Introductory remarks by the Acting Director of the Western Hemisphere Department, Nigel Chalk

October 21, 2021

As prepared for delivery

The good news is that, after taking a very heavy toll for much of 2021, the pandemic appears to be receding in many parts of Latin America and the Caribbean. However, this is not time for complacency. The battle against the virus is not over and countries continue to face a race between vaccinations and the spread of new variants. It is clear that rapid vaccination campaigns have worked to mitigate the pandemic’s impact. But we must also recognize that the continued unequal availability of vaccines remains a major challenge, especially for the region’s poorer and less populous countries. In this regard, the U.S. and other countries’ efforts to expand vaccine access in the region will make an important difference.

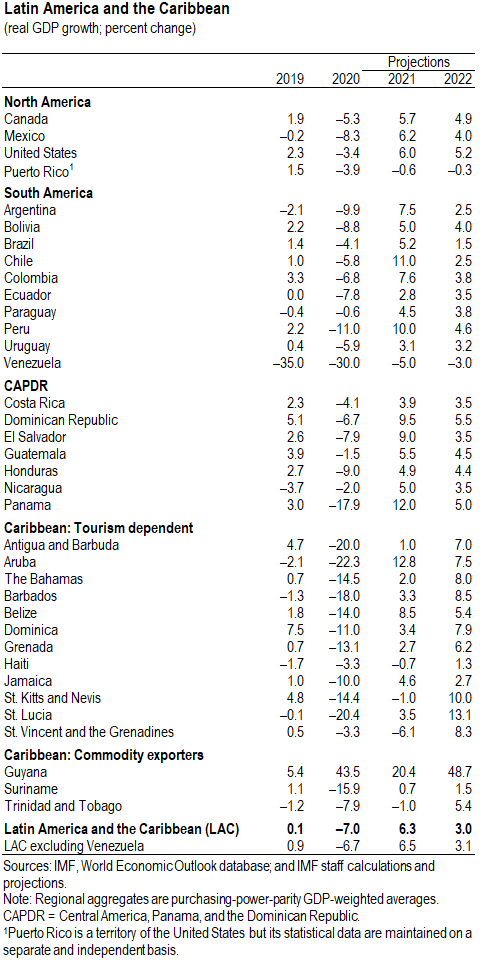

Turning to the economic outlook, activity in Latin America and the Caribbean gained momentum throughout the second half of last year and that continued into the early part of this year. Growth outturns have been better than expected and our revised forecasts reflect that fact. We expect LAC to grow by 6.3 percent in 2021 and then slow to around 3 percent in 2022 (see Table). However, there is a heterogeneity across the region and a lot of uncertainty associated with the outlook. Short-term growth is predicated on the successful handoff from policy support to a resurgence in private sector demand. Also, the outlook assumes a continuation of favorable external conditions, high commodity prices, and an unwinding of pent-up consumption and investment that has been restrained by the pandemic over the past 18 months.

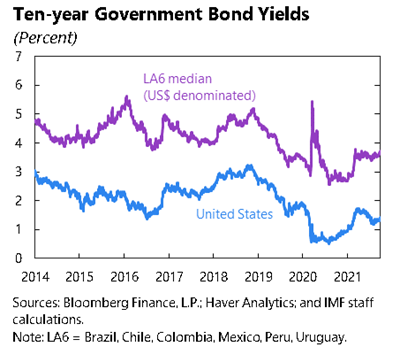

External factors have been a tailwind for many. A strong recovery in trading partner growth and an upward surge in commodity prices—which even after some correction generally remain above pre-pandemic levels—have buoyed the region. Global financing conditions remain very supportive allowing capital inflows and relatively cheap and available financing to foster the recovery (Figure 1). Finally, very strong remittance flows are an important lifeline for many, particularly in Central America.

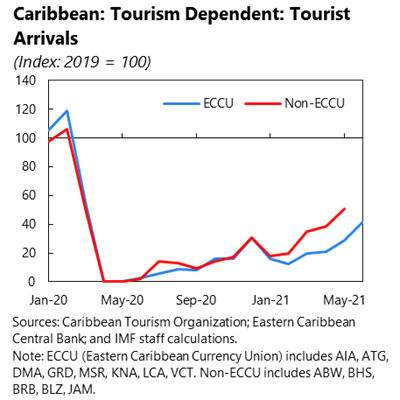

It is important to recognize, though, that the environment for many in the Caribbean countries remains very challenging. Tourism to the region is projected to grow only slowly and, while there are recent signs of a pickup in visitors going into the peak season, it is likely that the number of visitors for the year will only reach around 60 percent of pre-COVID-19 levels (Figure 2).

Of course, there are important uncertainties still ahead, particularly as relates to the evolution of both vaccinations and the degree to which COVID can be contained. Countries should prepare for this recovery not to be a linear path. Instead, they should anticipate a long and winding road ahead, with setbacks along the way, as the damage brought by the pandemic is gradually repaired.

In this regard, output for most of the region is not returning to the path we had envisaged prior to the pandemic. Recovery in employment has been uneven with the young, less educated, and women bearing a heavy burden. Prospects for productivity growth are uncertain and depend on whether high-productivity firms are able to survive and for the economic system to rotate capital and labor toward them. There has been important damage to human capital from persistent unemployment, increasing informality, and prolonged school closures. These trends could, potentially, take many years to reverse. In this regard, ambitious supply-side policies can help. Improving the effectiveness of public spending, examining the scope for a more equitable, progressive and growth-friendly tax system, and deepening investments in climate change adaptation and mitigation.

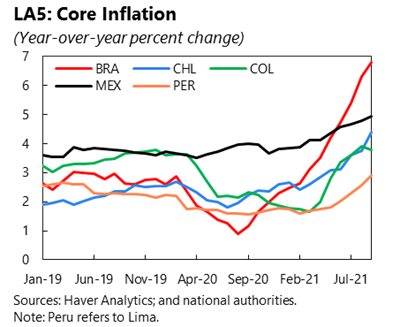

Finally, inflation pressures are becoming an important feature for much of the region (Figure 3). Rising commodity and food prices, supply chain disruptions, global increases in goods prices, sector-specific constraints, and closing output gaps are all driving consumer prices higher. Many central banks in the region have rightly reacted to these pressures by raising policy rates and underscoring their commitment to their inflation goals. It is likely that these interest rate increases will continue in many countries in the coming months and, if there are signs that inflation expectations are becoming less well anchored, then central banks will have to react promptly. Managing this delicate balance, at a time when the economy is still operating below its potential, will put a premium on clear and transparent communication. At the same time as monetary support is being withdrawn, there will need to be a careful unwinding of those extraordinary policy interventions that were introduced to counter the impact of the pandemic. Resources will certainly still be needed to bolster health systems, boost vaccination coverage and, in some cases, provide some targeted support for households and firms. However, at the same time, it will be important for policymakers to signal a credible commitment to putting debt back on a downward path.

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER:

Phone: +1 202 623-7100Email: MEDIA@IMF.org