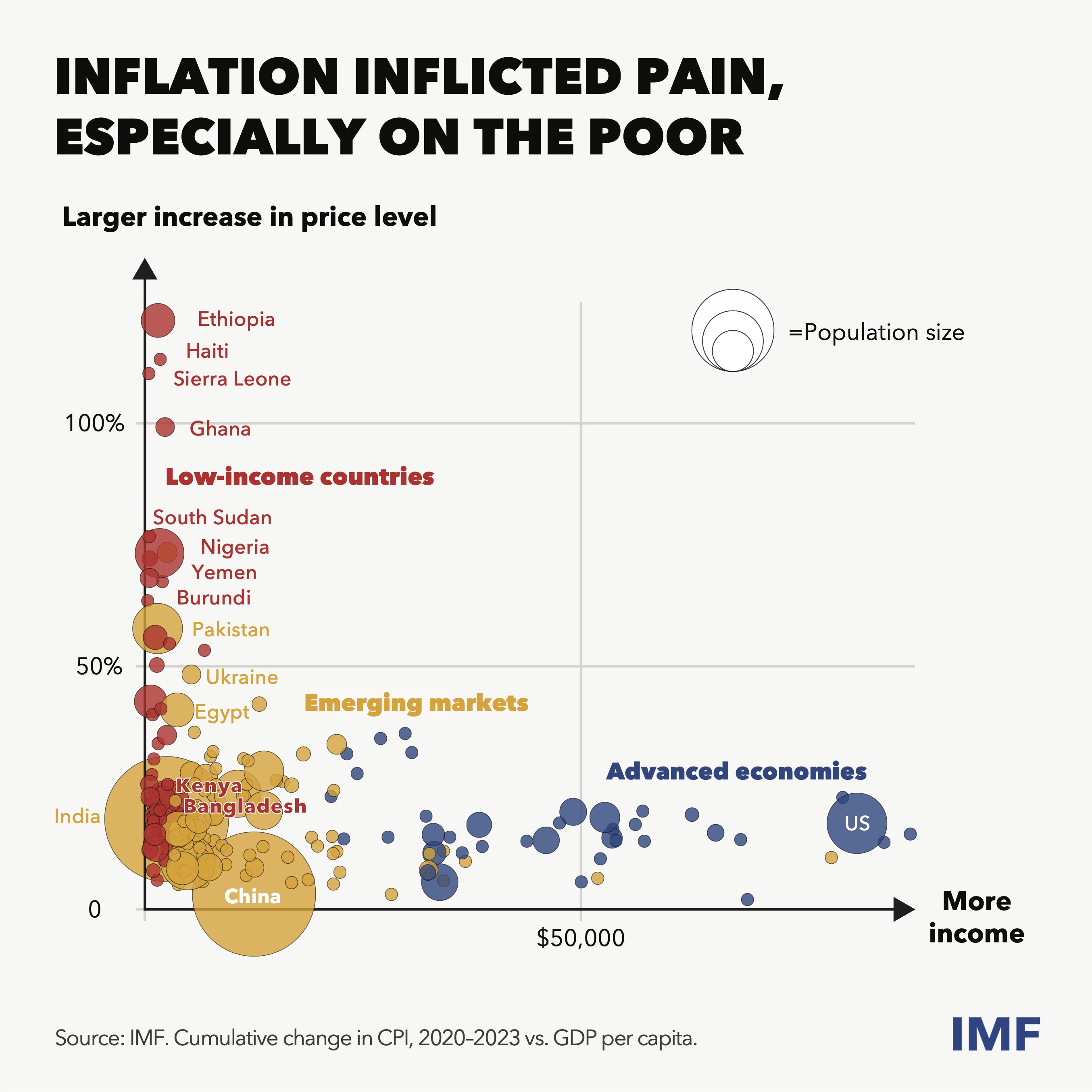

- For one thing, inflation rates may be falling, but the higher price level that we feel in our wallets is here to stay. Families are hurting, people are angry. Advanced economies saw inflation rates at once-in-a-generation highs. So too did many emerging market economies. But look how bad the situation was for the low-income countries. At the country level and at the level of individuals, inflation always hits the poor the hardest.

- Even worse, we are in a difficult geopolitical environment. We are all very worried about the expanding conflict in the Middle East and its potential to destabilize regional economies and global oil and gas markets. Its humanitarian impact, alongside the prolonged wars in Ukraine and elsewhere, is heartbreaking.

