Making Chile’s Economy More Dynamic, Greener, and Inclusive

February 15, 2024

Renewable energy and higher investments can boost growth, and support conditions toward a more inclusive economy

Chile’s economy is at a crossroads. Strong policies have successfully brought down high inflation and reduced the large current account deficit that emerged during the pandemic. Increases in social benefits have provided some relief in response to discontent over inequality. However, investment and growth are still tepid and social gaps remain high.

Going forward, Chile—the world’s largest copper producer, second largest lithium producer, and richly endowed with solar and wind—can both contribute to, and benefit from, the global green transition. A more dynamic and greener economy could also create conditions for greater equity and inclusion.

Boosting economic activity

Chile has a comparative advantage in renewable energy production. Costs of electricity generation are lower for solar and wind than fossil fuels thanks to the high solar radiation in Chile’s north and strong winds in the south. Already, electricity generated from solar and wind increased from 1 to 23 percent of total electricity supply during 2010–22.

Our estimates suggest that replacing coal with renewable energy, along the lines of the authorities’ plans to decommission coal-fired power plants by 2040, could boost economic activity by at least 1 percent over the long term. Such a shift in the energy mix would imply a nearly 30 percent cost reduction in electricity generation, in addition to the benefits from lower carbon emissions and air pollution. A shift in Chile’s energy mix would also significantly strengthen the economy’s resilience against future coal and fuel price shocks.

Development of the green hydrogen industry could offer additional growth prospects, conditional on further reductions in the production and transportation costs. The geographic mismatch between power generation and consumption is the main bottleneck for greater use of renewable energy. In particular, the areas rich in solar and wind in the northern and southern parts of Chile are more than 1,000 miles away from its economic hub in the central area. This could be resolved by upgrading the transmission network, including through the new Kimal-Lo Aguirre transmission line set to become operational in 2029.

New opportunities

Chile also has an opportunity to play a role in global efforts to reduce carbon emissions. This involves the greater use of lithium for energy storage in batteries. The resulting higher global demand for lithium offers prospects to expand Chile’s lithium production and related industries along the value chain, while balancing social and environmental objectives.

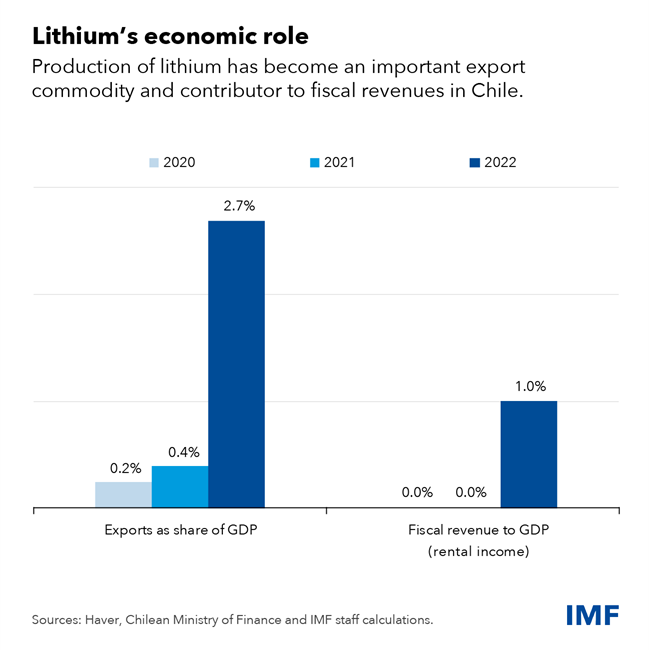

For Chile, lithium has already become an important source of exports and fiscal revenue in recent years when the lithium price surged. The country is planning to expand its lithium production through public-private partnerships. Providing a clear institutional framework for investors that can be swiftly implemented as global demand ramps up will be an important factor to further develop the industry.

More investment needed

While Chile’s economy is projected to resume growth in 2024, its average real economic growth rate has been declining for many years alongside negative productivity growth. Therefore, strengthening investment is critical to sustainably raise and diversify economic activity.

