Senegal's Growth Prospects are Strong

July 12, 2023

An ambitious reform agenda will help the country keep its growth momentum

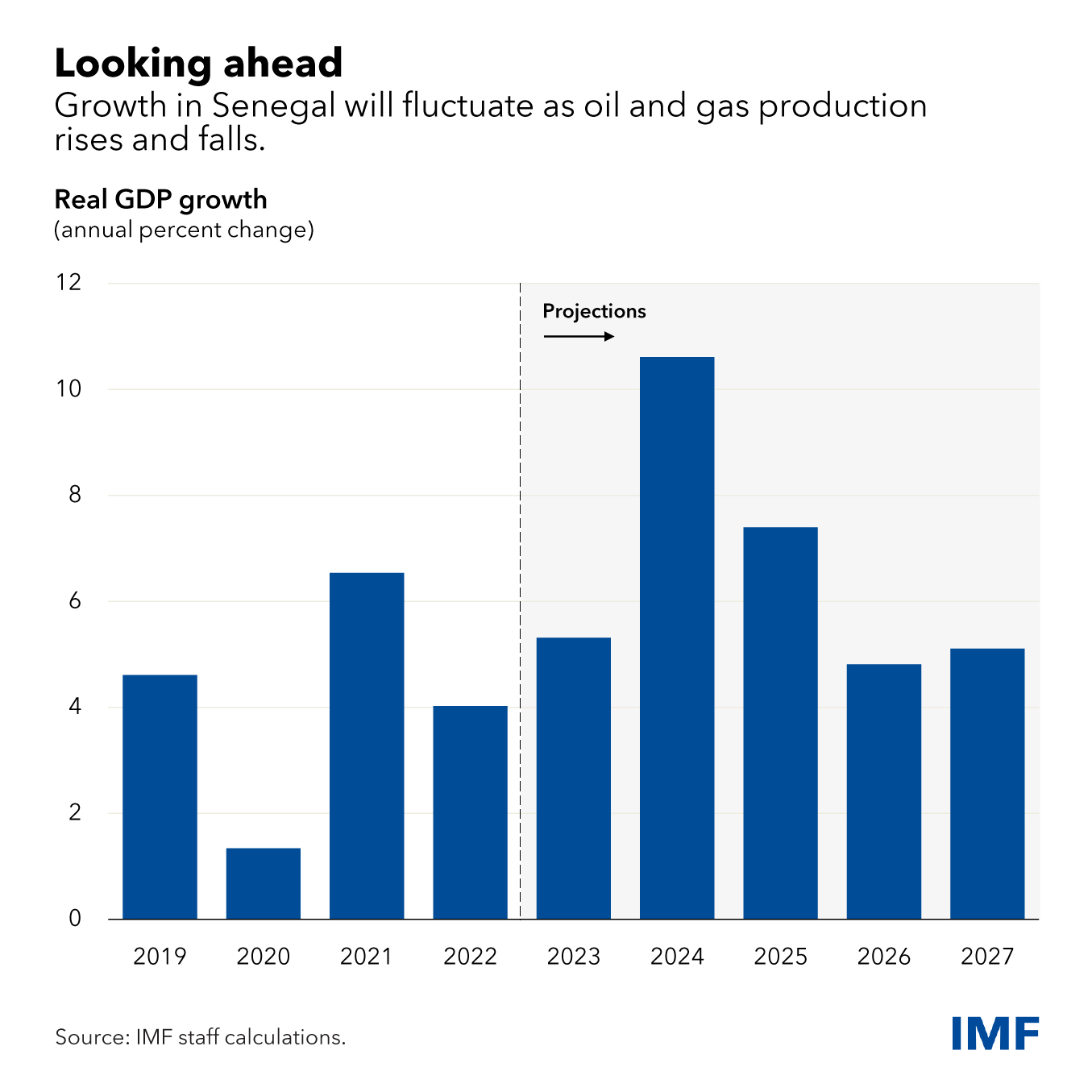

After slowing to 4.7 percent in 2022, growth in Senegal is projected to rebound to over 5.3 percent this year, due in part to an emerging oil and gas industry. This makes Senegal one of the strongest growing economies in sub-Saharan Africa. The country is facing some challenges, however, including spillovers from the war in Ukraine, tighter financing conditions, and increased political instability in the region. A widening fiscal deficit and increasing government debt are two major concerns.