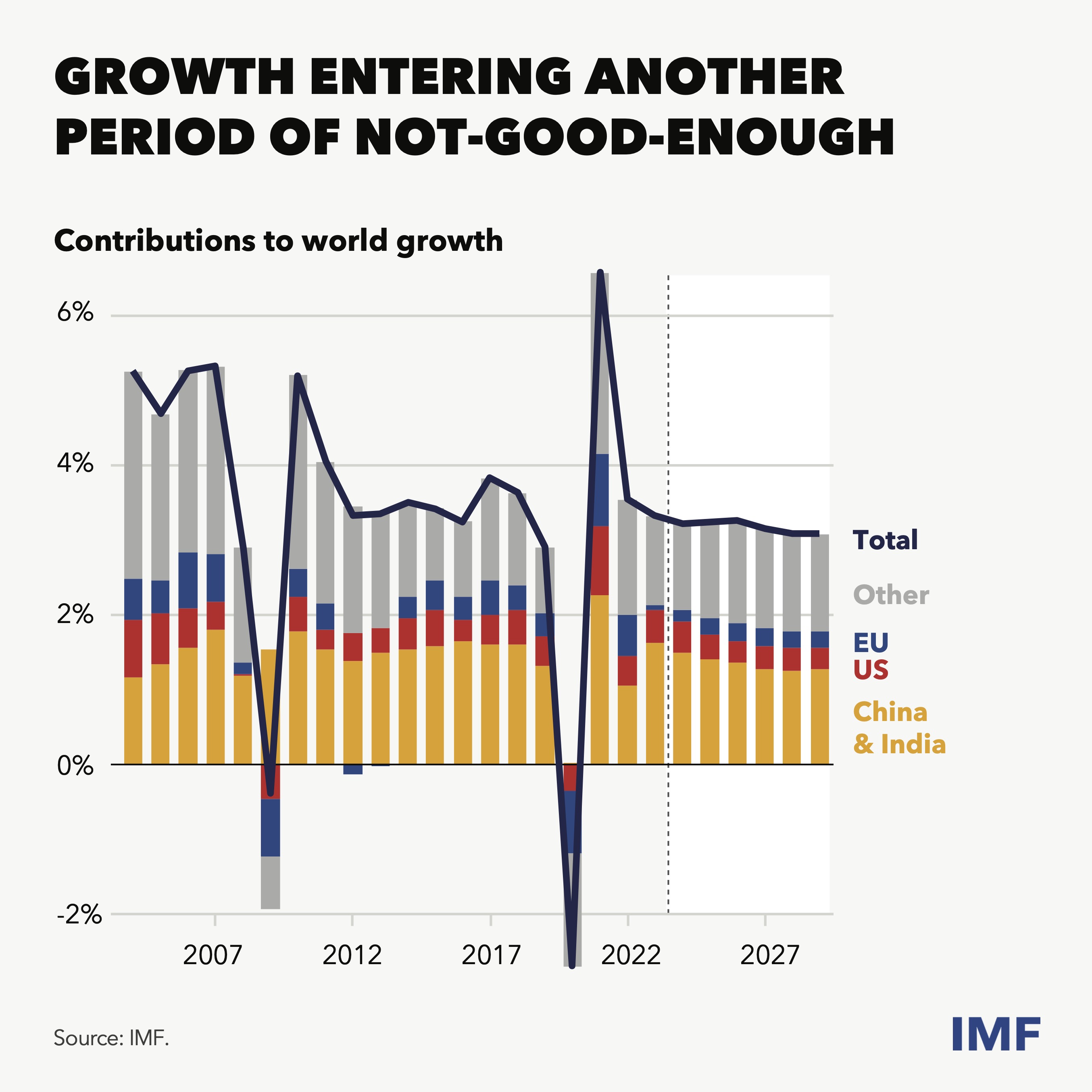

- And on top of it all, this is happening at a time when our forecasts point to an unforgiving combination of low growth and high debt—a difficult future.

Let’s take a closer look: medium-term growth is forecast to be lackluster—not sharply lower than pre-pandemic, but far from good enough. Not enough to eradicate world poverty. Nor to create the number of jobs we require. Nor to generate the tax revenues that governments need to service heavy debt loads while attending to vast investment needs, including the green transition.