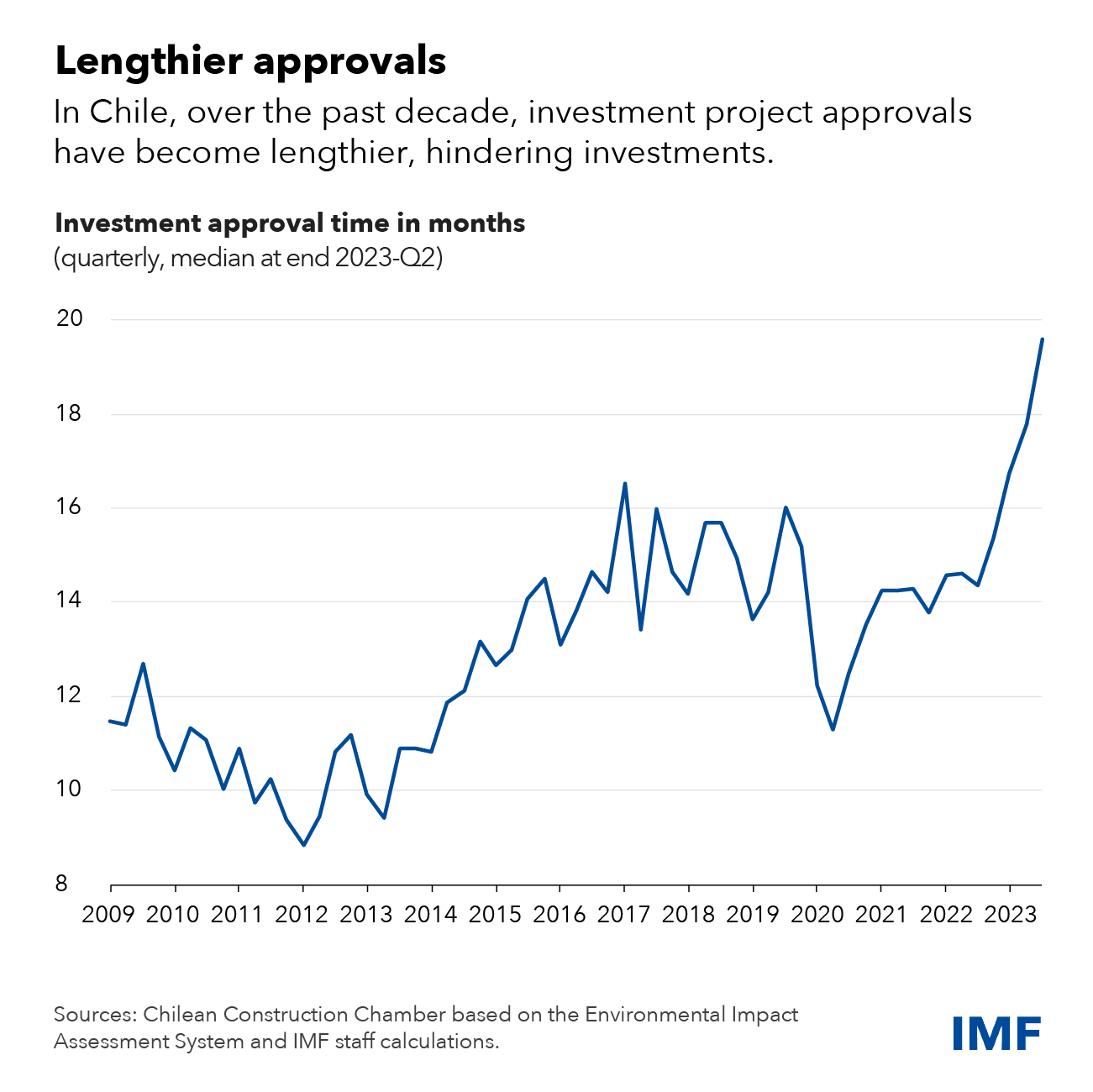

Investment approvals have become more complicated, uncertain, and lengthier over the years, largely reflecting more complex safeguards for the environment, health, safety, social concerns, and a larger number of stakeholders.

The government’s ongoing efforts to streamline and improve coordination of permitting processes, while maintaining high environmental standards, could contribute to lifting much-needed investment and bring meaningful growth dividends.

****

Luiza Antoun de Almeida is an Economist, Si Guo is a Senior Economist, and Andrea Schaechter is an Assistant Director in the Western Hemisphere Department.