In an interview with Country Focus, Edward Gemayel, IMF Mission Chief for Senegal, talks about the economic outlook for the country, and key pillars of the recently approved programs under the IMF’s Extended Fund Facility, the Extended Credit Facility and the Resilience and Sustainability Trust.

What is the economic outlook for Senegal?

Senegal’s strong post-pandemic recovery has been hindered by overlapping external shocks. As a result, growth forecasts have been revised down, inflation has soared, and the fiscal and current account deficits have widened. Public debt has also increased to over 76 percent of GDP.

The country has strong prospects however, reinforced by the production of oil and gas, which will give the economy a boost for the next few years. Growth is projected to accelerate to 10.6 percent in 2024 and 7.4 percent in 2025, with non-hydrocarbon growth expected to reach around 6 percent, assuming prudent macroeconomic policies and steadfast structural reforms are implemented under the IMF-supported programs.

The additional revenues from oil and gas exports will be set aside, in line with the new fiscal rule adopted, to ensure public spending can be sustained in the future, as the country transitions to renewables.

How much of an issue is inflation?

Inflation hit a multi-decade high of 9.7 percent in 2022, driven largely by the surge in food prices, which account for almost half of the CPI basket in Senegal. Inflation has since eased to around 9 percent and is projected to fall to around 5 percent by year-end but could potentially increase again if commodity prices remain high.

The Senegalese authorities responded by increasing fuel and electricity subsidies—which have soared to nearly 4 percent of GDP—and by raising public sector wages by about 20 percent. However, to contain the fiscal deficit, public investments were slashed. Looking forward, to preserve debt sustainability and to help curb inflation, important measures will need to be adopted, including streamlining tax exemptions and gradually phasing out energy subsidies while better targeting social spending to alleviate the impact of declining real incomes.

The IMF and Senegal have agreed to a new 36-month financing arrangement of US$1.5 billion. What are the objectives of the program?

The ECF/EFF arrangement aims to support Senegal’s pursuit of its reform agenda, which is centered around three main pillars: (i) reducing debt vulnerabilities by embarking on a credible fiscal consolidation path through further revenue mobilization and the phasing out of energy subsidies, (ii) strengthening public sector governance and anti-money laundering/combating the financing of terrorism, and (iii) fostering a more inclusive and private sector-led growth.

Senegal was also approved for the IMF’s Resilience and Sustainability Facility. How will the funds be used?

According to Senegal’s Nationally Determined Contribution (NDC), which outlines the country’s intended climate actions during 2023-30, financing to cover the country’s mitigation and adaptation needs amount to about 7 percent of GDP per year through 2030. The disbursements under the RSF’s 3-year arrangement amount to around 1 percent of GDP, or about US $324 million, and should help to mobilize additional financing and support from development partners, such as the World Bank, the UNDP, the AfDB, and the EIB, in addition to domestic resources. Key reform measures under the RSF specifically focus on gradually phasing out untargeted subsidies in the electricity sector, adopting an implementation plan to enact a strategy for greener public transport, collecting and disseminating geo-tagged granular risk climate data, and integrating climate change considerations into the budget process.

Senegal recently signed a Just Energy Transition Partnership (JETP) agreement with G7 countries and the EU. How will this agreement help Senegal’s climate change agenda?

On June 22, Senegal signed a JETP loan agreement with G7 countries and the EU worth $2.7bn. Essentially, JETP agreements aim to bridge the gap between developed and developing nations in moving towards clean energy. South Africa, Indonesia, and Vietnam are the first three countries to have signed such an agreement. In the case of Senegal, this partnership aims to support the country in (i) developing a climate-resilient strategy for the energy sector, (ii) increasing the share of renewable energy, (iii) improving storage and grid stability, and (iv) creating sustainable jobs. This agreement demonstrates Senegal's strong commitment to accelerate the transition to clean energy, as embedded in the authorities’ NDC.

Recently, there have been widespread protests in the country. What effect might these have on planned reforms?

Senegal is an important pole of stability in West Africa, and the authorities have consistently demonstrated their commitment to implementing transformative reforms. We encourage all stakeholders to resolve political differences in a peaceful manner. This will be key to ensure that Senegal can implement its ambitious reform agenda and achieve its full economic potential.