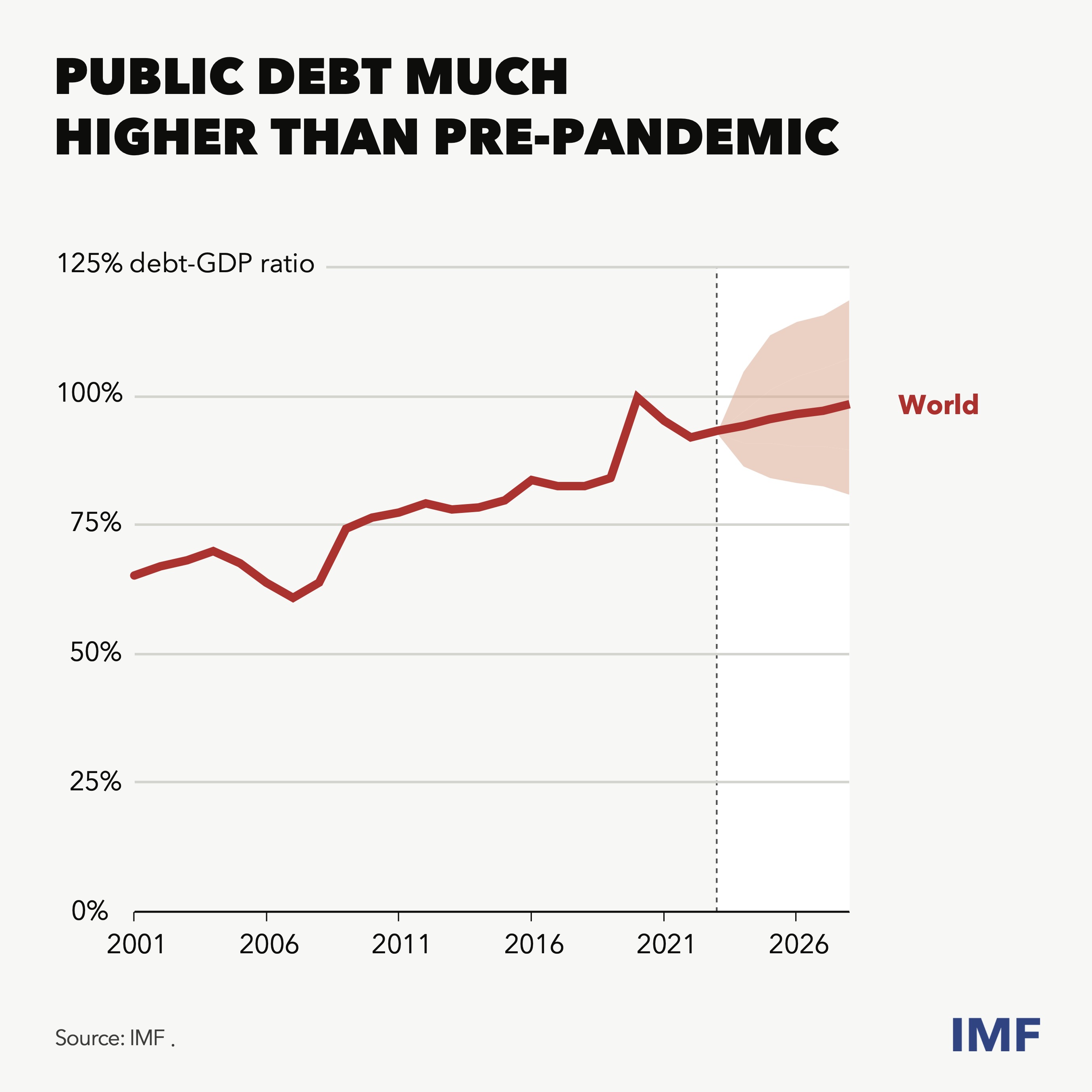

The picture is made more troubling by high and rising public debt—way higher than before the pandemic, even after the brief but significant fall in debt-to-GDP as inflation lifted nominal GDP. And do please notice the shaded area in the chart—what it shows is that, in a severe but plausible adverse scenario, debt could climb some 20 percentage points of GDP above our baseline.

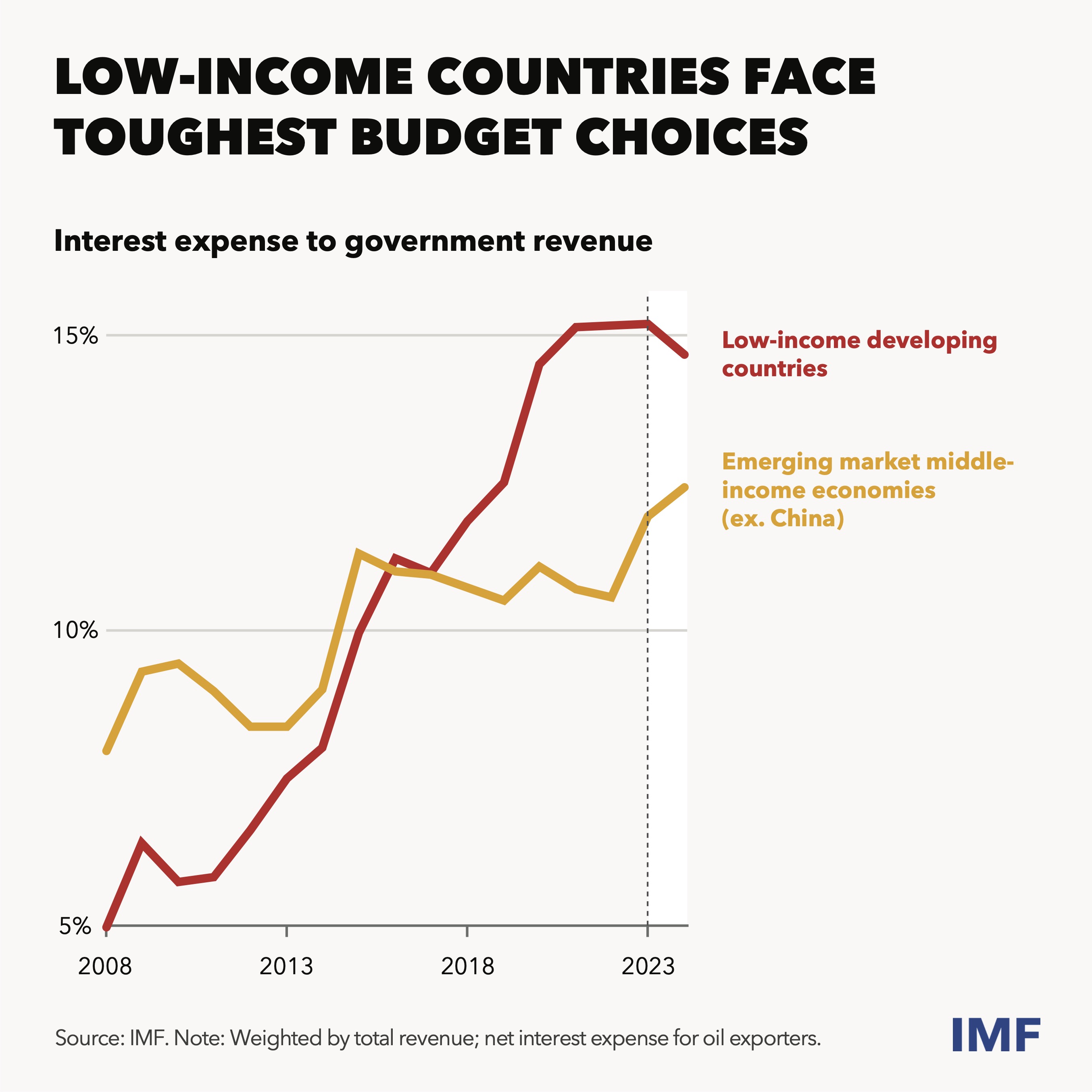

What does this mean for “fiscal space”? To answer this, let’s look at the share of government revenue consumed by interest payments. This is where high debt, high interest rates, and low growth come together—because it is growth that generates the revenues governments need to function and invest. As debt increases, fiscal space contracts disproportionately more in low-income countries—not all debt burdens are made the same.

And fiscal space keeps shrinking. Just look at the frightening evolution of the interest-to-revenue ratio over time. We can immediately see how the tough spending choices have become tougher with higher debt payments. Schools or climate? Digital connectivity or roads and bridges? That is what it comes down to.

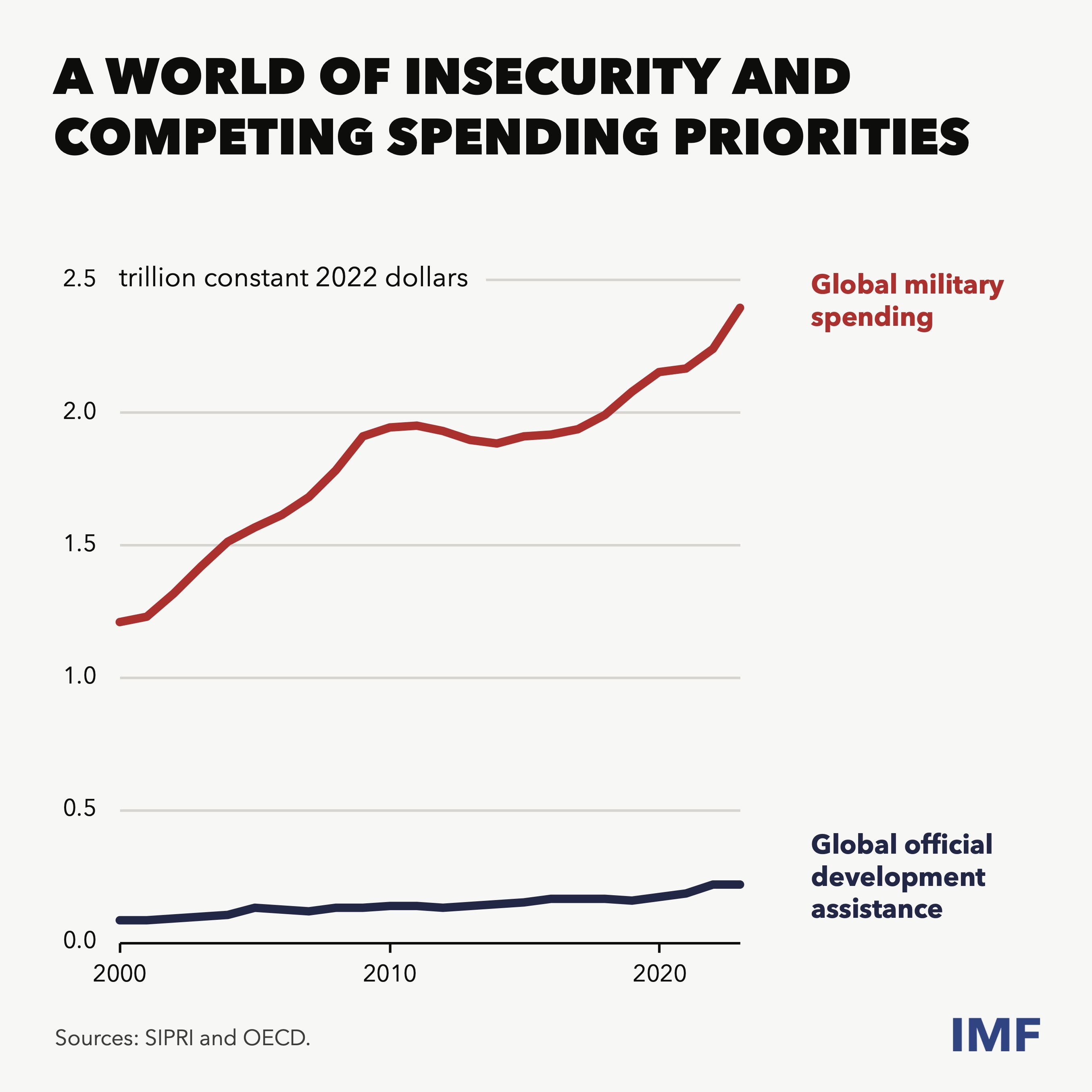

To make matters worse, we live in deeply troubled times. The peace dividend from the end of the Cold War is increasingly at risk. In a world of more wars and more insecurity, defense expenditures may well keep rising while aid budgets fall further behind the growing needs of developing countries.

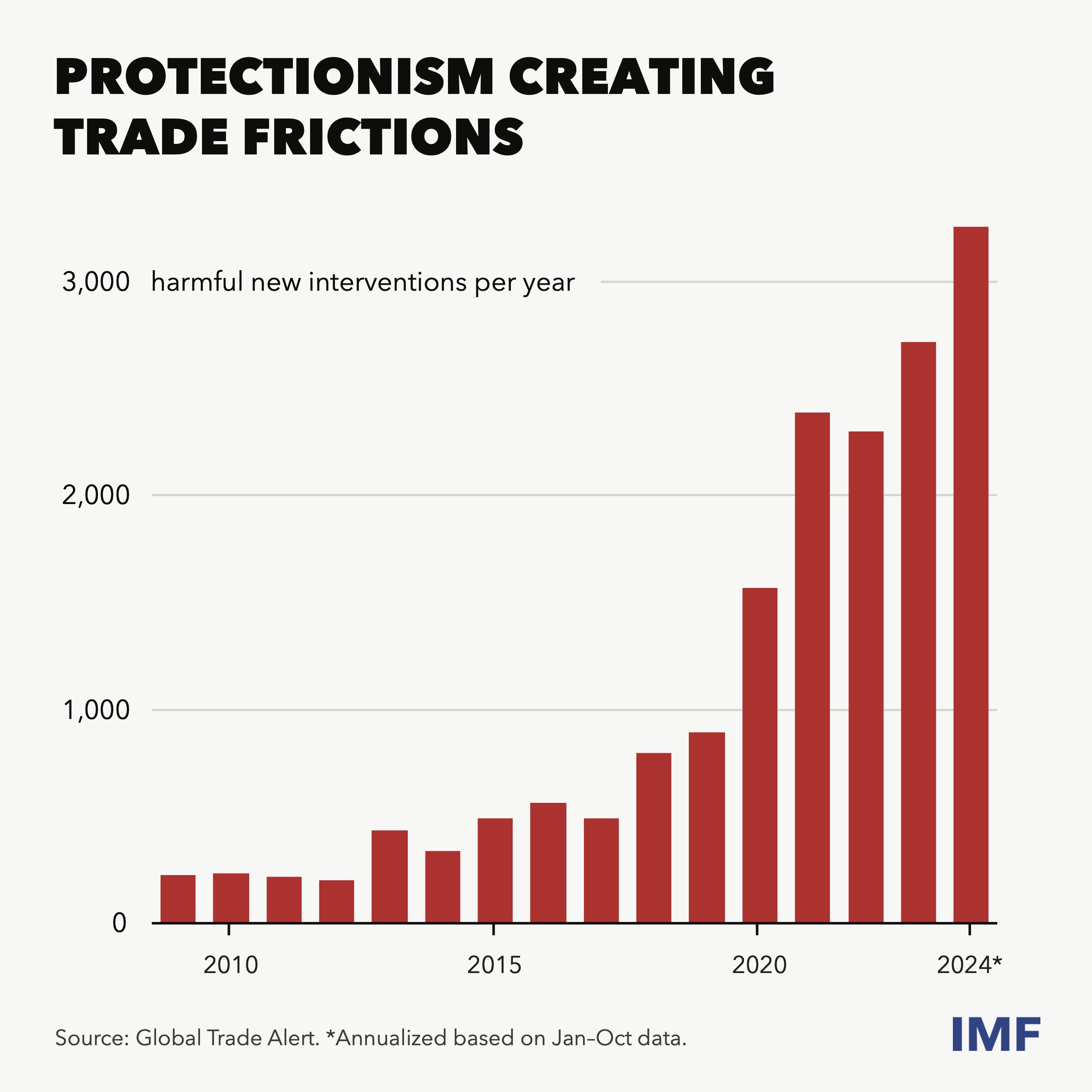

Not only is development assistance too small, but major players, driven by national security concerns, are increasingly resorting to industrial policy and protectionism, creating one trade restriction after another. Going forward, trade will not be the same engine of growth as before. It is the fracturing I warned of back in 2019—but worse. It is like pouring cold water on an already-lukewarm world economy.

My message today: we can do better.

As Ajay Banga, President of the World Bank and my dear colleague from across the street, likes to say: forecasts are not destiny. There is plenty we can and must do to lift our growth potential, reduce debt, and build a more resilient world economy.

Let me start with the domestic agenda. Governments must work to reduce debt and rebuild buffers for the next shock—which will surely come, and maybe sooner than we expect. Budgets need to be consolidated—credibly, yet gradually in most countries. This will involve difficult choices on how to raise revenues and make spending more efficient, while also making sure that policy actions are well-explained to earn the trust of the people.

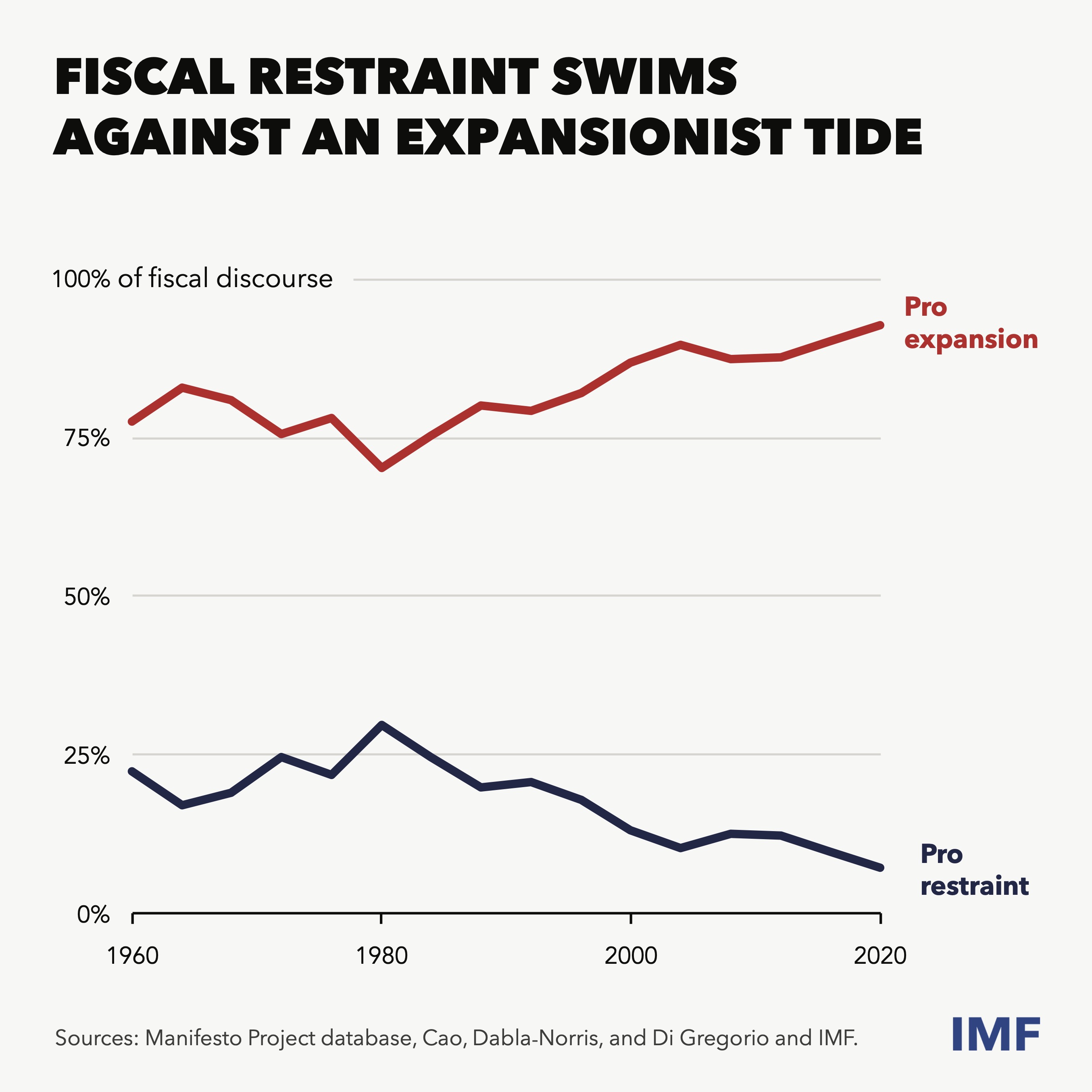

Here is the problem though: fiscal restraint is never popular. And, as a new paper by IMF staff shows, it’s only getting harder. Across a wide sample of countries, political discourse increasingly favors fiscal expansion. Even the traditionally fiscally conservative political parties are developing a taste for borrow-to-spend. Fiscal reforms are not easy, but they are necessary and they can enhance inclusion and opportunity. Countries have shown that it can be done.

Ultimately, over the medium term, growth is key—to deliver jobs, tax revenues, fiscal space, and debt sustainability. Everywhere I go, I hear the same: an aspiration for higher growth and better opportunities. The question is: how?

Answer: focus on reforms—there is no time to waste:

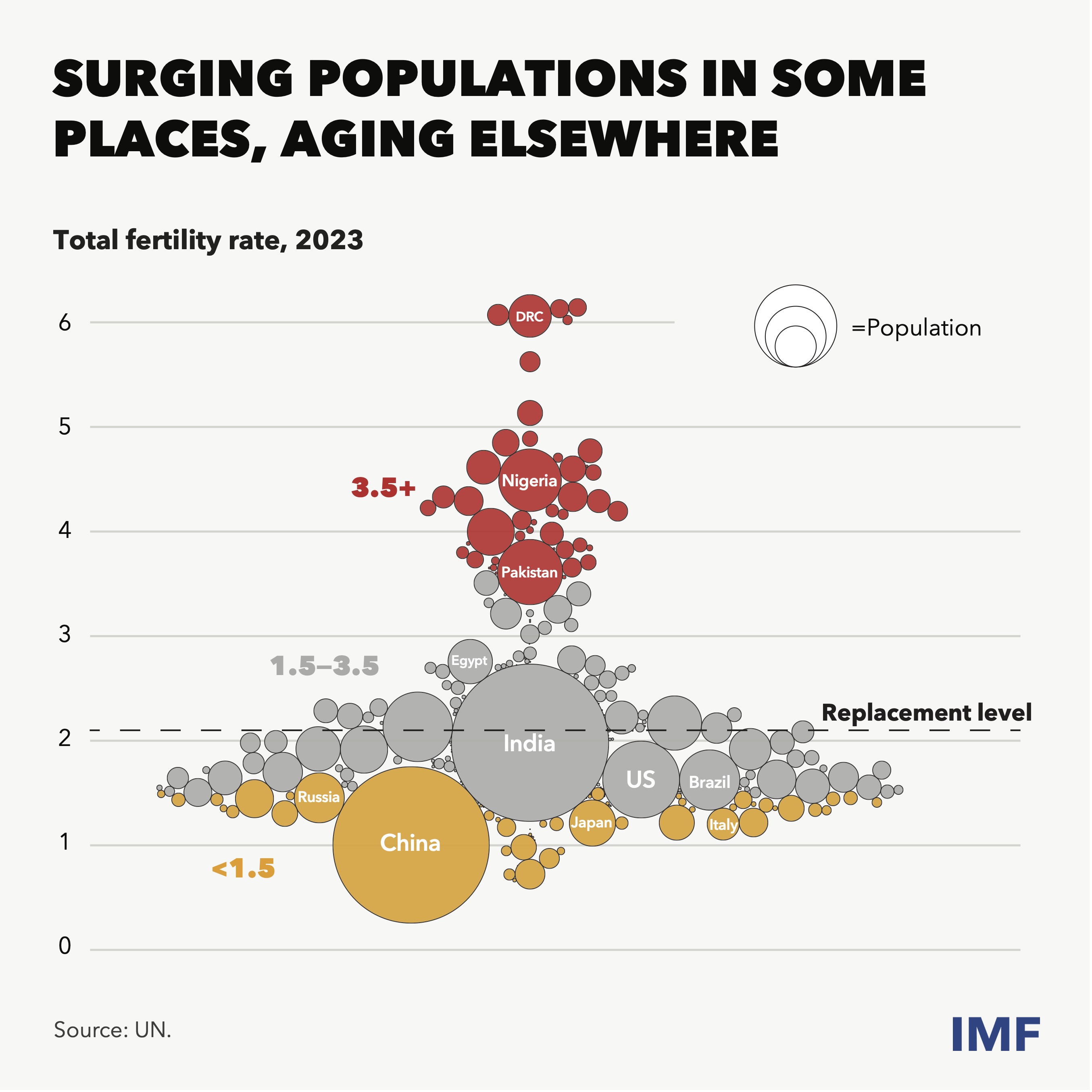

- First area of reforms: make job markets work for people. We confront a world of deeply uneven demography: surging young populations in some places, aging societies elsewhere. Economic migration can help, but only up to a point given the anxieties in many countries. So too can supportive steps to help get more women into the workforce. Above all, there is a need for reforms to enhance skill sets and match the right people to the right jobs.

- Second area: mobilize capital. There is an abundance of it globally, but often not in the right places or right types of investments—just think of all the money from all corners of the globe poured into liquid but less-productive assets in a few major financial centers. Putting savings to work for maximum economic benefit requires policymakers to focus on eliminating barriers such as weak investment environments and shallow capital markets. Financial sector oversight must not only ensure stability and resilience, but also encourage prudent risk-taking and value creation.

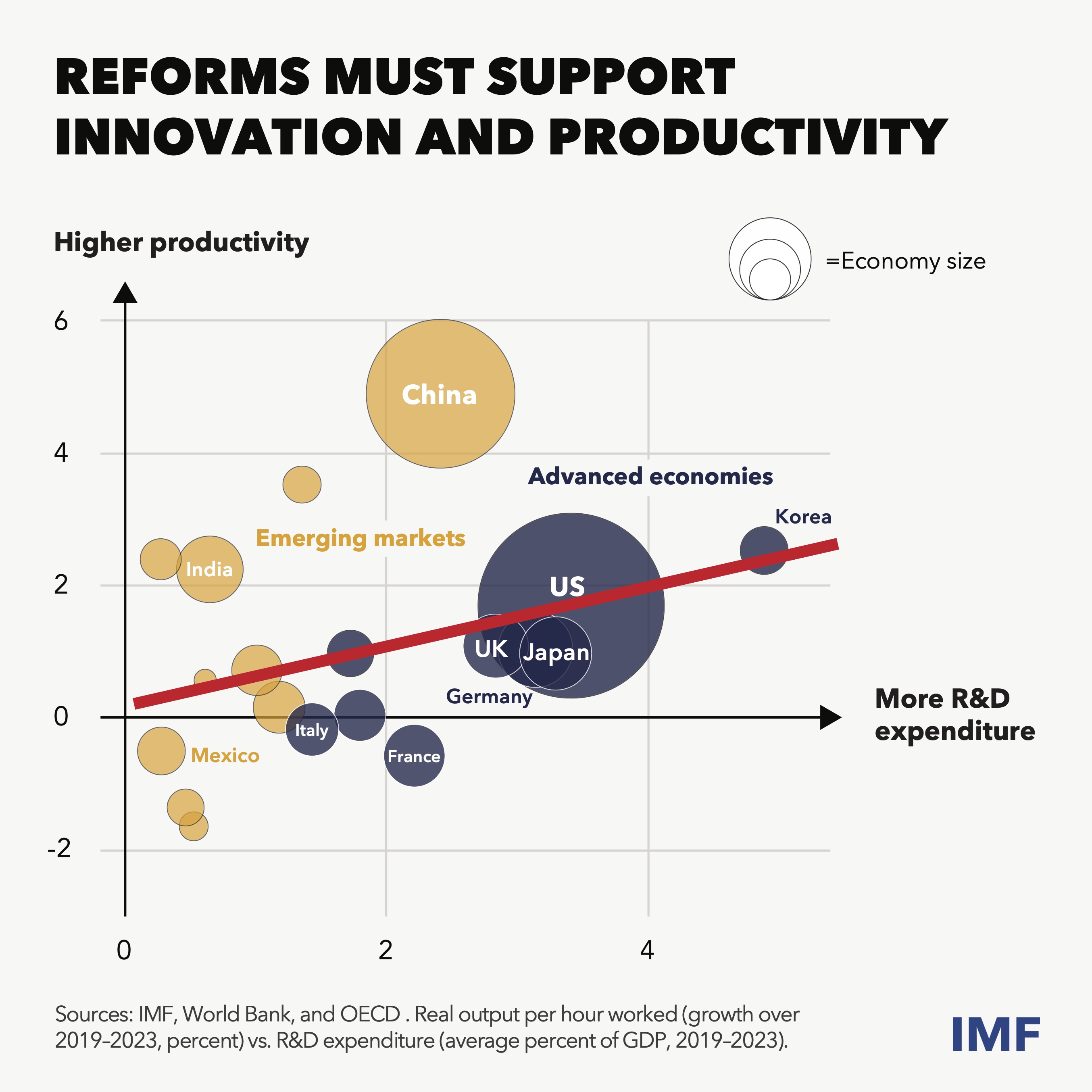

- Third area: enhance productivity. This is what yields more output per unit of input, and there are many ways to raise it, from improving governance and institutions to cutting red tape to harnessing the power of AI. More and better spending on education and R&D help. Among advanced economies, those that lead on innovation show what works: venture capital industries, ecosystems that bring not only financing but knowledge, advice, and professional networks—screening new ideas, identifying winners, feeding them from birth to graduation. There are many lessons for others to learn.

Globally, the pace of reforms has been slowing since the global financial crisis as discontent has risen.

But progress is possible. A new IMF study shows that resistance to reforms is often driven by beliefs and misperceptions about the reforms themselves as well as the distributional effects. Reforms are best developed through two-way dialogue with the public, with measures to mitigate the impact on those who risk losing out. We have learnt how much this matters.

As policymakers pursue reforms at home, they must also look outward.

There is much that countries can do together as members of an integrated economic community, each benefitting from its own comparative advantage.

The forces of technology, trade, and capital mobility have delivered a hugely valuable degree of interconnectedness.

Yet still, we live in a mistrustful, fragmented world where national security has risen to the top of the list of concerns for many countries. This has happened before—but never in a time of such high economic co-dependence.

My argument is that we must not allow this reality to become an excuse to do nothing to prevent a further fracturing of the global economy. Quite the opposite. My appeal during these Annual Meetings will be: let us work together, in an enlightened way, to lift our collective prospects.

Let us not take the global tensions as given, but rather resolve to work to lower the geopolitical temperature and attend to the tasks that can only be tackled together:

- Exhibit one: trade, which has lowered prices, improved quality, and created jobs. Thus far, trade has shown remarkable resilience in the face of new barriers, often flowing around them via third countries. But such redirection is not efficient, nor can we assume it will continue indefinitely. Countries would do well to recognize that the rules-based global trading system delivered many benefits and is worth preserving.

- Two: climate, where we face an existential challenge, with countries that contributed the least to global emissions now first to suffer. Unexpectedly fast global warming should be ringing alarm bells. The glaciers are melting, the icecaps crumbling. Adverse weather events have telegraphed a frightening message from the future. We know what we must do: create fiscal space for the green transition, eliminate fossil-fuel subsidies, and get capital to where it is most needed. But we must do it!

- Three: artificial intelligence, our single best shot at higher productivity. IMF research finds that AI, if managed well, has the potential to lift world growth by up to 0.8 percentage points—with that alone, we would go to a higher growth path than in the years before the pandemic. Yet AI is urgently in need of regulatory and ethical codes that are fundamentally global. Why? Because AI is borderless—it is already on smartphones everywhere. We better hurry. This technology will not wait!

In all these areas and many more, the bottom line is that countries need to relearn how to work together. And institutions like the IMF—born from the basic idea that pooling resources together is efficient—play a vital role.

In my first term as Managing Director—an unprecedented crisis period—we acted decisively to help our membership. We provided one trillion dollars’ worth of liquidity, and we delivered critical economic analysis and advice that helped policymakers synchronize their actions.

Now, in the first days of my second term we have delivered again.

Our Executive Board, in full consensus, has just approved important reforms that reinforce our strong financial position and directly benefit our membership. We are reducing charges and surcharges on our regular lending, and putting in place a comprehensive package that secures our concessional lending capacity to support low-income countries.

And on November 1 our Board will welcome a third Director for Sub-Saharan Africa, ensuring more voice for what has been an underrepresented region.

Combined with the fifty percent quota increase agreed at our last Annual Meetings, these actions give us the strength to continue to deliver high value-added to a membership that engages not out of charity but self-interest.

It is the value we bring to our members that has resulted in our membership growing—and on that note, a very warm welcome to the Principality of Liechtenstein as it joins us as our 191st member!

From our founding at Bretton Woods in the dark days of 1944 to today, the IMF has established a tradition of adapting to the changing world around it. Today, I give you my word: this will continue. We will stand with our members, always looking for the most impactful ways to serve.

By the time I complete my second term at the helm of the IMF, I will have led it for most of this decade. And if I were granted one wish, it would simply be this: let not this decade be remembered as one where we allowed conflict to get in the way of existential tasks, storing up vast costs and potential calamity for those to follow. Let it be remembered as a time when we rose above our differences for the good of all.

For our mutual prosperity—and ultimately for our survival—I say we can do better: let there be peace on earth and a revival of cooperation.

Thank you!

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER: Mayada Ghazala

Phone: +1 202 623-7100Email: MEDIA@IMF.org